Equus Announces Second Quarter Net Asset Value

August 13 2020 - 7:26PM

Equus Total Return, Inc. (NYSE: EQS) (the “Fund”

or “Equus”) reports net assets as of June 30, 2020, of $41.5

million, an increase of approximately $2.6 million since March 31,

2020. Net asset value per share increased to $3.07 as of June

30, 2020 from $2.88 as of March 31, 2020. Comparative data is

summarized below (in thousands, except per share amounts):

|

As of the Quarter Ended |

6/30/2020 |

3/31/2020 |

12/31/2019 |

9/30/2019 |

6/30/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets |

$ |

41,469 |

$ |

38,895 |

$ |

45,989 |

$ |

49,024 |

$ |

47,933 |

|

Shares outstanding |

|

13,518 |

|

13,518 |

|

13,518 |

|

13,518 |

|

13,518 |

|

Net assets per share |

$ |

3.07 |

$ |

2.88 |

$ |

3.40 |

$ |

3.63 |

$ |

3.55 |

|

|

|

|

|

|

|

|

|

|

|

|

The following were the portfolio companies that

experienced increases in their fair values during the second

quarter of 2020:

- Increase in the Value of

PalletOne. Equus holds an 18.7% fully-diluted share

interest in PalletOne, Inc. (“PalletOne”) one of the nation’s

largest wooden pallet manufacturers and a major supplier of treated

lumber in the southeastern United States. The fair value of

the Fund’s share interest in PalletOne increased from $26.5 million

to $27.5 million during the second quarter of 2020, principally as

a result of strong operational results during the quarter and the

trailing twelve months ended June 30, 2020. The Fund received

advice and assistance from a third-party valuation firm to support

its determination of the fair value of this investment.

Notwithstanding the strong operational results of PalletOne, it

remains uncertain as to the extent that the general economic

contraction caused by the coronavirus may have on the business of

PalletOne in subsequent quarters in 2020 and into 2021 (see A Note

About the Coronavirus and Other Events below).

- Increase in the Value of

Equus Energy. The price of crude oil, which began

the second quarter of 2020 at $20.48 per barrel, ended the quarter

at $40.65, largely as a result of the partial resumption of

economic activity in states and countries that had imposed

significant restrictions on their populations in connection with

the onset of COVID-19. Principally due to such price

increases, the value of this investment increased from $4.5 million

at March 31, 2020 to $5.5 million at June 30, 2020. The Fund

received advice and assistance from a third-party valuation firm to

support its determination of the fair value of this investment (see

A Note About the Coronavirus and Other Events below).

- Increase in the Value of

MVC Capital Shares. The trading price of MVC

Capital, Inc.’s (“MVC”) common stock increased from $4.37 per share

on March 31, 2020 to $6.53 per share as of June 30, 2020. The

Fund received $67,293 in cash and 4,449 MVC shares as stock

dividends during the quarter, resulting in a total of 578,596 MVC

shares held at June 30, 2020. The fair value of this holding

increased from $2.5 million at March 31, 2020 to $3.8 million as of

June 30, 2020.

A Note About The Coronavirus and Other

Events

The Impact of the Coronavirus Generally.

In 2019, SARS-CoV-2, a highly contagious pathogen which causes

COVID-19, coronavirus disease, or simply, the ‘coronavirus’, arose

in Wuhan Province, China. The coronavirus has had a substantial

detrimental impact on markets and economic forecasts for

governments and businesses worldwide. During the first and

second quarters of 2020, national, state, and local governments

across the United States implemented significant travel, movement,

and assembly restrictions, as well as restrictions on the movement

of goods, all of which have had, and are expected to continue to

have, a material adverse impact upon consumer and business demand.

Commencing in the second quarter of 2020, certain states

began to ease such restrictions, but such efforts may not be

sufficient to stimulate the resumption of economic activity at

levels that existed prior to the onset of the coronavirus.

Moreover, the easing of such restrictions has resulted in an

increased number of coronavirus infections, which in turn has

caused states to delay or even reverse allowances for movement and

assembly, each of which are expected to protract the adverse

economic effects of the coronavirus. If the coronavirus

continues to spread, or if the economic disruption caused thus far

by the coronavirus continues, our operations and financial

condition could be materially adversely affected.

Impact of the Coronavirus on Our Operations. The

highly contagious nature of the coronavirus has caused numerous

private and public organizations to substantially alter the way in

which they operate. Many such organizations have, to the extent

possible, required employees to work remotely to reduce

opportunities for contagion. We have also taken steps to minimize

the exposure of our employees and service providers by requiring

all such persons to work from a remote location. We utilize a

cloud-based storage and retrieval system for our records and can

communicate electronically or by telephone with third parties such

as our financial institutions, legal and accounting advisors, and

our portfolio companies. However, government directives on social

distancing and shelter-in-place mandates have rendered us unable to

travel to attend in-person board meetings, negotiations, and other

functions which are endemic to the interpersonal nature of private

equity investing. Should these disruptions and restrictions on

travel continue as a result of the coronavirus, we cannot,

therefore, assure you that our operations will not be materially

adversely affected thereby.

Impact of the Coronavirus on Our Portfolio

Companies. As noted above, certain of our portfolio companies

have been affected by various force majeure events that include the

global outbreak of the coronavirus. These events have had,

and may continue to have, a material adverse impact on our

portfolio companies’ supply chains, limit access to key commodities

or technologies, otherwise impact their employees, customers,

manufacturers or suppliers or otherwise cause material disruptions

to their industry or the industries they serve. In the case of the

coronavirus, such a force majeure event has had, and may continue

to have, a broader negative impact on the world economy and

international business activity generally. A protracted

negative impact to one or more of our portfolio companies as a

result of the coronavirus could have a material adverse effects on

our business, financial condition and results of operations.

Impact of Geopolitical Events and the

Coronavirus on the Oil and Gas Sector. The first quarter of 2020

witnessed substantial price decreases for crude oil, falling from

$61.06 at December 31, 2019 to $20.48 at March 31, 2020 before

partially recovering to $40.65 at June 30, 2020. The collapse

in prices was the result of a price war between the Russian

Federation and Saudi Arabia and a massive drop in forecasted demand

as a consequence of the coronavirus. Despite the price of

crude oil almost doubling during the second quarter of 2020, should

such prices not continue to recover to sustainable levels, a number

of smaller oil and gas firms that have incurred leverage could

experience severe economic challenges, including insolvency and

bankruptcy. Other firms, such as Equus Energy, could see

future capital expenditures to generate additional reserves from

existing mineral interests postponed indefinitely, which could have

a material adverse effect upon the operations and financial

condition of Equus Energy.

About Equus

The Fund is a business development company that

trades as a closed-end fund on the New York Stock Exchange under

the symbol "EQS". Additional information on the Fund may be

obtained from the Fund’s website at www.equuscap.com.

This press release may contain certain

forward-looking statements regarding future circumstances. These

forward-looking statements are based upon the Fund’s current

expectations and assumptions and are subject to various risks and

uncertainties that could cause actual results to differ materially

from those contemplated in such forward-looking statements

including, in particular, the performance of the Fund, including

our ability to achieve our expected financial and business

objectives, and the other risks and uncertainties described in the

Fund’s filings with the SEC. Actual results, events, and

performance may differ. Readers are cautioned not to place undue

reliance on these forward-looking statements, which speak only as

to the date hereof. Except as required by law, the Fund undertakes

no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Fund or any other

person that the events or circumstances described in such

statements are material.

Contact:

Patricia Baronowski Pristine Advisers, LLC (631) 756-2486

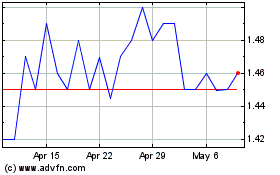

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

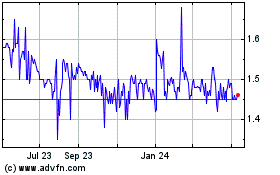

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Apr 2023 to Apr 2024