By Dave Sebastian

Finance chiefs at travel companies are struggling to plan ahead

despite a recent pickup in bookings, as the coronavirus continues

to spread and a vaccine is still months, if not years, away.

"We're basically prevented from saying the word 'forecast' right

now because whatever we forecast...it's wrong," said Shannon

Okinaka, chief financial officer at Hawaiian Airlines. "So we've

started to use the word 'planning scenarios' or 'planning

assumptions.'"

The pandemic and local quarantine requirements have changed the

airline's outlook. Hawaiian expects its operations to be around 25%

smaller next summer compared with 2019, Ms. Okinaka said. The

company booked a loss of $106.9 million in its latest quarter,

compared with a profit of $57.83 million in the prior-year period.

Hawaiian's finance team now focuses more on booking levels, the use

of travel vouchers and refunds -- metrics it paid less attention to

before the pandemic when it focused on its revenue, Ms. Okinaka

said.

Most of the 17 S&P 500 companies in the leisure, arts and

hospitality space have withdrawn or lowered their financial

guidance due to the pandemic as of Sept. 15, according to Dow Jones

Newswires, indicating a lack of visibility into what the future

might hold.

Widespread lockdown orders and travel restrictions have resulted

in cancellations and a drop in new bookings at leisure businesses.

Travel could see a partial recovery in the U.S. next year,

depending on when a vaccine might arrive, but a complete rebound

may have to wait until 2023 as the nation recovers from the

recession, said Adam Sacks, president of the consulting firm

Tourism Economics.

Travel companies have raised billions of dollars in emergency

funds, retired aircraft, shut hotels and cut thousands of jobs in

an effort to survive, as some have generated little or no

revenue.

CFOs at these companies say they are updating their models more

frequently to respond to fluctuating customer demand and work with

various scenarios to reflect the uncertainty surrounding the

industry. They track cash flows on a regular, oftentimes weekly,

basis, said Anthony Jackson, a principal at Deloitte, the

professional services-firm.

Mr. Jackson said he advises companies to assess the effect of

economic metrics such as gross domestic product on their revenue

instead of relying on historical data. Historical performance

"might not be a very reliable indicator as to what your future

performance is going to look like," Mr. Jackson said.

Marriott International Inc., the biggest hotel operator in the

world, has moved to tracking its cash flows daily as it looks to

reduce its cash burn, finance chief Leeny Oberg said. The company,

which runs about 5,500 hotels in North America, saw occupancy rates

drop 57.4 percentage points for the three months ended June 30.

Marriott in August expected an average corporate cash burn of about

$45 million a month. The company booked a loss of $234 million in

the latest quarter, its largest core operating loss on record.

"When I think of a CFO's role, in many cases it's about a

balance of the short-, the medium- and the long-term needs of the

business," Ms. Oberg said. "In this case, the pandemic really

requires that you should just focus a bit more toward the shorter

term and also a really strong focus on cash flow."

Bookings by leisure travelers partly recovered as states began

relaxing stay-at-home rules, but corporate travel, an important

part of Marriott's business, remains depressed as companies

continue to operate remotely.

To gauge demand, the company's finance team tracks booking and

cancellation trends by market, length of stay and time, Ms. Oberg

said. Before the pandemic, Marriott focused more on monthly trends

and expectations further out to forecast demand, as opposed to

daily data.

Cruise operator Carnival Corp. has simplified its models for

financial forecasts in the face of so much uncertainty. Finance

chief David Bernstein and his team used to track roughly 65,000

price points in determining forecasts but now focus on just 12.

"It's not worth it to go in that level of detail," Mr. Bernstein

said. "You need to be flexible."

Carnival used to plan its itineraries about two years ahead of

sailings, Mr. Bernstein said. The company in recent months had to

reschedule trips on the go because of cross-border restrictions and

other disruptions, such as delays in ship deliveries. It reported a

loss of more than $4 billion for the quarter ended May 31 and

expects to burn about $650 million a month in the second half of

the year.

At Cedar Fair LP, the theme-park operator, decision-making now

involves more analytical thinking, CFO Brian Witherow said. "In

Covid terms, a week is like six months, and a month is like a

year," Mr. Witherow said. "Things just change so rapidly."

One tool that has helped him was a recent survey conducted in

the company's parks, Mr. Witherow said. He used the results to

calculate metrics such as net promoter score, used to gauge the

likelihood of guests recommending Cedar Fair parks to others, he

said.

Despite all the changes to their forecasting, some finance

chiefs still rely on their instincts. "I've got a good gut feel,"

said Carnival's Mr. Bernstein, who has been CFO since 2007.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

September 20, 2020 09:14 ET (13:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

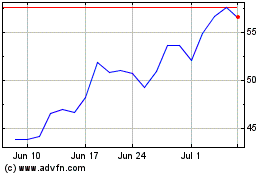

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From Apr 2023 to Apr 2024