FedEx On Pace for Largest Percent Decrease Since December 2008 -- Data Talk

September 18 2019 - 11:10AM

Dow Jones News

FedEx Corporation (FDX) is currently at $150.53, down $22.77 or

13.14%

-- Would be lowest close since Aug. 27, 2019, when it closed at

$149.53

-- On pace for largest percent decrease since Dec. 9, 2008, when

it fell 14.48%

-- On Tuesday, FedEx reported a first-quarter profit of $745

million, or $2.84 a share, compared with $835 million, or $3.10 a

share, a year earlier. Revenue declined slightly to $17.05 billion.

Analysts polled by FactSet expected earnings of $3.15 a share and

$17.06 billion in revenue

-- The company lowered its revenue outlook and said it expects

earnings to fall in its current fiscal year

-- Earlier Wednesday, analysts across the board downgraded their

price estimates for the company's stock. Stifel cut its rating on

the company from buy to hold and lowered its price target to $171

from $185 a share. Morgan Stanley analysts cut their price target

to $120 from $131 and JPMorgan & Chase Co. lowered its target

to $146 from $168 a share

-- Currently down four of the past five days

-- Currently down three consecutive days; down 13.54% over this

period

-- Worst three day stretch since the three days ending Dec. 21,

2018, when it fell 14.6%

-- Down 5.09% month-to-date

-- Down 6.69% year-to-date

-- Down 38.02% from 52 weeks ago (Sept. 19, 2018), when it

closed at $242.88

-- Down 13.32% at today's intraday low; largest intraday percent

decrease since Aug. 24, 2015, when it fell as much as 16.68%

-- Worst performer in the S&P 500 today

-- Third most active stock in the S&P 500 today

All data as of 10:29:43 AM

Source: Dow Jones Market Data, FactSet

(END) Dow Jones Newswires

September 18, 2019 10:55 ET (14:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

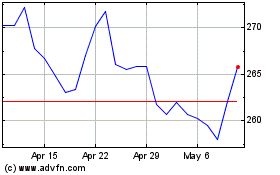

FedEx (NYSE:FDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

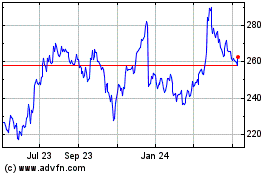

FedEx (NYSE:FDX)

Historical Stock Chart

From Apr 2023 to Apr 2024