Ford Sees Turnaround Gains -- WSJ

July 25 2019 - 3:02AM

Dow Jones News

By Mike Colias

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 25, 2019).

Ford Motor Co. posted flat second-quarter operating income and a

disappointing earnings outlook, but stood by a forecast for

improved profitability this year as it begins to reverse steep

losses overseas.

The company's shares fell in after-hours trading as its

quarterly results and full-year earnings forecast fell short of

analysts' expectations.

Ford on Wednesday reported $1.7 billion in operating profit for

the April-to-June period, helped by strong sales and pricing on

pickup trucks and sport-utility vehicles in its home U.S. market.

In another sign of some early progress on Chief Executive Jim

Hackett's turnaround strategy, the company also sharply cut losses

in China and swung to a small profit in Europe.

Ford's earnings per share, adjusted for one-time items, was 28

cents, lower than the 31-cent average forecast from Wall Street

analysts. That result included a 4-cent drag from a loss in value

on Ford's investment in a software company, Pivotal Software.

Net income also sank to $148 million, from $1.1 billion a year

earlier. The drop is largely explained by more than $1 billion in

charges stemming from plant closures and layoffs in Europe and

South America, where Ford recently undertook major

restructurings.

Ford shares slid nearly 7% in after-hours trading Wednesday. The

stock has rallied 35% this year amid improved financial results and

progress on a global restructuring plan aimed at restoring

profitability to money-losing business overseas.

Ford said earnings per share for 2019 would be $1.20 to $1.35,

lower than the $1.40 analysts' average estimate. It expects

operating income this year to be between $7 billion and $7.5

billion, up from $7 billion last year. Ford previously said it

expected an improvement, but hadn't pegged a range.

Second-quarter revenue was flat at $38.9 billion. After a rough

two-year stretch, Mr. Hackett crafted a turnaround plan which is

showing some success. The company said operating income from its

automotive business has grown for two straight quarters, the first

time that has happened in more than three years.

Ford is adding more trucks and sport-utility vehicles to its

lineup while trimming smaller, less-profitable car lines in the

U.S. and other markets. It also is shrinking its presence in Europe

and South America to focus on higher-margin categories, like

commercial vans and pickup trucks.

Ford trimmed losses in China to $155 million, from $483 million

a year earlier. The company has seen its market share dwindle in

the world's largest car market over the last two years, largely the

result of a tired product lineup, current and former executives

have said.

In the second quarter, Ford's China business got a lift from its

Lincoln luxury brand, which grew 7% in a down market and also

benefited from lighter import tariffs compared to a year earlier.

The company also said it is squeezing out more cost savings from

its China business as it tries to return to a profit.

Ford's Europe business swung to a $53 million operating profit,

from a $73 million loss a year earlier, as stronger sales of

vehicles to business buyers helped offset higher regulatory

costs.

"We expect continued strong execution" in China and Europe, Ford

finance chief Tim Stone told reporters Wednesday.

Profits from North America and its strong finance arm, Ford

Credit, continue to carry the auto maker despite slight

setbacks.

Operating profit from North America slipped 3% to $1.7 billion.

Overall U.S. vehicle sales were down in the quarter, but Ford

benefited from continued strong pricing on its F-Series pickup

trucks, the company's biggest moneymaker. The company boosted

average selling prices on the trucks by $1,200, to around

$47,500.

Ford also benefited from a 50% jump in sales of freshly

redesigned Ford Expedition large sport-utility vehicle, which

routinely sells for more than $60,000 and carries big profit

margins.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

July 25, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

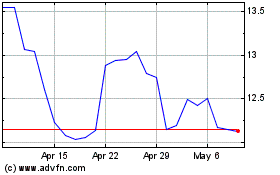

Ford Motor (NYSE:F)

Historical Stock Chart

From Mar 2024 to Apr 2024

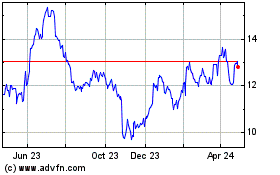

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2023 to Apr 2024