Fiverr International Ltd. (NYSE: FVRR) (“Fiverr”) today

announced its intention to offer, subject to market conditions and

other factors, $400 million aggregate principal amount of

Convertible Senior Notes due 2025 (the “Notes”) in a private

offering (the “Offering”) to qualified institutional buyers

pursuant to Rule 144A under the Securities Act of 1933, as amended

(the “Securities Act”). In connection with the Offering, Fiverr

expects to grant the initial purchasers of the Notes an option to

purchase, within a 13-day period beginning on, and including, the

date on which the Notes are first issued, up to an additional $60

million aggregate principal amount of the Notes.

The final terms of the Notes, including the initial conversion

price, interest rate and certain other terms, will be determined at

the time of pricing of the Offering. When issued, the Notes will be

senior, unsecured obligations of Fiverr. Interest on the Notes will

be payable semi-annually in arrears, and the Notes will mature on

November 1, 2025, unless earlier repurchased, redeemed or converted

in accordance with their terms. Prior to the close of business on

the business day immediately preceding May 1, 2025, the Notes will

be convertible at the option of the holders of the Notes only upon

the satisfaction of specified conditions and during certain

periods. Thereafter, the Notes will be convertible at the option of

the holders of the Notes at any time until the close of business on

the third scheduled trading day immediately preceding the maturity

date regardless of such conditions. Conversions of the Notes will

be settled in cash, ordinary shares of Fiverr or a combination

thereof, at Fiverr’s election.

Fiverr may not redeem the Notes prior to November 5, 2023,

except in the event of certain tax law changes. On or after

November 5, 2023, Fiverr may redeem, for cash, all or part of the

Notes if the last reported sale price of its ordinary shares has

been at least 130% of the conversion price then in effect for at

least 20 trading days (whether or not consecutive) during any 30

consecutive trading day period (including the last trading day of

such period) ending on, and including, the trading day immediately

preceding the date on which Fiverr provides notice of the

redemption at a redemption price equal to 100% of the principal

amount of the Notes to be redeemed, plus accrued and unpaid

interest to, but excluding, the redemption date. Holders of the

Notes will have the right to require Fiverr to repurchase all or a

portion of their Notes upon the occurrence of a fundamental change

(as defined in the indenture governing the Notes) at a cash

repurchase price equal to 100% of the principal amount of the Notes

to be repurchased, plus any accrued and unpaid interest to, but

excluding the fundamental change repurchase date.

In connection with the pricing of the Notes, Fiverr expects to

enter into privately negotiated capped call transactions with one

or more of the initial purchasers of the Notes or their respective

affiliates and/or other financial institutions (in this capacity,

the “Option Counterparties”). The capped call transactions are

expected generally to reduce the potential dilution to the holders

of ordinary shares of Fiverr upon any conversion of Notes and/or to

offset any cash payments Fiverr is required to make in excess of

the principal amount of converted Notes, as the case may be, with

such reduction and/or offset subject to a cap. If the initial

purchasers exercise their option to purchase additional Notes,

Fiverr expects to enter into additional capped call transactions

with the Option Counterparties.

Fiverr has been advised that, in connection with establishing

their initial hedges of the capped call transactions, the Option

Counterparties or their respective affiliates expect to purchase

ordinary shares of Fiverr and/or enter into various derivative

transactions with respect to the ordinary shares of Fiverr

concurrently with or shortly after the pricing of the Notes. This

activity could increase (or reduce the size of any decrease in) the

market price of the ordinary shares of Fiverr or the Notes at that

time. In addition, the Option Counterparties or their respective

affiliates may modify their hedge positions by entering into or

unwinding various derivatives with respect to the ordinary shares

of Fiverr and/or by purchasing or selling ordinary shares or other

securities of Fiverr in secondary market transactions following the

pricing of the Notes and prior to the maturity of the Notes (and

are likely to do so following any conversion, repurchase, or

redemption of the Notes, to the extent Fiverr exercises the

relevant election under the capped call transactions). This

activity could also cause or avoid an increase or a decrease in the

market price of the ordinary shares of Fiverr or the Notes, which

could affect the ability of holders of Notes to convert the Notes

and, to the extent the activity occurs during any observation

period related to a conversion of the Notes, it could affect the

number of ordinary shares of Fiverr, if any, and value of the

consideration that holders of Notes will receive upon conversion of

the Notes.

In addition, if any such capped call transactions fail to become

effective, whether or not the Offering is completed, the Option

Counterparties party thereto or their respective affiliates may

unwind their hedge positions with respect to the ordinary shares of

Fiverr, which could adversely affect the value of the ordinary

shares of Fiverr and, if the Notes have been issued, the value of

the Notes.

Fiverr intends to use a portion of the net proceeds from the

Offering to pay the cost of the capped call transactions. Fiverr

intends to use any remaining net proceeds from the Offering for

working capital or other general corporate purposes. If the initial

purchasers exercise their option to purchase additional Notes,

Fiverr expects to use a portion of the net proceeds from the sale

of the additional Notes to enter into additional capped call

transactions with the Option Counterparties and the remaining net

proceeds for general corporate purposes.

The Notes will be offered only to persons reasonably believed to

be qualified institutional buyers pursuant to Rule 144A under the

Securities Act. The offer and sale of the Notes and the ordinary

shares of Fiverr potentially issuable upon conversion of the Notes,

if any, have not been, and will not be, registered under the

Securities Act, any state securities laws or the securities laws of

any other jurisdiction, and unless so registered, the Notes and

such shares, if any, may not be offered or sold in the United

States except pursuant to an applicable exemption from such

registration requirements.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any offer or

sale of, the Notes (or any ordinary shares of Fiverr issuable upon

conversion of the Notes) in any state or jurisdiction in which the

offer, solicitation, or sale would be unlawful prior to the

registration or qualification thereof under the securities laws of

any such state or jurisdiction.

About Fiverr

Fiverr’s mission is to change how the world works together. For

over 10 years, the Fiverr platform has been at the forefront of the

future of work connecting businesses of all sizes with skilled

freelancers offering digital services in more than 400 categories,

across 8 verticals including graphic design, digital marketing,

programming, video and animation. In the twelve months ended June

30, 2020, 2.8 million customers bought a wide range of services

from freelancers across more than 160 countries.

Forward-Looking Statements

This press release contains forward-looking statements, within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 that involve risks and uncertainties.

Such forward-looking statements may include, among other things,

whether Fiverr will be able to consummate the Offering, the terms

of the Offering and the capped call transactions, expectations

regarding actions of the Option Counterparties and their respective

affiliates and the satisfaction of customary closing conditions

with respect to the Offering and the anticipated use of the net

proceeds of the Offering, and may be identified by words like

“anticipate,” “assume,” “believe,” “aim,” “forecast,” “indication,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “outlook,” “future,” “will,”

“seek” and similar terms or phrases. The forward-looking statements

contained in this announcement are based on management’s current

expectations, which are subject to uncertainty, risks and changes

in circumstances that are difficult to predict and many of which

are outside of our control.

Important factors that could cause actual outcomes to differ

materially from those indicated in the forward-looking statements

include, among others, the uncertainty surrounding the duration and

severity of COVID-19 and its effects on our business; the risk that

the Offering will not be consummated; the risk that the capped call

transactions will not become effective; and changes in global,

national, regional or local economic, business, competitive,

market, regulatory and other factors discussed under the heading

“Risk Factors” in the Company’s 2019 annual report on Form 20-F

filed with the Securities and Exchange Commission on March 31,

2020. Any forward-looking statement made by Fiverr in this press

release speaks only as of the date hereof. Factors or events that

could cause Fiverr’s actual results to differ may emerge from time

to time, and it is not possible for Fiverr to predict all of them.

Fiverr undertakes no obligation to publicly update any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201007005483/en/

Investor Relations: Jinjin Qian investors@fiverr.com

Press: Siobhan Aalders press@fiverr.com

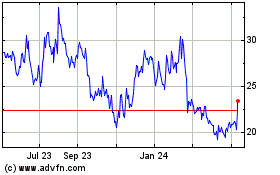

Fiverr (NYSE:FVRR)

Historical Stock Chart

From Mar 2024 to Apr 2024

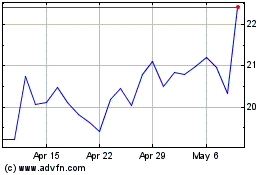

Fiverr (NYSE:FVRR)

Historical Stock Chart

From Apr 2023 to Apr 2024