Global Glut Keeps a Lid on Natural-Gas Prices

May 28 2020 - 11:23AM

Dow Jones News

By Ryan Dezember

Even the biggest producer in the country is backing away from

the dismal market for natural gas.

EQT Corp. has curtailed nearly 25% of the output from its wells

in Appalachia, holding it in the ground for when prices for the

power-generation fuel aren't so depressed. Given the way canceled

orders are piling up for export cargoes of liquefied natural gas,

it may be a while.

Natural-gas futures for July delivery fell 2.8% to $1.83 per

million British thermal units on Thursday, down 29% from a year ago

and well below what is needed to cover production costs for many

companies.

Thursday's decline accelerated after the U.S. Energy Information

Administration reported inventory levels rose last week by slightly

more than analysts had expected to bring stockpiles 42% above the

year-ago level.

A month ago, natural-gas prices appeared ready to pop. Major

producers, including EQT, had cut back on drilling in response to

falling prices. Meanwhile, a historic crash in crude prices

prompted drillers to shut in oil wells, which produce a lot of

natural gas as a byproduct. And it was coal, not natural gas, that

bore the brunt of the reduced demand for electricity during the

coronavirus pandemic. On May 5, natural-gas futures nosed above $2

for the first time since January.

The rallies have been fleeting, though. Mild May weather has

limited domestic demand, brimming storage facilities abroad have

reduced exports and the flow from oil wells hasn't declined by as

much as expected. Plus, oil prices have been rising, suggesting

that the crude curtailments won't last long.

Prices made another run higher before Memorial Day and the

arrival of summer weather that had many Americans switching on air

conditioners.

Analysts also credit EQT's big production cut, which the

Pittsburgh company's pipeline arm disclosed in a securities filing

early last week. The parent company said Tuesday that the

curtailments of 1.4 billion cubic feet a day began on May 16 and

could last through June, depending on prices.

Prices aren't expected to go much higher this summer. Goldman

Sachs Group Inc. analysts forecast an average summer price of

$2.04, though last week they warned clients that prices could fall

below $1.50 if domestic demand fails to pick up, production remains

apace and overseas buyers keep canceling orders for liquefied

natural gas, or LNG.

Such shipments have helped balance the U.S. market, though the

pandemic has sapped global demand for shale gas and bloated

stockpiles in Europe and Asia, which were already robust after a

mild winter left unburned a lot of gas meant for heating.

The main European price, set in the Netherlands, plunged to

$1.13 last week, down roughly 75% from 2019's average of $4.87,

according to JPMorgan analysts. The Asian benchmark, which traded

above $10 two years ago, dropped to $2.11 last week.

The collapse has prompted a rash of cancellations for LNG

deliveries. The daily volume of natural gas purchased by U.S.

export facilities has declined by about one-third to 6.5 billion

cubic feet this week, from more than 9.6 billion cubic feet at the

end of March, according to S&P Global Platts.

LNG demand is poised to fall further, said SunTrust Robinson

Humphrey analyst Welles Fitzpatrick. He has counted 45 canceled

shipments in July, from buyers ranging from commodity-trading firms

to utilities in Japan. The lost orders would reduce the amount of

gas absorbed by export terminals to less than 4 billion cubic feet

a day, Mr. Fitzpatrick estimates.

Forecasts like that have made it difficult for traders to gauge

the direction of prices at a time of year when the arrival of hot

weather should lift demand for electricity to power air

conditioners.

In February, hedge funds and other speculators had built up the

biggest short position, or bets that natural-gas prices would fall,

on record, according to Commodity Futures Trading Commission data.

That trade was unwound in late April but since then traders have

waffled between going long, or betting that prices will rise, and

short, the opposite.

Energy-trading firm Ritterbusch & Associates told clients in

a note that it is betting on prices to run up to around $2.35 in

the next couple of weeks as summer heat juices demand, but that the

rise could again be short-lived.

"This market should still be viewed as a trading affair rather

than one in which a long position can be established as a

longer-term investment, " Ritterbusch said.

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

May 28, 2020 11:08 ET (15:08 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

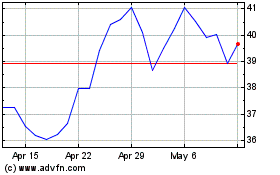

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

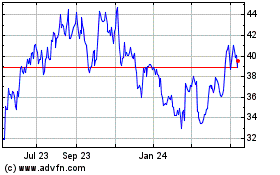

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024