Transports Keep Flashing Warning Signals Even as Stocks Flirt With Records

September 19 2019 - 5:11PM

Dow Jones News

By Paul Vigna

FedEx Corp. has offered the latest signal that a turning point

is coming in the business cycle.

The delivery company cut its 2020 outlook after the closing bell

Tuesday, pointing to trade tensions and a weak global economy.

Chief Executive Frederick Smith said on the company's conference

call that FedEx is taking steps to reduce its capacity, partly

because the absence of a trade deal with China has reduced the

movement of goods internationally.

Investors often look at the transport sector as a bellwether of

the economy. Believers in the so-called Dow Theory say weakness in

shares of companies that transport raw goods and materials can

point to turmoil for the broader market.

Sectors including transportation and manufacturing have been

sending out signals for months that a turn in the business cycle is

near, leaving investors to question the longevity of the decadelong

bull market in U.S. stocks.

The problem is there isn't any easy demarcation between a

growing economy and a contracting one, no solstice or equinox that

marks the turn of the seasons. Divining when the economy has

slipped into a recession -- or, at least, doing it ahead of other

investors -- requires sifting and analyzing myriad tea leaves and

smoke signals.

Although the broader market is still flirting with records, the

transport sector has struggled to recover lost ground -- a

potentially ominous sign for investors who believe transports need

to rebound for the market to break higher.

The U.S. manufacturing sector, some argue, has already fallen

into recession. On Monday, the New York Fed's manufacturing index

slid to just 2, below its level from the beginning of the last

recession, which began in 2007.

The Dow Transportation Average -- which tracks 20 of the

nation's largest airlines, railroads and truckers, including FedEx

-- is still down 8.8% over the past year, though it has gained 15%

this year. FedEx itself has fallen 37% over the past 12 months,

including a 12% drop this week.

Additionally, an index of freight shipments maintained by the

research firm Cass Information Systems Inc. has been falling every

month this year. After the 3% drop in the August index, the firm

said "the shipments index has gone from warning of a potential

slowdown to signaling an economic contraction."

By any reckoning, this expansion is old. It began in June 2009,

making it the longest on record, and it shows some of the typical

signs of a late-stage expansion. That doesn't automatically mean

the expansion must end, though.

Even the National Bureau of Economic Research, the official

arbiter of the cycle, doesn't have a strict definition of it. While

the shorthand is two consecutive quarters of contracting GDP

growth, it isn't a concrete definition.

The business cycle can be read through economic data, but it is

really about human nature, said Nick Reece, an analyst and

portfolio manager at Merk Investments LLC. That is what makes it so

hard to pin down. "It's driven by greed and fear, emotions of

excessive pessimism and optimism."

The employment picture looks healthy, with the unemployment rate

and weekly jobless claims both low. But a better way to examine the

health of the workforce, Mr. Reece said, is to look at moving

averages rather than one month's numbers.

For example, he said, when the 12-month moving average of

jobless claims -- currently at 221,800 -- rises above the 24-month

moving average -- currently at 223,500 -- it is a sign that growth

in the labor force has peaked. Another sign is when the current

unemployment rate, 3.7%, moves above the 12-month moving average,

which sits just one-tenth of a percentage point higher, at

3.8%.

Those numbers haven't flipped, but they are close. Mr. Reece

thinks the economy will keep growing, but he puts the chances of a

recession arriving in the next six months at 30% to 40%.

"We've been in the eighth inning for a long time," he said.

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

September 19, 2019 16:56 ET (20:56 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

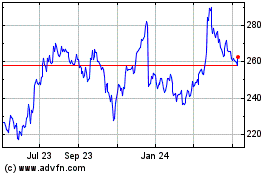

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

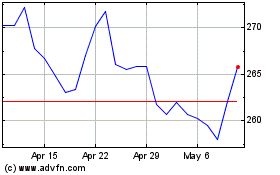

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024