Equus Shareholders Grant Authorization to Withdraw BDC Election and Increase Borrowing Capacity

November 19 2019 - 7:03PM

Equus Total Return, Inc. (NYSE: EQS) (“Equus” or the “Company”)

today announced that its shareholders have authorized the Company’s

Board of Directors (hereinafter, the “Board”) to: (i) cause the

Company’s withdrawal of its election to be classified as a business

development company (“BDC”) under the Investment Company Act of

1940 (the “1940 Act”) as part of a potential strategic

transformation of Equus into an operating company or a permanent

capital vehicle; and, to the extent Equus remains a BDC, (ii)

increase the Company’s borrowing capacity under the 1940 Act for

additional portfolio investments.

The authorization to withdraw the Company’s BDC election, which

expires on March 31, 2020, is a consequence of the Company’s Plan

of Reorganization announced on May 15, 2014 (also referred to

herein as the “Plan”). In announcing the Plan, Equus stated its

intention to implement the Plan which entailed, among other things:

(i) the restructuring of the Company by way of an acquisition of,

or merger with, an operating company, and (ii) a withdrawal of the

Company’s election to be classified as a BDC. Although Equus has

been authorized to withdraw and terminate the Company’s BDC

election under the 1940 Act, it will not submit any such withdrawal

unless and until Equus has entered into a definitive agreement to

acquire an operating company or qualify as a permanent capital

vehicle.

The authorization to increase the Company’s borrowing capacity

is a consequence of the Small Business Credit Availability Act

(“SBCAA”) which was signed into law in March 2018 and amends

certain sections of the 1940 Act applicable to BDCs. Pursuant to

the SBCAA, a BDC may be authorized by its board or its shareholders

to decrease its asset coverage ratio from 200% to 150%, the effect

of which is to double the potential borrowing capacity of BDCs. The

SBCAA requires a one-year waiting period to decrease the ratio if

authorized solely by a BDC’s board of directors, but such decrease

may be implemented immediately if authorized by its shareholders,

as in the case of Equus.

Equus management regularly reviews and evaluates the Company’s

performance, prospects and long-term strategic plans in light of

the Company’s business and the industries in which it invests, and

then makes recommendations to the Board of Directors. Over the past

several years, the Company has examined a number of potential

transactions in a variety of industries, including energy, natural

resources, containers and packaging, real estate, media,

technology, and telecommunications. These reviews have included

consideration of potential strategic transactions to maximize value

to shareholders as an operating company or a permanent capital

vehicle not subject to the 1940 Act, as well as potential

investments that could be made while continuing as a BDC, but which

would require more borrowing capacity than has previously been

possible for Equus. The pursuit of these growth strategies has

culminated in the authorization granted by the Company’s

stockholders to the Board to: (i) withdraw the Company’s BDC

authorization as part of a potential strategic transformation of

Equus into an operating company or a permanent capital vehicle and,

to the extent Equus remains a BDC, (ii) increase the Company’s

borrowing capacity for additional portfolio investments.

Potential Advantages

An operating company structure, in lieu of a closed-end fund

structure, could be advantageous to Equus and its shareholders in

various ways, including: (i) a wider range of growth opportunities

through merger with and acquisition of other operating companies,

(ii) a valuation of Equus based on typical operating criteria such

as earnings, revenue, and gross profit, instead of net asset value,

(iii) lower proportional compliance costs due to Equus not being

regulated under the 1940 Act, and (iv) greater flexibility to issue

common and preferred equity, as well as other types of securities

as consideration for acquisitions and growth of the Company.

To the extent that Equus remains a BDC, an increase in the

Company’s borrowing capacity could be advantageous to Equus and its

shareholders to: (i) enable the Company to participate in a wider

variety of potential investments, some of which could involve debt

securities issued by Equus as part of the consideration for the

investment, and (ii) potentially improve returns to stockholders by

increasing the assets under management and generating returns on

these assets in excess of the Company’s borrowing costs.

Moreover, the Company believes that it could gain cost

efficiencies in managing a greater number of assets such that Fund

expenses as a percentage of assets under management would decrease.

In recent years, Fund management has made significant efforts to

decrease overall costs and costs relative to its net asset value

including, for example, reductions in staff and in the number of

members of the Company’s Board.

Risks and Uncertainties

The transformation of Equus into an operating company or the

continuation of Equus as BDC with increased borrowing capacity are

each subject to various conditions, risks, and uncertainties. Such

risks should be considered in addition to the items identified as

“Risk Factors” in the Company’s most recent Annual Report on Form

10-K filed with the Securities and Exchange Commission (the “SEC”)

on March 29, 2019.

Forward-Looking Statements

This press release contains certain forward-looking statements

regarding possible future circumstances. These forward-looking

statements are based upon the Company’s current expectations and

assumptions and are subject to various risks and uncertainties that

could cause actual results to differ materially from those

contemplated in such forward-looking statements including, in

particular, the performance of the Company, including our ability

to achieve our expected financial and business objectives, our

ability to execute our reorganization (including a possible

Consolidation) and complete the transactions contemplated thereby,

our ability to secure additional borrowings as authorized by our

shareholders, the other risks and uncertainties described herein,

as well as those contained in the Company’s filings with the SEC.

Actual results, events, and performance may differ. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as to the date hereof. The Company

undertakes no obligation to release publicly any revisions to these

forward-looking statements that may be made to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events. The inclusion of any statement in this

release does not constitute an admission by the Company or any

other person that the events or circumstances described in such

statements are material.

Contacts:

Patricia Baronowski Pristine Advisers, LLC (631) 756-2486

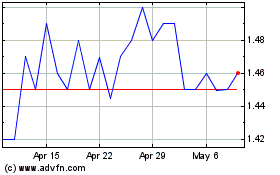

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

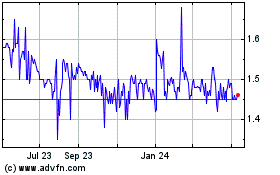

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Apr 2023 to Apr 2024