UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14C

INFORMATION REQUIRED IN INFORMATION

STATEMENT

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section

14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

|

□

|

Preliminary information statement

|

|

□

|

Confidential, for use of the Commission only (as permitted by Rule 14c-5(d)(2))

|

|

x

|

Definitive information statement

|

EQUUS TOTAL RETURN, INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

o

|

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

(5)

|

Total fee paid:

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

EQUUS TOTAL RETURN, INC.

700 Louisiana Street, 48th Floor

Houston, Texas 77002

DEFINITIVE INFORMATION STATEMENT

NO VOTE OR OTHER ACTION OF THE COMPANY’S

STOCKHOLDERS

IS REQUIRED IN CONNECTION WITH THIS INFORMATION

STATEMENT

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

INTRODUCTION

This notice and information statement (“Information

Statement”) is being furnished to the stockholders of Equus Total Return, Inc., a Delaware corporation (“Equus”

or the “Company”), in connection with actions taken by holders of a majority of our voting shares to authorize the

Equus Board of Directors (sometimes referred to hereinafter as the “Board”) in its discretion, to undertake the following

(collectively, the “Authorizations”):

|

|

·

|

withdraw, on or before March 31, 2020, the Company’s election to be regulated as a business

development company (“BDC”) under the Investment Company Act of 1940 (hereafter, the “1940 Act”); and

|

|

|

·

|

reduce the Company’s asset coverage ratio from 200% of net asset value to 150% of net asset

value as permitted under the 1940 Act.

|

These Authorizations are intended to enable

the Board greater flexibility to pursue the following objectives: (i) pursue a transformative transaction that would result in

a termination of the Company’s status as a BDC and a restructuring of Equus as an operating company, and (ii) to the extent

that the Company remains a BDC, secure debt capital of up to double the Company’s aggregate net asset value to enable the

Company to make additional investments as a BDC.

The authorization to withdraw the Company’s

BDC election is a consequence of the Company’s Plan of Reorganization announced on May 15, 2014 (sometimes also referred

to herein as the “Plan”). In our announcement of the Plan of Reorganization, we stated that Equus intended to implement

the Plan, which entailed: (i) the restructuring of the Company by way of an acquisition of, or merger with, an operating company

(referred to in the Plan as a “Consolidation”), and (ii) a withdrawal of the Company’s election to be classified

as a BDC. Although we have been authorized to withdraw and terminate the Company’s BDC election under the 1940 Act, we will

not submit any such withdrawal unless and until Equus has entered into a definitive agreement to acquire or merge with an operating

company.

The authorization to reduce the Company’s

asset coverage ratio from 200% to 150% is a consequence of the Small Business Credit Availability Act (USC §80a-61(a)) which

was signed into law in March 2018 (hereinafter, the “SBCAA”). Prior to the SBCAA, Equus would only have been able to

borrow an amount equal to its net asset value (i.e. a 200% asset coverage ratio). Under the SBCAA, Equus will, with the authorization

described above, be able to borrow an amount equal to double its net asset value (i.e. a 150% asset coverage ratio).

Pursuant to Section 14(c) of the Securities

Exchange Act of 1934, as amended (“Exchange Act”), and Regulation 14C and Schedule C thereunder, this Information Statement

will be mailed out on or about November 22, 2019 (the “Mailing Date”) to the Company’s shareholders of record,

as of November 14, 2019 (the “Record Date”). As of the Record Date, we had outstanding 13,518,146 shares of common

stock. We have no other shares of voting stock outstanding.

This Information Statement is being circulated

to advise the shareholders of the Authorizations given to the Board to (i) terminate the Company’s BDC election on or before

March 31, 2020, and (ii) reduce the Company’s asset coverage ratio from 200% to 150% of net asset value. Nevertheless, pursuant

to Rule 14c-2 of the Exchange Act, the Authorizations will not be effective until 20 days after the Mailing Date. We anticipate

that the Authorizations will become effective on or about December 12, 2019 (the “Effective Date”).

RECORD DATE, VOTE REQUIRED AND RELATED INFORMATION

Section 54(c) of the 1940 Act permits a BDC

to voluntarily withdraw its election to be classified as such by filing a notice of withdrawal of election with the U.S. Securities

and Exchange Commission (“SEC”). Our Certificate of Incorporation provides that an affirmative vote of holders of a

majority of the Company’s voting shares may authorize the Board to effect the withdrawal of our BDC election.

As amended by the SBCAA, Section 61(a) of the

1940 Act also permits Equus, if authorized by our Board and/or our shareholders, to increase the Company’s borrowing capacity

from one to two times our net asset value by reducing our asset coverage ratio from 200% to 150% (hereinafter, the “Reduced

Asset Coverage Ratio”). The SBCAA requires a one-year waiting period to implement the Reduced Asset Coverage Ratio if authorized

solely by our Board, but such implementation may be made one day after the effective date of authorization by our shareholders.

The affirmative vote of holders of a majority

of the Company’s common stock could either be taken at a special meeting of the stockholders or through written consent from

the holders of a majority of our issued and outstanding voting securities.

The authority of our stockholders to take these

actions by written consent, in lieu of a meeting, is provided by Section 228 of the General Corporation Law of Delaware and Section

2.8 of the Equus Bylaws, which provides that any actions required to be taken at any annual or special meeting of stockholders

of the Company, or any actions which may be taken at any annual or special meeting of such stockholders, may be taken without a

meeting, without prior notice and without a vote, if a consent in writing, setting forth the actions so taken, is signed by the

holders of outstanding stock having not less than the minimum number of votes that would be necessary to authorize or take such

actions at a meeting at which all shares entitled to vote thereon were present and voted. If the Authorizations were not adopted

by majority written consent pursuant to Section 228, such actions would have been required to be considered by our stockholders

at a special stockholders’ meeting convened for the specific purpose of approving the Authorizations.

The Company has authorized capital stock consisting

of 50,000,000 shares of common stock. As of the date of this Information Statement, the Company had 13,518,146 shares of its common

stock issued and outstanding. On November 14, 2019, the Secretary of the Company received the written consent of shareholders collectively

holding 7,410,090 shares, or 54.82% of our issued and outstanding common stock, approving the Authorizations. No further vote of

our stockholders is required to effect the Authorizations, which are expected to become effective on or about December 12, 2019.

The transfer agent for our common stock is American

Stock Transfer & Trust Co., LLC, 6201 15th Avenue, 3rd Floor, Brooklyn, New York 11219.

NO MEETING OF STOCKHOLDERS REQUIRED

We are not soliciting any votes in connection

with the Authorizations. The shareholders that have consented to the Authorizations collectively hold a majority of the Company’s

outstanding common stock and, accordingly, such shareholders have sufficient voting rights to approve the Authorizations.

Under Delaware law, the Effective Date of the

Authorizations is twenty (20) days following the giving of notice of the Authorizations to all other stockholders. This Information

Statement constitutes the required notice under Delaware law.

REASONS FOR OBTAINING AUTHORIZATION TO WITHDRAW OUR

BDC ELECTION

Plan of Reorganization

Announcement. On May 15, 2014, we announced

that, via a unanimous vote of our Board, the Company intended to effect a Plan of Reorganization within the meaning of Section

2(a)(33) of the 1940 Act (hereinafter referred to as the “Plan”). We further stated that, in furtherance of the Plan,

we intended to pursue an acquisition or merger with an operating company (referred to in the Plan as a “Consolidation”)

to (i) be restructured into a publicly-traded operating company, and (ii) terminate the Company’s election to be classified

as a BDC. Since the adoption of the Plan, we have been and are presently evaluating other suitable target operating companies which

we may acquire or with which we, or a special purpose subsidiary, may merge with or into to complete our Plan of Reorganization.

Intention to Maintain Exchange Act Reporting

Status and NYSE Listing. Currently, Equus and other BDCs are subject to various provisions of both the 1940 Act as well as

the Exchange Act. If, as a result of a Consolidation, Equus is transformed into an operating company instead of a closed-end fund,

the Company will no longer be subject to the 1940 Act but will still be subject to the reporting requirements of the Exchange Act.

This means, for example, that Equus will continue, following a Consolidation, to file annual, quarterly, and period reports with

the SEC on Forms 10-K, 10-Q, and 8-K, respectively. Further, we intend to ensure that Equus satisfies the continued listing criteria

for operating companies pursuant to applicable rules of the New York Stock Exchange. To this end, we intend to seek potential Consolidation

candidates with sufficient revenue, earnings, and market capitalization that, when combined with Equus, would enable the Company

to meet these listing standards. However, we cannot guarantee that every candidate with which we may conclude Consolidation will

enable us to meet these listing standards, and we may have to list our securities on a different exchange if we are unable to satisfy

such listing requirements following a Consolidation.

Summary of Efforts to Achieve a Consolidation

Our Board, together with Equus management, regularly

reviews and evaluates the Company’s performance, prospects and long-term strategic plans in light of the Company’s

business and the industries in which it invests. These reviews have included periodic consideration of potential strategic transactions

to maximize value to shareholders. Commencing in September 2012, management of the Company began to explore various strategic options

to maximize shareholder value that could, if effected, result in the acquisition of the Company by another corporation or a change

the Company’s structure from a BDC into an operating company. These efforts culminated in the Plan of Reorganization adopted

in May 2014. Since the adoption of the Plan, Company management has examined a number of potential transactions and strategic alternatives

to effect a Consolidation under the Plan. During 2017, the Company entered into an agreement to acquire an operating company, but

such agreement was terminated by the operating company prior to completion because it had received a “Superior Proposal”

(as such term was defined in the relevant acquisition agreement) from a third party. Since the termination of that agreement, the

Company has again examined a number of potential transactions in a variety of industries, including energy, natural resources,

containers and packaging, real estate, technology, and telecommunications. While we are endeavoring to achieve a Consolidation

and are presently evaluating various opportunities that could enable us to do so, we cannot assure you that we will be able to

do so before March 31, 2020, the expiration of the present BDC withdrawal authorization given by our stockholders, or at all. Moreover,

we cannot assure you that the terms of any such transaction that would embody a Consolidation would be acceptable to us or our

stockholders.

Shareholder Approvals Required to Implement

the Plan

Authorization to Withdraw. Even though

the Equus Board has approved the Plan, we require authorization from our shareholders to withdraw the Company’s BDC election

before we are able to enter into an agreement that would result in a Consolidation. We are sending you this Information Statement

because we have already received the necessary consents from a majority of the holders of the Company’s outstanding shares

who have provided the authorization for the withdrawal on or before March 31, 2020. The withdrawal authorization does not, however,

guarantee that the withdrawal of our BDC election will actually occur. We intend to file Form N-54C – "Notification

of Withdrawal of Election to be Subject to Sections 55 Through 65 of the Investment Company Act of 1940" with the SEC (hereafter,

a “Notice of Withdrawal”) only if we are reasonably satisfied that the Consolidation will be completed within a short

time after the filing.

Approval of Consolidation. Once we have

entered into an agreement that would result in a Consolidation, we cannot close the transactions contemplated by such an agreement

unless and until a majority of the holders of our outstanding shares approve the Consolidation. The Equus Board has not, at this

time, either reviewed or approved any proposed Consolidation and we cannot guarantee that, given such Board approval, the Equus

shareholders will in turn approve the same. Consequently, we cannot guarantee you that we will submit a Notice of Withdrawal or

that Equus will otherwise complete the Consolidation and become an operating company not subject to the 1940 Act.

Advantages of an Operating Company Structure

When considering the relatively small size of

our Company, the regulatory compliance restraints placed upon BDCs, and opportunities that Equus may have to expand via a Consolidation,

organic growth, and retained earnings, we believe that Equus should consider a Consolidation and resulting transformation into

an operating company for the benefit of its stockholders. In particular, we believe an operating company structure, in lieu of

a closed-end fund structure, could be advantageous to the Company in a variety of ways, such as the following:

|

|

•

|

Growth and Development Opportunities. If we are able to fully implement the Plan of Reorganization

and become an operating company, we expect to capitalize on growth opportunities through growth and development of our core operating

business, as well as by acquisition. Further, we would expect that Equus will be valued by the investing public based on traditional

criteria applicable to operating companies, such as revenue, gross profit, and net earnings instead of net asset value (“NAV”)

and the Company’s portfolio investments.

|

|

|

•

|

Lower Proportional Compliance Costs. Given the relatively small size of our Company at

present, should Equus effect a Consolidation and transform itself into a much larger operating company, we anticipate lowering

our overall compliance-related costs as a percentage of our assets, particularly with the expected elimination of costs associated

with compliance with the 1940 Act.

|

|

|

•

|

Increased Flexibility in the Issuance of Common Equity. Under the 1940 Act, absent stockholder

approval, we may not issue new shares of our common stock at a per share price less than our then NAV. The market prices for shares

of BDCs such as Equus are generally lower, often substantially lower, than their NAVs, making it much more difficult for BDCs to

raise equity capital than for operating companies. In the case of the Company, because our stock price has been below our NAV for

several years, we have generally been unable to access the equity capital markets to take advantage of opportunities during this

period that could, in our view, have generated higher returns than the cost of equity capital. While the restriction against issuing

shares below NAV provides our stockholders an appropriate and meaningful protection against dilution of their indirect investment

interest in our portfolio securities, this can also be a significant impediment to our ability to moderately expand or make small

acquisitions using our shares. If Equus did not have this restriction, we would have increased flexibility to issue our common

stock, but would nevertheless remain subject to NYSE rules which require stockholder approval for an issuance of common stock that

represents more than 20% of our outstanding shares.

|

|

|

•

|

Greater Ability to Issue Other Securities. BDCs are limited or restricted as to the type

of securities other than common stock, such as options, warrants, and preferred stock, which they may issue. In addition, issuances

of senior debt and senior equity securities require that certain "asset coverage" tests and other criteria be satisfied

on a continuing basis. This significantly affects the use of these types of securities. In the case of debt securities, we are

limited in our use of these instruments because asset coverage continuously changes by variations in market prices of the Company's

investment securities. In the case of equity securities, counterparties and financiers in mergers and acquisitions often require

the issuance of preferred equity securities or other equity-linked instruments as an essential component of these transactions.

Operating companies benefit from having maximum flexibility to raise capital and acquire other commercial interests through various

financing structures and a wider array of potential financial instruments that may be issued.

|

|

|

•

|

Related Party Transactions. The 1940 Act significantly restricts, among other things,

(a) transactions involving transfers of property between a BDC and affiliated persons (including affiliated persons of such affiliated

persons) and (b) joint transactions with a third party involving a BDC and affiliated persons (including affiliated persons of

such affiliated persons). An exemption from these restrictions can be obtained from the SEC, but it is typically a time-consuming

and expensive procedure, regardless of the intrinsic fairness of such transaction or the approval thereof by disinterested directors

of the BDC. We believe that situations may arise in which the Company’s best interests are served by such transactions. Further,

we believe that our stockholders are adequately protected by the fiduciary obligations imposed on the Company's directors under

Delaware corporate governance law, which generally requires that the disinterested members of the Board determine fairness to the

Company of an interested-party transaction (provided full disclosure of all material facts regarding the transaction and the interested

party's relationship with the Company is made), and SEC disclosure rules, which require the Company to include specified disclosure

regarding transactions with related parties in its Exchange Act filings.

|

|

|

•

|

Compensation of Directors and Executive Officers. The 1940 Act limits the extent to which

and the circumstances under which directors and executive officers of a BDC may be paid compensation other than in the form of

salary payable in cash. For example, the issuance of restricted stock is generally prohibited, absent a lengthy exemptive application

process with the SEC. However, we believe that, by achieving greater flexibility in the structuring of director and employee compensation

packages, we will be able to attract and retain additional talented and qualified personnel and to more fairly reward and more

effectively motivate our personnel.

|

|

|

•

|

Eligible Investments. BDCs may not acquire any asset other than "qualifying assets"

(i.e. securities issued by privately-held or public microcap U.S. companies in certain industries) unless, at the time of the acquisition

is made, qualifying assets represent at least 70% of the value of the BDC’s total assets. If we are able to fully implement

the Plan of Reorganization and become an operating company, we will not be subject to these restrictions affecting the type or

jurisdiction of assets we may acquire, nor on the composition of our assets, the result of which will be greater flexibility to

acquire enterprises in a broader asset class and invest our financial resources in a wider range of opportunities in more diverse

geographies and industries.

|

Risks to Stockholders of a Withdrawal

of BDC Status

If we withdraw the Company’s election

to be treated as a BDC, Equus will no longer be subject to regulation under the 1940 Act, which is designed to protect the interests

of investors in investment companies. Some of the items listed above that would provide advantages to Equus as an operating company,

would also present certain risks to our shareholders, inasmuch as stockholders would no longer have the following protections of

the 1940 Act:

|

|

•

|

Leverage Limits. We would no longer be subject to the requirement in Section 61 of the

1940 Act that we maintain a ratio of assets to senior securities (such as senior debt or preferred stock) of at least 150% and

we would not be limited by statute or regulation to the amount of leverage we could incur.

|

|

|

•

|

Range of Investments. We would no longer be prohibited from investing in certain types

of companies, such as brokerage firms, insurance, companies, and investment companies.

|

|

|

•

|

Changes in Financial Reporting. While the conversion of Equus into an operating company

will enable us to consolidate the financial results of entities we control, a change in our method of accounting could also reduce

the reported value of our investments in controlled privately-held companies by eliminating our ability to report an increase in

the fair value of these holdings.

|

|

|

•

|

Protection of Directors and Officers. We would no longer be prohibited from protecting

any director or officer against any liability to the Company or our stockholders arising from willful malfeasance, bad faith, gross

negligence, or reckless disregard of the duties involved in the conduct of that person’s office, although there are similar

limitations under Delaware law, our Certificate of Incorporation, and our Bylaws that would still apply.

|

|

|

•

|

Fidelity Bond. We would no longer be required to provide and maintain an investment company

blanket bond issued by a reputable fidelity insurance company to protect us against larceny and embezzlement.

|

|

|

•

|

Director Independence. We would no longer be required to ensure that a majority of our

directors are persons who are not “interested persons,” as that term is defined in the 1940 Act, and certain persons,

such as investment bankers, that would be prevented from serving on our Board if we were a BDC. However, assuming we can comply

with the NYSE’s listing standards for operating companies, we will remain subject to NYSE listing standards that require

the majority of directors of a listed company and all members of its compensation, audit and nominating committees to be “independent”

as defined under NYSE rules.

|

|

|

•

|

Affiliate Transactions. We would no longer be subject to provisions of the 1940 Act regulating

transactions between BDCs and certain affiliates, although we would still be subject to conflict of interest rules and governance

procedures that exist under Delaware law and NYSE rules.

|

|

|

•

|

Share Issuances. We would no longer be subject to provisions of the 1940 Act restricting

our ability to issue shares below NAV or in exchange for services, nor would we be restricted in issuing more than one class of

equity securities or instruments that could be converted into other classes of equity securities.

|

|

|

•

|

Share Repurchases. We would no longer be restricted under the 1940 Act in our ability

to repurchase shares from our stockholders, and would instead be subject only to NYSE rules and Delaware corporate law requirements

for such repurchases.

|

|

|

•

|

Change of Business. We would be able to change the nature of our business and fundamental

investment policies without having to obtain the approval of our stockholders.

|

|

|

•

|

Director and Officer Incentives. We would no longer require exemptive relief from the

SEC before implementing incentive compensation plans for our key executives and non-executive directors.

|

Effect on Financial Reporting

If we effect the withdrawal of our election

to be treated as a BDC and complete a Consolidation, our accounting methods will undergo substantial changes. As a BDC, our financial

statements are presented and accounted for under the specialized method of accounting applicable to investment companies, which

requires us to recognize our investments, including controlled investments, at fair value. As a BDC, we are generally precluded

from consolidating the operational results of our controlled and wholly-owned subsidiaries.

As an operating company, we will be required

to account for investments based on the degree of control or influence we can exert over the entity and, therefore, will be required

to consolidate controlled entities and use either the equity method of accounting, fair value option or historical cost method

of accounting for the financial statement presentation and accounting of other securities held. Following a Consolidation, we expect

to consolidate the operational results in entities we control including, for example, our investment in Equus Energy, and elect

the fair value option for our investments in other securities. Accordingly, the change in our accounting method could have a material

impact on the presentation of our financial statements commencing on the day we withdraw our BDC election.

Effect on Tax Reporting

In addition to our BDC election, we currently

qualify as a regulated investment company (“RIC”) for federal income tax purposes and, therefore, are not required

to pay corporate income taxes on any income or gains that we distribute to our stockholders. If we cease to be treated as a BDC

and instead become an operating company, we will not qualify as a RIC. We will then become subject to corporate level federal income

tax on our income (without regard to any distributions we make to our stockholders) pursuant to Subchapter C of the Internal Revenue

Code. As a consequence, any distributions we make to our stockholders will be net of federal income tax owing by the Company, and

our stockholders will further be subject to federal income tax in connection with the receipt of such distributions.

Process and Conditions of Withdrawing our

BDC Election

Assuming that a suitable merger or acquisition

candidate for Equus can be secured and a definitive agreement can be executed, the withdrawal authorization will permit the Equus

Board to approve a filing with the SEC of a Notice of Withdrawal on or before March 31, 2020. The Notice of Withdrawal, if and

when filed, will immediately terminate the Company's status as a BDC under the 1940 Act. Our intention is to file the Notice of

Withdrawal shortly before we complete a Consolidation, but we will not file the Notice of Withdrawal until we are reasonably certain

that Equus will not be deemed to be an investment company without the protection of its BDC election.

After we file the Notice of Withdrawal with

the SEC, the Company will no longer be subject to the regulatory provisions of the 1940 Act applicable to BDCs, including regulations

related to insurance, custody, composition of our Board of Directors, affiliated transactions and any compensation arrangements.

Anticipated Timeline

As discussed above, we are presently evaluating

various possible merger and acquisition candidates and transaction structures by which we may effect a Consolidation. In order

to enter into a binding agreement that would, if consummated, result in a Consolidation, we have required the present withdrawal

authorization to withdraw our BDC election from our shareholders. Now that this authorization has been provided, we believe that

we can more actively consider and possibly move toward the negotiation, production, and execution of a definitive agreement that

embodies a Consolidation. We expect that any such agreement will be subject to a number of conditions to closing and, therefore,

the timing of such closing is presently uncertain. We will, however, not file the Notice of Withdrawal unless and until we are

reasonably certain that the closing of the Consolidation will occur within a relatively short time after filing.

THE AUTHORIZATION GIVEN TO OUR BOARD TO EFFECT A WITHDRAWAL OF

THE COMPANY’S ELECTION TO BE REGULATED AS A BDC UNDER THE 1940 ACT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS

THE SEC PASSED UPON THE FAIRNESS OR MERITS OF THE AUTHORIZATION NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED

IN THIS INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

PLEASE NOTE THAT THIS IS NEITHER A REQUEST FOR YOUR VOTE NOR

A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU ABOUT THE PRESENT AUTHORIZATION AND THE POSSIBLE

WITHDRAWAL OF THE COMPANY’S ELECTION TO BE REGULATED AS A BDC.

REASONS FOR OBTAINING AUTHORIZATION TO REDUCE OUR ASSET

COVERAGE RATIO

Examination of Strategic Alternatives for

Equus

Notwithstanding the Board’s adoption of

our Plan of Reorganization as described above, the acquisition of a suitable operating company may ultimately not be feasible or

in the best interest of Equus stockholders. In such a case, we may ultimately not consummate a Consolidation and may instead remain

a BDC subject to the 1940 Act. We have, therefore, sought an additional authorization from our stockholders to decrease our permissible

asset coverage ratio under the 1940 Act to enable us to have greater flexibility in selecting potential portfolio investments for

the Company, some of which may require us to undertake indebtedness in order to consummate the investment.

Background and 1940 Act Requirements

New Requirements Applicable to BDCs.

The Company is a closed-end management investment company that has elected to be regulated as a BDC under the 1940 Act. Section

61(a) of the 1940 Act applies asset coverage requirements which limit the ability of BDCs to incur leverage. For purposes of the

1940 Act, “asset coverage” means the ratio of (1) the total assets of a BDC, less all liabilities and indebtedness

not represented by senior securities, to (2) the aggregate amount of senior securities representing indebtedness (plus, in the

case of senior securities represented by preferred stock, the aggregate involuntary liquidation of such BDC’s preferred stock).

As a BDC, we are required to meet a minimum asset coverage ratio reflecting the value of our total assets to our total senior securities,

which include all of our borrowings, including any preferred stock we may issue in the future. Prior to March 2018, Section 61(a)

of the 1940 Act did not permit a BDC to issue senior securities unless, at the time of issuance, the BDC had an asset coverage

ratio of at least 200% taking into account such issuance of senior securities (i.e., a maximum debt-to-equity ratio of 1:1). With

the adoption of the SBCAA in March 2018, the 1940 Act was amended to permit BDCs to lower their asset coverage ratio to 150% (i.e.,

a maximum debt-to-equity ratio of 2:1) if certain conditions are satisfied as set forth in the SBCAA. In other words, while the

Company currently may borrow $1 for investment purposes for every $1 of net asset value (i.e., a maximum debt-to-equity ratio of

1:1), the Company will now be able to borrow $2 for investment purposes for every $1 of net asset value (i.e., a maximum debt-to-equity

ratio of 2:1).

Conditions to the Reduced Asset Coverage

Ratio. The SBCAA provides that in order for a BDC such as Equus, whose common stock is traded on a national securities exchange,

to be subject to the Reduced Asset Coverage Ratio, the BDC must obtain either: (i) approval of the required majority of its non-interested

directors, as defined in the Section 57(o) of the 1940 Act, which would become effective one year after the date of such approval,

or (ii) approval of the Reduced Asset Coverage Ratio by the Equus stockholders, which would become effective one day after such

approval. As holders of a majority of our common stock have already approved the Reduced Asset Coverage Ratio in writing, Pursuant

to Rule 14c-2 of the Exchange Act, the effective date of this approval will be 20 days after the Mailing Date of this Information

Statement, which is anticipated to be December 12, 2019.

Approvals Received. On November 14, 2019,

the Secretary of the Company received consents from holders of a majority of the Company’s outstanding common stock approving

the Reduced Asset Coverage Ratio and authorizing the Board to implement the same. Further, on October 8, 2019, the Board unanimously

determined that, to the extent that the Company remains a BDC, the Reduced Asset Coverage Ratio is in the best interests of the

Company and its stockholders and also approved the Reduced Asset Coverage Ratio. Although the Company may determine not to significantly

increase its leverage immediately after it becomes subject to the Reduced Asset Coverage Ratio, we believe that, if Equus is to

remain a BDC, having the flexibility for the Company to incur the aforementioned additional leverage is in the best interests of

Equus stockholders.

Rationale for the Reduced Asset Coverage

Ratio

In contemplating whether to implement the Reduced

Asset Coverage Ratio, we considered and evaluated various factors, including the following (each, as discussed more fully below):

·

the additional flexibility to take advantage of attractive investment opportunities;

·

the potential impact (both positive and negative) on returns to stockholders and net asset

value;

·

the impact of leverage on the Company’s expenses, including the increased interest payments

on borrowed funds fees payable by the Company;

·

additional disclosure obligations and other considerations; and

·

the additional risks to stockholders in light of increased leverage relative to benefits of

the use of increased leverage.

No single factor was determinative of our decision,

but rather, we based our determination on the total mix of information available to us. Each of these factors is discussed below.

Flexibility to Take Advantage of Attractive

Investment Opportunities

We cannot predict when attractive investment

opportunities will present themselves, and attractive opportunities may arise at a time when market conditions are not favorable

to raising additional equity capital. In addition, certain sellers of investment opportunities may be willing to accept debt as

part or all of the consideration for the investment (i.e. seller-financed investments). If we are not able to access additional

capital (either at all or on favorable terms) when attractive investment opportunities arise, the Company’s ability to grow

could be adversely affected. Based on the Company’s balance sheet as of September 30, 2019 and applying the Reduced Asset

Coverage Ratio would allow the Company to borrow approximately $70.9 million in additional capital. This amount would provide additional

flexibility to pursue attractive investment opportunities. We believe that the greater deal flow that may be achieved with this

additional capital could enable the Company to participate more meaningfully in various investment opportunities with increased

diversification of the overall portfolio, which would be in the best interest of stockholders. With more capital, we expect that

the Company would, over time, likely be an even more meaningful capital provider to the middle market and be able to better compete

for high-quality investment opportunities with its competitors, including other BDCs and investment funds, alternative investment

vehicles (such as hedge funds) and traditional financial services companies (such as commercial banks), many of which have greater

resources than the Company currently has.

BDCs may invest up to 30% of their assets in

entities that are not considered “eligible portfolio companies” (as defined in the 1940 Act), which include companies

located outside of the United States, entities that are operating pursuant to certain exceptions under the 1940 Act, and publicly-traded

entities with a market capitalization exceeding $250 million. An increase in total assets available for investment as a result

of incurring additional leverage would consequently increase the amount available to invest in assets not considered eligible portfolio

companies, thus providing us greater flexibility when evaluating investment opportunities for Equus.

The following table sets forth the following

information:

·

the Company’s total assets, total debt outstanding (in dollars and as a percentage of

total assets), net assets and asset coverage ratio as of September 30, 2019;

·

assuming that as of September 30, 2019 the Company had incurred the maximum amount of borrowings

that could be incurred by the Company with a 200% asset coverage ratio, the Company’s pro forma total assets, total debt

outstanding (with the maximum amount of additional borrowings that would be permitted to incur in dollars and as a percentage of

total assets), net assets and asset coverage ratio; and

·

assuming that as of September 30, 2019 the Company had incurred the maximum amount of borrowings

that could be incurred by the Company under the Reduced Asset Coverage Ratio of 150%, the Company’s pro forma total assets,

total debt outstanding (with the maximum amount of additional borrowings that would be permitted to incur in dollars and as a percentage

of total assets), net assets and asset coverage ratio.

In evaluating the information presented below,

it is important to recognize that the maximum amount of borrowings that could be incurred by the Company is presented for comparative

and informational purposes only and such information is not a representation of the amount of borrowings that the Company intends

to incur or that would be available to the Company to be incurred.

|

|

|

|

|

Pro Forma Amounts

as of September 30, 2019

Assuming that the Company Had Incurred

The Maximum Amount of Borrowings That

Could Be Incurred by the Company

|

|

Selected Consolidated Financial Statement Data

(dollar amounts in thousands)

|

|

Actual Amounts

as of

September 30, 2019(1)

|

|

With a 200%

Asset Coverage Ratio(2)

|

|

With a 150%

Asset Coverage Ratio(3)

|

|

Total Assets

|

|

$ 76,209

|

|

$ 98,048

|

|

$ 147,072

|

|

Total Debt Outstanding(4)

|

|

$ 27,185

|

|

$ 49,024

|

|

$ 98,048

|

|

Net Assets

|

|

$ 49,024

|

|

$ 49,024

|

|

$ 49,024

|

|

Asset Coverage Ratio

|

|

|

|

200.0%

|

|

150.0%

|

|

|

(1)

|

As of September 30, 2019, the Company’s total outstanding indebtedness represented 35.7%

of the Company’s total assets.

|

|

|

(2)

|

Based on the Company’s total outstanding indebtedness of $27.0 million as of September 30,

2019 and applying an asset coverage ratio of 200%, the Company could have incurred up to an additional $21.8 million of borrowings,

bringing the Company’s total indebtedness and total assets to $49.0 million and $98.0 million, respectively. The maximum

amount of additional borrowings of $21.8 million would have represented 22.3 % of the total assets of $98.0 million, which are

the total assets that the Company would have had with such additional borrowings.

|

|

|

(3)

|

Assuming that the Company had incurred the maximum amount of borrowings that could be incurred

by the Company under an asset coverage ratio of 200% with total assets of $98.0 million and then applying the Reduced Asset Coverage

Ratio of 150%, the Company could have incurred an additional $49.0 million for a total of $98.0 million of borrowings, bringing

the Company’s total indebtedness and total assets to $98.0 million and $147.1 million, respectively. The maximum amount of

additional borrowings of $49.0 million would have represented 33.3% of the total assets of $147.1 million, which are the total

assets that the Company would have had with such additional borrowings.

|

|

|

(4)

|

Includes short-term borrowings of $27.0 million to maintain the Company’s status as a regulated

investment company under the Internal Revenue Code.

|

The Potential Impact on Returns to Stockholders

and Net Asset Value

General Considerations. In contemplating

the implementation of the Reduced Asset Coverage Ratio, we considered how access to greater leverage has the potential to increase

and sustain the Company’s investment yield and returns to Equus stockholders. Funds that use leverage generally aim to earn

an investment return on money raised through leverage that exceeds the costs of leveraging, and thereby to increase returns to

stockholders. We acknowledge that, while investment returns in excess of the costs of leverage would benefit our stockholders,

investment returns that are less than the costs of leverage would also reduce returns to our stockholders. We would expect to incur

additional indebtedness to the extent that we believe that, over time, the costs of carrying the assets to be acquired through

leverage are likely to be lower than the Company’s expected incremental investment yield and returns on equity.

While we cannot assure you that the investment

yield and returns on equity attributable to borrowing would exceed the costs of such leverage, we believe that the benefits of

increased leverage outweigh the risks, as noted in more detail below.

Possible Effect of Leverage on Returns to

Stockholders. The following table illustrates the potential effect of leverage on returns from an investment in the Company’s

common stock assuming that the Company employs (1) its actual asset coverage ratio as of September 30, 2019, (2) a hypothetical

asset coverage ratio of 200% and (3) a hypothetical asset coverage ratio of 150%, each at various annual returns on the Company’s

portfolio as of September 30, 2019, net of expenses. The calculations in the table below are hypothetical, and actual returns

may be significantly higher or lower than those appearing in the table below.

|

Assumed Return on the Company’s Portfolio (Net of Expenses)

|

|

(10.00%)

|

|

(5.00%)

|

|

0.00%

|

|

5.00%

|

|

10.00%

|

|

Corresponding return to common stockholder assuming actual asset coverage as of September 30, 2019 (280.3%)(1)

|

|

(14.93%)

|

|

(9.93%)

|

|

(4.93%)

|

|

0.07%

|

|

5.07%

|

|

Corresponding return to common stockholder assuming 200% asset coverage(2)

|

|

(15.79%)

|

|

(10.79%)

|

|

(5.79%)

|

|

(0.79%)

|

|

4.21%

|

|

Corresponding return to common stockholder assuming 150% asset coverage(3)

|

|

(16.80%)

|

|

(11.80%)

|

|

(6.80%)

|

|

(1.80%)

|

|

3.20%

|

|

|

(1)

|

Based on (i) $76.2 million in total assets as of September 30, 2019, (ii) $27.0 million in outstanding

indebtedness as of September 30, 2019, (iii) $49.0 million in net assets as of September 30, 2019 and (iv) a weighted average interest

rate on the Company’s indebtedness, as of September 30, 2019, excluding fees (such as fees on undrawn amounts and amortization

of financing costs), of 5.00%.

|

|

|

(2)

|

Based on (i) $98.0 million in total assets on a pro forma basis as of September 30, 2019, after

giving effect of a hypothetical asset coverage ratio of 200%, (ii) $49.0 million in outstanding indebtedness on a pro forma basis

as of September 30, 2019, after giving effect to a hypothetical asset coverage ratio of 200%, (iii) $49.0 million in net assets

as of September 30, 2019 and (iv) a weighted average interest rate on the Company’s indebtedness, as of September 30, 2019,

excluding fees (such as fees on undrawn amounts and amortization of financing costs), of 5.00%.

|

|

|

(3)

|

Based on (i) $147.1 million in total assets on a pro forma basis as of September 30, 2019, after

giving effect of a hypothetical asset coverage ratio of 150%, (ii) $98.0 million in outstanding indebtedness on a pro forma basis

as of September 30, 2019, after giving effect to a hypothetical asset coverage ratio of 150%, (iii) 49.0 million in net assets

as of September 30, 2019 and (iv) a weighted average interest rate on the Company’s indebtedness, as of September 30, 2019,

excluding fees (such as fees on undrawn amounts and amortization of financing costs), of 5.00%.

|

Effect of Leverage on Expenses

General Considerations. We considered

the impact of the use of higher leverage on the Company's expenses, noting that additional leverage would increase overall Company

expenses, including interest expense and additional expenses relating to the management of additional portfolio investments. On

the other hand, we also considered that, because Equus is an internally managed BDC, it does not pay a management fee that increases

proportionately with an increase in gross assets as is customarily the case with management fees paid to external fund advisors.

Moreover, Equus will also not be required to pay incentive fees to an external advisor, which fees can consist of up to 20% of

realized gains on the sale of Company investments. Principally as a result of the Company’s internal management structure,

the Board expects that personnel and administrative expenses relating to increased investment activity will not increase proportionately

with the increase in gross assets, thereby gaining the Company certain efficiencies relative to a similarly-situated BDC that is

externally managed. We considered that these cost efficiencies could provide a potential greater benefit to Equus stockholders

than would otherwise be the case with an externally managed fund if Equus management is able to increase the value of the Company’s

portfolio holdings.

Estimated Expenses as a Percentage of Net

Assets. The following table is intended to assist readers in understanding the costs and expenses of the Company based on the

assumptions set forth below. We caution you that some of the percentages indicated in the table below are estimates and may vary.

Except where the context suggests otherwise, the Company will pay such fees and expenses out of its net assets and, consequently,

stockholders will indirectly bear such fees or expenses as investors in the Company.

|

|

|

|

|

Annualized Expenses

Based on Pro Forma Expenses

for the Nine Months Ended

September 30, 2019

Assuming that the Company

Had Incurred the Maximum

Amount of Borrowings That

Could Be Incurred

by the Company

|

|

Estimated Annual Expenses

as a Percentage of Net Assets

(all amounts in 000s)

|

|

Actual Asset Coverage

as of September 30, 2019

(280.3%)(1)

|

|

Assuming 200%

Asset Coverage(2)

|

|

Assuming 150%

Asset Coverage(2)

|

|

Annual Operating Expenses(2)

|

|

7.64%

|

|

9.34%

|

|

13.16%

|

|

Interest Paid on Borrowed Funds(3)

|

|

0.02%

|

|

2.24%

|

|

7.24%

|

|

Total Annual Expenses

|

|

7.66%

|

|

11.59%

|

|

20.41%

|

|

|

(1)

|

Based on actual net assets and expenses (annualized) as reported in the Company’s quarterly

report on Form 10-Q for the quarter and nine months ended September 30, 2019.

|

|

|

(2)

|

Assumes that the Company will gain efficiencies from increased capital availability and that annual

operating expenses for additional borrowings will be, as a percentage of additional assets acquired with these additional borrowings,

half of the current rate of operating expenses.

|

|

|

(3)

|

For any borrowings in excess of the $27.0 million borrowed by the Company to maintain its status

as a RIC, the table assumes an average interest rate on our indebtedness of 5%.

|

Example. The following example demonstrates

the projected dollar amount of total cumulative expenses that would be incurred over various periods with respect to a hypothetical

investment in the Company's Common Stock, assuming (1) actual asset coverage (280.3%) as of September 30, 2019, (2) a hypothetical

asset coverage ratio of 200% and (3) a hypothetical asset coverage ratio of 150%, assuming that the Company's annual operating

expenses remain at the levels set forth in the table above for the respective asset coverage ratio. Transaction expenses are not

included in the following example.

An investor would pay the following expenses

on a $1,000 investment in the Company's Common Stock:

|

|

|

1 Year

|

|

3 Years

|

|

5 Years

|

|

10 Years

|

|

Based on the Company’s Actual Asset Coverage Ratio of 280.3% as of September 30, 2019(1)

|

|

$ 77

|

|

$ 230

|

|

$ 383

|

|

$ 766

|

|

Based on 200% Asset Coverage(2)

|

|

$ 116

|

|

$ 348

|

|

$ 579

|

|

$ 1,159

|

|

Based on 150% Asset Coverage(3)

|

|

$ 204

|

|

$ 612

|

|

$ 1,020

|

|

$ 2,041

|

|

|

(1)

|

Assumes a 5% annual return resulting entirely from net realized gains on the Company’s current

investment portfolio of $42.9 million (none of which is subject to incentive fees on capital gains).

|

|

|

(2)

|

Assumes a 5% annual return resulting entirely from net realized gains on the Company’s hypothetical

investment portfolio of $64.7 million (none of which is subject to incentive fees on capital gains).

|

|

|

(3)

|

Assumes a 5% annual return resulting entirely from net realized gains on the Company’s hypothetical

investment portfolio of $113.8 million (none of which is subject to incentive fees on capital gains).

|

The examples from the table above assume no

unrealized capital depreciation and a 5% annual return resulting entirely from net realized capital gains. To the extent that our

investment strategy involves investments that generate primarily current income, we believe that a 5% annual return resulting entirely

from net realized capital gains would be unlikely.

These examples and the expenses in the tables

above should not be considered a representation of our future expenses, and actual expenses may be greater or lesser than those

shown. While the examples assume, as required by the SEC, a 5% annual return, our performance will vary and may result in a return

greater or less than 5%.

While the above tables assume as indicated an

asset coverage ratio that could be as low as 150%, the Board, in consultation with Company management, will determine the appropriate

level of leverage for the Company based on a variety of factors. As such, the Company may continue to operate with lower levels

of leverage (i.e., higher asset coverage ratios) than is permitted with the Reduced Asset Coverage Ratio.

Additional Disclosure Obligations and Other

Considerations

Additional Disclosures. We also noted

that the Company must comply with the following additional disclosure requirements in connection with the Reduced Asset Coverage

Ratio:

·

not later than five (5) business days after the date on which the 150% minimum asset coverage

ratio is approved, the Company is required to disclose such approval, and the effective date of such approval, in (1) a filing

submitted to the SEC under Section 13(a) or 15(d) of the Exchange Act; and (2) a notice on the Company’s website;

·

the Company is required to disclose, in each periodic filing required under Section 13(a)

of the Exchange Act: (1) the aggregate principal amount or liquidation preference, as applicable, of the senior securities issued

by the Company and the asset coverage ratio as of the date of the Company’s most recent financial statements included in

that filing; (2) that the 150% minimum asset coverage ratio was approved; and (3) the effective date of such approval; and

·

as an issuer of common stock, the Company is also required to include in each periodic filing

required under Section 13(a) of the Exchange Act disclosures that are reasonably designed to ensure that the Company’s stockholders

are informed of: (1) the amount of senior securities (and the associated asset coverage ratios) of the Company, determined as of

the date of the most recent financial statements of the Company included in the filing; and (2) the principal risk factors associated

with the senior securities described in the preceding clause, to the extent that risk is incurred by the Company.

Other Considerations. In addition, the

we also considered that holders of any senior securities, including any additional senior securities that Company may be able to

issue as a result of the reduced asset coverage requirements, will have fixed-dollar claims on the Company’s assets that

are superior to the claims of the stockholders. In the case of a liquidation event, holders of these senior securities would receive

proceeds to the extent of their fixed claims before any distributions are made to the stockholders, and the issuance of additional

senior securities may result in fewer proceeds remaining for distribution to the stockholders if the assets purchased with the

capital raise from such issuances decline in value.

Risks Relative to Potential Benefits Associated

With the Use of Increased Leverage

We considered how increased leverage could increase

the risks associated with investing in the Company's Common Stock. For example, if the value of the Company's assets decreases,

leverage will cause the Company's net asset value to decline more sharply than it otherwise would have without leverage or with

lower leverage. Similarly, any decrease in the Company's revenue would cause its net income to decline more sharply than it would

have if the Company had not borrowed or had borrowed less. Such a decline could also negatively affect the Company's ability to

make future dividend payments on its common stock or preferred stock. In addition, common stockholders will bear the burden of

any increase in the Company's expenses as a result of its use of leverage, including interest expenses and any increase in personnel

expenses relative to the management of additional portfolio investments. Nevertheless, we viewed the potential benefits of increased

leverage as outweighing these risks.

Conclusion

Based on our consideration of each of the above

factors and such other information as we deemed relevant, we have concluded that the Reduced Asset Coverage Ratio is in the best

interests of Equus and its stockholders. Holders of a majority of the voting securities of the Company have approved the Reduced

Asset Coverage Ratio and have authorized the Board to effect this change.

THE AUTHORIZATION GIVEN TO OUR BOARD TO EFFECT

THE REDUCED ASSET COVERAGE RATIO FROM 200% TO 150% UNDER THE 1940 ACT HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, NOR HAS

THE SEC PASSED UPON THE FAIRNESS OR MERITS OF THE AUTHORIZATION NOR UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED

IN THIS INFORMATION STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

PLEASE NOTE THAT THIS IS NEITHER A REQUEST

FOR YOUR VOTE NOR A PROXY STATEMENT, BUT RATHER AN INFORMATION STATEMENT DESIGNED TO INFORM YOU ABOUT THE PRESENT AUTHORIZATION

AND THE POSSIBLE INCREASE IN THE AMOUNT OF DEBT THAT THE COMPANY MAY INCUR.

FREQUENTLY ASKED QUESTIONS

Why did I receive this Information Statement?

Applicable laws require us to provide you information

regarding the Authorizations even though your vote is neither required nor requested for the Authorizations to become effective.

What will I receive when the Authorizations become effective?

The Authorizations has already been approved,

and you will not receive anything notifying you that the Authorizations have become effective.

How does the Authorization to Withdraw the Company’s

BDC Election affect the Company’s ability to achieve a Consolidation?

The authorization to the Board to withdraw the

Company’s BDC election is necessary for the Company to enter into an agreement that, if consummated, would effect a Consolidation.

When will Equus withdraw its BDC election?

If Equus enters into an agreement that will

result in a Consolidation, we will only withdraw the Company’s BDC election once we are reasonably certain that the Consolidation

will close.

How does the Authorization for the Reduced Asset Coverage

Ratio affect the Company’s ability to achieve a Consolidation?

The authorization for the Reduced Asset Coverage

Ratio is intended to facilitate greater investment flexibility for the Company in the event Equus does not pursue a Consolidation

and instead remains a BDC.

Why am I not being asked to vote?

The holders of a majority of the issued and

outstanding shares of our common stock have already approved the Authorizations pursuant to a written consent in lieu of a meeting.

Such approval is sufficient under Delaware law, and no further approval by our stockholders is required.

What do I need to do now?

Nothing. This Information Statement is purely

for your information and does not require or request you to do anything.

Whom can I contact with questions?

If you have any questions about any of the actions

to be taken by the Company, please contact us by calling toll free at 1-888-323-4533.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the amount of the

Company’s common stock beneficially owned (unless otherwise indicated) as of November 14, 2019, by (1) any person known

to the Company to be the beneficial owner of more than 5% of the outstanding shares of the Company’s common stock, (2) each

director of the Company, (3) each named executive officer, and (4) all directors and executive officers as a group.

The number of shares beneficially owned by

each entity, person, director, or executive officer is determined under SEC rules and the information is not necessarily indicative

of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the entity

or individual has sole or shared voting power or investment power and also any shares that the entity or individual had the right

to acquire as of November 14, 2019, or within 60 days after November 14, 2019, through the exercise of any stock option or other

right. Unless otherwise indicated, to our knowledge each individual has sole investment and voting power, or shares such powers

with his spouse, with respect to the shares set forth in the table.

|

Name

|

|

Sole

Voting and Investment Power

|

|

Other

Beneficial

Ownership

|

|

Total

|

|

Percent of

Class

Outstanding

|

|

Fraser Atkinson

|

|

|

21,389

|

|

|

|

—

|

|

|

|

21,389

|

|

|

|

*

|

|

|

Kenneth I. Denos

|

|

|

265,754

|

|

|

|

—

|

|

|

|

265,754

|

|

|

|

1.97

|

%

|

|

Henry W. Hankinson

|

|

|

19,500

|

|

|

|

—

|

|

|

|

19,500

|

|

|

|

*

|

|

|

John A. Hardy

|

|

|

500,000

|

|

|

|

—

|

|

|

|

500,000

|

|

|

|

3.70

|

%

|

|

L’Sheryl D. Hudson(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

*

|

|

|

Robert L. Knauss

|

|

|

92,670

|

|

|

|

—

|

|

|

|

92,670

|

|

|

|

*

|

|

|

MVC Capital, Inc. (2)

|

|

|

—

|

|

|

|

3,228,024

|

|

|

|

3,228,024

|

|

|

|

23.88

|

%

|

|

Bertrand des Pallieres(3) (4)

|

|

|

1,057,017

|

|

|

|

1,142,675

|

|

|

|

2,199,692

|

|

|

|

16.27

|

%

|

|

All directors and executive officers as a group (6 persons)

|

|

|

899,313

|

|

|

|

—

|

|

|

|

899,313

|

|

|

|

6.65

|

%

|

* Indicates less than one percent.

|

|

(1)

|

Ms. Hudson serves as the Company’s Senior Vice President and Chief Financial Officer. Ms. Hudson is not a director of the Company.

|

|

|

(2)

|

Includes 3,228,024 shares held directly by MVC Capital, Inc. (“MVC”), a business development company managed and directed by The Tokarz Group Advisers, LLC (“TTGA”), an investment adviser registered pursuant to the Investment Advisers Act of 1940. MVC’s and TTGA’s business address is 287 Bowman Avenue, 2nd Floor, Purchase, New York 10577.

|

|

|

(3)

|

Includes 10,000 shares held directly by Mobiquity Investments Limited and indirectly by Mobiquity Investments Corp. and Versatile Systems Inc., of which Mr. des Pallieres serves as a director. Mr. des Pallieres disclaims beneficial ownership of the securities held directly by Mobiquity Investments Limited and Versatile Systems Inc. and nothing herein shall be construed as an admission that such individual is, for the purpose of Section 13(d) or 13(g) of the Securities Exchange Act of 1934, the beneficial owner of any such securities.

|

|

|

(4)

|

Includes 1,057,017 shares held directly by Mr. des Pallieres. Also includes 145,833 shares held directly by SPQR Capital Holdings S.A., a Luxembourg societe anonyme in which Mr. des Pallieres is a minority stockholder and serves as a director. Also includes 986,842 shares held directly by Lansdowne Capital S.A., a Luxembourg societe anonyme that is indirectly wholly-owned by Mr. des Pallieres.

|

NO DISSENTER’S RIGHTS

Under the General Corporation Law of Delaware,

stockholders are not entitled to dissenter’s rights of appraisal in connection with the Authorizations.

PROPOSALS BY SECURITY HOLDERS

No security holder has requested us to include

any additional proposals in this Information Statement.

INTEREST OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE

ACTED UPON

No officer or director of the Company has any

substantial interest in the matters acted upon by our shareholders.

ADDITIONAL INFORMATION

We file reports with the SEC, which include

annual and quarterly reports, as well as other information the Company is required to file pursuant to the 1940 Act and the Exchange

Act. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington,

D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The

SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers

that file electronically with the SEC at http://www.sec.gov.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

Only one Information Statement is being delivered

to multiple security holders sharing an address unless we received contrary instructions from one or more of the security holders.

We shall deliver promptly, upon written or oral request, a separate copy of the Information Statement to a security holder at a

shared address to which a single copy of the document was delivered. A security holder can notify us that the security holder wishes

to receive a separate copy of the Information Statement by sending a written request to us at 700 Louisiana Street, 48th

Floor, Houston, Texas 77002, or by calling us toll free at (888) 323-4533. A security holder may utilize the same address and telephone

number to request either separate copies or a single copy for a single address for all future information statements and proxy

statements, if any, and annual reports of the Company.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Kenneth I. Denos

Secretary

November

18, 2019

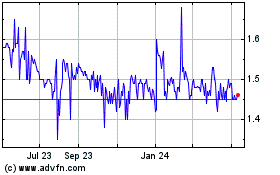

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Mar 2024 to Apr 2024

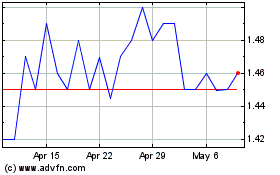

Equus Total Return (NYSE:EQS)

Historical Stock Chart

From Apr 2023 to Apr 2024