Current Report Filing (8-k)

October 04 2019 - 5:10PM

Edgar (US Regulatory)

false0001609711

0001609711

exch:XNYS

us-gaap:CommonClassAMember

2019-10-03

2019-10-03

0001609711

2019-10-03

2019-10-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

October 3, 2019

GoDaddy Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-36904

|

|

46-5769934

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

14455 N. Hayden Road

|

|

Scottsdale

|

Arizona

|

|

85260

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(480) 505-8800

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock

|

|

GDDY

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 1.01 Entry into a Material Definitive Agreement

Effective October 3, 2019, Go Daddy Operating Company, LLC and GD Finance Co, Inc. (“GD Finance” and together with Go Daddy Operating Company, LLC, the “Borrowers”), entered into an Amendment No. 3 (the “Amendment”) to the Second Amended and Restated Credit Agreement dated as of February 15, 2017 (as amended by Amendment No. 1, dated as of November 22, 2017, as further amended by the Joinder and Amendment Agreement dated as of June 3, 2019, and as further amended, restated, supplemented or otherwise modified, refinanced or replaced from time to time, the “Credit Agreement”) by and among the Borrowers, Desert Newco, LLC (“Desert Newco”), the lenders or other financial institutions or entities from time to time party thereto and Barclays Bank PLC (“Barclays”), as Administrative Agent, Collateral Agent, Swingline Lender and Letter of Credit Issuer (the “Agent”).

The Borrowers and the Agent entered into the Amendment in connection with the refinancing of all outstanding Tranche B-1 Term Loans (the “Existing Term Loans”) and creation of a new tranche of term loans consisting of Tranche B-2 Term Loans (the “Replacement Term Loans”). The Replacement Term Loans, except with respect to the definition of “Applicable Margin” and Section 5.1(b), have identical terms to the Existing Term Loans and are in a like principal amount as the outstanding Existing Term Loans. The proceeds of the Replacement Term Loans were used to refinance all of the Existing Term Loans. Pursuant to the Amendment, the initial new Applicable Margin is (i) 1.75% for the Replacement Term Loans that are LIBOR Loans (as defined in the Credit Agreement), which is 25 basis points lower than the current interest rate margin and (ii) 0.75% for the Replacement Term Loans that are ABR Loans (as defined in the Credit Agreement), which is 25 basis points lower than the current interest rate margin. The Replacement Term Loans were issued at a 0.125% discount at original issue.

The foregoing description of the Amendment is qualified in its entirety by reference to the full text of the Amendment and the Credit Agreement, which are filed as Exhibit 10.1 to this Current Report on Form 8-K and Exhibit 10.1 to the Company’s Current Report on Form 8-K filed on February 16, 2017, respectively, and are incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit Number

|

|

Exhibit Description

|

|

10.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

GODADDY INC.

|

|

|

|

|

|

Date:

|

October 4, 2019

|

/s/ Ray E. Winborne

|

|

|

|

Ray E. Winborne

|

|

|

|

Chief Financial Officer

|

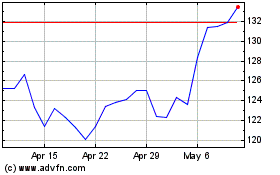

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

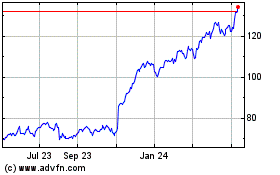

GoDaddy (NYSE:GDDY)

Historical Stock Chart

From Apr 2023 to Apr 2024