Flex LNG Q2, 2020 Earnings Release

August 19 2020 - 1:00AM

Flex LNG Ltd. ("Flex LNG" or the “Company”) today announced its

unaudited financial results for the second quarter and six months

ended June 30, 2020.

Highlights:

- Revenues of $25.8 million for the second quarter 2020, compared

to $38.2 million for the first quarter 2020.

- Net loss of $6.7 million and loss per share of $0.12 for the

second quarter 2020, compared to a net loss of $14.9 million and

loss per share of $0.27 for the first quarter 2020.

- Average Time Charter Equivalent ("TCE") rate of $46,588 per day

for the second quarter 2020, compared to $67,740 per day for the

first quarter 2020.

- Adjusted EBITDA of $17.4 million for the second quarter 2020,

compared to $27.8 million for the first quarter 2020.

- Adjusted net loss of $0.7 million for the second quarter 2020,

compared to adjusted net income of $9.3 million for the first

quarter 2020.

- Adjusted loss per share of $0.01 for the second quarter

2020, compared to adjusted earnings per share of $0.17 for the

first quarter 2020.

- Long-term financing secured at attractive terms for all vessels

and newbuildings.

- In June 2020, the Company signed a $156.4 million sale and

leaseback transaction with an Asian based leasing house for the

newbuilding Flex Amber.

- In June 2020, the Company signed a $125 million financing with

a syndicate of banks for the newbuilding Flex Volunteer, which is

scheduled for delivery in the first quarter 2021.

- In July 2020, the Company took delivery of its seventh

newbuilding LNG carrier, the Flex Aurora.

- In July 2020, the technical ship management for Flex Ranger was

successfully transferred to Flex LNG Fleet Management AS. Following

this transfer, all vessels are managed by Flex LNG Fleet Management

AS.

- In August 2020, the Company took delivery of its eighth

newbuilding LNG carrier, the Flex Artemis, which immediately

commenced its long-term charter to Clearlake Shipping, a subsidiary

of the Gunvor Group.

Øystein M Kalleklev, CEO of Flex LNG

Management AS, commented:“The Covid-19 pandemic and

resulting mobility restrictions posed multifaceted challenges for

LNG shipping, which in nature is mobile and woven into global

supply chains. Notwithstanding these obstacles, we have managed to

operate our ships with 100 per cent up-time and availability, with

cargoes being delivered without disruptions or delays to our

customers. Furthermore, we have mobilized our newbuildings for

delivery of which two ships, Flex Aurora and Flex Artemis, have

already been delivered.

Crew rotations have been made particularly

difficult for the shipping industry, resulting in a lot of

seafarers being effectively stranded on ships. We are however

pleased that we on average have been able to carry out two crew

changes per ship in this period, thus minimizing extended stay for

our seafarers.

First class operational performance means we are

able to deliver trading results in line with our guidance, with a

TCE for the quarter of $47k per day, despite our exposure to a weak

spot market during the spring and the summer. We expect similar

trading result for the third quarter, even with mobilization of

three or possibly four newbuildings during this quarter.”

Second Quarter 2020 Result

PresentationFlex LNG will release its financial results

for the second quarter 2020 on Wednesday August 19, 2020. In

connection with the earnings release, a webcast and conference call

will be held at 3:00 p.m. CEST (9:00 a.m. EST). In order to attend

the webcast and/or conference call you may do one of the

following:

Attend by Webcast:Use to the follow link prior

to the webcast: https://edge.media-server.com/mmc/p/6qeg8ow6

Attend by Conference Call:Applicable dial-in

telephone numbers are as follows:Norway: +47 21 56 31 62United

Kingdom: +44 (0) 203 0095 710United Kingdom (local): 0844 493

3857United States (Toll Free): +1 866 869 2321

Confirmation Code: 4971456

The presentation material which will be used in

the teleconference/webcast can be downloaded on www.flexlng.com and

replay details will also be available at this website.

For further information, please contact:

Harald Gurvin, CFO

Telephone: +47 23 11 40 00

Forward-Looking

StatementsMatters discussed in this press release may

constitute forward-looking statements. The Private Securities

Litigation Reform Act of 1995 provides safe harbor protections for

forward-looking statements in order to encourage companies to

provide prospective information about their business.

Forward-looking statements include statements concerning plans,

objectives, goals, strategies, future events or performance, and

underlying assumptions and other statements, which are other than

statements of historical facts. The Company desires to take

advantage of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 and is including this cautionary

statement in connection with this safe harbor legislation. The

words "believe," "expect," "anticipate," "estimate," "intend,"

"plan," "target," "project," "likely," "may," "will," "would,"

"could" and similar expressions identify forward-looking

statements.

The forward-looking statements in this press

release are based upon various assumptions, many of which are

based, in turn, upon further assumptions, including without

limitation, management’s examination of historical operating

trends, data contained in the Company’s records and other data

available from third parties. Although management believes that

these assumptions were reasonable when made, because these

assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are

beyond the Company’s control, there can be no assurance that the

Company will achieve or accomplish these expectations, beliefs or

projections. The Company undertakes no obligation, and specifically

declines any obligation, except as required by law, to publicly

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise.

In addition to these important factors, other

important factors that, in the Company’s view, could cause actual

results to differ materially from those discussed in the

forward-looking statements include: unforeseen liabilities, future

capital expenditures, the strength of world economies and

currencies, general market conditions, including fluctuations in

charter rates and vessel values, changes in demand in the LNG

tanker market, the length and severity of the COVID-19 outbreak,

the impact of public health threats and outbreaks of other highly

communicable diseases, changes in the Company’s operating expenses,

including bunker prices, dry-docking and insurance costs, the fuel

efficiency of the Company’s vessels, the market for the Company’s

vessels, availability of financing and refinancing, ability to

comply with covenants in such financing arrangements, failure of

counterparties to fully perform their contracts with the Company,

changes in governmental rules and regulations or actions taken by

regulatory authorities, including those that may limit the

commercial useful lives of LNG tankers, potential liability from

pending or future litigation, general domestic and international

political conditions, potential disruption of shipping routes due

to accidents or political events, vessel breakdowns and instances

of off-hire, and other factors, including those that may be

described from time to time in the reports and other documents that

the Company files with or furnishes to the U.S. Securities and

Exchange Commission (“Other Reports”). For a more complete

discussion of certain of these and other risks and uncertainties

associated with the Company, please refer to the Other Reports.

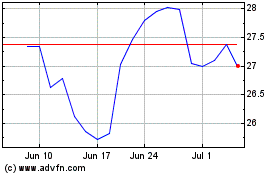

FLEX LNG (NYSE:FLNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

FLEX LNG (NYSE:FLNG)

Historical Stock Chart

From Apr 2023 to Apr 2024