CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus are “forward looking statements.” Statements regarding our expectations regarding the

business are “forward looking statements.” In addition, words such as “estimates,” “projected,” “expects,” “estimated,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “would,” “future,” “propose,” “target,” “goal,” “objective,” “outlook” and

variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. The forward-looking statements contained in this prospectus and in our other periodic

filings are not guarantees of future performance, conditions or results and are based on our current expectations and beliefs concerning future developments and their potential effects on us. There can be no assurance that future developments

affecting us will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may cause actual results or performance to be materially

different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under “Summary—Risk Factor Summary”, “Risk Factors”, and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” below. Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary

in material respects from those projected in these forward-looking statements. We may face additional risks and uncertainties that are not presently known to us, or that we deem to be immaterial, which may also impair our business, financial

condition or prospects. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

5

SUMMARY

This summary highlights selected information from this prospectus and does not contain all of the information that is important to making

an investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes included in this prospectus and the information set forth under the headings

“Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” See also the section entitled “Where You Can Find More

Information.”

Unless otherwise indicated or the context otherwise requires, references in this Business Summary to

“we,” “us,” “our” and other similar terms refer to Fathom OpCo and its subsidiaries prior to the Business Combination and to Fathom and its consolidated subsidiaries after

giving effect to the Business Combination.

Our Mission

Our mission is to accelerate manufacturing innovation for the most product-driven companies in the world.

Business Overview

Fathom, through our

consolidated subsidiary Fathom Holdco, LLC (“Fathom OpCo” or “Predecessor”), is a leading on-demand digital manufacturing platform in North America, providing comprehensive product

development to many of the largest and most innovative companies in the world. We have extensive expertise in both additive and traditional manufacturing, enabling our agile, technology-agnostic platform to blend manufacturing technologies and

processes to deliver hybridized solutions designed to meet the specific needs of our customers. This flexible problem-solving approach empowers our customers to accelerate their product development cycles, reducing manufacturing lead times for low

to mid-volume production.

We combine diverse, scaled manufacturing capabilities and deep

technical know-how to enable our customers to get to market faster, putting their design and product goals above the manufacturing limitations often imposed by other service providers. We pair our expertise

and manufacturing capabilities with a unified proprietary suite of software—which becomes an extension of the customer’s digital product development and low- to

mid-volume production threads. By continuously augmenting our software suite to stay in tune with evolving Industry 4.0 trends, we believe our platform is ideally suited to serve the product development and low- to mid-volume production parts needs of the largest and most innovative companies in the world.

Our differentiated strategy focuses on speed, problem solving, adaptive technical responsiveness, and a focus on manufacturing to meet

customers’ design intent—allowing our customers to iterate faster and shorten their product development and production cycles from months to days.

Our deep technical expertise and integrated, software-driven approach underpin a comprehensive suite of capabilities, with over 25 unique

manufacturing processes spread across 12 manufacturing facilities with nearly 450,000 square feet of manufacturing capacity in the United States (“U.S.”). Our scale and breadth of offerings allows our customers to consolidate their supply

chain and product development needs and to source through a single supplier. Fathom seamlessly blends in-house capabilities of 530+ advanced manufacturing systems across plastic and metal additive technologies

(90+ industrial-grade systems), computer numerical control (“CNC”) machining, injection molding and tooling, precision sheet metal fabrication, and design engineering, catering to a broad set of end markets. Fathom’s manufacturing

technologies and capacity are further extended through utilization of a selected group of highly qualified suppliers who specialize in injection molding and tooling and CNC machining.

6

With over 35 years of industry experience, Fathom is at the forefront of the Industry 4.0

digital manufacturing revolution, serving customers in the technology, defense, aerospace, medical, automotive and IOT sectors. Fathom’s certifications include: ISO 9001:2015, ISO 13485:2016, AS9100:2016, NIST

800-171 and International Traffic in Arms Regulations (“ITAR”) registered.

Fathom is

also a platform built for taking advantage of attractive future merger and acquisition opportunities. Fathom’s successful and proven acquisition strategy is enabled by our unique integration playbook including our proprietary software platform,

which allows a streamlined integration of acquired companies. Over the past three years, we have successfully completed 13 acquisitions to bolster our operations and service offerings.

Fathom’s business was founded in 1984 under the name Midwest Composite Technologies, LLC (“MCT”). Following the merger of MCT

and Kemeera, LLC in 2019, the business was rebranded to operate under the “Fathom Digital Manufacturing” name and key technical capabilities were added in direct response to the needs of our largest and most innovative corporate customers.

Today, Fathom is the result of the successful integration of 13 complementary companies, acquired over the past three years, creating a robust on-demand digital manufacturing platform with a proven array of

additive and traditional manufacturing capabilities.

As a result of our scale and superior offerings, we have developed a loyal base of

approximately 3,000 customers, including many of the largest and most innovative companies in the world, with excellent representation across Fortune’s 500 list. As of December 31, 2021, our customers included: (i) 7 of the top 10

aerospace companies, (ii) 4 of the top 10 automotive and electric vehicle companies, (iii) 4 of the top 10 consumer companies, (iv) 8 of the top 10 industrial companies, (v) 8 of the top 10 medical companies, and (vi) 7 of the top 10 technology

companies. Over the year ended December 31, 2021, no single customer represented more than 5% of our total revenue.

Our target

market consists of the highly fragmented U.S. low-to mid-volume manufacturing market of CNC machining, injection molding, precision sheet metal and additive

manufacturing. This market is projected to grow from $25 billion in 2021 to $33 billion in 2025, fueled by growth in demand for additive manufacturing and continuation of the trend of customers increasingly outsourcing their product

development prototyping and low-to mid-volume manufacturing needs.

Industry Opportunities

Overall,

manufacturing is a very large but highly fragmented market undergoing disruptive changes driven by rapid advances in how products are being designed and manufactured enabled by the adoption of Industry 4.0 practices.

The overall manufacturing market is one of the largest industries in the world, using industrial design processes to turn raw materials into

components and finished goods ranging from aircraft to microelectronics. Taking a new product from customer requirements through a design concept, the product development cycle and eventually to manufacture is a complex, costly and time-consuming

process. Product development and manufacturing processes are undergoing disruptive changes driven by Industry 4.0 practices, the next wave of the Industrial Revolution.

According to IBIS World, a research firm, there are over 570,000 manufacturing businesses in the United States employing over

11.3 million employees. The manufacturing industry is highly fragmented with over 75% of these manufacturing businesses employing less than 20 people, according to a study by SCORE, a research

7

firm. The US Bureau of Labor Statistics reported that there are approximately 2.7 million engineers and technicians with about 75% employed in the manufacturing, professional, scientific,

technical, and government sectors.

Within the overall manufacturing market, the highly fragmented

low- to mid- volume precision sheet metal fabrication, injection molding, CNC machining, and additive manufacturing market is estimated to be approximately

$25 billion.

Shorter product life cycles and demanding customer requirements are changing how companies develop and

manufacture new products.

Over the past decade, R&D spending in the manufacturing sector has increased from $445 billion

in 2010 to an estimated $600+ billion in 2021. Over this period, new products have contributed a growing share of total corporate revenue, requiring an ever-increasing speed and frequency of new product launches. In 2010, 220,000 new products were

launched, while in 2021 more than 350,000 new products were launched. These trends are pushing companies to innovate faster by accelerating product development cycles to increase their frequency of product launches. Companies must be very agile to

be successful.

Product designs are also becoming more complex as companies strive to launch more differentiated and higher functioning

products and push manufacturing constraints using increasingly advanced manufacturing processes. As their product portfolio becomes more diverse and customized, companies must manage their manufacturing supply chain to be more localized and on-demand. By digitizing their product lifecycle companies can simplify and consolidate their supply chain.

Deployment of maturing Industry 4.0 practices shortens product

time-to-market and provides agility but requires companies to seek out advanced manufacturing partners.

Industry 4.0 is primarily driven by the digitization of manufacturing including the commercialization of additive manufacturing complemented by

advanced traditional manufacturing technologies. Advancements in software tools and the use of artificial intelligence/machine learning techniques help to digitize the entire product development and manufacturing lifecycle. The digitization of

manufacturing is changing how new products are designed, manufactured and serviced, generating a large need for more on-demand manufacturing at the same time.

Additive manufacturing, complemented by key advanced traditional manufacturing technologies, offers greater agility and flexibility than

traditional manufacturing technologies. These technologies are capable of meeting the rigorous demands of corporate customers in the aerospace, automotive, industrial, medical and consumer sectors where products are highly engineered with precise

specifications.

On-demand manufacturing technologies allow custom production of parts in low- to mid- volume quantities with condensed turnaround times. As summarized below, these technologies are highly flexible and adaptive:

| |

• |

|

Additive manufacturing can produce highly complex parts using printed materials which would otherwise be

extremely difficult to produce via traditional methods. |

| |

• |

|

CNC machining is a subtractive manufacturing process that utilizes a variety of precision computer guided tools.

This process yields products with precision and repeatability, while offering high-quality surface finish optionality. |

| |

• |

|

Injection molding offers the ability to rapidly produce complex parts using molten material, formed in molds.

This process delivers consistency, quality, and cost-effectiveness for larger-scale production. |

8

| |

• |

|

Precision sheet metal fabrication involves cutting and bending of metal sheets, resulting in parts which are

highly durable. Lower production expenses make this a highly attractive fabrication process for low-volume jobs with fewer timing constraints. |

Technological advancements are expected to drive continued growth in on-demand digital manufacturing

technologies.

| |

• |

|

As advances in additive manufacturing make it better suited for higher-volume applications, it is expected to

take share from traditional manufacturing processes. Additive manufacturing offers the benefits of speed, part consolidation, weight reduction, and the ability to create complex geometries. |

| |

• |

|

CNC machining has exhibited rapid technological advances over the past five to ten years and has gained

significant share as a result. CNC workflow improvements have streamlined the process, reducing costs. |

| |

• |

|

While injection molding production serves a mature market, advances in fast-turnaround applications are driving

growth which should not be overlooked. |

| |

• |

|

Precision sheet metal fabrication is projected to grow at an accelerated rate between 2020 and 2025.

|

These technologies have driven significant advancements, improving speed, volumes, material capabilities, and the

overall customer experience. Companies leveraging these advanced technologies, particularly the largest and most innovative, are likely to see significant improvements in efficiencies across their entire manufacturing supply chain. In search of

further efficiencies, large enterprise companies are regionalizing and shortening their supply chain and consolidating their supplier partners.

These same companies are working to take advantage of Industry 4.0 technologies and advancement in the hybridized model of additive

manufacturing and advance traditional manufacturing technologies to optimize new product development and manufacturing. Through technological advances, additive manufacturing and other traditional processes are expected to become more accessible,

enabling in-house adoption. However, in-house production lines are often underutilized, inefficient, and are not cost effective when used solely for internal needs. In-house manufacturing options often lack the scale and capabilities to deliver end-to-end solutions required by corporate customers.

Within the $25 billion low- to mid- volume market

for precision sheet metal fabrication, injection molding, CNC machining, and additive manufacturing, we estimate that approximately 40% is handled in-house, 55%+ is serviced by regional design services

bureaus, and the remaining ~5% is captured by legacy digital manufacturers.

There are thousands of small regional design services bureaus

nationwide, most of which possess specialized and limited-service offerings. Some of these regional bureaus serve large enterprise companies but are constrained by inability to scale to meet the requirements of these demanding customers along with

the scarcity of skilled labor and limited capacity. Legacy on-demand digital manufacturers are focused on prosumers and we believe their focus on automation often compromises the flexibility required to meet

the evolving needs of corporate customers. We also believe that these legacy digital manufacturers are best-suited for simple, template-based part production and that their low-touch business model typically

is predicated on serving thousands of individual product developers. On-demand digital manufacturing brokers have limited in-house production and must therefore

outsource much of their own production needs, limiting oversight of the production process and hindering quality control and the ability to deliver complex parts. Involving multiple manufacturing suppliers also increases customer concerns relating

to the safeguarding of intellectual property.

We believe that large enterprise companies, which represent 50-60%

of the outsourced portion of this $25 billion low- to mid-volume manufacturing market, are seeking collaborative, long-term partnerships with their key

9

manufacturing suppliers, and in particular a partner that can advance Industry 4.0 practices to scale with them and ultimately allow them to simplify and shorten their supply chain. Fathom’s

value proposition and strategic partnership approach positions the Company to continue taking share from regional design bureaus and legacy digital manufacturers in the $25 billion low- to mid-volume manufacturing market.

Business Strengths and Strategies

Our key competitive strengths

We

enable some of the world’s largest and most innovative companies to accelerate new product development and shorten time to market from months to weeks (or even days). We believe our position as a leading

on-demand digital manufacturing platform purpose-built to serve the product development prototyping and low- to mid-volume

production needs of the largest and most innovative companies, coupled with the following competitive strengths, will allow us to maintain and extend our market leading position.

| |

• |

|

Adaptable, scalable platform with nationwide reach. Our platform is not reliant on any individual

manufacturing technology, hardware provider, or materials supplier. Our agile business model allows us to respond to evolving customer needs through seamless integration of new manufacturing technologies, software capabilities, and materials. We

have built a footprint of 12 manufacturing locations that enables us to produce and deliver parts to our customers nationwide, often in as a little as 24 hours. We expect to continue to benefit from continued innovation in additive and traditional

manufacturing, and our established customer relationships which provide us differentiated insights into demand for new technologies, informing investments which expand our capabilities. |

| |

• |

|

Broad suite of manufacturing processes, deep technical expertise, and proprietary software

platform. Our platform combines multiple manufacturing processes, dedicated engineering support, and purpose- built proprietary software to deliver a holistic solution which enhances efficiency for our customers. Our business is designed

with the flexibility to accommodate complex designs and provide enterprise- grade, quick-turn manufacturing services for high-precision, high-quality parts at scale. Our broad set of manufacturing capabilities eliminates the need for customers to

source parts across many single- process competitors or adhere to design constraints imposed by competing national manufacturing platforms and brokerages. This enables our customers to iterate designs faster and reduce time to market.

|

| |

• |

|

Strong customer relationships across diverse end-markets.

Our base of 3,000 active customers include many of the largest and most innovative companies in the world, spanning a diverse range of industries. Our strong value proposition is demonstrated through our greater than 90% customer retention

rate for the year ended December 31, 2021, and our performance is not reliant on any single customer; in 2021, our largest customer comprised less than 5% of revenue. We have a differentiated ability to establish and cultivate

revenue-generating relationships with multiple contacts across individual customers’ R&D and engineering organizations, leaving us increasingly entrenched as their on-demand manufacturing partner of

choice. |

| |

• |

|

Highly experienced management team and Board of Directors. Our leadership team combines a deep

additive and advanced manufacturing pedigree with decades of public market experience and a track record of scaling high-growth companies. We believe we have assembled a differentiated management team and Board of Directors who are particularly

well-equipped to successfully lead our Company and achieve our strategic goals. |

10

Our Strategy for Growth

| |

• |

|

Increased penetration of our existing enterprise-level corporate customer base and expansion through new

enterprise-level corporate customers. Our focus has historically been on enterprise-level corporate customers with wide-ranging, complex research and development needs. Our value proposition resonates with these customers’ need for

technology-agnostic, hands-on, quick-turn prototyping of low-to-mid volume, high-value parts. We believe we can continue to grow

by maintaining our strategy of expanding relationships across departments within existing corporate customers, as well as building relationships with new corporate customers through our differentiated capabilities. |

| |

• |

|

Expanded offering of additive manufacturing capabilities. We provide comprehensive services that

offer advanced technologies and processes tailored to our customer needs. To maintain our differentiated and market-leading suite of capabilities, we expect we will continue to integrate new capabilities into our platform. We plan to make informed

investments in new technologies, supported by our robust, ongoing dialogue with customers and deep industry expertise. |

| |

• |

|

Capitalizing on outsourcing trends in prototyping and low- to mid-volume manufacturing. It has become increasingly expensive and challenging for companies to maintain the materials, equipment, and skilled labor necessary to keep pace with the rate of innovation in

today’s market. Additionally, fluctuations in companies’ internal R&D cycles make it less efficient to build and fund a full suite of in-house capabilities. Based on current industry trends, we

expect companies to further rely on outsourced providers for their prototyping and low- to mid-volume manufacturing. We believe we are well-positioned to capture market

share as a result of this trend due to our comprehensive capabilities and corporate focus. |

| |

• |

|

Further enhancement of our software and digital capabilities. We are continuously working to expand

our software platform’s capabilities and believe this offering is pivotal in driving future growth. Our main areas of focus are: (i) further digitization of our offering through development of an internet-of-things enabled product suite, (ii) continued improvement of turnaround times and production efficiency achieved by leveraging our data analytics and artificial intelligence capabilities,

(iii) enhancing the customer experience through greater integration of our platform into our customers’ PLM, MES and ERP systems, and (iv) reduction of our customers’ need for on-site

inventory through the establishment of digitized supply chain management systems. |

| |

• |

|

Continued pursuit of strategic add-on acquisitions.

Targeted acquisitions and integrations of complimentary digital manufacturing companies into our business represent an attractive growth opportunity, given our successful track record and the highly fragmented nature of our industry. Since

2019, we have completed 13 acquisitions (with four completed in 2021), transforming Fathom into a leading on-demand digital manufacturing company with a highly scalable breadth of manufacturing capabilities.

We have optimized our platform to streamline the integration of new companies into the Fathom ecosystem, allowing us to deploy our proprietary playbook and realize synergies. |

11

Organizational Structure

The following diagram illustrates in simplified terms the structure and ownership of Fathom and its operating subsidiaries.

| 1. |

Altimar II Founders include Altimar Sponsor II, LLC and the seven former directors of Altimar II.

|

| 2. |

The warrants held by Public Shareholders are Public Warrants and the warrants held by Altimar Sponsor II, LLC

are Private Placement Warrants. The organizational structure diagram assumes none of the Warrants have been exercised. The organizational structure diagram also excludes the Earnout Shares and the Sponsor Earnout Shares. |

| 3. |

Legacy Fathom Owners include Fathom Blocker Owners and Continuing Fathom Unitholders, which include the CORE

Investors. |

12

U.S. Federal Income Tax Considerations

For a discussion summarizing the U.S. federal income tax considerations of an investment in shares of Class A common stock or Warrants,

please see “Certain U.S. Federal Income Tax Considerations.”

Sources of Industry and Market Data

Where information has been sourced from a third party, the source of such information has been identified.

Unless otherwise indicated, the information contained in the prospectus on the market environment, market developments, market trends, and

competition in the markets in which we operate is taken from publicly available sources, including third-party sources, or reflects our estimates that are principally based on information from publicly available sources. Some data are also based on

good faith estimates, which are derived from internal company analyses or review of internal company reports as well as the independent sources referred to above.

Although Fathom believes that the information on which it has based these estimates of industry position and industry data are generally

reliable, the accuracy and completeness of this information is not guaranteed and it has not independently verified any of the data from third-party sources nor has it ascertained the underlying economic assumptions relied upon therein. Statements

as to industry position are based on market data currently available. While Fathom is not aware of any misstatements regarding the industry data presented herein, these estimates involve risks and uncertainties and are subject to change based on

various factors, including those discussed under the heading “Risk Factors” in this prospectus.

Risk Factor Summary

You should consider carefully all of the risks described below, together with the other information contained in this prospectus, before making

a decision to invest in our Class A common stock. For purposes of the below summary of risk factors, “we” and “our” refers to Fathom or Fathom OpCo, as the context may require. Such risks include, but are not limited to:

| |

• |

|

we are subject to risks related to the ongoing COVID-19 pandemic and any

future outbreaks of other highly infectious or contagious disease; |

| |

• |

|

we face increasing competition in many aspects of our business; |

| |

• |

|

we may not realize the anticipated benefits of our business acquisitions, and any acquisition, strategic

relationship, joint venture or investment could disrupt our business and harm our operating results and financial condition; |

| |

• |

|

if we are unable to manage our growth and expand our operations successfully, our reputation, brands, business

and results of operations may be harmed; |

| |

• |

|

our success depends on our ability to deliver on-demand manufacturing

capabilities and custom parts that meet the needs of our customers and to effectively respond to changes in our industry; |

| |

• |

|

our failure to meet our customers’ expectations regarding quick turnaround time, price or quality could

adversely affect our business and results of operations; |

| |

• |

|

we are subject to risks related to our dependency on our key management members and other key personnel, as well

as attracting, retaining and developing qualified personnel in a highly competitive talent market; |

13

| |

• |

|

we may be subject to litigation risks and may face liabilities and damage to our professional reputation as a

result; |

| |

• |

|

we may be subject to cybersecurity risks and changes to data protection regulation; |

| |

• |

|

our businesses are subject to extensive domestic and foreign regulations that may subject us to significant costs

and compliance requirements; |

| |

• |

|

we are subject to risks related to the Tax Receivable Agreement; |

| |

• |

|

unfavorable global economic conditions, including changes in inflation and interest rates, could adversely affect

our business, financial condition or results of operations; |

| |

• |

|

we may be subject to risks related to our status as an emerging growth company within the meaning of the

Securities Act; |

| |

• |

|

we are subject to the risks of our status as a “controlled company” within the meaning of the NYSE

listing standards; |

| |

• |

|

the grant of registration rights to certain of our investors and the future exercise of such rights may adversely

affect the market price of our Class A common stock; |

| |

• |

|

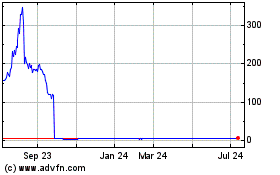

the volatility of our stock price as the result of being a recent de-SPAC

IPO directly impacts the valuation of our warrants and earnout shares and could increase the volatility in our net income (loss) in our consolidated statements of net income (loss); |

| |

• |

|

our management team has limited experience managing a public company; |

| |

• |

|

we have identified material weaknesses in our internal control over financial reporting. Failure to achieve and

maintain effective internal control over financial reporting could result in our failure to accurately or timely report our financial condition or results of operations which could have a material adverse effect on our business and stock price;

|

| |

• |

|

the effect of legal, tax and regulatory changes; and |

| |

• |

|

other factors detailed under “Risk Factors” below. |

Emerging Growth Company

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) exempts emerging growth companies from

being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a registration statement under the Securities Act declared effective or do not have a class of securities

registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply

to non-emerging growth companies but any such election to opt out is irrevocable. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it

has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of Altimar II’s

financial statements with another public company which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period difficult or impossible because of the potential differences in

accounting standards used.

We will remain an emerging growth company until the earlier of: (1) (a) December 31, 2027, (b) the last

day of the fiscal year in which we have total annual gross revenue of at least $1.07 billion, or (c) the last day of the fiscal year in which we are deemed to be a large accelerated filer, which means the market value of our common

14

equity that is held by non-affiliates exceeds $700 million as of the end of the prior fiscal year’s second fiscal quarter; and (2) the date

on which we have issued more than $1.00 billion in non-convertible debt securities during the prior three-year period. References herein to “emerging growth company” have the meaning associated

with it in the JOBS Act.

Smaller Reporting Company

Additionally, we are a “smaller reporting company” as defined in Item 10(f)(1) of Regulation

S-K. Smaller reporting companies may take advantage of certain reduced disclosure obligations, including, among other things, providing only two years of audited financial statements. We expect to remain a

smaller reporting company until the last day of the fiscal year in which (i) the market value of our common stock held by non-affiliates exceeds $250 million as of the prior June 30, or

(ii) our annual revenues exceeded $100 million during such completed fiscal year and the market value of our common stock held by non-affiliates exceeds $700 million as of the prior June 30.

Corporate Information

We are a

Delaware corporation. Our principal executive office is located at 1050 Walnut Ridge Drive, Hartland, WI 53029. Our telephone number is (262) 367-8254. Our website is www.fathommfg.com. Information contained

on our website is not a part of this prospectus, and the inclusion of our website address in this prospectus is an inactive textual reference only.

15

THE OFFERING

| Issuer |

Fathom Digital Manufacturing Corporation. |

| Class A common stock offered by the Selling Stockholders |

Up to 7,000,000 shares of Class A common stock. |

| Use of Proceeds |

We will not receive any of the proceeds from the sale of the shares of Class A common stock by the Selling Stockholders. |

| Market for our shares of Class A common stockk |

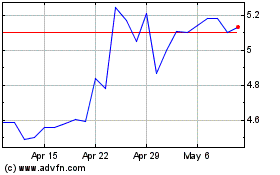

Our Class A common stock is currently listed on the NYSE under the symbol “FATH.” |

| Risk Factors |

An investment in the securities offered hereby is speculative and involves a high degree of risk. You should carefully consider the information set forth under “Risk Factors” and elsewhere in this prospectus. |

16

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risks described below before making an

investment decision. Our business, prospects, financial condition, or operating results could be harmed by any of these risks, as well as other risks not known to us or that we consider immaterial as of the date of this prospectus. The trading price

of our securities could decline due to any of these risks, and, as a result, you may lose all or part of your investment. Our actual results may differ materially from any future results expressed or implied by such forward-looking statements as a

result of various factors, including, but not limited to, those discussed in the sections of this prospectus entitled “Cautionary Note Regarding Forward-Looking Statements” and “Management’s Discussion and

Analysis of Financial Condition and Results of Operations.”

Business Risks

We face significant competition and expect to face increasing competition in many aspects of our business, which could cause our operating results to

suffer.

The digital manufacturing industry in which we operate is fragmented and highly competitive. We compete for customers with

a wide variety of custom parts manufacturers and methods. Some of our current and potential competitors include captive in-house production capabilities, other custom parts manufacturers, brokers of custom

parts and additive manufacturing vendors, including those utilizing 3D printing processes. Moreover, some of our existing and potential competitors are researching, designing, developing and marketing other types of products and manufacturing

capabilities. We also expect that future competition may arise from the development or improvement of allied or related techniques for digital manufacturing, including from the issuance of patents to other companies that may inhibit our ability to

compete effectively. Furthermore, our competitors may attempt to adopt and improve upon key aspects of our business model, such as development of technology that automates much of the manual labor conventionally required to quote and manufacture

custom parts, implementation of interactive web-based and automated user interface and quoting systems and/or building scalable operating models specifically designed for efficient custom parts production.

Third-party Computer Aided Design (“CAD”) software companies may develop software that mold-makers, injection molders and CNC machine shops could use to compete with our business model. Additive manufacturers may develop stronger, higher

temperature resins or introduce other improvements that could more effectively compete with us on part quality. We may also, from time to time, establish alliances or relationships with other competitors or potential competitors, including 3D

printer Original Equipment Manufacturers (“OEMs”). To the extent companies terminate such relationships and establish alliances and relationships with our competitors, our business could be harmed.

Existing and potential competitors may have substantially greater financial, technical, marketing and sales, manufacturing, distribution and

other resources and name recognition than us, as well as experience and expertise in intellectual property rights, any of which may enable them to compete effectively against us. For example, a number of companies that possess substantial resources

have announced that they are beginning digital manufacturing initiatives, which will further strengthen the competition we face.

Though

we plan to continue to expend resources to develop new technologies, processes and manufacturing capabilities, we cannot assure you that we will be able to maintain our current competitive position or continue to compete successfully against current

and future sources of competition. Our challenge in developing new business opportunities is identifying custom parts for which our automated quotation and digital manufacturing processes offer an attractive value proposition, and we may not be able

to identify any new custom parts categories with favorable economics similar to our existing offerings. If we do not keep pace with technological change, demand for our offerings may decline and our operating results may suffer.

17

Our success depends on our ability to deliver on-demand

manufacturing capabilities and custom parts that meet the needs of our customers and to effectively respond to changes in our industry.

We derive almost all of our revenue from the manufacture and sale to our customers of quick-turn, low volume custom parts for prototyping,

support of internal manufacturing and limited quantity product release up to mid volume production requirements. Our business has been and, we believe, will continue to be, affected by changes in our customers’ new product and product line

introductions, requirements and preferences, rapid technological change and the emergence of new standards and practices, any of which could render our technology and manufacturing capabilities less attractive, uneconomical or obsolete. To the

extent that our customers’ need for quick-turn to mid-volume production parts decreases significantly for any reason, it would likely have a material adverse effect on our business and operating results

and harm our competitive position. In addition, CAD simulation and other technologies may reduce the demand for physical prototype parts. Therefore, we believe that to remain competitive, we must continually expend resources to enhance and improve

our technology and manufacturing capabilities.

In particular, we plan to increase our research and development efforts and to continue to

focus a significant portion of those efforts to further develop our technology in areas such as our interactive project management platform and manufacturing processes, technology offerings and broaden the range of parts that we are able to

manufacture. We believe successful execution of this part of our business plan is critical for our ability to compete in our industry and grow our business, and there are no guarantees we will be able to do so in a timely fashion, or at all.

Broadening the range of parts and technologies that we are able to manufacture and offer is of particular importance because limitations in manufacturability are the primary reason we are not able to fulfill many quotation requests. There are no

guarantees that the resources we devote to executing on this aspect of our business plan will improve our business and operating results or result in increased demand for our custom parts and manufacturing capabilities. Failures in this area could

adversely impact our operating results and harm our reputation and brands. Even if we are successful in executing in this area, our industry is subject to rapid and significant technological change, and our competitors may develop new technologies

and manufacturing capabilities that are superior to ours.

Any failure to properly meet the needs of our customers or respond to changes

in our industry on a cost-effective and timely basis, or at all, would likely have a material adverse effect on our business and operating results and harm our competitive position.

Our failure to meet our customers’ expectations regarding quick turnaround time, price or quality could adversely affect our business and results

of operations.

We believe many of our customers are facing increased pressure from global competitors to be first to market with

their finished products, often resulting in a need for quick turnaround of custom parts. We believe our ability to quickly quote, manufacture and ship custom parts has been an important factor in our results to date. There are no guarantees we will

be able to meet customers’ increasing expectations regarding quick turnaround time. If we fail to meet our customers’ expectations regarding turnaround time in any given period, our business and results of operations will likely suffer.

Demand for our custom parts and manufacturing capabilities is sensitive to price. We believe our competitive pricing has been an

important factor in our results to date. Therefore, changes in our pricing strategies can have a significant impact on our business and ability to generate revenue. Many factors, including our production and personnel costs and our competitors’

pricing and marketing strategies, can significantly impact our pricing strategies. If we fail to meet our customers’ price expectations in any given period, demand for our custom parts and manufacturing capabilities could be negatively impacted

and our business and results of operations could suffer.

Most of our customers have a need for specific quality of quick-turn, on-demand custom parts. We believe our ability to create parts meeting our customers’ specifications and quality expectations is an important factor in

18

our results to date. We cannot assure you that we will be able to continue to consistently manufacture custom parts that achieve the production specifications and quality that our customers

expect. If we fail to meet our customers’ specifications and quality expectations in any given period, demand for our custom parts and manufacturing capabilities could be negatively impacted and our business and results of operations could

suffer.

The strength of our brands is important to our business, and any failure to maintain and enhance our brands would hurt our ability to

retain and expand our customer base as well as further penetrate existing customers.

Because our custom parts and manufacturing

capabilities are sold primarily through our website, the success of our business depends upon our ability to attract new and repeat customers to our website in order to increase business and grow our revenue. Customer awareness and the perceived

value of our brands will depend largely on the success of our marketing efforts, as well as our ability to consistently provide quality custom parts within the required timeframes and positive customer experiences, which we may not do successfully.

A primary component of our business strategy is the continued promotion and strengthening of our brands. We may choose to increase our branding expense materially, but we cannot be sure that this investment will be profitable. If we are unable to

successfully maintain and enhance our brands, this could have a negative impact on our business and ability to generate revenue.

Sales efforts to

large customers involve risks that may not be present or that are present to a lesser extent with respect to sales to smaller organizations.

Attracting and retaining business from large enterprise customers is an element of our business strategy. Sales to large customers involve

risks that may not be present or that are present to a lesser extent with sales to smaller organizations, such as longer sales cycles, more complex customer requirements, substantial upfront sales costs, less predictability in completing some of our

sales and extended payment terms. A number of factors influence the length and variability of our sales cycle, including the need to educate potential customers about the uses and benefits of our platform, the various technologies available and

manufacturing capabilities, the longer period of time for large customers to evaluate and test our project management platform prior to making a purchase decision and placing an order, the discretionary nature of purchasing and budget cycles and the

competitive nature of evaluation and purchasing approval processes. As a result, the length of our sales cycle, from identification of the opportunity to deal closure, may vary significantly from customer to customer, with sales to large enterprises

typically taking longer to complete. Moreover, larger organizations may demand more customization, which would increase our upfront investment in the sales effort with no guarantee that these customers will seek to use our manufacturing capabilities

widely enough across their organization to justify our substantial upfront investment. A portion of these customers may purchase our offerings on payment terms, requiring us to assume a credit risk for

non-payment in the ordinary course of business. If we fail to effectively manage these risks associated with sales to large customers, our business, financial condition and results of operations may be

affected.

Our business depends in part on our ability to process a large volume of new custom part designs from a diverse group of customers and

successfully identify significant opportunities for our business based on those submissions.

We believe the volume of new custom

part designs we process and the size and diversity of our customer base give us valuable insight into the needs of our prospective customers. We utilize this industry knowledge to determine where we should focus our development resources. If the

number of new custom part designs we process or the size and diversity of our customer base decrease, our ability to successfully identify significant opportunities for our business and meet the needs of customers could be negatively impacted. In

addition, even if we do continue to process a large number of new custom part designs and work with a significant and diverse customer base, there are no guarantees that any industry knowledge we extract from those interactions will be successfully

utilized to help us identify significant business opportunities or better understand the needs of our existing or prospective customers.

19

Wage increases and pressure in certain geographies may prevent us from sustaining our competitive

advantage and may reduce our profit margin.

Measures are being taken in the United States and globally to increase minimum wages,

and there is a shortage of skilled labor in certain locations leading to increased wage pressure. Similarly, with an increased global focus on environmental, social and corporate-governance concerns and sustainability, input costs have been steadily

rising. In addition, enhanced federally subsidized unemployment benefits during the ongoing COVID-19 pandemic may have been contributing to labor shortages at some of our facilities. Accordingly, we may need

to increase the levels of labor compensation more rapidly than in the past to remain competitive in attracting and retaining the quality and amount of labor that our business requires. To the extent that we are not able to control or recoup wage

increases through our pricing, wage increases may reduce our margins and cash flows, which could adversely affect our business.

The loss of one or

more key members of our management team or personnel, or our failure to attract, integrate and retain additional personnel in the future, could harm our business and negatively affect our ability to successfully grow our business.

We are highly dependent upon the continued service and performance of the key members of our management team and other personnel. The loss of

any of these individuals, each of whom is “at will” and may terminate his or her employment relationship with us at any time, could disrupt our operations and significantly delay or prevent the achievement of our business objectives. We

believe that our future success will also depend in part on our continued ability to identify, hire, train and motivate qualified personnel. High demand exists for senior management and other key personnel (including technical, engineering, product,

finance and sales personnel) in the digital manufacturing industry. A possible shortage of qualified individuals in the regions where we operate might require us to pay increased compensation to attract and retain key employees, thereby increasing

our costs. In addition, we face intense competition for qualified individuals from numerous companies, many of whom have substantially greater financial and other resources and name recognition than us. We may be unable to attract and retain

suitably qualified individuals who are capable of meeting our growing operational, managerial and other requirements, or we may be required to pay increased compensation in order to do so. For example, our failure to attract and retain shop floor

employees may inhibit our ability to fulfill production orders for our customers. Our failure to attract, hire, integrate and retain qualified personnel could impair our ability to achieve our business objectives.

All of our employees are at-will employees, meaning that they may terminate their employment

relationship with us at any time, and their knowledge of our business and industry would be extremely difficult to replace. We generally enter into non-competition agreements with our employees and certain

consultants. These agreements prohibit our employees and applicable consultants from competing directly with us or working for our competitors or customers while they work for us, and in some cases, for a limited period after they cease working for

us. We may be unable to enforce these agreements under the laws of the jurisdictions in which our employees and applicable consultants work and it may be difficult for us to restrict our competitors from benefiting from the expertise that our former

employees or consultants developed while working for us. If we cannot demonstrate that our legally protectable interests will be harmed, we may be unable to prevent our competitors from benefiting from the expertise of our former employees or

consultants and our ability to remain competitive may be diminished.

Our growth strategy relies on business acquisitions. We may not realize the

anticipated benefits of such acquisitions, and any acquisition, strategic relationship, joint venture or investment could disrupt our business and harm our operating results and financial condition.

Our business and customer base have been built in part through organic growth, but also through acquisitions of businesses that increase market

share in our current markets or expand into other markets, or broaden our technology, intellectual property or product line capabilities. We have completed 13 acquisitions

20

during the last three years, and we intend to continue to aggressively pursue attractive opportunities to enhance or expand our offerings through acquisitions, strategic relationships, joint

ventures or investments that we believe may allow us to implement our growth strategy. For example, in December 2019, we acquired ICO Mold, LLC (“ICOMold”) to enable us to expand our existing Search Engine Optimization (“SEO”)

and Search Engine Marketing (“SEM”) capabilities. During 2020 and 2021, we completed six acquisitions that added CNC machining to our manufacturing capabilities, and three acquisitions that added precision sheet metal fabrication to our

offerings. We cannot forecast the number, timing or size of any future acquisitions or other similar strategic transactions, or the effect that any such transactions might have on our operating or financial results. We may not be able to

successfully identify future acquisition opportunities or complete any such acquisitions if we cannot reach agreement on commercially favorable terms, if we lack sufficient resources to finance the transaction on our own and cannot obtain financing

at a reasonable cost or if regulatory authorities prevent such transactions from being completed.

Although we have substantial experience

engaging in these types of transactions, such transactions may be complex, time consuming and expensive, and may present numerous challenges and risks including:

| |

• |

|

an acquired company, asset or technology not furthering our business strategy as anticipated;

|

| |

• |

|

difficulties entering and competing in new product or geographic markets and increased competition, including

price competition; |

| |

• |

|

integration challenges; |

| |

• |

|

challenges in working with strategic partners and resolving any related disagreements or disputes;

|

| |

• |

|

high valuation for a company, asset or technology, or changes in the economic or market conditions or assumptions

underlying our decision to make an acquisition; |

| |

• |

|

significant problems or liabilities associated with acquired businesses, assets or technologies, including

increased intellectual property and employment-related litigation exposure; |

| |

• |

|

acquisition of a significant amount of goodwill, which could result in future impairment charges that would

reduce our earnings; and |

| |

• |

|

requirements to record substantial charges and amortization expense related to certain purchased intangible

assets, deferred stock compensation and other items, as well as other charges or expenses. |

Any one of these challenges

or risks could impair our ability to realize any benefit from our acquisitions, strategic relationships, joint ventures or investments after we have expended resources on them, as well as divert our management’s attention. Any failure to

successfully address these challenges or risks could disrupt our business and harm our operating results and financial condition. Moreover, any such transaction may not be viewed favorably by investors or other stakeholders.

If we proceed with a particular acquisition, we may have to use cash, issue new equity securities with dilutive effects on existing

stockholders, incur indebtedness, assume contingent liabilities, or amortize assets or expenses in a manner that might have a material adverse effect on our financial condition and results of operations. Acquisitions will also require us to record

certain acquisition-related costs and other items as current period expenses, which would have the effect of reducing our reported earnings in the period in which an acquisition is consummated. In addition, we could also face unknown liabilities or

write-offs due to our acquisitions, which could result in a significant charge to our earnings in the period in which they occur. We will also be required to record any goodwill or other long-lived asset impairment charges in the periods in which

they occur, which could result in a significant charge to our earnings in any such period.

Achieving the expected returns and synergies

from future acquisitions will depend, in part, upon our ability to integrate the products and services, technology, administrative functions and personnel of these businesses into our offering lines in an efficient and effective manner. We cannot

assure you that we will be able to do so, that

21

any acquired businesses will perform at levels and on the timelines anticipated by our management or that we will be able to realize these synergies. In addition, acquired technologies and

intellectual property may be rendered obsolete or uneconomical by our own or our competitors’ technological advances. Management resources may also be diverted from operating our existing businesses to certain acquisition integration

challenges. If we are unable to successfully integrate acquired businesses, our anticipated revenues and profits may be lower. Our profit margins may also be lower, or diluted, following the acquisition of companies whose profit margins are less

than those of our existing businesses.

In addition, from time to time we may enter into negotiations for acquisitions, relationships,

joint ventures or investments that are not ultimately consummated. These negotiations could result in significant diversion of management time, as well as substantial

out-of-pocket costs.

If we are unable to manage our growth and

expand our operations successfully, our reputation and brands may be damaged, and our business and results of operations may be harmed.

Over the past several years, we have experienced rapid growth. For example, we have grown from 44 full-time employees as of October 31,

2018 to 706 full-time employees as of December 31, 2021. We expect this growth to continue and the number of facilities from which we operate to increase in the future. Our ability to effectively manage our anticipated growth and expansion of

our operations will require us to do, among other things, the following:

| |

• |

|

enhance our operational, financial and management controls and infrastructure, human resource policies, and

reporting systems and procedures; |

| |

• |

|

effectively scale our operations, including accurately predicting the need for floor space, equipment, and

additional staffing; and |

| |

• |

|

successfully identify, recruit, hire, train, develop, maintain, motivate and integrate additional employees.

|

These enhancements and improvements will require significant capital expenditures and allocation of valuable management

and employee resources. Furthermore, our growth has placed, and will continue to place, a strain on our operational, financial and management infrastructure. Our future financial performance and our ability to execute on our business plan will

depend, in part, on our ability to effectively manage any future growth and expansion. There are no guarantees we will be able to do so in an efficient or timely manner, or at all. Our failure to effectively manage growth and expansion could have a

material adverse effect on our business, results of operations, financial condition, prospects, reputation and brands, including impairing our ability to perform to our customers’ expectations.

We may not timely and effectively scale and adapt our existing technology, processes and infrastructure to meet the needs of our business.

A key element to our continued growth is the ability to quickly and efficiently quote an increasing number of customer submissions across

geographic regions and to manufacture the related custom parts. This will require us to timely and effectively scale and adapt our existing technology, processes and infrastructure to meet the needs of our business. With respect to our website,

project management platform and quoting technology, it may become increasingly difficult to maintain and improve their performance, especially during periods of heavy usage and as our solutions become more complex and our user traffic increases

across geographic regions. Similarly, our manufacturing automation technology may not enable us to process the large numbers of unique designs and efficiently manufacture the related custom parts in a timely fashion to meet the needs of our

customers as our business continues to grow. Any failure in our ability to timely and effectively scale and adapt our existing technology, processes and infrastructure could negatively impact our ability to retain existing customers and attract new

customers, damage our reputation and brands, result in lost revenue, and otherwise substantially harm our business and results of operations.

22

We may require additional capital to support business growth, and this capital might not be available

on acceptable terms, if at all. If we are unable to raise additional capital when needed, our financial condition could be adversely affected and we may not be able to execute our growth strategy.

We intend to continue to make acquisitions and other investments to support our business growth and may require additional funds to respond to

business challenges, including the need to complement our growth strategy, increase market share in our current markets or expand into other markets, or broaden our technology, intellectual property or manufacturing capabilities. Accordingly, we may

need to obtain equity or debt financings to secure additional funds. If we raise additional funds through future issuances of equity or convertible debt securities, our existing stockholders could suffer significant dilution, and any new equity

securities we issue could have rights, preferences and privileges superior to those of holders of our common stock. The New Credit Agreement and any debt financing we secure in the future could involve restrictive covenants relating to our capital

raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities, including potential acquisitions. We may not be able to obtain additional

financing on terms favorable to us, if at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us when we require it, our ability to continue to support our business growth and to respond to business challenges

could be significantly impaired, and our business may be adversely affected.

Numerous factors may cause us not to maintain the revenue growth that

we have historically experienced.

Although our revenue has grown from $20.6 million for the year ended December 31, 2019

to $152.2 million for the year ended December 31, 2021, we may not be able to maintain our historical rate of revenue growth. We believe that our continued revenue growth will depend on many factors, a number of which are out of our

control, including among others, our ability to:

| |

• |

|

retain and further penetrate existing customers, as well as attract new customers; |

| |

• |

|

consistently execute on custom part orders in a manner that satisfies our customers’ product needs and

provides them with a superior experience; |

| |

• |

|

develop new technologies or manufacturing processes and broaden the range of custom parts we offer;

|

| |

• |

|

capitalize on customers’ product expectations for access to comprehensive, user-friendly e-commerce capabilities 24 hours per day, 7 days per week; |

| |

• |

|

increase the strength and awareness of our brands across geographic regions; |

| |

• |

|

respond to changes in customers’ needs, technology and our industry; |

| |

• |

|

react to challenges from existing and new competitors; and |

| |

• |

|

respond to an economic recession which negatively impacts manufacturers’ ability to innovate and bring new

products to market. |

We cannot assure you that we will be successful in addressing the factors above and continuing to

grow our business and revenue.

Errors or defects in the software we use or custom parts we manufacture could cause us to incur additional costs,

lose revenue and business opportunities, damage our reputation and expose us to potential liability.

The sophisticated software we

use and the often complex custom parts we manufacture may contain errors, defects or other performance problems at any point in the life of the software or custom parts. If errors or defects are discovered in our current or future software or in the

custom parts we manufacture for customers, we may not be able to correct them in a timely manner or provide an adequate response to our customers. We may therefore need to expend significant financial, technical and management resources, or divert

some of our development

23

resources, in order to resolve or work around those errors or defects. We may also experience an increase in our service and warranty costs. Particularly in the medical sector, errors or defects

in our software or custom parts we manufacture could lead to claims by patients against us and our customers and expose us to lawsuits that may damage our and our customers’ reputations. Claims may be made by individuals or by classes of users.

Our product liability and related insurance policies may not apply or sufficiently cover any product liability lawsuit that arises from defective software we may use or the custom parts we manufacture. Customers such as our collaboration partners

may also seek indemnification for third party claims allegedly arising from breaches of warranties under our collaboration agreements.

Errors, defects or other performance problems in the software we use or custom parts we manufacture may also result in the loss of, or delay

in, the market acceptance of our platform and digital manufacturing capabilities. Such difficulties could also cause us to lose customers and, particularly in the case of our largest customers, the potentially substantial associated revenue which

would have been generated by our sales to companies participating in our customer supply chains. Technical problems, or the loss of a customer with a particularly important national or global reputation, could also damage our own business reputation

and cause us to lose new business opportunities.

Interruptions to or other problems with our website, project management platform, information

technology systems, manufacturing processes or other operations could damage our reputation and brands and substantially harm our business and results of operations.

The satisfactory performance, reliability, consistency, security and availability of our website and interactive project management platform,

information technology systems, manufacturing processes and other operations are critical to our reputation and brands, and to our ability to effectively service customers. Any interruptions or other problems that cause any of our website,

interactive project management platform or information technology systems to malfunction or be unavailable, or negatively impact our manufacturing processes or other operations, may damage our reputation and brands, result in lost revenue, cause us

to incur significant costs seeking to remedy the problem and otherwise substantially harm our business and results of operations.

A

number of factors or events could cause such interruptions or problems, including among others: human and software errors, design faults, challenges associated with upgrades, changes or new facets of our business, power loss, telecommunication

failures, fire, flood, extreme weather, political instability, acts of terrorism, war, break-ins and security breaches, contract disputes, labor strikes and other workforce-related issues, capacity constraints

due to an unusually large number of customers and potential customers accessing our website or project management platform or ordering parts at the same time, and other similar events. These risks are augmented by the fact that our customers come to

us largely for our quick-turn low to mid-volume manufacturing capabilities and that accessibility and turnaround speed are often of critical importance to these customers. We are dependent upon our facilities

through which we satisfy all of our production demands and in which we house all of the computer hardware necessary to operate our website and systems as well as managerial, customer service, sales, marketing and other similar functions, and we have

not identified alternatives to these facilities or established fully redundant systems in multiple locations. In addition, we are dependent in part on third parties for the implementation and maintenance of certain aspects of our communications and

production systems, and therefore preventing, identifying and rectifying problems with these aspects of our systems is to a large extent outside of our control.

Moreover, the business interruption insurance that we carry may not be sufficient to compensate us for the potentially significant losses,

including the potential harm to the future growth of our business that may result from interruptions in our offerings and manufacturing processes as a result of system failures.

24

If a natural or man-made disaster strikes any of our

manufacturing facilities, we may be unable to manufacture our products for a substantial period of time and our sales will decline.

We manufacture all of our products in 12 manufacturing facilities located in the United States. These facilities and the manufacturing

equipment we use would be costly to replace if damaged by a natural or man-made disaster, and could require substantial lead time to repair or replace. Our facilities may be harmed by natural or man-made disasters, including, without limitation, earthquakes, floods, tornadoes, fires, hurricanes, tsunamis, nuclear disasters, terrorist attacks, or as a result of the ongoing

COVID-19 pandemic. In the event any of our facilities are affected by a disaster, we may:

| |

• |

|

be unable to meet the shipping deadlines of our customers; |

| |

• |

|

experience disruptions in our ability to process submissions and generate quotations, manufacture and ship parts,

provide marketing and sales support and customer service and otherwise operate our business, any of which could negatively impact our business; |

| |

• |

|

be forced to rely on third-party manufacturers; |

| |

• |

|

need to expend significant capital and other resources to address any damage caused by the disaster; and

|

| |

• |

|

lose customers and be unable to reacquire those customers. |

Although we possess insurance for damage to our property and the disruption of our business from casualties, this insurance may not be

sufficient to cover all of our potential losses and may not continue to be available to us on acceptable terms, or at all.

If our present single or

limited source suppliers become unavailable or inadequate, our customer relationships, results of operations and financial condition may be adversely affected.

We acquire substantially all of the manufacturing equipment and certain of our materials that are critical to the ongoing operation and future

growth of our business from third parties. We do not have long-term supply contracts with any of our suppliers and operate on a purchase-order basis. While most manufacturing equipment and materials for our products are available from multiple

suppliers, certain of those items are only available from single or limited sources. Should any of our present single or limited source suppliers for manufacturing equipment or materials become unavailable or inadequate, or impose terms unacceptable

to us such as increased pricing terms, we could be required to spend a significant amount of time and expense to develop alternate sources of supply, and we may not be successful in doing so on terms acceptable to us, or at all. Natural disasters,

such as hurricanes or tornadoes, may affect our supply of materials, particularly resins, from time to time, and we may purchase larger amounts of certain materials in anticipation of future shortages or increases in pricing. In addition, if we were

unable to find a suitable supplier for a particular type of manufacturing equipment or material, we could be required to modify our existing manufacturing processes and offerings to accommodate the situation. As a result, the loss of a single or

limited source supplier could adversely affect our relationship with our customers and our results of operations and financial condition.

We are

subject to payment-related risks.

We accept payments using a variety of methods, including credit card, customer invoicing,

physical bank check and payment upon delivery. As we offer new payment options to our customers, we may be subject to additional regulations, compliance requirements and fraud risk. For certain payment methods, including credit and debit cards, we

pay interchange and other fees, which may increase over time and raise our operating costs and lower profitability. We rely on third parties to provide payment processing services, including the processing of credit cards, debit cards or electronic

checks, and it could disrupt our business if these companies become unwilling or unable to provide these services to us. We are also subject to payment card association operating rules, certification requirements and rules governing electronic funds

transfers, which could change or be

25

reinterpreted to make it difficult or impossible for us to comply. If we fail to comply with these rules or requirements, we may be subject to fines and higher transaction fees and lose our

ability to accept credit and debit card payments from our customers, process electronic funds transfers, or facilitate other types of online payments, and our business and operating results could be adversely affected.

Workplace accidents or environmental damage could result in substantial remedial obligations and damage to our reputation.

Accidents or other incidents that occur at our manufacturing and other facilities or involve our personnel or operations could result in claims

for damages against us. In addition, in the event we are found to be financially responsible, as a result of environmental or other laws or by court order, for environmental damages alleged to have been caused by us or occurring on our premises, we

could be required to pay substantial monetary damages or undertake expensive remedial obligations. The amount of any costs, including fines or damages payments that we might incur under such circumstances, could substantially exceed any insurance we

have to cover such losses. Any of these events, alone or in combination, could have a material adverse effect on our business, financial condition and results of operations and could adversely affect our reputation.

Interruptions, delays in service or inability to increase capacity at third-party data center facilities could adversely affect our business and

reputation.

Our business, brands, reputation and ability to attract and retain customers depend upon the satisfactory performance,

reliability and availability of our project management platform, depend upon the availability of the internet and our third-party service providers. We rely on third party data center facilities operated by Amazon Web Services (“AWS”), Ace