Current Report Filing (8-k)

April 17 2020 - 4:21PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

April 15, 2020

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-13270

|

90-0023731

|

|

(State or Other Jurisdiction of

|

(Commission

|

(IRS Employer

|

|

Incorporation)

|

File Number)

|

Identification No.)

|

10603 W. Sam Houston Pkwy N.,

Suite 300

Houston, Texas 77064

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not applicable)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

FTK

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On April 16, 2020, Flotek Industries, Inc. (the "Company") entered into a promissory note (the "Note") in favor of PNC Bank, National Association reflecting a loan in the amount of $4,788,100 (the "Loan"). The Loan is granted pursuant to the Paycheck Protection Program (the "PPP") administered by the United States Small Business Administration as part of the Conronavirus Aid, Relief, and Economic Security Act (the "CARES Act"), which provides for forgiveness of up to the full principal amount and accrued interest of qualifying loans.

Pursuant to the terms of the Note, the Loan will bear a rate of interest equal to 1.00% per annum and matures on April 16, 2022 (the "Maturity Date"). Interest and principal payments are deferred until October 16, 2020, at which time principal that is not forgiven pursuant to the PPP shall convert to an amortizing term loan. Pursuant to the terms of the PPP, the principal may be forgiven if Loan proceeds are used for qualifying expenses as described in the CARES Act. On November 15, 2020, all accrued interest is due and payable, and equal installments of principal are due and payable monthly from that date through the Maturity Date. Interest is due and payable at the same time as the monthly principal payments. The Loan is also subject to certain late charges and a default rate as described in the Note.

The foregoing description of the Note is qualified in its entirety by reference to its full text, a copy of which is attached as Exhibit 10.1 and is incorporated herein by reference.

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth above in Item 1.01 is hereby incorporated by reference into this Item 2.03.

|

|

|

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On April 15, 2020, the Company received written notice from the New York Stock Exchange (the "NYSE") notifying it that the average closing price of the Company's common stock over a period of 30 consecutive trading days was below the minimum $1.00 per share requirement for continued listing on the NYSE under Item 802.01C of the NYSE Listed Company Manual.

In accordance with applicable NYSE procedures, the Company plans to notify the NYSE of its intent to cure the $1.00 per share deficiency. Based on the applicable NYSE procedures, the Company has six months following the receipt of the written notice mentioned above to cure the deficiency and regain compliance. The notice has no immediate impact on the listing of the Company's common stock, which will continue to trade on the NYSE subject to the Company’s continued compliance with the other listing requirements of the NYSE. The common stock of the Company will continue to trade under the symbol “FTK,” but will have an added designation of “.BC” to indicate that the status of the common stock is “below compliance” with the NYSE continued listing standards. The “.BC” indicator will be removed at such time as the Company is deemed to be in compliance. The Company intends to monitor the closing share price for its common stock and explore available options to regain compliance.

|

|

|

|

Item 7.01.

|

Regulation FD Disclosure.

|

On April 17, 2020, the Company issued a press release with respect to the NYSE notice. The full text of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K.

The foregoing information is intended to be furnished under Item 7.01 of Form 8-K, "Regulation FD Disclosure." This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Act, whether made before or after the date of this report, regardless of any general incorporation language in the filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

10.1

|

|

|

|

99.1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FLOTEK INDUSTRIES, INC.

|

|

|

|

|

|

|

|

|

Date: April 17, 2020

|

|

/s/ Nicholas J. Bigney

|

|

|

|

|

Name:

|

Nicholas J. Bigney

|

|

|

|

|

Title:

|

Senior Vice President, General Counsel & Corporate Secretary

|

|

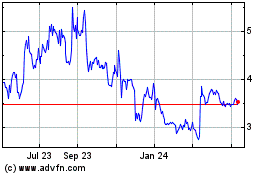

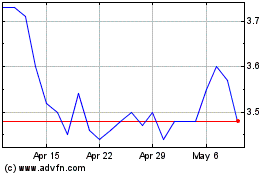

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024