Frank’s International N.V. (NYSE: FI) (the “Company” or “Frank’s”)

today reported financial and operational results for the three and

six months ended June 30, 2020.

Second Quarter 2020 Financial

Highlights

- Second quarter net loss of $34.2

million improved over prior period resulting from market-related

impairments taken in the first quarter of 2020.

- Second quarter revenue of $86.1

million and Adjusted EBITDA of ($1.7) million reflecting

decremental margin of 24% driven by cost reductions.

- Second quarter cash flows from

operating activities of $26.4 million and free cash flow of $16.1

million both showing a significant improvement from the prior

quarter.

- Actions both completed and in

progress expanding previously announced cost reduction initiatives,

projecting an approximate 25% year over year reduction in

costs.

“The second quarter reflects the sudden and

historic downturn in our industry created by the Covid-19 pandemic

and highly volatile and lower oil prices. During the quarter, we

saw some of our highest producing geographies experience reductions

in rig activity of greater than 80% resulting in a significant

revenue decline. We communicated our aggressive cost cutting

measures last quarter, and I am very pleased that Frank’s

management and our entire employee base has executed various cost

reduction plans expeditiously, the results of which are reflected

in our reported results. While we cannot control the operational

plans of our customers and the resulting short term revenue swings

we experience, we can and have controlled our costs during the

quarter, holding decremental margins to less than 25%. This was

made possible through the effective management of a wide range of

cost control measures that we accelerated and intensified over the

past quarter. Cost containment and efficiency is not a periodic

exercise but something we are practicing on a daily basis at

Frank’s. The entire Frank’s team remains focused on exploring

opportunities to work more efficiently in the future and reset our

cost base,” said Michael Kearney, the Company’s Chairman, President

and Chief Executive Officer.

“We are also focused on maintaining a strong

balance sheet and cash position. Our progress in this area is

reflected by the resurgence in our cash balance from year end

levels and strong free cash flow during the quarter.”

Mr. Kearney continued, “Our customers and their

respective drilling programs continue to show impacts from Covid-19

shutdowns due to logistics issues, as well as delays in the

start-up of new drilling programs. We are seeing signs of

stabilization, with some rigs recommencing work in the third

quarter and others planned to begin programs during the fourth

quarter. As we navigate the Covid-19 pandemic, protecting the

health and safety of our employees, customers and communities

remains of the utmost importance, with our cross-functional

Covid-19 task force overseeing ongoing, localized risk assessment

and modified work protocols.

“Frank’s continues to generate value for our

customers by offering technological solutions that safely reduce

the time to drill, case and complete wells. Our multi-product line

solutions add value in the most extreme applications, most recently

with a joint Cementing and TRS operation on behalf of a major

operator in the Gulf of Mexico. Following intensive pre-job

technical analysis, the ultra-heavy landing string installation

utilized multiple Frank’s load bearing technologies. The combined

solutions facilitated a safe and efficient operation, while

achieving a customer hook load record, adding to the Frank’s

history of record hook load achievements.

“Frank’s also recently introduced the Caseless

Insertable™ Float System, a new cementing technology suitable for a

float collar, landing collar and guide or float shoe assembly. This

versatile, patented solution offers a modular design and threadless

interface that can be configured to a wide range of operational

requirements, eliminating specialized premium connections,

manufacturing lead time and the costs associated with transporting

and storing excess inventory. It has performed successfully in both

offshore and onshore applications, most recently on behalf of a

major operator in the U.S. onshore market.

“In summary, we have aggressively responded to

recent market shocks and continued to place our strongest focus on

delivering exemplary service to our customers. Our employees have

demonstrated their commitment to excellence and this organization,

and we are poised to weather these conditions and position

ourselves well for an eventual recovery,” concluded Mr.

Kearney.

Segment Results

Tubular Running Services

Tubular Running Services revenue was $62.3

million for the second quarter of 2020, compared to $89.5 million

in the first quarter of 2020, and $106.6 million for the second

quarter of 2019. The decrease in sequential revenue, which is down

30% from the first quarter and 42% from the prior year quarter, was

primarily driven by activity disruptions brought about from

Covid-19 and customer spending cuts in response to falling oil

prices, with the largest impacts felt in the U.S. onshore and

offshore markets. In Africa, personnel logistics issues and reduced

activity levels, also as a consequence of Covid-19, further

contributed to the decline.

Segment adjusted EBITDA for the second quarter

of 2020 was $4.1 million, or 7% of revenue, compared to $13.3

million, or 15% of revenue, for the first quarter of 2020 and $25.4

million, or 24% of revenue, for the second quarter of 2019. The

adjusted EBITDA deterioration is related to the revenue declines

experienced due to current market conditions, especially in U.S.

onshore and offshore markets as well as in Africa.

Tubulars

Tubulars revenue for the second quarter of 2020

was $8.7 million, compared to $12.5 million for the first quarter

of 2020, and $22.3 million for the second quarter of 2019. The

sequential decrease was the result of lower demand for the

Company’s tubular products in light of reduced drilling program

activity.

Segment adjusted EBITDA for the second quarter

of 2020 was $0.7 million, or 8% of revenue, compared to $1.4

million, or 11% of revenue, for the first quarter of 2020 and $3.9

million, or 18% of revenue for the second quarter of 2019. The

sequential decrease was driven by lower revenue levels.

Cementing Equipment

Cementing Equipment revenue was $15.0 million in

the second quarter of 2020, compared to $21.5 million in the first

quarter of 2020 and $26.7 million for the second quarter of 2019.

The sequential decline was driven by significantly reduced customer

activity in the U.S. onshore and offshore market. The

year-over-year decline is primarily related to the decline in the

U.S. onshore market which began during the second half of 2019.

Segment adjusted EBITDA for the second quarter

of 2020 was $0.9 million, or 6% of revenue, compared to $2.5

million, or 12% of revenue, for the first quarter of 2020 and $3.0

million, or 11% of revenue, for the second quarter of 2019. Lower

adjusted EBITDA was driven by revenue declines brought about by

market contractions in North and South America.

Profit Improvement Actions Update

As an update to the progress made in reducing

the cost base of the Company, Frank’s now anticipates realizing

reductions to its cost structure of at least 25% year over year

including both operational and support costs. The cost reductions

achieved specific to Company support costs are now estimated to

yield savings in excess of $50 million in 2020. Compensation cost

estimates are expected to be reduced by 30% year over year. The

Company intends to continue pursuing additional efficiencies in the

coming quarters that are expected to result in further savings.

Other Financial Information

Cash expenditures related to property, plant and

equipment and intangibles were $10.3 million for the second quarter

of 2020, with the significant majority of this spend related to

in-flight capital projects approved and initiated during 2019. The

Company estimates total capital expenditures for the full year 2020

to range between $25.0 million and $30.0 million.

As of June 30, 2020, the Company’s consolidated

cash and cash equivalents were $192.9 million compared to $170.9

million as of the prior quarter, an improvement of $22 million. The

Company had no outstanding debt as of June 30, 2020 nor as of the

prior quarter. Total liquidity at June 30, 2020 was $218 million,

including cash and cash equivalents, and $25 million available

under the Company’s Credit Facility. For the second quarter of

2020, the Company generated operating cash flow of $26.4 million

and free cash flow of $16.1 million. This was produced from both

improved customer collections in the quarter and benefits of cost

reductions.

Income tax expense for the quarter was $9.0

million compared to an income tax benefit in the first quarter of

$15.6 million largely attributable to credits resulting from

governmental and regulatory support programs.

The financial measures provided that are not

presented in accordance with U.S. generally accepted accounting

principles (“GAAP”) are defined and reconciled to their most

directly comparable GAAP measures. Please see “Use of Non-GAAP

Financial Measures” and the reconciliations to the nearest

comparable GAAP measures.

Conference Call

The Company will host a conference call to

discuss second quarter 2020 results on Tuesday, August 4, 2020 at

10:00 a.m. Central Time (11:00 a.m. Eastern Time). Participants may

join the conference call by dialing (800) 708-4540 or (847)

619-6397. The conference call ID number is 49849977. To listen via

live webcast, please visit the Investor Relations section of the

Company's website, www.franksinternational.com. A presentation will

also be posted on the Company’s website prior to the conference

call.

An audio replay of the conference call will be

available in the Investor Relations section of the Company’s

website approximately two hours after the conclusion of the call

and remain available for a period of approximately 90 days.

About Frank’s International

Frank’s International N.V. is a global oil

services company that provides a broad and comprehensive range of

highly engineered tubular running services, tubular fabrication,

and specialty well construction and well intervention solutions

with a focus on complex and technically demanding wells. Founded in

1938, Frank’s has approximately 2,700 employees and provides

services to leading exploration and production companies in both

onshore and offshore environments in approximately 50 countries on

six continents. The Company’s common stock is traded on the NYSE

under the symbol “FI.” Additional information is available on the

Company’s website, www.franksinternational.com.

Contact:

Melissa CougleMelissa.Cougle@franksintl.com281-966-7300

|

FRANK’S INTERNATIONAL N.V. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(In thousands, except per share data) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

Services |

$ |

74,583 |

|

|

$ |

105,083 |

|

|

$ |

127,091 |

|

|

$ |

179,666 |

|

|

$ |

242,497 |

|

|

Products |

11,518 |

|

|

18,409 |

|

|

28,563 |

|

|

29,927 |

|

|

57,565 |

|

|

Total revenue |

86,101 |

|

|

123,492 |

|

|

155,654 |

|

|

209,593 |

|

|

300,062 |

|

| |

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

Cost of revenue, exclusive of depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

Services |

61,051 |

|

|

79,380 |

|

|

85,785 |

|

|

140,431 |

|

|

169,024 |

|

|

Products |

8,286 |

|

|

13,988 |

|

|

23,475 |

|

|

22,274 |

|

|

43,603 |

|

|

General and administrative expenses |

22,286 |

|

|

26,683 |

|

|

34,026 |

|

|

48,969 |

|

|

69,437 |

|

|

Depreciation and amortization |

17,252 |

|

|

19,718 |

|

|

23,913 |

|

|

36,970 |

|

|

49,155 |

|

|

Goodwill impairment |

— |

|

|

57,146 |

|

|

— |

|

|

57,146 |

|

|

— |

|

|

Severance and other charges, net |

5,162 |

|

|

20,725 |

|

|

815 |

|

|

25,887 |

|

|

1,270 |

|

|

(Gain) loss on disposal of assets |

(650 |

) |

|

60 |

|

|

154 |

|

|

(590 |

) |

|

381 |

|

|

Operating loss |

(27,286 |

) |

|

(94,208 |

) |

|

(12,514 |

) |

|

(121,494 |

) |

|

(32,808 |

) |

| |

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

Tax receivable agreement (“TRA”) related adjustments |

— |

|

|

— |

|

|

220 |

|

|

— |

|

|

220 |

|

|

Other income, net |

156 |

|

|

2,026 |

|

|

669 |

|

|

2,182 |

|

|

1,198 |

|

|

Interest income, net |

178 |

|

|

533 |

|

|

426 |

|

|

711 |

|

|

1,194 |

|

|

Foreign currency gain (loss) |

1,693 |

|

|

(9,892 |

) |

|

(661 |

) |

|

(8,199 |

) |

|

(178 |

) |

|

Total other income (expense) |

2,027 |

|

|

(7,333 |

) |

|

654 |

|

|

(5,306 |

) |

|

2,434 |

|

| |

|

|

|

|

|

|

|

|

|

| Loss before income taxes |

(25,259 |

) |

|

(101,541 |

) |

|

(11,860 |

) |

|

(126,800 |

) |

|

(30,374 |

) |

| Income tax expense

(benefit) |

8,986 |

|

|

(15,563 |

) |

|

3,300 |

|

|

(6,577 |

) |

|

13,073 |

|

| Net loss |

$ |

(34,245 |

) |

|

$ |

(85,978 |

) |

|

$ |

(15,160 |

) |

|

$ |

(120,223 |

) |

|

$ |

(43,447 |

) |

| |

|

|

|

|

|

|

|

|

|

| Loss per common

share: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

$ |

(0.15 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.19 |

) |

| |

|

|

|

|

|

|

|

|

|

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

225,853 |

|

|

225,505 |

|

|

225,052 |

|

|

225,855 |

|

|

224,854 |

|

|

FRANK’S INTERNATIONAL N.V. |

|

SELECTED OPERATING SEGMENT DATA |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Revenue |

|

|

|

|

|

|

|

|

|

|

Tubular Running Services |

$ |

62,327 |

|

|

$ |

89,497 |

|

|

$ |

106,615 |

|

|

$ |

151,824 |

|

|

$ |

204,694 |

|

|

Tubulars |

8,741 |

|

|

12,542 |

|

|

22,334 |

|

|

21,283 |

|

|

40,991 |

|

|

Cementing Equipment |

15,033 |

|

|

21,453 |

|

|

26,705 |

|

|

36,486 |

|

|

54,377 |

|

| Total |

$ |

86,101 |

|

|

$ |

123,492 |

|

|

$ |

155,654 |

|

|

$ |

209,593 |

|

|

$ |

300,062 |

|

| |

|

|

|

|

|

|

|

|

|

| Segment Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

Tubular Running Services |

$ |

4,049 |

|

|

$ |

13,305 |

|

|

$ |

25,400 |

|

|

$ |

17,354 |

|

|

$ |

43,135 |

|

|

Tubulars |

681 |

|

|

1,396 |

|

|

3,934 |

|

|

2,077 |

|

|

8,046 |

|

|

Cementing Equipment |

886 |

|

|

2,544 |

|

|

3,029 |

|

|

3,430 |

|

|

6,823 |

|

|

Corporate |

(7,308 |

) |

|

(10,186 |

) |

|

(15,200 |

) |

|

(17,494 |

) |

|

(31,183 |

) |

|

Total |

$ |

(1,692 |

) |

|

$ |

7,059 |

|

|

$ |

17,163 |

|

|

$ |

5,367 |

|

|

$ |

26,821 |

|

|

FRANK’S INTERNATIONAL N.V. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

| |

June 30, |

|

December 31, |

| |

2020 |

|

2019 |

| Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

192,921 |

|

|

$ |

195,383 |

|

|

Restricted cash |

1,358 |

|

|

1,357 |

|

|

Accounts receivables, net |

137,068 |

|

|

166,694 |

|

|

Inventories, net |

79,857 |

|

|

78,829 |

|

|

Assets held for sale |

8,732 |

|

|

13,795 |

|

|

Other current assets |

8,943 |

|

|

10,360 |

|

|

Total current assets |

428,879 |

|

|

466,418 |

|

| |

|

|

|

|

Property, plant and equipment, net |

297,794 |

|

|

328,432 |

|

|

Goodwill |

42,785 |

|

|

99,932 |

|

|

Intangible assets, net |

9,643 |

|

|

16,971 |

|

|

Deferred tax assets, net |

15,774 |

|

|

16,590 |

|

|

Operating lease right-of-use assets |

29,594 |

|

|

32,585 |

|

|

Other assets |

29,513 |

|

|

33,237 |

|

|

Total assets |

$ |

853,982 |

|

|

$ |

994,165 |

|

| |

|

|

|

| Liabilities and

Equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued liabilities |

$ |

104,022 |

|

|

$ |

120,321 |

|

|

Current portion of operating lease liabilities |

7,854 |

|

|

7,925 |

|

|

Deferred revenue |

425 |

|

|

657 |

|

|

Total current liabilities |

112,301 |

|

|

128,903 |

|

| |

|

|

|

|

Deferred tax liabilities |

1,503 |

|

|

2,923 |

|

|

Non-current operating lease liabilities |

22,803 |

|

|

24,969 |

|

|

Other non-current liabilities |

23,711 |

|

|

27,076 |

|

|

Total liabilities |

160,318 |

|

|

183,871 |

|

| |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock |

2,860 |

|

|

2,846 |

|

|

Additional paid-in capital |

1,082,008 |

|

|

1,075,809 |

|

|

Accumulated deficit |

(341,349 |

) |

|

(220,805 |

) |

|

Accumulated other comprehensive loss |

(30,013 |

) |

|

(30,298 |

) |

|

Treasury stock |

(19,842 |

) |

|

(17,258 |

) |

|

Total stockholders’ equity |

693,664 |

|

|

810,294 |

|

|

Total liabilities and equity |

$ |

853,982 |

|

|

$ |

994,165 |

|

|

FRANK’S INTERNATIONAL N.V. |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(In thousands) |

| |

|

|

|

| |

Six Months Ended June 30, |

| |

2020 |

|

2019 |

| Cash flows from

operating activities |

|

|

|

| Net loss |

$ |

(120,223 |

) |

|

$ |

(43,447 |

) |

|

Adjustments to reconcile net loss to cash from operating

activities |

|

|

|

|

Depreciation and amortization |

36,970 |

|

|

49,155 |

|

|

Equity-based compensation expense |

5,661 |

|

|

5,591 |

|

|

Goodwill impairment |

57,146 |

|

|

— |

|

|

Loss on asset impairments and retirements |

20,532 |

|

|

— |

|

|

Amortization of deferred financing costs |

194 |

|

|

177 |

|

|

Deferred tax provision (benefit) |

(1,690 |

) |

|

3,702 |

|

|

Provision for bad debts |

1,750 |

|

|

85 |

|

|

(Gain) loss on disposal of assets |

(590 |

) |

|

381 |

|

|

Changes in fair value of investments |

813 |

|

|

(1,879 |

) |

|

Unrealized (gain) loss on derivative instruments |

— |

|

|

204 |

|

|

Other |

(380 |

) |

|

(373 |

) |

| Changes in operating assets

and liabilities |

|

|

|

|

Accounts receivable |

24,465 |

|

|

(14,334 |

) |

|

Inventories |

(4,539 |

) |

|

(2,323 |

) |

|

Other current assets |

2,272 |

|

|

2,063 |

|

|

Other assets |

390 |

|

|

111 |

|

|

Accounts payable and accrued liabilities |

(15,187 |

) |

|

(17,118 |

) |

|

Deferred revenue |

(226 |

) |

|

22 |

|

|

Other non-current liabilities |

(3,212 |

) |

|

594 |

|

| Net cash provided by

(used in) operating activities |

4,146 |

|

|

(17,389 |

) |

| Cash flows from

investing activities |

|

|

|

| Purchases of property, plant

and equipment and intangibles |

(20,259 |

) |

|

(17,240 |

) |

| Proceeds from sale of

assets |

6,565 |

|

|

260 |

|

| Purchase of investments |

— |

|

|

(20,185 |

) |

| Proceeds from sale of

investments |

2,832 |

|

|

31,739 |

|

| Other |

(256 |

) |

|

— |

|

| Net cash used in

investing activities |

(11,118 |

) |

|

(5,426 |

) |

| Cash flows from

financing activities |

|

|

|

| Repayments of borrowings |

— |

|

|

(3,492 |

) |

| Treasury shares withheld for

taxes |

(1,086 |

) |

|

(1,542 |

) |

| Treasury share repurchase |

(1,498 |

) |

|

— |

|

| Proceeds from the issuance of

ESPP shares |

552 |

|

|

692 |

|

| Deferred financing costs |

— |

|

|

(184 |

) |

| Net cash used in

financing activities |

(2,032 |

) |

|

(4,526 |

) |

| Effect of exchange rate

changes on cash |

6,543 |

|

|

(416 |

) |

| Net decrease in cash, cash

equivalents and restricted cash |

(2,461 |

) |

|

(27,757 |

) |

| Cash, cash equivalents and

restricted cash at beginning of period |

196,740 |

|

|

186,212 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

194,279 |

|

|

$ |

158,455 |

|

Forward Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, as amended. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that the Company expects, believes or anticipates will or may occur

in the future are forward-looking statements. Without limiting the

generality of the foregoing, forward-looking statements contained

in this press release specifically include statements, estimates

and projections regarding the Company’s future business strategy

and prospects for growth, cash flows and liquidity, financial

strategy, budget, projections and operating results, the amount,

nature and timing of capital expenditures, the availability and

terms of capital, the level of activity in the oil and gas

industry, volatility of oil and gas prices, unique risks associated

with offshore operations, political, economic and regulatory

uncertainties in international operations, the ability to develop

new technologies and products, the ability to protect intellectual

property rights, the ability to employ and retain skilled and

qualified workers, the level of competition in the Company’s

industry, global or national health concerns, including health

epidemics, including Covid-19, the continuation of a swift and

material decline in global crude oil demand and crude oil prices

for an uncertain period of time, the length of time it will take

for the United States and the rest of the world to slow the spread

of the Covid-19 virus to the point where applicable authorities are

comfortable easing current restrictions on various commercial and

economic activities, future actions of foreign oil producers such

as Saudi Arabia and Russia and the risk that they take actions that

will prolong or exacerbate the current over-supply of crude oil,

the timing, pace and extent of an economic recovery in the United

States and elsewhere, the impact of current and future laws,

rulings, governmental regulations, accounting standards and

statements, and related interpretations, and other guidance. These

statements are based on certain assumptions made by the Company

based on management’s experience, expectations and perception of

historical trends, current conditions, anticipated future

developments and other factors believed to be appropriate.

Forward-looking statements are not guarantees of performance.

Although the Company believes the expectations

reflected in its forward-looking statements are reasonable and are

based on reasonable assumptions, no assurance can be given that

these assumptions are accurate or that any of these expectations

will be achieved (in full or at all) or will prove to have been

correct. Moreover, such statements are subject to a number of

assumptions, risks and uncertainties, many of which are beyond the

control of the Company, which may cause actual results to differ

materially from those implied or expressed by the forward-looking

statements. These include the factors discussed or referenced in

the “Risk Factors” section of the Company’s Annual Report on Form

10-K for the year ended December 31, 2019 filed with the SEC and

the additional factors discussed or referenced in the “Risk

Factors” section of the Company’s Quarterly Report on Form 10-Q for

the quarter ended June 30, 2020 that will be filed with the SEC.

Any forward-looking statement speaks only as of the date on which

such statement is made, and the Company undertakes no obligation to

correct or update any forward-looking statement, whether as a

result of new information, future events or otherwise, except as

required by applicable law, and we caution you not to rely on them

unduly.

Use of Non-GAAP Financial

Measures

This press release and the accompanying

schedules include the non-GAAP financial measures of adjusted net

loss, adjusted net loss per diluted share, free cash flow, adjusted

EBITDA and adjusted EBITDA margin, which may be used periodically

by management when discussing the Company’s financial results with

investors and analysts. The accompanying schedules of this press

release provide a reconciliation of these non-GAAP financial

measures to their most directly comparable financial measure

calculated and presented in accordance with GAAP. Adjusted net

loss, adjusted net loss per diluted share, free cash flow, adjusted

EBITDA and adjusted EBITDA margin are presented because management

believes these metrics provide additional information relative to

the performance of the Company’s business. These metrics are

commonly employed by financial analysts and investors to evaluate

the operating and financial performance of the Company from period

to period and to compare it with the performance of other publicly

traded companies within the industry. You should not consider

adjusted net loss, adjusted net loss per diluted share, free cash

flow, adjusted EBITDA and adjusted EBITDA margin in isolation or as

a substitute for analysis of the Company’s results as reported

under GAAP. Because adjusted net loss, adjusted net loss per

diluted share, free cash flow, adjusted EBITDA and adjusted EBITDA

margin may be defined differently by other companies in the

Company’s industry, the Company’s presentation of these non-GAAP

financial measures may not be comparable to similarly titled

measures of other companies, thereby diminishing their utility.

The Company defines adjusted net loss as net

loss before goodwill impairment and severance and other charges,

net, net of tax. The Company defines adjusted net loss per share as

net loss before goodwill impairment and severance and other

charges, net, net of tax, divided by diluted weighted average

common shares. The Company defines free cash flow as net cash

provided by (used in) operating activities less purchases of

property, plant and equipment and intangibles. The Company defines

adjusted EBITDA as net income (loss) before interest income, net,

depreciation and amortization, income tax benefit or expense, asset

impairments, gain or loss on disposal of assets, foreign currency

gain or loss, equity-based compensation, the effects of the tax

receivable agreement, unrealized and realized gains or losses and

other non-cash adjustments and other charges or credits. The

Company uses adjusted EBITDA to assess its financial performance

because it allows the Company to compare its operating performance

on a consistent basis across periods by removing the effects of its

capital structure (such as varying levels of interest expense),

asset base (such as depreciation and amortization), income tax,

foreign currency exchange rates and other charges and credits. The

Company defines adjusted EBITDA margin as adjusted EBITDA divided

by total revenue.

Please see the accompanying financial tables for

a reconciliation of these non-GAAP measures to their most directly

comparable GAAP measures.

|

FRANK’S INTERNATIONAL N.V. |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATION |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

RECONCILIATION |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

86,101 |

|

|

|

$ |

123,492 |

|

|

|

$ |

155,654 |

|

|

|

$ |

209,593 |

|

|

|

$ |

300,062 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Net

loss |

$ |

(34,245 |

) |

|

|

$ |

(85,978 |

) |

|

|

$ |

(15,160 |

) |

|

|

$ |

(120,223 |

) |

|

|

$ |

(43,447 |

) |

|

| Goodwill

impairment |

— |

|

|

|

57,146 |

|

|

|

— |

|

|

|

57,146 |

|

|

|

— |

|

|

| Severance and

other charges, net |

5,162 |

|

|

|

20,725 |

|

|

|

815 |

|

|

|

25,887 |

|

|

|

1,270 |

|

|

| Interest income,

net |

(178 |

) |

|

|

(533 |

) |

|

|

(426 |

) |

|

|

(711 |

) |

|

|

(1,194 |

) |

|

| Depreciation and

amortization |

17,252 |

|

|

|

19,718 |

|

|

|

23,913 |

|

|

|

36,970 |

|

|

|

49,155 |

|

|

| Income tax expense

(benefit) |

8,986 |

|

|

|

(15,563 |

) |

|

|

3,300 |

|

|

|

(6,577 |

) |

|

|

13,073 |

|

|

| (Gain) loss on

disposal of assets |

(650 |

) |

|

|

60 |

|

|

|

154 |

|

|

|

(590 |

) |

|

|

381 |

|

|

| Foreign currency

(gain) loss |

(1,693 |

) |

|

|

9,892 |

|

|

|

661 |

|

|

|

8,199 |

|

|

|

178 |

|

|

| TRA related

adjustments |

— |

|

|

|

— |

|

|

|

(220 |

) |

|

|

— |

|

|

|

(220 |

) |

|

| Charges and

credits (1) |

3,674 |

|

|

|

1,592 |

|

|

|

4,126 |

|

|

|

5,266 |

|

|

|

7,625 |

|

|

|

Adjusted EBITDA |

$ |

(1,692 |

) |

|

|

$ |

7,059 |

|

|

|

$ |

17,163 |

|

|

|

$ |

5,367 |

|

|

|

$ |

26,821 |

|

|

|

Adjusted EBITDA margin |

(2.0 |

) |

% |

|

5.7 |

|

% |

|

11.0 |

|

% |

|

2.6 |

|

% |

|

8.9 |

|

% |

|

|

|

|

(1) |

Comprised of Equity-based compensation expense (for the three

months ended June 30, 2020, March 31, 2020 and June 30, 2019:

$3,515, $2,146 and $3,017, respectively, and for the six months

ended June 30, 2020 and 2019: $5,661 and $5,591, respectively),

Unrealized and realized (gains) losses (for the three months ended

June 30, 2020, March 31, 2020 and June 30, 2019: $111, $(1,704) and

$(383), respectively, and for the six months ended June 30, 2020

and 2019: $(1,593) and $(691), respectively) and

Investigation-related matters (for the three months ended June 30,

2020, March 31, 2020 and June 30, 2019: $48, $1,150 and $1,492,

respectively, and for the six months ended June 30, 2020 and 2019:

$1,198 and $2,725, respectively). |

|

FRANK’S INTERNATIONAL N.V. |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATION |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

SEGMENT ADJUSTED EBITDA RECONCILIATION |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| Segment

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

Tubular Running Services |

$ |

4,049 |

|

|

$ |

13,305 |

|

|

$ |

25,400 |

|

|

$ |

17,354 |

|

|

$ |

43,135 |

|

|

Tubulars |

681 |

|

|

1,396 |

|

|

3,934 |

|

|

2,077 |

|

|

8,046 |

|

|

Cementing Equipment |

886 |

|

|

2,544 |

|

|

3,029 |

|

|

3,430 |

|

|

6,823 |

|

|

Corporate |

(7,308 |

) |

|

(10,186 |

) |

|

(15,200 |

) |

|

(17,494 |

) |

|

(31,183 |

) |

| |

(1,692 |

) |

|

7,059 |

|

|

17,163 |

|

|

5,367 |

|

|

26,821 |

|

| Goodwill

impairment |

— |

|

|

(57,146 |

) |

|

— |

|

|

(57,146 |

) |

|

— |

|

| Severance and

other charges, net |

(5,162 |

) |

|

(20,725 |

) |

|

(815 |

) |

|

(25,887 |

) |

|

(1,270 |

) |

| Interest income,

net |

178 |

|

|

533 |

|

|

426 |

|

|

711 |

|

|

1,194 |

|

| Depreciation and

amortization |

(17,252 |

) |

|

(19,718 |

) |

|

(23,913 |

) |

|

(36,970 |

) |

|

(49,155 |

) |

| Income tax

(expense) benefit |

(8,986 |

) |

|

15,563 |

|

|

(3,300 |

) |

|

6,577 |

|

|

(13,073 |

) |

| Gain (loss) on

disposal of assets |

650 |

|

|

(60 |

) |

|

(154 |

) |

|

590 |

|

|

(381 |

) |

| Foreign currency

gain (loss) |

1,693 |

|

|

(9,892 |

) |

|

(661 |

) |

|

(8,199 |

) |

|

(178 |

) |

| TRA related

adjustments |

— |

|

|

— |

|

|

220 |

|

|

— |

|

|

220 |

|

| Charges and

credits (1) |

(3,674 |

) |

|

(1,592 |

) |

|

(4,126 |

) |

|

(5,266 |

) |

|

(7,625 |

) |

|

Net loss |

$ |

(34,245 |

) |

|

$ |

(85,978 |

) |

|

$ |

(15,160 |

) |

|

$ |

(120,223 |

) |

|

$ |

(43,447 |

) |

|

|

|

|

(1) |

Comprised of Equity-based compensation expense (for the three

months ended June 30, 2020, March 31, 2020 and June 30, 2019:

$3,515, $2,146 and $3,017, respectively, and for the six months

ended June 30, 2020 and 2019: $5,661 and $5,591, respectively),

Unrealized and realized gains (losses) (for the three months ended

June 30, 2020, March 31, 2020 and June 30, 2019: $(111), $1,704 and

$383, respectively, and for the six months ended June 30, 2020 and

2019: $1,593 and $691, respectively) and Investigation-related

matters (for the three months ended June 30, 2020, March 31, 2020

and June 30, 2019: $48, $1,150 and $1,492, respectively, and for

the six months ended June 30, 2020 and 2019: $1,198 and $2,725,

respectively). |

|

FRANK’S INTERNATIONAL N.V. |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATION |

|

(In thousands) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

FREE CASH FLOW RECONCILIATION |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in) operating

activities |

$ |

26,398 |

|

|

$ |

(22,252 |

) |

|

$ |

12,381 |

|

|

$ |

4,146 |

|

|

$ |

(17,389 |

) |

| Less: purchases of property,

plant and equipment and intangibles |

10,291 |

|

|

9,968 |

|

|

9,095 |

|

|

20,259 |

|

|

17,240 |

|

| Free cash

flow |

$ |

16,107 |

|

|

$ |

(32,220 |

) |

|

$ |

3,286 |

|

|

$ |

(16,113 |

) |

|

$ |

(34,629 |

) |

|

FRANK’S INTERNATIONAL N.V. |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATION |

|

(In thousands, except per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF ADJUSTED NET LOSS AND ADJUSTED NET LOSS

PER DILUTED SHARE |

| |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

| |

2020 |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(34,245 |

) |

|

$ |

(85,978 |

) |

|

$ |

(15,160 |

) |

|

$ |

(120,223 |

) |

|

$ |

(43,447 |

) |

| Goodwill impairment (net of

tax) |

— |

|

|

55,740 |

|

|

— |

|

|

55,740 |

|

|

— |

|

| Severance and other charges,

net (net of tax) |

4,937 |

|

|

20,355 |

|

|

613 |

|

|

25,292 |

|

|

1,067 |

|

| Net loss excluding

certain items |

$ |

(29,308 |

) |

|

$ |

(9,883 |

) |

|

$ |

(14,547 |

) |

|

$ |

(39,191 |

) |

|

$ |

(42,380 |

) |

| |

|

|

|

|

|

|

|

|

|

| Loss per diluted

share |

$ |

(0.15 |

) |

|

$ |

(0.38 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.53 |

) |

|

$ |

(0.19 |

) |

| Goodwill impairment (net of

tax) |

— |

|

|

0.25 |

|

|

— |

|

|

0.25 |

|

|

— |

|

| Severance and other charges,

net (net of tax) |

0.02 |

|

|

0.09 |

|

|

— |

|

|

0.11 |

|

|

— |

|

| Loss per diluted share

excluding certain items |

$ |

(0.13 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.19 |

) |

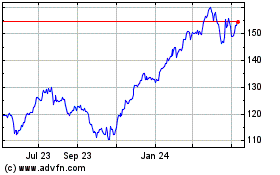

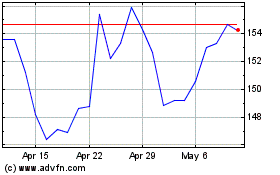

Fiserv (NYSE:FI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Fiserv (NYSE:FI)

Historical Stock Chart

From Apr 2023 to Apr 2024