Current Report Filing (8-k)

May 20 2020 - 4:16PM

Edgar (US Regulatory)

0000033213

false

0000033213

2020-05-18

2020-05-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): May 20, 2020 (May 19, 2020)

EQT CORPORATION

(Exact name of registrant as specified in

its charter)

|

Pennsylvania

|

|

001-3551

|

|

25-0464690

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

625 Liberty Avenue, Suite 1700,

Pittsburgh, Pennsylvania 15222

(Address of principal executive offices,

including zip code)

(412) 553-5700

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

|

EQT

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

EQT Corporation Executive Severance Plan

On May 19, 2020, the Management Development

and Compensation Committee (the “Compensation Committee”) of the Board of Directors (the “Board”) of EQT

Corporation (the “Company”) approved the EQT Corporation Executive Severance Plan (the “Severance Plan”),

which will provide benefits to eligible participating executives upon a qualifying termination of employment. The Compensation

Committee views the adoption of the Severance Plan as a transition away from the Company’s legacy approach of entering into

individual confidentiality, non-solicitation and non-competition agreements with executive officers and certain other key employees

– which individual agreements previously served as the vehicle for severance arrangements between the Company and individual

executives and key employees – to a consolidated executive severance plan, which the Compensation Committee views as a best

practice. The severance benefits provided under the Severance Plan are generally consistent with or, with respect to certain provisions,

less favorable than, the comparable severance benefits currently provided to executives under the Company’s form of legacy

confidentiality, non-solicitation and non-competition agreement.

The Compensation Committee believes that

the Severance Plan will continue to support the Company’s ability to attract and retain executives whose leadership is critical

to the Company’s business by providing a participating executive with income protection in the event that the executive experiences

an involuntary termination of employment without cause during the term of the Severance Plan. Upon execution of a participation

agreement by an eligible participating executive, the Severance Plan will replace any currently existing severance arrangement

between the Company and the participating executive.

Under the Severance Plan, participants are

eligible to receive certain severance benefits upon a termination of employment (i) by the Company other than for “cause”,

due to a participant’s “disability,” or due to a participant’s death or (ii) by the participant with “good

reason” (in each case, as defined in the Severance Plan), subject to the participant’s execution and nonrevocation

of a release of claims in favor of the Company and continued compliance with certain restrictive covenants. The severance benefits

include:

|

|

·

|

A lump sum cash payment equal to the amount of any unpaid annual cash bonus for the calendar year before the year in which

the participant’s termination of employment occurs, payable based on actual performance when annual bonuses are paid in the

ordinary course (the “Unpaid Prior Year Bonus”);

|

|

|

·

|

A cash severance payment generally equal to two times (for the Company’s Chief Executive Officer) or one times (for all

other participants) the sum of the participant’s (i) annual base salary and (ii) the average of the annual bonuses the participant

earned for the three fiscal years preceding the year of the participant’s termination of employment, which will be paid in

equal installments over a period ranging from twenty-four months (for the Company’s Chief Executive Officer) to twelve months

(for all other participants) following the participant’s termination of employment;

|

|

|

·

|

A lump sum cash payment equal to the participant’s annual cash bonus for the year in which the termination of employment

occurs, prorated to reflect the number of days that the participant was employed during the calendar year and payable based on

actual performance when annual bonuses are paid in the ordinary course;

|

|

|

·

|

A lump sum cash payment equal to the product of (i) eighteen and (ii) 100% of the then-current COBRA monthly rate for family

coverage, which will be paid within sixty days following the participant’s termination of employment; and

|

|

|

·

|

Accelerated vesting of a prorated portion of all outstanding time-vesting long-term incentive awards and continued vesting

of a prorated portion of all outstanding performance-vesting awards through the conclusion of the applicable performance period,

which will be settled based on actual performance at the end of the applicable performance period.

|

If the termination of employment occurs

during the two-year period following a Change in Control (as defined in the EQT Corporation 2020 Long-Term Incentive Plan), the

severance benefits include:

|

|

·

|

Payment of the Unpaid Prior Year Bonus;

|

|

|

·

|

A cash severance payment generally equal to three times (for the Company’s Chief Executive Officer), two times (for participants

who are executive officers of the Company as defined under Section 16 of the Securities Exchange Act of 1934, as amended) or one

times (for all other participants) the sum of the participant’s (i) annual base salary and (ii) the average of the annual

bonuses the participant earned for the three fiscal years preceding the year of the participant’s termination of employment,

which will be paid within sixty days following the participant’s termination of employment;

|

|

|

·

|

A lump sum cash payment equal to the participant’s annual cash bonus for the year in which the termination of employment

occurs, prorated to reflect the number of days that the participant was employed during the calendar year and payable based on

actual performance when annual bonuses are paid in the ordinary course;

|

|

|

·

|

A lump sum cash payment equal to the product of (i) twenty-four and (ii) 100% of the then-current COBRA monthly rate for family

coverage, which will be paid within sixty days following the participant’s termination of employment; and

|

|

|

·

|

Accelerated vesting of all outstanding time-vesting long-term incentive awards and continued vesting of all outstanding performance-vesting

awards remaining outstanding through the conclusion of the applicable performance period, which will be settled based on actual

performance at the end of the applicable performance period.

|

In addition, the Severance Plan includes a perpetual confidentiality

covenant and noncompetition and nonsolicatiton covenants that apply during the participant’s employment and for twelve to

thirty-six months thereafter.

The foregoing description of the Severance

Plan does not purport to be complete and is qualified in its entirety by reference to the Severance Plan, which is filed as Exhibit

10.1 to this Form 8-K.

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

EQT CORPORATION

|

|

|

|

|

|

Date: May 20, 2020

|

By:

|

/s/ William E. Jordan

|

|

|

Name:

|

William E. Jordan

|

|

|

Title:

|

Executive Vice President and General Counsel

|

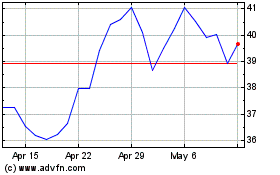

EQT (NYSE:EQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

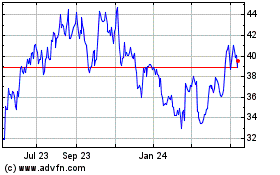

EQT (NYSE:EQT)

Historical Stock Chart

From Apr 2023 to Apr 2024