Additional Proxy Soliciting Materials (definitive) (defa14a)

May 14 2021 - 5:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

EVERCORE INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

Dear NAME,

We hope that you are safe and well. We realize it is peak proxy season and you are busy, so let me get straight to the point: we are seeking your voting

support for the three items in our 2021 proxy statement (a copy of which is included): electing our directors, supporting our “Say on Pay” (SOP) proposal and ratifying our auditors.

Last year our SOP proposal received 93.7% shareholder support at our annual meeting, and our executive compensation program has not changed materially since

then, but let me summarize a few highlights from our proxy statement:

|

|

•

|

In 2020, we achieved record Net Revenues of approximately $2.33 billion on an Adjusted basis and

$2.26 billion on a GAAP basis, an increase of approximately 14% and 13%, respectively, from our 2019 results (a reconciliation of Adjusted to GAAP results is available in our proxy statement). In addition, we continued to deliver strong

EPS and Net Income for our shareholders.

|

|

|

•

|

Our five year TSR of 129% demonstrates long-term positive growth in our share price.

|

|

|

•

|

Our NEOs demonstrated strong leadership in a pandemic-dominated environment where nearly all employees worked

remotely for most of 2020. Our results demonstrated the success of past strategic and growth initiatives to invest in broadening and diversifying our capabilities, as we were effectively able to serve clients in dynamic and volatile market

environments.

|

|

|

•

|

Our collaborative culture was evidenced by our appointment of Ralph Schlosstein and John Weinberg as Co-Chairmen of the Board and Co-CEOs, reflecting a collaborative operating style that has existed for over four years.

|

These financial and operational achievements, among other factors, drove the decision to increase NEO compensation from 2019. In 2020, while we increased our Co-CEO’s compensation by $3.5 million from 2019, their pay was flat relative to 2018, our previous record year (which we outperformed in 2020 on an Adjusted basis). Taken together, these decisions

demonstrate our commitment to payment for performance and balancing results for our shareholders with employee compensation.

Finally, this year we

continued to build for the future, publishing our inaugural Sustainability Report, advancing our DE&I initiatives, and enabling our own and our clients’ ESG-focused investments and actions. Attached

please find our Sustainability Report for your reference, which you can also find on our website.

Please let us know if a call would be helpful and we

welcome any additional feedback that you may have.

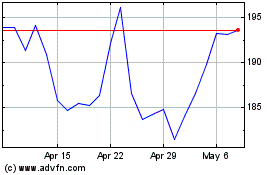

Evercore (NYSE:EVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

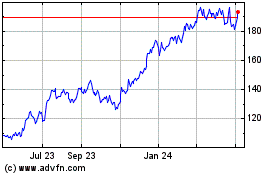

Evercore (NYSE:EVR)

Historical Stock Chart

From Apr 2023 to Apr 2024