Current Report Filing (8-k)

June 02 2020 - 4:16PM

Edgar (US Regulatory)

false--12-310001045450

0001045450

2020-05-29

2020-05-29

0001045450

us-gaap:SeriesGPreferredStockMember

2020-05-29

2020-05-29

0001045450

us-gaap:CommonStockMember

2020-05-29

2020-05-29

0001045450

us-gaap:SeriesCPreferredStockMember

2020-05-29

2020-05-29

0001045450

us-gaap:SeriesEPreferredStockMember

2020-05-29

2020-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2020

EPR Properties

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-13561

|

|

43-1790877

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

909 Walnut Street,

|

Suite 200

|

|

Kansas City,

|

Missouri

|

64106

|

|

(Address of principal executive offices) (Zip Code)

|

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common shares, par value $0.01 per share

|

|

EPR

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

5.75% Series C cumulative convertible preferred shares, par value $0.01 per share

|

|

EPR PrC

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

9.00% Series E cumulative convertible preferred shares, par value $0.01 per share

|

|

EPR PrE

|

|

New York Stock Exchange

|

|

|

|

|

|

|

|

5.75% Series G cumulative redeemable preferred shares, par value $0.01 per share

|

|

EPR PrG

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

Item 3.03.

|

Material Modification to Rights of Security Holders.

|

The information set forth in Item 5.03 below regarding the amendment to the Amended and Restated Declaration of Trust, as amended (the "Declaration of Trust"), of EPR Properties (the "Company") is incorporated by reference into this Item 3.03.

|

|

|

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On May 29, 2020, at the 2020 Annual Meeting of Shareholder (the "2020 Annual Meeting") of the Company held on May 29, 2020, the Company's shareholders approved an amendment (the "Amendment") to the Declaration of Trust to add a new Article Twentieth. The new Article Twentieth allows the Company to redeem its Securities where the person owning or controlling such Securities is determined to be unsuitable to own or control such Securities due to failure to comply with all applicable laws, statutes and ordinances pursuant to which any gaming authority possesses regulatory, permit and licensing authority over the conduct of gaming activities. The new Article Twentieth defines the term "Securities" to mean the Company's common shares, preferred shares and/or capital stock, member's interests or membership interests, partnership interests or other equity securities of entities affiliated with the Company. The Amendment was filed with the State Department of Assessments and Taxation of Maryland on June 1, 2020.

The foregoing description of the Amendment is not complete and is qualified in its entirety by reference to the Amendment, a copy of which is filed herewith as Exhibit 3.1 and incorporated herein by reference. A more detailed description of the material changes in rights of the Company's shareholders as a result of the Amendment was included in Proposal No. 3 of the Company's definitive proxy statement filed with the Securities and Exchange Commission on April 17, 2020, which description is incorporated in its entirety herein by reference.

|

|

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

At the Company's 2020 Annual Meeting, the matters voted upon and the number of votes cast for, against or withheld, as well as the number of abstentions and broker non-votes as to such matters, were as stated below:

Proposal No. 1

The following nominees for trustees were elected to serve one-year terms expiring in 2021:

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Withheld

|

Broker Non-Votes

|

|

Barrett Brady

|

56,417,895

|

|

1,301,656

|

|

9,990,570

|

|

|

Peter C. Brown

|

56,318,835

|

|

1,400,716

|

|

9,990,570

|

|

|

James B. Connor

|

56,717,138

|

|

1,002,413

|

|

9,990,570

|

|

|

Robert J. Druten

|

55,288,917

|

|

2,430,635

|

|

9,990,570

|

|

|

Gregory K. Silvers

|

56,944,761

|

|

774,790

|

|

9,990,570

|

|

|

Robin P. Sterneck

|

55,579,278

|

|

2,140,274

|

|

9,990,570

|

|

|

Virginia E. Shanks

|

56,906,707

|

|

812,845

|

|

9,990,570

|

|

Proposal No. 2

The shareholders approved the compensation of the Company's named executive officers as presented in the Company's proxy statement on a non-binding, advisory basis:

|

|

|

|

|

|

|

For

|

53,118,132

|

|

|

Against

|

4,339,678

|

|

|

Abstain

|

261,742

|

|

|

Broker Non-Vote

|

9,990,570

|

|

Proposal No. 3

The shareholders approved the Amendment to the Company's Declaration of Trust as described under Item 5.03 above:

|

|

|

|

|

|

|

For

|

57,254,033

|

|

|

Against

|

319,963

|

|

|

Abstain

|

145,556

|

|

|

Broker Non-Vote

|

9,990,570

|

|

Proposal No. 4

The shareholders approved the ratification of KPMG LLP as the Company's independent registered public accounting firm for 2020:

|

|

|

|

|

|

|

For

|

65,912,023

|

|

|

Against

|

1,655,642

|

|

|

Abstain

|

142,457

|

|

|

Broker Non-Vote

|

—

|

|

Item 9.01 Financial Statements and Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

Articles of Amendment of Amended and Restated Declaration of Trust of EPR Properties, filed June 1, 2020.

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPR PROPERTIES

|

|

|

|

|

|

|

By:

|

|

/s/ Craig L. Evans

|

|

|

Name:

|

|

Craig L. Evans

|

|

|

Title:

|

|

Executive Vice President, General Counsel and Secretary

|

Date: June 2, 2020

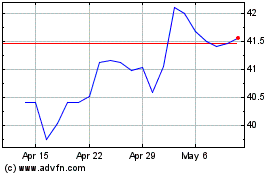

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

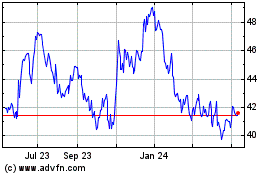

EPR Properties (NYSE:EPR)

Historical Stock Chart

From Apr 2023 to Apr 2024