Fortuna Silver Mines Inc. (NYSE: FSM) (TSX: FVI)

is pleased to report production results for the third quarter of

2019 from its two operating mines in Latin America, the San Jose

Mine in Mexico and the Caylloma Mine in Peru. The Company

produced 1.9 million ounces of silver and 11,436 ounces of gold

plus base metal by-products. Silver and gold production for

the first nine months of 2019 totaled 6.6 million ounces and 38,247

ounces respectively; being 1 percent above and 4 percent below the

Company’s nine month projection respectively. Fortuna is on

schedule to produce between 8.2 to 9.0 million ounces of silver and

between 49 to 54 thousand ounces of gold or between 11.7 to 12.9

million Ag Eq1 ounces in 2019 in accordance with our annual

production guidance (refer to Fortuna news release dated January

17, 2019).

Third Quarter Production

Highlights

- Silver production of 1,937,293 ounces; 13 percent decrease over

Q3 2018

- Gold production of 11,436 ounces; 9 percent decrease over

Q3 2018

- Lead production of 7,157,229 pounds; 6 percent decrease over Q3

2018

- Zinc production of 11,517,861 pounds; 0.3 percent increase over

Q3 2018

- Cash cost2 for San Jose is US$70.8/t, slightly above 2019

annual cost guidance of between $63.5 to $70.1/t

- Cash cost2 for Caylloma is US$93.0/t, is 5 percent above 2019

annual cost guidance of between $80.0 to $88.4/t

Consolidated Operating

Highlights

|

|

Third Quarter 2019 |

Third Quarter 2018 |

|

|

Caylloma, Peru |

San Jose, Mexico |

Consolidated |

Caylloma, Peru |

San Jose, Mexico |

Consolidated |

|

Processed Ore |

|

|

|

Tonnes milled |

134,338 |

267,998 |

|

135,996 |

262,710 |

|

|

Average tpd milled |

1,493 |

3,045 |

|

1,511 |

2,985 |

|

|

Silver3 |

|

|

|

Grade (g/t) |

64 |

219 |

|

65 |

258 |

|

|

Recovery (%) |

82.42 |

90.72 |

|

84.69 |

91.47 |

|

|

Production (oz) |

228,168 |

1,709,125 |

1,937,293 |

239,253 |

1,991,211 |

2,230,465 |

|

|

Third Quarter 2019 |

Third Quarter 2018 |

|

|

Caylloma, Peru |

San Jose, Mexico |

Consolidated |

Caylloma, Peru |

San Jose, Mexico |

Consolidated |

|

Gold |

|

|

|

Grade (g/t) |

0.25 |

1.40 |

|

0.17 |

1.61 |

|

|

Recovery (%) |

46.61 |

90.56 |

|

21.37 |

91.24 |

|

|

Production (oz) |

494 |

10,942 |

11,436 |

155 |

12,387 |

12,542 |

|

Lead |

|

|

|

Grade (%) |

2.68 |

|

|

2.74 |

|

|

|

Recovery (%) |

90.16 |

|

|

92.23 |

|

|

|

Production (lbs) |

7,157,229 |

|

7,157,229 |

7,575,541 |

|

7,575,541 |

|

Zinc |

|

|

|

Grade (%) |

4.35 |

|

|

4.24 |

|

|

|

Recovery (%) |

89.38 |

|

|

90.36 |

|

|

|

Production (lbs) |

11,517,861 |

|

11,517,861 |

11,482,583 |

|

11,482,583 |

Notes to the first page and table above, as applicable:1.

Silver equivalent production does not include lead or zinc and is

calculated using a silver to gold ratio of 72 to 12.

Preliminary estimates of cash operating costs per tonne are subject

to modification on final cost consolidation3. Metallurgical

recovery for silver at the Caylloma Mine is calculated based on

silver content in lead concentrate4. Totals may not add due

to rounding

San Jose Mine, Mexico

The San Jose Mine produced 1,709,125 ounces of

silver and 10,942 ounces of gold in the third quarter of 2019,

8 percent and 13 percent below budget respectively.

Average head grades for silver and gold were 219 g/t and 1.4

g/t, 8 percent and 14 percent below budget respectively. The

decrease in silver and gold production during the third quarter is

mainly due to scheduled mine production activities at lower grade

stopes which is in line with the mine’s production program for the

quarter. Silver and gold production for the first nine months

of 2019 totaled 5.9 million ounces and 36,887 ounces respectively;

being 1 percent above and 7 percent below the mine’s nine month

projection. Annual production of gold and silver at the San

Jose Mine is expected to be within the 2019 annual production

guidance of between 7.3 to 8.1 million ounces of silver and between

49 to 54 thousand ounces of gold (refer to Fortuna news release

dated January 17, 2019).

The San Jose Mine cash cost per tonne for the

third quarter of 2019 is US$70.8; slightly above the annual

guidance range due to higher ground support costs and increased

mine contractor tariffs. Cash cost per tonne for the year is

expected to be within the high end of the annual guidance range

(refer to Fortuna news release dated January 17, 2019).

Caylloma Mine, Peru

The Caylloma Mine produced 228,168 ounces of

silver in the third quarter of 2019, 1 percent above budget.

The average silver head grade of 64 g/t was 3 percent above

budget. Silver production for the first nine months of 2019

totaled 692,005 ounces; 1 percent above the mine’s nine month

projection.

Lead and zinc production in the third quarter of

2019 was 7,157,229 pounds and 11,517,861 pounds respectively, 9

percent and 9 percent above budget respectively. The average

head grades for lead and zinc were 2.68 % and 4.35 %, 9

percent and 11 percent above budget respectively. Base metals

production for the first nine months of 2019 totaled 21,304,857

pounds of lead and 33,986,132 pounds of zinc; being 2 percent and 8

percent above the mine’s nine month projection.

The Caylloma Mine cash cost per tonne for the

third quarter of 2019 is US$93.0; 5 percent above the annual

guidance range due to timing of indirect costs related to

processing plant maintenance. Cash cost per tonne for the year is

expected to be within the high end of the annual guidance range

(refer to Fortuna news release dated January 17, 2019).

Qualified Person

Amri Sinuhaji, Technical Services Director –

Mine Planning, is the Qualified Person for Fortuna Silver Mines

Inc. as defined by National Instrument 43-101. Mr. Sinuhaji

is a Professional Engineer registered with the Association of

Professional Engineers and Geoscientists of the Province of British

Columbia (#48305) and has reviewed and approved the scientific and

technical information contained in this news release.

About Fortuna

Silver Mines Inc.

Fortuna is a growth oriented, precious metals

producer focused on mining opportunities in Latin America.

Our primary assets are the Caylloma silver Mine in southern

Peru, the San Jose silver-gold Mine in Mexico and the Lindero gold

Project, currently under construction, in Argentina. The

Company is selectively pursuing acquisition opportunities

throughout the Americas and in select other areas. For more

information, please visit our website at www.fortunasilver.com.

Jorge A. Ganoza President, CEO and

DirectorFortuna Silver Mines Inc.

Trading symbols: NYSE: FSM | TSX: FVI

Investor Relations:

Carlos BacaT (Peru): +51.1.616.6060, ext. 0

Forward looking Statements

This news release contains forward looking

statements which constitute "forward looking information" within

the meaning of applicable Canadian securities legislation and

"forward looking statements" within the meaning of the "safe

harbor" provisions of the Private Securities Litigation Reform Act

of 1995 (collectively, "Forward looking Statements"). All

statements included herein, other than statements of historical

fact, are Forward looking Statements and are subject to a variety

of known and unknown risks and uncertainties which could cause

actual events or results to differ materially from those reflected

in the Forward looking Statements. The Forward looking Statements

in this news release include, without limitation, statements about

the Company's plans for its mines and mineral properties; the

Company's business strategy, plans and outlook; the merit of the

Company's mines and mineral properties; the future financial or

operating performance of the Company; 2019 production and cost

guidance; and proposed expenditures. Often, but not always, these

Forward looking Statements can be identified by the use of words

such as "estimated", "potential", "open", "future", "assumed",

"projected", "used", "detailed", "has been", "gain", "planned",

"reflecting", "will", "containing", "remaining", "to be", or

statements that events, "could" or "should" occur or be achieved

and similar expressions, including negative variations.

Forward looking Statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to be

materially different from any results, performance or achievements

expressed or implied by the Forward looking Statements. Such

uncertainties and factors include, among others, changes in general

economic conditions and financial markets; changes in prices for

silver and other metals; technological and operational hazards in

Fortuna's mining and mine development activities; risks inherent in

mineral exploration; uncertainties inherent in the estimation of

mineral reserves, mineral resources, and metal recoveries;

governmental and other approvals; political unrest or instability

in countries where Fortuna is active; labor relations issues; as

well as those factors discussed under "Risk Factors" in the

Company's Annual Information Form. Although the Company has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in Forward looking Statements, there may be other factors

that cause actions, events or results to differ from those

anticipated, estimated or intended.

Forward looking Statements contained herein are

based on the assumptions, beliefs, expectations and opinions of

management, including but not limited to expectations regarding the

Company's plans for its mines and mineral properties; mine

production costs; expected trends in mineral prices and currency

exchange rates; the accuracy of the Company's current mineral

resource and reserve estimates; that the Company's activities will

be in accordance with the Company's public statements and stated

goals; that there will be no material adverse change affecting the

Company or its properties; that all required approvals will be

obtained; that there will be no significant disruptions affecting

operations and such other assumptions as set out herein. Forward

looking Statements are made as of the date hereof and the Company

disclaims any obligation to update any Forward looking Statements,

whether as a result of new information, future events or results or

otherwise, except as required by law. There can be no assurance

that Forward looking Statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, investors should not

place undue reliance on Forward looking Statements.

This news release also refers to non-GAAP

financial measures, such as cash cost per tonne of processed ore;

cash cost per payable ounce of silver; total production cost per

tonne; all-in sustaining cash cost; all-in cash cost; adjusted net

(loss) income; operating cash flow per share before changes in

working capital, income taxes, and interest income; and adjusted

EBITDA. These measures do not have a standardized meaning or method

of calculation, even though the descriptions of such measures may

be similar. These performance measures have no meaning under

International Financial Reporting Standards (IFRS) and therefore,

amounts presented may not be comparable to similar data presented

by other mining companies.

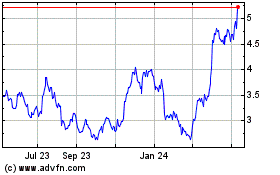

Fortuna Silver Mines (NYSE:FSM)

Historical Stock Chart

From Mar 2024 to Apr 2024

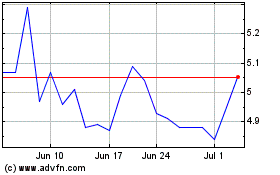

Fortuna Silver Mines (NYSE:FSM)

Historical Stock Chart

From Apr 2023 to Apr 2024