The GEO Group, Inc. (NYSE: GEO) (“GEO”), a fully integrated equity real estate

investment trust (“REIT”) and a leading provider of enhanced

in-custody rehabilitation, post-release support, and

community-based programs, reported today its financial

results for the second quarter and the first six months of 2021 and

increased its financial guidance for the full-year 2021.

Second Quarter 2021 Highlights

- Total revenues of $565.4 million

- Net Income Attributable to GEO of $42.0 million

- Adjusted Net Income of $50.8 million

- Normalized FFO of $0.58 per diluted share

- AFFO of $0.70 per diluted share

We reported second quarter 2021 net income attributable to GEO

of $42.0 million compared to $36.7 million for the second quarter

2020. We reported total revenues for the second quarter 2021 of

$565.4 million compared to $587.8 million for the second quarter

2020. Second quarter 2021 results reflect $7.5 million in one-time

employee restructuring expenses, pre-tax, a $3.0 million loss on

real estate assets, pre-tax, a $1.7 million gain on the

extinguishment of debt, pre-tax, and $0.1 million in the tax effect

of adjustments to net income attributable to GEO. Excluding these

items, we reported second quarter 2021 Adjusted Net Income of $50.8

million compared to $43.1 million for the second quarter 2020.

We reported second quarter 2021 Normalized Funds From Operations

(“Normalized FFO”) of $69.7 million, or $0.58 per diluted share,

compared to $61.5 million, or $0.51 per diluted share, for the

second quarter 2020. We reported second quarter 2021 Adjusted Funds

From Operations (“AFFO”) of $84.4 million, or $0.70 per diluted

share, compared to $78.8 million, or $0.66 per diluted share, for

the second quarter 2020.

Our better-than-expected financial performance during the second

quarter 2021 was driven by continued favorable cost trends; higher

occupancies at our facilities for the U.S. Marshals Service and

U.S. Immigration and Customs Enforcement; and increased revenue and

earnings from our electronic monitoring segment.

George C. Zoley, Executive Chairman of GEO, said, “We are

pleased with our strong second quarter results and our increased

financial guidance for the full year. We believe our robust

financial performance is representative of the strength of our

diversified business segments. We recognize that there have been

concerns regarding our future access to financing, and we believe

that our continued focus on debt reduction, the ongoing review of

potential asset sales, and the evaluation of our corporate tax

structure are all prudent steps as we work towards addressing these

concerns.”

First Six Months 2021 Highlights

- Total revenues of $1.14 billion

- Net Income Attributable to GEO of $92.5 million

- Adjusted Net Income of $84.9 million

- Normalized FFO of $1.02 per diluted share

- AFFO of $1.30 per diluted share

For the first six months of 2021, we reported net income

attributable to GEO of $92.5 million compared to $61.9 million for

the first six months of 2020. We reported total revenues for the

first six months of 2021 of $1.14 billion compared to $1.19 billion

for the first six months of 2020. Results for the first six months

of 2021 reflect $7.5 million in one-time employee restructuring

expenses, pre-tax, a $10.4 million gain on real estate assets,

pre-tax, and a $4.7 million gain on the extinguishment of debt,

pre-tax. Excluding these items, we reported Adjusted Net Income of

$84.9 million for the first six months of 2021 compared to $72.0

million for the first six months of 2020.

For the first six months of 2021, we reported Normalized FFO of

$122.7 million, or $1.02 per diluted share, compared to $108.7

million, or $0.91 per diluted share, for the first six months of

2020. For the first six months of 2021, we reported AFFO of $156.6

million, or $1.30 per diluted share, compared to $145.4 million, or

$1.21 per diluted share, for the first six months of 2020.

Updated 2021 Financial Guidance

- FY21 Net Income Attributable to GEO of $167.5-$174.5

Million

- FY21 Adjusted EBITDAre of $441.5-$448.5 Million

- FY21 AFFO of $2.51-$2.57 per diluted share

We have increased our financial guidance for the full year 2021

and have issued our financial guidance for the third and fourth

quarters of 2021. For the full year 2021, we expect Net Income

Attributable to GEO to be in a range of $167.5 million to $174.5

million on annual revenues of approximately $2.23 billion. We

expect full year 2021 Adjusted EBITDAre to be in a range of

approximately $441.5 million to $448.5 million. We expect full year

2021 Adjusted Net Income per diluted share to be in a range of

$1.34 to $1.40 and full year 2021 AFFO per diluted share to be in a

range of $2.51 to $2.57.

For the third quarter 2021, we expect Net Income Attributable to

GEO to be in a range of $39 million to $42 million on quarterly

revenues of $548 million to $553 million. We expect third quarter

2021 AFFO to be in a range of $0.62 to $0.64 per diluted share. For

the fourth quarter 2021, we expect Net Income Attributable to GEO

to be in a range of $36 million to $40 million on quarterly

revenues of $538 million to $543 million. We expect fourth quarter

2021 AFFO to be in a range of $0.59 to $0.63 per diluted share.

Our guidance reflects our previously announced expectation that

our contracts with the Federal Bureau of Prisons at the Big Spring

Correctional Facility and Flightline Correctional Facility in Texas

will not be renewed when the current contract option periods expire

on November 30, 2021.

Balance Sheet and Liquidity

At the end of the second quarter 2021, we had approximately $483

million in cash on hand, resulting from the previously announced

drawdown of our Revolving Credit Facility. Our decision to draw on

our Revolving Credit Facility was a conservative precautionary step

to preserve liquidity, maintain financial flexibility, and obtain

additional funds for general corporate purposes.

During the first six months of 2021, we reduced our net recourse

debt by approximately $105 million, which represents substantial

progress toward our previously articulated objective of reducing

net recourse debt by $125 million to $150 million in 2021. Based on

our progress to date and our better-than-expected earnings and cash

flows, we have increased our target for net debt reductions in 2021

to no less than $150 million to $175 million.

During the first six months of 2021, we also completed the sale

of three real estate assets in our Reentry Services,

Community-Based segment, totaling approximately 700 beds.

Additionally, on July 1, 2021, we completed the sale of certain

non-real estate assets in our Youth services segment. On a combined

basis, these sales generated net proceeds of approximately $27

million. We are evaluating the potential sale of additional

company-owned assets.

COVID-19 Information

As the COVID-19 pandemic has impacted communities across the

United States and around the world, our employees and facilities

have also been impacted by the spread of COVID-19. Ensuring the

health and safety of our employees and all those in our care has

always been our number one priority.

During the pandemic, we have implemented mitigation initiatives

to address the risks of COVID-19, consistent with the guidance

issued for correctional and detention facilities by the Centers for

Disease Control and Prevention (“CDC”). We will continue to evaluate and refine the

steps we have taken as appropriate and necessary based on updated

guidance by the CDC and best practices. We are grateful for our

frontline employees who continue to make daily sacrifices to care

for all those in our facilities. Information on the COVID-19

mitigation initiatives implemented by GEO can be found at

www.geogroup.com/COVID19.

Conference Call Information

We have scheduled a conference call and simultaneous webcast for

today at 11:00 AM (Eastern Time) to discuss our second quarter 2021

financial results as well as our outlook. The call-in number for

the U.S. is 1-877-250-1553 and the international call-in number is

1-412-542-4145. In addition, a live audio webcast of the conference

call may be accessed on the Webcasts section under the News, Events

and Reports tab of GEO’s investor relations webpage at

investors.geogroup.com. A replay of the webcast will be available

on the website for one year. A telephonic replay of the conference

call will be available until August 18, 2021 at 1-877-344-7529

(U.S.) and 1-412-317-0088 (International). The participant passcode

for the telephonic replay is 10159108.

About The GEO Group

The GEO Group (NYSE: GEO) is a

fully integrated equity real estate investment trust specializing

in the design, financing, development, and operation of secure

facilities, processing centers, and community reentry centers in

the United States, Australia, South Africa, and the United Kingdom.

GEO is a leading provider of enhanced in-custody rehabilitation,

post-release support, electronic monitoring, and community-based

programs. GEO’s worldwide operations include the ownership and/or

management of 114 facilities totaling approximately 90,000 beds,

including idle facilities and projects under development, with a

workforce of up to approximately 20,000 professionals.

Reconciliation Tables and Supplemental Information

GEO has made available Supplemental Information which contains

reconciliation tables of Net Income Attributable to GEO to Net

Operating Income, Net Income to EBITDAre (EBITDA for real estate)

and Adjusted EBITDAre (Adjusted EBITDA for real estate), and Net

Income Attributable to GEO to FFO, Normalized FFO and Adjusted FFO,

along with supplemental financial and operational information on

GEO’s business and other important operating metrics, and in this

press release, Net Income Attributable to GEO to Adjusted Net

Income. The reconciliation tables are also presented herein. Please

see the section below titled “Note to Reconciliation Tables and

Supplemental Disclosure - Important Information on GEO’s Non-GAAP

Financial Measures” for information on how GEO defines these

supplemental Non-GAAP financial measures and reconciles them to the

most directly comparable GAAP measures. GEO’s Reconciliation Tables

can be found herein and in GEO’s Supplemental Information available

on GEO’s investor webpage at investors.geogroup.com.

Note to Reconciliation Tables and Supplemental Disclosure –

Important Information on GEO’s Non-GAAP Financial Measures

Net Operating Income, EBITDAre, Adjusted EBITDAre, Funds from

Operations, Normalized Funds from Operations, Adjusted Funds from

Operations, and Adjusted Net Income are non-GAAP financial measures

that are presented as supplemental disclosures. GEO has presented

herein certain forward-looking statements about GEO's future

financial performance that include non-GAAP financial measures,

including Adjusted EBITDAre, Net Operating Income, FFO, Normalized

FFO, and AFFO. The determination of the amounts that are included

or excluded from these non-GAAP financial measures is a matter of

management judgment and depends upon, among other factors, the

nature of the underlying expense or income amounts recognized in a

given period.

While we have provided a high level reconciliation for the

guidance ranges for full year 2021, we are unable to present a more

detailed quantitative reconciliation of the forward-looking

non-GAAP financial measures to their most directly comparable

forward-looking GAAP financial measures because management cannot

reliably predict all of the necessary components of such GAAP

measures. The quantitative reconciliation of the forward-looking

non-GAAP financial measures will be provided for completed annual

and quarterly periods, as applicable, calculated in a consistent

manner with the quantitative reconciliation of non-GAAP financial

measures previously reported for completed annual and quarterly

periods.

Net Operating Income is defined as revenues less operating

expenses, excluding depreciation and amortization expense, general

and administrative expenses, real estate related operating lease

expense, and start-up expenses, pre-tax. Net Operating Income is

calculated as net income adjusted by subtracting equity in earnings

of affiliates, net of income tax provision, and by adding income

tax provision, interest expense, net of interest income, gain/loss

on extinguishment of debt, depreciation and amortization expense,

general and administrative expenses, real estate related operating

lease expense, gain on real estate assets, pre-tax, and start-up

expenses, pre-tax.

EBITDAre (EBITDA for real estate) is defined as net income

adjusted by adding provisions for income tax, interest expense, net

of interest income, depreciation and amortization, and gain on real

estate assets, pre-tax. Adjusted EBITDAre (Adjusted EBITDA for real

estate) is defined as EBITDAre adjusted for net loss attributable

to non-controlling interests, stock-based compensation expenses,

pre-tax, and certain other adjustments as defined from time to

time, including for the periods presented start-up expenses,

pre-tax, one-time employee restructuring expenses, pre-tax,

COVID-19 expenses, pre-tax, close-out expenses, pre-tax, and other

non-cash revenue and expense, pre-tax.

Given the nature of our business as a real estate owner and

operator, we believe that EBITDAre and Adjusted EBITDAre are

helpful to investors as measures of our operational performance

because they provide an indication of our ability to incur and

service debt, to satisfy general operating expenses, to make

capital expenditures and to fund other cash needs or reinvest cash

into our business. We believe that by removing the impact of our

asset base (primarily depreciation and amortization) and excluding

certain non-cash charges, amounts spent on interest and taxes, and

certain other charges that are highly variable from year to year,

EBITDAre and Adjusted EBITDAre provide our investors with

performance measures that reflect the impact to operations from

trends in occupancy rates, per diem rates and operating costs,

providing a perspective not immediately apparent from net income

attributable to GEO. The adjustments we make to derive the non-GAAP

measures of EBITDAre and Adjusted EBITDAre exclude items which may

cause short-term fluctuations in income from continuing operations

and which we do not consider to be the fundamental attributes or

primary drivers of our business plan and they do not affect our

overall long-term operating performance. EBITDAre and Adjusted

EBITDAre provide disclosure on the same basis as that used by our

management and provide consistency in our financial reporting,

facilitate internal and external comparisons of our historical

operating performance and our business units and provide continuity

to investors for comparability purposes.

Funds From Operations, or FFO, is defined in accordance with

standards established by the National Association of Real Estate

Investment Trusts, or NAREIT, which defines FFO as net income/loss

attributable to common shareholders (computed in accordance with

United States Generally Accepted Accounting Principles), excluding

real estate related depreciation and amortization, excluding gains

and losses from the cumulative effects of accounting changes,

extraordinary items and sales of properties, and including

adjustments for unconsolidated partnerships and joint ventures.

Normalized Funds from Operations, or Normalized FFO, is defined

as FFO adjusted for certain items which by their nature are not

comparable from period to period or that tend to obscure GEO’s

actual operating performance, including for the periods presented

gain on the extinguishment of debt, pre-tax, start-up expenses,

pre-tax, one-time employee restructuring expenses, pre-tax,

COVID-19 expenses, pre-tax, close-out expenses, pre-tax, and tax

effect of adjustments to FFO. Adjusted Funds From Operations, or

AFFO, is defined as Normalized FFO adjusted by adding non-cash

expenses such as non-real estate related depreciation and

amortization, stock based compensation expense, the amortization of

debt issuance costs, discount and/or premium and other non-cash

interest, and by subtracting recurring consolidated maintenance

capital expenditures and other non-cash revenue and expenses.

Adjusted Net Income is defined as Net Income Attributable to GEO

adjusted for certain items which by their nature are not comparable

from period to period or that tend to obscure GEO’s actual

operating performance, including for the periods presented

gain/loss on real estate assets, pre-tax, gain on the

extinguishment of debt, pre-tax, start-up expenses, pre-tax,

one-time employee restructuring expenses, pre-tax, COVID-19

expenses, pre-tax, close-out expenses, pre-tax, and tax effect of

adjustments to Net Income Attributable to GEO.

Because of the unique design, structure and use of our GEO

Secure Services and GEO Care facilities, we believe that assessing

the performance of our secure facilities, processing centers, and

reentry centers without the impact of depreciation or amortization

is useful and meaningful to investors. Although NAREIT has

published its definition of FFO, companies often modify this

definition as they seek to provide financial measures that

meaningfully reflect their distinctive operations. We have modified

FFO to derive Normalized FFO and AFFO that meaningfully reflect our

operations. Our assessment of our operations is focused on

long-term sustainability. The adjustments we make to derive the

non-GAAP measures of Normalized FFO and AFFO exclude items which

may cause short-term fluctuations in net income attributable to GEO

but have no impact on our cash flows, or we do not consider them to

be fundamental attributes or the primary drivers of our business

plan and they do not affect our overall long-term operating

performance. We may make adjustments to FFO from time to time for

certain other income and expenses that do not reflect a necessary

component of our operational performance on the basis discussed

above, even though such items may require cash settlement.

Because FFO, Normalized FFO and AFFO exclude depreciation and

amortization unique to real estate as well as non-operational items

and certain other charges that are highly variable from year to

year, they provide our investors with performance measures that

reflect the impact to operations from trends in occupancy rates,

per diem rates, operating costs and interest costs, providing a

perspective not immediately apparent from Net Income Attributable

to GEO. We believe the presentation of FFO, Normalized FFO and AFFO

provide useful information to investors as they provide an

indication of our ability to fund capital expenditures and expand

our business. FFO, Normalized FFO and AFFO provide disclosure on

the same basis as that used by our management and provide

consistency in our financial reporting, facilitate internal and

external comparisons of our historical operating performance and

our business units and provide continuity to investors for

comparability purposes. Additionally, FFO, Normalized FFO and AFFO

are widely recognized measures in our industry as a real estate

investment trust.

Safe-Harbor Statement

This press release contains forward-looking statements regarding

future events and future performance of GEO that involve risks and

uncertainties that could materially affect actual results,

including statements regarding GEO’s financial guidance for the

full-year, third quarter, and fourth quarter of 2021. Risks and

uncertainties that could cause actual results to vary from current

expectations and forward-looking statements contained in this press

release include, but are not limited to: (1) GEO’s ability to meet

its financial guidance for 2021 given the various risks to which

its business is exposed; (2) GEO’s ability to deleverage and repay,

refinance or otherwise address its debt maturities in an amount or

on the timeline it expects, or at all; (3) changes in federal and

state government policy, orders, directives, legislation and

regulations that affect public-private partnerships with respect to

secure, correctional and detention facilities, processing centers

and reentry centers, including the timing and scope of

implementation of President Biden's Executive Order directing the

U.S. Attorney General not to renew the U.S. Department of Justice

contracts with privately operated criminal detention facilities;

(4) changes in federal immigration policy; (5) public and political

opposition to the use of public-private partnerships with respect

to secure correctional and detention facilities, processing centers

and reentry centers; (6) the magnitude, severity, and duration of

the current COVID-19 global pandemic, its impact on GEO, GEO's

ability to mitigate the risks associated with COVID-19, and the

efficacy and distribution of COVID-19 vaccines; (7) GEO’s ability

to sustain or improve company-wide occupancy rates at its

facilities in light of the COVID-19 global pandemic and policy and

contract announcements impacting GEO’s federal facilities in the

United States; (8) fluctuations in our operating results, including

as a result of contract terminations, contract renegotiations,

changes in occupancy levels and increases in our operating costs;

(9) general economic and market conditions, including changes to

governmental budgets and its impact on new contract terms, contract

renewals, renegotiations, per diem rates, fixed payment provisions,

and occupancy levels; (10) GEO’s ability to timely open facilities

as planned, profitably manage such facilities and successfully

integrate such facilities into GEO’s operations without substantial

costs; (11) GEO’s ability to win management contracts for which it

has submitted proposals and to retain existing management

contracts; (12) risks associated with GEO’s ability to control

operating costs associated with contract start-ups; (13) GEO’s

ability to successfully pursue growth and continue to create

shareholder value; (14) GEO’s ability to obtain financing or access

the capital markets in the future on acceptable terms or at all;

(15) other factors contained in GEO’s Securities and Exchange

Commission periodic filings, including its Form 10-K, 10-Q and 8-K

reports.

Second quarter and first six months of 2021 financial tables

to follow:

Condensed Consolidated Balance

Sheets* (Unaudited)

As of As of June 30, 2021 December 31,

2020 (unaudited) (unaudited)

ASSETS Cash and cash

equivalents $

483,048

$

283,524

Restricted cash and cash equivalents

29,892

26,740

Accounts receivable, less allowance for doubtful accounts

313,831

362,668

Contract receivable, current portion

6,420

6,283

Prepaid expenses and other current assets

35,449

32,108

Total current assets $

868,640

$

711,323

Restricted Cash and Investments

45,465

37,338

Property and Equipment, Net

2,074,350

2,122,195

Contract Receivable

382,829

396,647

Operating Lease Right-of-Use Assets, Net

120,208

124,727

Assets Held for Sale

28,197

9,108

Deferred Income Tax Assets

36,604

36,604

Intangible Assets, Net (including goodwill)

932,753

942,997

Other Non-Current Assets

74,563

79,187

Total Assets $

4,563,609

$

4,460,126

LIABILITIES AND SHAREHOLDERS' EQUITY Accounts

payable $

75,329

$

85,861

Accrued payroll and related taxes

65,298

67,797

Accrued expenses and other current liabilities

189,770

202,378

Operating lease liabilities, current portion

28,095

29,080

Current portion of finance lease obligations, long-term debt, and

non-recourse debt

27,240

26,180

Total current liabilities $

385,732

$

411,296

Deferred Income Tax Liabilities

30,726

30,726

Other Non-Current Liabilities

117,273

115,555

Operating Lease Liabilities

98,474

101,375

Finance Lease Liabilities

2,614

2,988

Long-Term Debt

2,632,332

2,561,881

Non-Recourse Debt

311,390

324,223

Total Shareholders' Equity

985,068

912,082

Total Liabilities and Shareholders' Equity $

4,563,609

$

4,460,126

* all figures in '000s

Condensed Consolidated Statements of

Operations* (Unaudited)

Q2 2021 Q2 2020 YTD 2021 YTD 2020

(unaudited) (unaudited) (unaudited) (unaudited)

Revenues $

565,419

$

587,829

$

1,141,796

$

1,192,846

Operating expenses

405,009

444,035

833,160

905,781

Depreciation and amortization

33,306

33,434

67,423

66,761

General and administrative expenses

54,688

45,543

103,167

99,325

Operating income

72,416

64,817

138,046

120,979

Interest income

5,985

5,248

12,187

10,686

Interest expense

(32,053)

(30,610)

(63,897)

(64,790)

Gain on extinguishment of debt

1,654

-

4,693

1,563

Gain/(Loss) on dispositions of real estate

(2,950)

(1,304)

10,379

(880)

Income before income taxes and equity in earnings of

affiliates

45,052

38,151

101,408

67,558

Provision for income taxes

5,063

4,196

12,999

10,742

Equity in earnings of affiliates, net of income tax

provision

1,942

2,699

4,007

4,959

Net income

41,931

36,654

92,416

61,775

Less: Net loss attributable to noncontrolling

interests

28

66

88

126

Net income attributable to The GEO Group, Inc. $

41,959

$

36,720

$

92,504

$

61,901

Weighted Average Common Shares Outstanding:

Basic

120,426

119,810

120,225

119,602

Diluted

120,470

119,964

120,431

119,937

Net income per Common Share Attributable to The GEO

Group, Inc. **: Basic: Net income per share —

basic $

0.29

$

0.31

$

0.71

$

0.52

Diluted: Net income per share — diluted $

0.29

$

0.31

$

0.70

$

0.52

Regular Dividends Declared per Common Share $

-

$

0.48

$

0.25

$

0.96

* All figures in '000s, except per share data ** Diluted

earnings per share attributable to GEO available to common

stockholders was calculated and presented in GEO’s unaudited

financial statements under the two-class method for the six months

ended June 30, 2021 due to the issuance of GEO’s 6.50% exchangeable

senior notes due 2026 as the exchangeable senior notes are

considered to be participating securities.

Reconciliation of Net Income

Attributable to GEO to Adjusted Net Income (In

thousands, except per share data)(Unaudited)

Q2 2021

Q2 2020

YTD 2021

YTD 2020

Net Income attributable to GEO

$

41,959

$

36,720

$

92,504

$

61,901

Add: (Gain)/Loss on real estate assets, pre-tax

2,950

1,304

(10,379

)

880

Gain on extinguishment of debt, pre-tax

(1,654

)

-

(4,693

)

(1,563

)

Start-up expenses, pre-tax

-

553

-

2,506

One-time employee restructuring expenses, pre-tax

7,459

-

7,459

-

COVID-19 expenses, pre-tax

-

3,877

-

4,769

Close-out expenses, pre-tax

-

2,284

-

4,220

Tax effect of adjustments to Net Income attributable to GEO

105

(1,599

)

13

(762

)

Adjusted Net Income

$

50,819

$

43,139

$

84,904

$

71,951

Weighted average common shares outstanding - Diluted

120,470

119,964

120,431

119,937

Adjusted Net Income Per Diluted Share *

$

0.42

$

0.36

$

0.71

$

0.60

* In accordance with GAAP, diluted earnings per share

attributable to GEO available to common stockholders is calculated

under the if-converted method or the two-class method, whichever

calculation results in the lowest diluted earnings per share

amount, which may be lower than Adjusted Net Income Per Diluted

Share.

Reconciliation of Net Income

Attributable to GEO to FFO, Normalized FFO, and AFFO*

(Unaudited)

Q2 2021 Q2 2020 YTD 2021 YTD 2020

(unaudited) (unaudited) (unaudited) (unaudited)

Net

Income attributable to GEO $

41,959

$

36,720

$

92,504

$

61,901

Add (Subtract): Real Estate Related Depreciation and Amortization

18,846

18,384

37,818

36,780

(Gain)/Loss on real estate assets, pre-tax

2,950

1,304

(10,379)

880

Equals: NAREIT defined FFO $

63,755

$

56,408

$

119,943

$

99,561

Add (Subtract): Gain on extinguishment of debt,

pre-tax

(1,654)

-

(4,693)

(1,563)

Start-up expenses, pre-tax

-

553

-

2,506

One-time employee restructuring expenses, pre-tax

7,459

-

7,459

-

COVID-19 expenses, pre-tax

-

3,877

-

4,769

Close-out expenses, pre-tax

-

2,284

-

4,220

Tax effect of adjustments to funds from operations **

105

(1,599)

13

(762)

Equals: FFO, normalized $

69,665

$

61,523

$

122,722

$

108,731

Add (Subtract): Non-Real Estate Related Depreciation &

Amortization

14,460

15,050

29,605

29,981

Consolidated Maintenance Capital Expenditures

(4,572)

(4,139)

(8,511)

(11,166)

Stock Based Compensation Expenses

4,023

4,706

11,426

14,474

Other non-cash revenue & expenses

(1,102)

-

(2,204)

-

Amortization of debt issuance costs, discount and/or premium and

other non-cash interest

1,903

1,708

3,586

3,378

Equals: AFFO $

84,377

$

78,848

$

156,624

$

145,398

Weighted average common shares outstanding - Diluted

120,470

119,964

120,431

119,937

FFO/AFFO per Share - Diluted Normalized FFO

Per Diluted Share $

0.58

$

0.51

$

1.02

$

0.91

AFFO Per Diluted Share $

0.70

$

0.66

$

1.30

$

1.21

Regular Common Stock Dividends per common

share $

-

$

0.48

$

0.25

$

0.96

* all figures in '000s, except per share data ** tax

adjustments related to gain/loss on real estate assets, Gain on

extinguishment of debt, Start-up expenses, One-time employee

restructuring expenses, COVID-19 expenses, and Close-out expenses.

Reconciliation of Net Income

Attributable to GEO to Net Operating Income, EBITDAre and Adjusted

EBITDAre* (Unaudited)

Q2 2021 Q2 2020 YTD 2021 YTD 2020

(unaudited) (unaudited) (unaudited) (unaudited)

Net Income

attributable to GEO $

41,959

$

36,720

$

92,504

$

61,901

Less Net loss attributable to noncontrolling interests

28

66

88

126

Net Income $

41,931

$

36,654

$

92,416

$

61,775

Add (Subtract): Equity in earnings of affiliates, net of

income tax provision

(1,942)

(2,699)

(4,007)

(4,959)

Income tax provision

5,063

4,196

12,999

10,742

Interest expense, net of interest income

26,068

25,362

51,710

54,104

Gain on extinguishment of debt

(1,654)

-

(4,693)

(1,563)

Depreciation and amortization

33,306

33,434

67,423

66,761

General and administrative expenses

54,688

45,543

103,167

99,325

Net Operating Income, net of operating lease obligations

$

157,460

$

142,490

$

319,015

$

286,185

Add: Operating lease expense, real estate

4,240

4,792

8,325

9,744

(Gain)/Loss on real estate assets, pre-tax

2,950

1,304

(10,379)

880

Start-up expenses, pre-tax

-

553

-

2,506

Net Operating Income (NOI) $

164,650

$

149,139

$

316,961

$

299,315

Q2 2021 Q2 2020 YTD 2021 YTD

2020 (unaudited) (unaudited) (unaudited) (unaudited)

Net

Income $

41,931

$

36,654

$

92,416

$

61,775

Add (Subtract): Income tax provision **

5,354

4,681

13,630

11,670

Interest expense, net of interest income ***

24,414

25,362

47,017

52,541

Depreciation and amortization

33,306

33,434

67,423

66,761

(Gain)/Loss on real estate assets, pre-tax

2,950

1,304

(10,379)

880

EBITDAre $

107,955

$

101,435

$

210,107

$

193,627

Add (Subtract): Net loss attributable to noncontrolling interests

28

66

88

126

Stock based compensation expenses, pre-tax

4,023

4,706

11,426

14,474

Start-up expenses, pre-tax

-

553

-

2,506

One-time employee restructuring expenses, pre-tax

7,459

-

7,459

-

COVID-19 expenses, pre-tax

-

3,877

-

4,769

Close-out expenses, pre-tax

-

2,284

-

4,220

Other non-cash revenue & expenses, pre-tax

(1,102)

-

(2,204)

-

Adjusted EBITDAre $

118,363

$

112,921

$

226,876

$

219,722

* all figures in '000s ** including income tax provision on

equity in earnings of affiliates *** includes (gain)/loss on

extinguishment of debt

2021 Outlook/Reconciliation

(In thousands, except per share data) (Unaudited)

FY 2021 Net Income Attributable to GEO

$

167,500

to

$

174,500

Real Estate Related Depreciation and Amortization

76,000

76,000

Gain/Loss on Real Estate

(10,000

)

(10,000

)

Funds from Operations (FFO)

$

233,500

to

$

240,500

(Gain)/Loss on Extinguishment of Debt

(5,000

)

(5,000

)

Non-recurring Expenses

10,000

10,000

Normalized Funds from Operations

$

238,500

to

$

245,500

Non-Real Estate Related Depreciation and Amortization

60,000

60,000

Consolidated Maintenance Capex

(17,000

)

(17,000

)

Non-Cash Stock Based Compensation

19,000

19,000

Non-Cash Interest Expense

7,500

7,500

Other Non-Cash Revenue & Expenses

(4,000

)

(4,000

)

Adjusted Funds From Operations (AFFO)

$

304,000

to

$

311,000

Net Interest Expense

103,000

103,000

Non-Cash Interest Expense

(7,500

)

(7,500

)

Consolidated Maintenance Capex

17,000

17,000

Income Taxes (including income tax provision on equity in

earnings of affiliates)

25,000

25,000

Adjusted EBITDAre

$

441,500

to

$

448,500

G&A Expenses

193,000

193,000

Non-recurring Expenses

(10,000

)

(10,000

)

Non-Cash Stock Based Compensation

(19,000

)

(19,000

)

Equity in Earnings of Affiliates

(8,000

)

(8,000

)

Real Estate Related Operating Lease Expense

19,000

19,000

Net Operating Income

$

616,500

to

$

623,500

Adjusted Net Income Per Diluted Share *

$

1.34

$

1.40

AFFO Per Diluted Share

$

2.51

to

$

2.57

Weighted Average Common Shares Outstanding-Diluted

121,000

to

121,000

* In accordance with GAAP, diluted earnings per share

attributable to GEO available to common stockholders is calculated

under the if-converted method or the two-class method, whichever

calculation results in the lowest diluted earnings per share

amount, which may be lower than Adjusted Net Income Per Diluted

Share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210804005317/en/

Pablo E. Paez, (866) 301 4436 Executive Vice President,

Corporate Relations

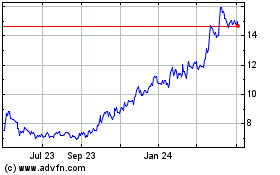

Geo (NYSE:GEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

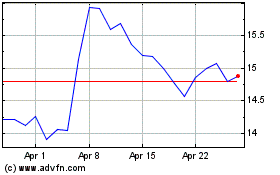

Geo (NYSE:GEO)

Historical Stock Chart

From Apr 2023 to Apr 2024