Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

February 24 2022 - 6:42AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2022

Commission File Number: 001-38264

Four Seasons Education (Cayman) Inc.

Room1301, Zi’an Building, 309 Yuyuan Road, Jing’an District, Shanghai

PRC 200040

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data and per share data)

|

|

|

As of |

|

|

|

|

February 28, |

|

|

August 31, |

|

|

August 31, |

|

|

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

378,358 |

|

|

|

417,756 |

|

|

|

64,664 |

|

|

Accounts receivable and contract assets, net |

|

|

360 |

|

|

|

496 |

|

|

|

77 |

|

|

Amounts due from related parties |

|

|

- |

|

|

|

767 |

|

|

|

119 |

|

|

Other receivables, deposits and other assets |

|

|

10,566 |

|

|

|

10,548 |

|

|

|

1,633 |

|

|

Short-term investments |

|

|

31,000 |

|

|

|

20,000 |

|

|

|

3,096 |

|

|

Long-term investments under fair value - current |

|

|

96,558 |

|

|

|

228,155 |

|

|

|

35,316 |

|

|

Total current assets |

|

|

516,842 |

|

|

|

677,722 |

|

|

|

104,905 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

10,855 |

|

|

|

12,769 |

|

|

|

1,976 |

|

|

Property and equipment, net |

|

|

15,804 |

|

|

|

5,285 |

|

|

|

818 |

|

|

Operating lease right-of-use assets |

|

|

150,696 |

|

|

|

35,696 |

|

|

|

5,525 |

|

|

Intangible assets, net |

|

|

7,118 |

|

|

|

3,974 |

|

|

|

615 |

|

|

Goodwill |

|

|

36,967 |

|

|

|

- |

|

|

|

- |

|

|

Deferred tax assets |

|

|

16,253 |

|

|

|

16,184 |

|

|

|

2,505 |

|

|

Equity method investments |

|

|

36,784 |

|

|

|

251 |

|

|

|

39 |

|

|

Long-term investments under fair value – non-current |

|

|

163,303 |

|

|

|

- |

|

|

|

- |

|

|

Other non-current assets |

|

|

12,571 |

|

|

|

18,302 |

|

|

|

2,832 |

|

|

Total non-current assets |

|

|

450,351 |

|

|

|

92,461 |

|

|

|

14,310 |

|

|

TOTAL ASSETS |

|

|

967,193 |

|

|

|

770,183 |

|

|

|

119,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Amounts due to related parties |

|

|

1,495 |

|

|

|

2,108 |

|

|

|

326 |

|

|

Accrued expenses and other current liabilities |

|

|

86,947 |

|

|

|

111,553 |

|

|

|

17,267 |

|

|

Operating lease liabilities – current |

|

|

52,674 |

|

|

|

20,831 |

|

|

|

3,224 |

|

|

Income tax payable |

|

|

10,630 |

|

|

|

10,761 |

|

|

|

1,666 |

|

|

Deferred revenue |

|

|

75,242 |

|

|

|

51,981 |

|

|

|

8,047 |

|

|

Total current liabilities |

|

|

226,988 |

|

|

|

197,234 |

|

|

|

30,530 |

|

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data and per share data)

|

|

|

As of |

|

|

|

|

February 28, |

|

|

August 31, |

|

|

August 31, |

|

|

|

|

2021 |

|

|

2021 |

|

|

2021 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

|

1,673 |

|

|

|

1,442 |

|

|

|

223 |

|

|

Operating lease liabilities – non-current |

|

|

92,144 |

|

|

|

8,451 |

|

|

|

1,308 |

|

|

Total non-current liabilities |

|

|

93,817 |

|

|

|

9,893 |

|

|

|

1,531 |

|

|

TOTAL LIABILITIES |

|

|

320,805 |

|

|

|

207,127 |

|

|

|

32,061 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

|

646,388 |

|

|

|

563,056 |

|

|

|

87,154 |

|

|

TOTAL LIABILITIES AND EQUITY |

|

|

967,193 |

|

|

|

770,183 |

|

|

|

119,215 |

|

3

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share data and per share data)

|

|

|

Six Months Ended August 31, |

|

|

|

|

2020 |

|

|

2021 |

|

|

2021 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Revenue |

|

|

142,481 |

|

|

|

178,616 |

|

|

|

27,648 |

|

|

Cost of revenue |

|

|

(84,470 |

) |

|

|

(111,169 |

) |

|

|

(17,208 |

) |

|

Gross profit |

|

|

58,011 |

|

|

|

67,447 |

|

|

|

10,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

(58,287 |

) |

|

|

(53,064 |

) |

|

|

(8,214 |

) |

|

Sales and marketing expenses |

|

|

(14,938 |

) |

|

|

(17,649 |

) |

|

|

(2,732 |

) |

|

Impairment loss |

|

|

- |

|

|

|

(52,433 |

) |

|

|

(8,116 |

) |

|

Operating loss |

|

|

(15,214 |

) |

|

|

(55,699 |

) |

|

|

(8,622 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subsidy income |

|

|

7,852 |

|

|

|

1,894 |

|

|

|

293 |

|

|

Interest income, net |

|

|

1,892 |

|

|

|

2,020 |

|

|

|

313 |

|

|

Other income, net |

|

|

662 |

|

|

|

1,177 |

|

|

|

182 |

|

|

Loss before income taxes and loss from

equity method investments |

|

|

(4,808 |

) |

|

|

(50,608 |

) |

|

|

(7,834 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

(1,395 |

) |

|

|

(2,121 |

) |

|

|

(328 |

) |

|

Loss from equity method investments |

|

|

(1,364 |

) |

|

|

(36,499 |

) |

|

|

(5,650 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(7,567 |

) |

|

|

(89,228 |

) |

|

|

(13,812 |

) |

|

Net loss attributable to non-controlling interest |

|

|

61 |

|

|

|

(467 |

) |

|

|

(72 |

) |

|

Net loss attributable to Four Seasons Education (Cayman) Inc. |

|

|

(7,628 |

) |

|

|

(88,761 |

) |

|

|

(13,740 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

(0.33 |

) |

|

|

(3.84 |

) |

|

|

(0.59 |

) |

|

Diluted |

|

|

(0.33 |

) |

|

|

(3.84 |

) |

|

|

(0.59 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating net loss per ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

23,131,195 |

|

|

|

23,131,195 |

|

|

|

23,131,195 |

|

|

Diluted |

|

|

23,131,195 |

|

|

|

23,131,195 |

|

|

|

23,131,195 |

|

4

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands, except share data and per share data)

|

|

|

Six Months Ended August 31, |

|

|

|

|

2020 |

|

|

2021 |

|

|

2021 |

|

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

|

Net loss |

|

|

(7,567 |

) |

|

|

(89,228 |

) |

|

|

(13,812 |

) |

|

Other comprehensive loss, net of tax of nil |

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(9,633 |

) |

|

|

(251 |

) |

|

|

(39 |

) |

|

Comprehensive loss |

|

|

(17,200 |

) |

|

|

(89,479 |

) |

|

|

(13,851 |

) |

|

Less: Comprehensive income (loss) attributable to non-controlling interest |

|

|

61 |

|

|

|

(467 |

) |

|

|

(72 |

) |

|

Comprehensive loss attributable to Four Seasons Education (Cayman) Inc. |

|

|

(17,261 |

) |

|

|

(89,012 |

) |

|

|

(13,779 |

) |

5

Recent Development

On December 23, 2021, the Company issued a press release to announce that in response to the regulatory developments relating to after-school tutoring services, including the Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education, published in July 2021 by the General Office of the CPC Central Committee and the General Office of the State Council (the “Opinion”) and the related implementation rules, regulations and measures promulgated by competent authorities, the Company planned to cease offering tutoring services relating to academic subjects to students from kindergarten through grade nine (“K-9 Academic AST Services”) in the mainland of China by the end of December 2021.

The Company has completed the cessation by the due date and expects that the cessation will have a substantial adverse impact on the Company’s revenues for the fiscal year ending February 28, 2022 and subsequent periods. In the fiscal year ended February 28, 2021, the revenues from offering K-9 Academic AST Services accounted for a substantial majority of the Company’s total revenues.

Building on its strong curriculum development capabilities, exceptional educational resources and a team well-versed in the high-quality education content, the Company will continue to operate and develop its non- K-9 Academic AST Services business, and will further explore other opportunities to provide educational services in accordance with relevant rules and regulations.

The Company is committed to fully complying with the policy directives in the Opinion and any related implementation rules, regulations and measures adopted by the central and local governments of China. The Company will continue to seek guidance from and work constructively with the government authorities in various provinces and municipalities in China in connection with its efforts to comply with the policy directives in the Opinion and any related implementation rules, regulations and measures. The Company will continue developing and improving its services and update its shareholders as appropriate.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB6.4604 to US$1.00, the rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on August 31, 2021.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Four Seasons Education (Cayman) Inc. |

|

|

|

|

|

By: |

|

/s/ Yi Zuo |

|

Name: |

|

Yi Zuo |

|

Title: |

|

Chief Executive Officer |

Date: February 24, 2022

7

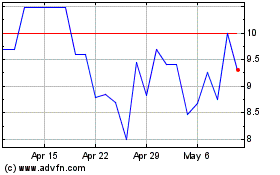

Four Seasons Education C... (NYSE:FEDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

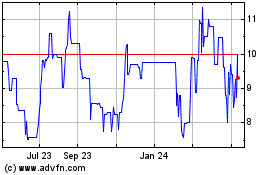

Four Seasons Education C... (NYSE:FEDU)

Historical Stock Chart

From Apr 2023 to Apr 2024