Harbert Discovery Fund Files Lawsuit Seeking to Hold Enzo Board Accountable for Acts of Entrenchment and Illegal Maneuvers

February 06 2020 - 3:07PM

Business Wire

Details Enzo’s Efforts to Manipulate Corporate

Machinery to Disenfranchise Shareholders

Harbert Discovery Fund, LP and Harbert Discovery Co-Investment

Fund I, LP (collectively “HDF”), the beneficial owners of more than

11.8% of the outstanding shares of Enzo Biochem, Inc. (NYSE: ENZ)

(“Enzo” or the “Company”), today announced that it has filed a

complaint in the U.S. District Court for the Southern District of

New York asserting direct claims against Enzo and asserting both

direct and derivative claims against members of its Board of

Directors (the “Board”) (Case 1:20-cv-01021). The complaint alleges

that Enzo has engaged in brazen acts of entrenchment and misuse of

the corporate machinery in an effort to keep Barry Weiner on the

Board after most of Enzo’s shareholders had voted and it had become

clear that Weiner would be removed.

Commenting on the complaint, Kenan Lucas, Managing Director and

Portfolio Manager of HDF, stated: “Enzo’s refusal to accept the

will of its shareholders is highly unfortunate. With this misguided

and illegal attempt to disenfranchise shareholders, the Board has

proven a willingness to go to any extreme, including violating

their own Charter, in an attempt to further entrench themselves.

Enzo has turned what should be a fair and equitable process on its

head by changing the rules of the game in the final seconds of the

fourth quarter. The Company’s actions have left us with no choice

but to bring this litigation and seek to defend the rights of

shareholders.”

HDF’s complaint details the following:

- By January 28, 2020, three days before the election, with most

of the expected votes cast, it was clear that HDF would

prevail.

- Unbending to the will of its shareholders – the owners of the

Company – the Board took decisive but illegal action.

- Three days before facing imminent defeat at Enzo’s annual

shareholder (the “Annual Meeting” or “Meeting”) scheduled for

January 31, 2020, the Director Defendants made false and misleading

statements in violation of Section 14(a) and Rule 14a-9 of the

Securities and Exchange Act (the "Exchange Act"), which were

deliberately designed to enable them to change the rules of

election and nullify the will of the shareholders so that Defendant

Weiner might have a chance to remain on the Company’s board of

directors (the “Board”).

- Defendants issued a press release (“January 28 Enzo Press

Release”) falsely stating that the Annual Meeting had been delayed

for three weeks, until February 25, 2020, purportedly so that

shareholders could vote on a proposed By-Law amendment to expand

the Board from five to up to seven members. Notwithstanding that

announcement, on the morning of January 31, the Company disclosed

that the Annual Meeting would be held less than two hours

later.

- At 7:07 a.m. on January 31, 2020, Enzo filed a supplement to

its proxy statement with the SEC (“January 31 Enzo Proxy”)

revealing it had one more trick up its sleeve. Contrary to the

announcement in the January 28 Enzo Press Release that the Annual

Meeting was delayed, Enzo declared in the January 31 Enzo Proxy

that it would in fact convene the Annual Meeting as originally

scheduled, less than two hours later, at 9:00 a.m., in New York

City (HDF is based in Alabama) and then adjourn and reconvene it on

February 25, 2020. This was the first and only notice Enzo

shareholders received stating that a meeting would in fact be

convened on January 31, 2020 after the previous announcement that

the Meeting would be “delayed.”

- Believing that no meeting was to be held on January 31, 2020,

HDF did not send a representative to the Yale Club, where the

Annual Meeting was held. Had HDF been in attendance, it would have

voted the shares and proxies it held to defeat any motion to

adjourn and forced the Company to hold the Meeting as planned that

day, ensuring the election of its nominees to a five person Board

and the defeat of Defendant Weiner.

- In addition to deceiving HDF and other shareholders into not

attending the Annual Meeting, the Board engaged in a further act of

entrenchment with respect to its proposed By-Law amendment. Article

II, Section 2 of the By-Laws fixes the number of board seats at

five and the Charter requires a supermajority vote to amend that

provision. Notwithstanding that, the Company declared in the

January 31 Enzo Proxy that the By-Law provision fixing the number

of board seats at five had been – at some point in the past –

“inadvertently” placed in the wrong section of the By-Laws and,

instead, should have been included in another By-Law provision that

required only a majority vote to amend. For reasons explained

further in HDF’s complaint, the convenient discovery of this

purported mistake in the midst of this contest is another obvious,

blatant entrenchment tactic.

- HDF has filed this action to hold the Director Defendants fully

accountable for their acts of entrenchment and violation of the

federal securities laws, to seek recompense for those actions which

have caused HDF hundreds of thousands of dollars in additional,

unnecessary legal, proxy and other advisory fees, and to lay a

marker so that the Director Defendants’ gamesmanship stops. Should

Defendants again seek to manipulate the election, HDF will promptly

move this Court to prevent them from doing so.

The full text of Enzo’s complaint is available at:

https://cureenzo.com/wp-content/uploads/2020/02/HDF-Complaint-2-6-20.pdf

Please visit our website at www.cureenzo.com to learn more.

Important Information about Participants in a Proxy

Solicitation:

Harbert Discovery Fund, LP (“Harbert Discovery”), Harbert

Discovery Fund GP, LLC (“Harbert Discovery GP”), Harbert Discovery

Co-Investment Fund I, LP (“Harbert Discovery Co-Investment” and

together with Harbert Discovery, the “Discovery Funds”), Harbert

Discovery Co-Investment Fund I GP, LLC (“Harbert Discovery

Co-Investment GP”), Harbert Fund Advisors, Inc. (“HFA”), Harbert

Management Corporation (“HMC”), Jack Bryant (“Mr. Bryant”), Raymond

Harbert (“Mr. Harbert”) and Kenan Lucas (“Mr. Lucas” and together

with Harbert Discovery, Harbert Discovery GP, Harbert Discovery

Co-Investment, Harbert Discovery Co-Investment GP, HFA, HMC and

Messrs. Bryant and Harbert, the “Harbert Discovery Parties”)

(collectively, the “Participants”) have filed with the Securities

and Exchange Commission (the “SEC”) a definitive proxy statement

and accompanying form of proxy to be used in connection with the

solicitation of proxies from the shareholders of Enzo Biochem, Inc.

(the “Company”) in connection with the annual meeting of

shareholders of the Company (the “Annual Meeting”). All

shareholders of the Company are advised to read the definitive

proxy statement and other documents related to the solicitation of

proxies by the Participants in respect of the Annual Meeting, as

they contain important information, including additional

information related to the Participants, their nominees for

election to the board of directors of the Company and the Annual

Meeting. The definitive proxy statement and an accompanying proxy

card will be furnished to some or all of the Company’s shareholders

and are, along with other relevant documents, available at no

charge on the SEC website at http://www.sec.gov/ and are available

upon request from the Participants’ proxy solicitor, Okapi

Partners, by calling (888) 758-6707 (banks and brokers call collect

(212) 297-0720).

Additional information about the Participants can be found on

the Definitive Proxy Statement filed by the Participants on

December 6, 2019.

About Harbert Discovery Fund (HDF)

HDF invests in a concentrated portfolio of publicly traded small

capitalization companies in the US and Canada. We perform

significant due diligence on each portfolio company prior to

investing. In addition to researching all publicly available

information and meeting with management, our diligence includes

substantial primary research with industry experts, consultants,

bankers, customers and competitors. We often spend months or years

researching ideas before making an investment decision and we only

invest in companies that we believe are significantly undervalued,

and where there is the potential for change to enhance or

accelerate value creation. In an effort to unlock this potential

value, we seek to work directly with the boards and management

teams of our portfolio companies privately and collaboratively,

engaging with them on a range of factors including governance,

board composition, corporate strategy, capital allocation,

strategic alternatives and operations. We have effected positive,

fundamental changes at our current and past investments through

this behind-the-scenes, constructive approach. HDF currently has

board representation at three of our portfolio companies. In each

case, changes to the board were agreed upon privately and it is our

strong preference in every investment to avoid the unnecessary

distractions and costs of a public proxy campaign.

About Harbert Management Corporation (HMC)

HMC is an alternative asset management firm with approximately

$7.0 billion in regulatory assets under management as of December

31, 2019. HMC currently sponsors nine distinct investment

strategies with dedicated investment teams. Additional information

about HMC can be found at www.harbert.net.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200206005895/en/

Investor Contact Okapi Partners LLC Bruce Goldfarb /

Chuck Garske / Jason Alexander, 212-297-0720

info@okapipartners.com

Media Contact Sloane & Company Dan Zacchei / Joe

Germani, 212-486-9500 dzacchei@sloanepr.com /

jgermani@sloanepr.com

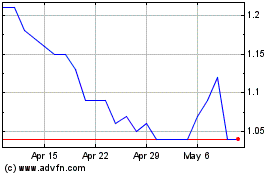

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

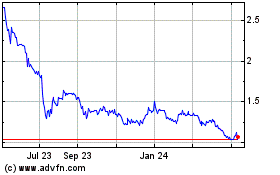

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Apr 2023 to Apr 2024