Sends Letter to Shareholders Highlighting

Enzo’s Sustained History of Underperformance and Missteps of

Current Entrenched Board and Management Team

Believes Current Leadership Has Operated Enzo

as a “Lifestyle Business” With Its Own Interests Placed Ahead of

Shareholders’

HDF’s Director Candidates – Fabian Blank and

Peter Clemens – Can Help Address Depressed Stock Price and Create

Significant Value for All Shareholders

Full letter available at

https://cureenzo.com/

Harbert Discovery Fund, LP and Harbert Discovery Co-Investment

Fund I, LP (collectively “HDF”), the beneficial owner of more than

11.8% of the outstanding shares of Enzo Biochem, Inc. (NYSE: ENZ)

(“Enzo” or the “Company”), announced today in a detailed letter to

shareholders that it is nominating two director candidates for

election to the Company’s Board of Directors (the “Board”) at its

2019 Annual Meeting of Shareholders.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20190917005689/en/

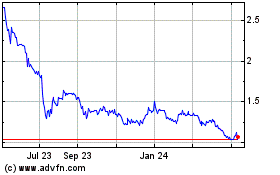

Image 1: Total Shareholder Return.

(Photo: Business Wire)

The full text of the letter follows:

September 17, 2019

Dear Fellow Shareholders,

Harbert Discovery Fund, LP and Harbert Discovery Co-Investment

Fund I, LP (collectively “HDF”) currently own approximately 11.8%

of the outstanding shares of Enzo Biochem, Inc. (NYSE: ENZ) (“Enzo”

or the “Company”), making us the Company’s largest shareholder.

We are writing today because we believe Enzo is deeply

undervalued. This depressed valuation is, in our view, a direct

result of the Company’s current Board of Directors’ (the “Board”)

and management team’s persistent inability to execute Enzo’s stated

strategy, deliver on the promises of the Company’s technology and

manage the cost structure of the business prudently.

For decades, Enzo has operated as a “lifestyle business,” where

management has seemingly placed its own personal and financial

interests ahead of its shareholders’ best interests. The Board has

repeatedly let this behavior go unchecked and has failed to hold

management accountable for its clear inability to deliver

profitable growth or acceptable absolute or relative shareholder

returns.

Enzo’s underperformance is not a matter of perspective or a

story requiring nuance: the Company has drastically underperformed

the Russell 2000 by nearly 1,100% over the last 30 years. Clearly,

it is time for change. This is why over the last several months we

have attempted to engage in substantive, private discussions with

the Company regarding the composition of the Board, in an effort to

install new independent directors who can help address the

Company’s problems. Unfortunately, the Board’s ultimate response to

our discussions was unproductive, and we are now forced to pursue

other options to ensure that shareholders are properly represented

in the Board room.

We are nominating two highly-qualified Board candidates – Fabian

Blank and Peter Clemens – for election at the 2019 Annual Meeting

of Shareholders (the “Annual Meeting”). These independent

candidates have deep operational, financial and strategic

experience within the healthcare industry. Having already studied

Enzo and the challenges it faces, both candidates are prepared to

bring their substantive experience to bear to help steer the

Company in the direction of long-term value creation for all

shareholders. HDF believes our candidates can immediately help

improve the Company’s expense structure and implement a growth

strategy that will generate durable long-term shareholder value.

Our nominees also are well-positioned to create near-term value

through a full exploration of strategic alternatives, with a focus

on potential sales of non-core assets and intellectual

property.

The Case for Change at

Enzo

Sustained History of Value Destruction:

It is our belief that management and the Board’s misguided

strategy and failure to execute coupled with an excessive,

misaligned and unjustifiable compensation structure has resulted in

consistent value destruction for shareholders, as evidenced by

Enzo’s stock price which has significantly underperformed any

relevant index or peer group comparison across any time period,

going back 30 years. See Image 1: Total Shareholder Return.

History of Overpromising and Underdelivering:

Management has a long track record of hyping various platforms

and technologies in development, only to fail to deliver the

promised results. While this pattern is systemic and has repeated

itself for decades, the debacle with AmpiProbe provides a current

and salient example of this disappointing phenomenon.

Since 2012, Enzo has briefed investors on its strategy to roll

out a new lower cost lab-to-lab business model derived from the

development of AmpiProbe:

- 2012 – Management first highlighted AmpiProbe and its

significant potential in March during its second quarter earnings

call.

- 2014 – Two years after the original promise of

AmpiProbe, during the fiscal Q4 2014 earnings call in October,

management stated in reference to AmpiProbe, “We hope to see the

first of these tests available for marketing sometime after the

first of the calendar year.”

- 2015 – The Company’s December investor presentation

referred to the potential of AmpiProbe to deliver cost savings to

the market, stating, “Enzo Is Positioned to Thrive NOW.”

- 2016 – AmpiProbe had still not progressed. On the fiscal

Q3 2016 earnings call held in June, management stated, “I think we

are in fairly good shape to hopefully see a comprehensive product

sometime by year end or soon thereafter. And what I mean by

comprehensive product is a panel that can potentially generate

revenue growth for us as a company of some size.”

- 2018 – Two and a half years later on the fiscal Q1 2019

earnings call held in December 2018, management stated, “We have

been working to now build systems that not only will be approved

for a New York State approval, but also for an FDA approval and

that is very important in the totality of this process and we are

moving forward in that.” This comment is particularly objectionable

considering management initially indicated that FDA approval would

not be required, claiming New York State approval would

suffice.

Despite its statements over the past seven years that AmpiProbe

would drive growth and profitability for Enzo, as of today,

AmpiProbe has not generated any material

revenue for the Company. In fact, Enzo’s revenues declined

from $103 million in fiscal 2012 to $87 million in the LTM period

ended April 30, 2019.2

Similar to its failed promises about new products generating

growth, for years management has repeatedly pointed to strategic

partnerships as a source of growth – yet nothing has ever come to

fruition.

- 2014 – “We continue to look for effective least

dilutive ways to monetize many of the transformational technologies

we have developed. And as such, we continue to explore joint

ventures and other forms of partnerships as a way to help advance

technologies and benefit all of us as shareholders” – Barry

Weiner Q3 2014 Earnings Call.

- 2016 – “Establishing business relationships on many

fronts is a key goal of the many goals that we have set forth for

our team here. We are in dialog with multiple parties. We are

fortunate that we have many platform technologies that appeal and

touch on different segments of this particular marketplace and we

are looking to expand those platforms into areas where we may not

have the interest or the time or the focus to expand the utility of

the platforms. And so we are in dialog. And you could very well see

the consummation of relationships with a number of parties out

there in the near future.” – Barry Weiner Q4 2016 Earnings

Call.

- 2018 – “Finally, we have been developing cost effective

approaches on various platforms, not only in molecular, but in the

area of anatomical pathology, immunohistochemistry, in flow

cytometry these various platforms and business opportunities that

are under development, provide from multiple unique opportunities

to partner and joint venture to exploit the commercialization

capability that they present and dialog is now currently underway

to try to move these products in a more expeditious way.” – Barry

Weiner Q4 2018 Earnings Call.

- 2019 – “Our commercial efforts towards implementing our

marketing plan is twofold, expanding our internal highly trained

and technical sales teams and supplementing this effort with a

focused business development program to partner, collaborate and/or

combine with companies in the diagnostic testing market. In the

past quarter alone we’ve held numerous discussions with many

strategic partners, many of whom we’ve met with over the last year.

Defining the scope of new relationships and building collaborations

and partnerships takes time. However, Enzo’s disruptive strategic

plan is gaining market awareness and acceptance and we are

confident new relationships will materialize.” – Barry Weiner Q2

2019 Earnings Call.

We have identified dozens of Company quotes substantively

similar to the above. Despite all of these statements, to date the

Company has not announced any material strategic partnerships,

further illuminating the same pattern of hype and failure that the

Board has overseen for years.

This is, in our view, the behavior of a leadership team more

concerned with the self-perpetuation of a “lifestyle business” than

with delivering results to shareholders, and of a Board that has

failed to provide effective oversight for years.

Failed Corporate Governance:

Enzo’s corporate governance is structured to maintain the status

quo and benefit insiders at the expense all other stakeholders. The

over-tenured Board has approved a misguided strategy and not held

management accountable for years of underperformance. It is widely

accepted that boards that follow corporate governance best

practices make better decisions that result in positive outcomes

for all shareholders. They clearly define a company’s strategy and

hold the management team accountable for delivering on that

strategy. Enzo desperately needs fresh perspective in the boardroom

in order to address numerous governance deficiencies,

including:

- Dual Chairman/CEO as compared to the overwhelming majority of

Russell 3000 companies that have separated the two positions;3

- Chairman/CEO holds a 44-year tenure;

- CFO is on the Board with a running 43-year tenure;

- Average director tenure is 20+ years as compared to an average

of 11-13 years for the Russell 3000;4

- Average director age is 65;

- Classified Board as compared to the majority of Russell 3000

companies that elect all their directors annually;5 and

- Shareholders do not have the right to call a special

meeting.

Excessive Compensation for Underperformance:

Consistent losses of shareholder value, consistent promises of

successes just around the corner that never seem to arrive and a

consistent lack of oversight at the Board level appear to be the

hallmarks of Enzo.

Enzo has reported operating losses every year since 2004, with

cumulative negative operating income of -$180 million, excluding

legal expenses and settlements. Yet, during this same period, the

Board approved paying Chairman / CEO Elazar Rabbani and his

brother-in-law CFO Barry Weiner nearly $32 million, including a

bonus every single year. This figure does not include the annual

related-party payments Mr. Rabbani and Mr. Weiner receive in

exchange for leasing the Farmingdale lab facility to the Company.

In 2018, Mr. Rabbani and Mr. Weiner each received roughly $600,000

under this arrangement. Additionally, in 2018 while the stock

cratered -59% over the course of the year, Mr. Rabbani and Mr.

Weiner were paid $2.7 million not including the related party

payments.

We believe this unacceptable performance coupled with Enzo’s

hallmark of declining profitability is a direct result of

management’s defective strategy and lack of execution, making the

excessive compensation even more troubling. A truly independent and

competent Board would not reward management for such dramatic

long-term fundamental underperformance, and would instead have long

ago aligned leadership’s compensation plan with the level of value

generated for shareholders.

The Opportunity at Enzo

In spite of the decades of poor oversight and mismanagement,

Enzo has a collection of businesses and assets that, with a sound

growth strategy, more prudent expense structure, appropriate

capital allocation, and effective, independent oversight could be

worth significantly more than the value currently ascribed by the

market.

The bulk of the value at Enzo could be unlocked through three

factors:

- A new corporate strategy that acknowledges Enzo’s strengths and

weaknesses as well as the broader market realities;

- A sale of non-core assets; and

- Once Enzo is generating cash, return of excess cash to

shareholders.

Enzo’s attempts to launch a new model for the diagnostic

marketplace has overburdened the business with unnecessary

expenses. Enzo has neither the scale nor the expertise to execute

on this strategy and attempting to do so puts the whole enterprise

at risk. Enzo is too small today and building out a sales force

would be too costly for Enzo to successfully market the “labs to

labs” business whereby Enzo will serve as the “central capability”

for smaller labs.6 Investor’s recognition of this fact is a

significant factor of the share price underperformance over the

years.

Instead, Enzo should focus on the inherent strengths of its

lab’s location in a high-density population market and strong

relationships with existing customers. Building on those two

strengths coupled with prudent cost cuts could return that segment

to profitability.

With respect to the life sciences division, Enzo is correct to

look to strategic partnerships to accelerate growth. The failure to

consummate any meaningful partnerships over the years is, we

believe, a result of management failures and weak Board oversight

as well as Enzo’s highly litigious reputation in the industry.

Without change, shareholders will continue to see the pattern of

promises without follow-through. However, we believe the vast

expertise and extensive networks of our candidates will put Enzo in

a position to execute strategic partnerships that can quickly

accelerate growth in the life sciences division.

Enzo has a very valuable patent portfolio of 343 patents and 157

patents pending as evidenced by $117 million of settlements since

2001. Unfortunately, Enzo’s legal expenses over that period were

$99 million.7 Not only has decades of patent litigation at Enzo

harmed the Company’s reputation, impairing its ability to form

partnerships for growth, but the litigation has not produced an

attractive return for shareholders. Instead of continuing to

litigate, Enzo should look to monetize non-core patents. This would

provide an immediate, substantial cash inflow to the business,

while also signaling to potential strategic partners that Enzo is

looking to work together in good faith in the future.

The therapeutics division has value to a strategic buyer, but at

Enzo it has proved to be a distraction to management and the

Company as a whole. Instead of periodically promoting one potential

therapy or another, only to see it fail to progress beyond a Phase

I or Phase II trial, Enzo should sell the division to a buyer with

a proven track record of successful therapeutic development.

Divesting therapeutics would provide the best risk adjusted value

for Enzo shareholders.

Following the right sizing of the clinical services cost

structure, accelerated growth in the life sciences division, the

sale of non-core IP, and the sale of the therapeutics division,

Enzo could have a cash balance that matches or exceeds the current

market capitalization of the business today. Under those

assumptions, shareholders are getting $87 million of revenue for

free today when peers for the clinical services division and life

sciences division trade for roughly 2.2x revenue and 6.5x revenue,

respectively. Applying those multiples to each segment implies

nearly 3x upside from the current share price.

Clearly, there is substantial opportunity at Enzo for all

shareholders. However, the current, misguided strategy is resulting

in increasing expenses and a declining cash balance. The current

Board cannot, in our view, achieve Enzo’s full potential. Immediate

change is needed.

Our Solution for Enzo

It is our view that Enzo’s Board is entrenched, detached and

more focused on self-perpetuation than the concerns of other

shareholders. Its seeming acceptance of negative returns, insider

dealings, and constant misallocation of capital is simply

unacceptable. Each day the current Board remains in place the

status quo continues – and shareholders suffer.

HDF believes two new independent directors will be able to

refocus Enzo’s Board and swiftly deliver value for shareholders.

After an extensive search, HDF has identified two extremely

qualified Board candidates who we believe, upon election and

subject to their fiduciary duties, will:

- Bring new and necessary perspectives to the Board;

- Develop a better strategic plan for the business;

- Be immediately impactful in addressing the Company’s bloated

cost structure;

- Hold management accountable for its performance;

- Deliver on the potential of strategic partnerships to grow the

business;

- Restructure executive compensation in a manner that is aligned

with shareholder interests; and

- Evaluate the full range of strategic alternatives available to

create shareholder value.

HDF’s highly-qualified director candidates, who will truly

represent and act in the best interests of all shareholders, will

realign the Company’s operating and growth strategy and create

significant value at Enzo, are:

Fabian Blank: Healthcare Advisor and Investor

Operational Expertise – Substantial operational and growth

experience in healthcare space

- Mr. Blank is a senior healthcare executive with a broad and

diversified operational background across multiple areas of the

healthcare industry and substantial experience advising companies

like Enzo on healthcare strategy, digitalization, disruption, and

growth.

- Mr. Blank is an Independent Non-Executive Director of Georgia

Healthcare Group PLC, an integrated healthcare group that is prime

listed on the London Stock Exchange. His primary focus is on

guiding the group through its digitalization and growth ambitions

across its services-, pharma-, laboratory- and insurance

assets.

- Mr. Blank serves as an Advisory Board Member of GYANT.com, a

US-based health tech company providing artificial intelligence

enabled patient engagement services to HMOs and other healthcare

players. He is particularly focused on establishing the company’s

business in Europe.

- Mr. Blank is the Non-Executive Chairman of Recover Health Ltd.,

an Israeli digital health startup focused on developing a digital

platform to increase the quality of life of both stroke survivors

and caregivers.

- From 2013 to 2016, Mr. Blank was the CEO and Co-owner of the

Meduna Klinik Group, a privately held clinic group specialized on

post-acute services. He successfully grew revenues and EBITDA in a

highly competitive market before consummating a successful sale to

a private equity buyer.

- From 2000 to 2013, he was at McKinsey & Company, Inc.,

where he also served as a Partner of the firm. He served technology

and healthcare clients from various settings of acute, rehab, labs

or polyclinics on growth topics, with operational presence in over

20 countries.

- He holds a graduate business management degree (Diplom

Kaufmann) from the HHL Leipzig Graduate School of Management and

completed additional studies at University of Trier, Boston

University’s Questrom School of Business and ESADE in Barcelona,

Spain.

Peter (Pete) Clemens: Director of Vituro Health

Financial Expertise – Public healthcare company CFO

- Mr. Clemens has a distinguished career in healthcare serving in

multiple senior finance roles and is a two-time public company

healthcare CFO with significant turnaround, growth, operational,

and M&A experience. During his tenures, shareholders of his

past companies saw annualized returns of 33.7% and 38.0%,

respectively.

- He is currently the Director of Vituro Health and Chairman of

the Samford University Board of Overseers.

- From 2011 to 2015, Mr. Clemens served as the CFO of Surgical

Care Affiliates, providing valuable guidance through an IPO

process, transitioning from private equity ownership, and several

years of robust growth for the company.

- From 1995 to 2010, he worked at Caremark where he held multiple

senior finance roles for over 15 years and was CFO of the company

as they successfully completed a $21B merger of equals with CVS

Corporation after over a decade of tremendous growth and outsized

returns to shareholders.

- Mr. Clemens previously served on the board of DSI Renal, a

privately-owned dialysis company that was sold to Fresenius in

September of 2011.

- Mr. Clemens began his career in credit and lending roles at

both AmSouth Bank and Wachovia Bank.

- He holds a Bachelor’s degree from Samford University and an MBA

in Finance from Vanderbilt University.

The status quo is not what Enzo needs. We believe the current

Board lacks the leadership, objectivity and perspective to hold

management accountable and make decisions that are in the best

interests of all shareholders. For months, HDF has attempted to

engage in productive dialogue with the Company to reconstruct the

Board. Our strong preference was to work privately in a

constructive manner with the goal of greatly improving corporate

governance while attempting to avoid the difficulties and

distractions of a proxy battle. The Company’s response has been

unproductive and discouraging, while highlighting the deep-seated

issues resulting from the Company’s lack of leadership and

oversight.

Without shareholder involvement, we believe management will

continue to benefit as shareholders continue to suffer. Therefore,

we are nominating our candidates for election to the Board at the

2019 Annual Meeting of Shareholders.

Sincerely,

Harbert Discovery Fund, LP

Harbert Discovery Co-Investment Fund I, LP

Kenan Lucas, Managing Director and Portfolio Manager of Harbert

Discovery Fund GP, LLC and Harbert Discovery Co-Investment Fund I

GP, LLC

SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT AND

OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES FROM THE

STOCKHOLDERS OF ENZO BIOCHEM, INC. BY HARBERT DISCOVERY FUND, LP,

HARBERT DISCOVERY FUND GP, LLC, HARBERT DISCOVERY CO-INVESTMENT

FUND I, LP, HARBERT DISCOVERY CO-INVESTMENT FUND I GP, LLC, HARBERT

FUND ADVISORS, INC., HARBERT MANAGEMENT CORPORATION, JACK BRYANT,

KENAN LUCAS, AND RAYMOND HARBERT WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION

RELATING TO THE PARTICIPANTS IN SUCH PROXY SOLICITATION. WHEN

COMPLETED, A DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WILL BE

MAILED TO STOCKHOLDERS OF ENZO BIOCHEM, INC. AND WILL ALSO BE

AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S

WEBSITE AT HTTP://WWW.SEC.GOV. INFORMATION RELATING TO THE

PARTICIPANTS IN SUCH PROXY SOLICITATION IS CONTAINED IN THE

SCHEDULE 13D, AS ORIGINALLY FILED ON APRIL 8, 2019 AND AS MOST

RECENTLY AMENDED ON SEPTEMBER 17, 2019. EXCEPT AS OTHERWISE

DISCLOSED IN SUCH SCHEDULE 13D, THE PARTICIPANTS HAVE NO INTEREST

IN ENZO BIOCHEM, INC.

Important Disclosure THIS STATEMENT CONTAINS OUR CURRENT

VIEWS ON THE VALUE OF SECURITIES OF ENZO BIOCHEM, INC. (“ENZO”).

OUR VIEWS ARE BASED ON OUR ANALYSIS OF PUBLICLY AVAILABLE

INFORMATION AND ASSUMPTIONS WE BELIEVE TO BE REASONABLE. THERE CAN

BE NO ASSURANCE THAT THE INFORMATION WE CONSIDERED IS ACCURATE OR

COMPLETE, NOR CAN THERE BE ANY ASSURANCE THAT OUR ASSUMPTIONS ARE

CORRECT. WE DO NOT RECOMMEND OR ADVISE, NOR DO WE INTEND TO

RECOMMEND OR ADVISE, ANY PERSON TO PURCHASE OR SELL SECURITIES AND

NO ONE SHOULD RELY ON THIS STATEMENT OR ANY ASPECT OF THIS

STATEMENT TO PURCHASE OR SELL SECURITIES OR CONSIDER PURCHASING OR

SELLING SECURITIES. THIS STATEMENT DOES NOT PURPORT TO BE, NOR

SHOULD IT BE READ, AS AN EXPRESSION OF ANY OPINION OR PREDICTION AS

TO THE PRICE AT WHICH ENZO’S SECURITIES MAY TRADE AT ANY TIME. AS

NOTED, THIS STATEMENT EXPRESSES OUR CURRENT VIEWS ON ENZO. OUR

VIEWS AND OUR HOLDINGS COULD CHANGE AT ANY TIME WITHOUT NOTICE AND

WE MAKE NO COMMITMENT TO UPDATE THIS STATEMENT IN THE EVENT OUR

VIEWS OR HOLDINGS CHANGE. INVESTORS SHOULD MAKE THEIR OWN DECISIONS

REGARDING ENZO AND ITS PROSPECTS WITHOUT RELYING ON, OR EVEN

CONSIDERING, ANY OF THE INFORMATION CONTAINED IN THIS

STATEMENT.

About Harbert Discovery Fund (HDF) HDF invests in a

concentrated portfolio of publicly traded small capitalization

companies in the US and Canada. We perform significant due

diligence on each portfolio company prior to investing. In addition

to researching all publicly available information and meeting with

management, our diligence includes substantial primary research

with industry experts, consultants, bankers, customers and

competitors. We often spend months or years researching ideas

before making an investment decision and we only invest in

companies that we believe are significantly undervalued, and where

there is the potential for change to enhance or accelerate value

creation. In an effort to unlock this potential value, we seek to

work directly with the boards and management teams of our portfolio

companies privately and collaboratively, engaging with them on a

range of factors including governance, board composition, corporate

strategy, capital allocation, strategic alternatives and

operations. We have effected positive, fundamental changes at our

current and past investments through this behind-the-scenes,

constructive approach. HDF currently has board representation at

three of our portfolio companies. In each case, changes to the

board were agreed upon privately and it is our strong preference in

every investment to avoid the unnecessary distractions and costs of

a public proxy campaign.

About Harbert Management Corporation (HMC) HMC is an

alternative asset management firm with approximately $6.6 billion

in regulatory assets under management as of September 1, 2019. HMC

currently sponsors nine distinct investment strategies with

dedicated investment teams. Additional information about HMC can be

found at www.harbert.net.

1Source: Bloomberg as of August 31, 2019.

Note: 2018 Proxy Peer Group performance calculated as an equal

weight index.

2 Source: Company filings.

3

https://www.russellreynolds.com/en/Insights/thought-leadership/Documents/TCB-Corporate-Board-Practices-2019.pdf

4

https://corpgov.law.harvard.edu/2019/05/07/corporate-board-practices-in-the-sp-500-and-russell-3000-2019-edition/

5 All of the five largest U.S. mutual funds, the Council of

Institutional Investors, the largest public pension funds, and the

leading proxy advisory firms (ISS and Glass Lewis) have adopted

policies that support the annual election of directors and oppose

board classification. See proxy voting guidelines for Fidelity,

Vanguard, American Funds, Franklin Mutual Advisers, and T. Rowe

Price; Council of Institutional Investors, Policies on Corporate

Governance (2016); CalPERS, Global Principles of Accountable

Corporate Governance (2010); Institutional Shareholder Services,

U.S. Proxy Voting Summary Guidelines (2013), and Glass Lewis &

Co., Proxy Paper Guidelines.

6 Enzo third quarter and nine months operating results press

release dated June 10, 2019.

7 SEC filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190917005689/en/

Investor Contact Okapi Partners LLC Bruce Goldfarb /

Chuck Garske / Jason Alexander, 212-297-0720 info@okapipartners.com

Media Contact Sloane & Company Dan Zacchei / Sarah

Braunstein, 212-486-9500 dzacchei@sloanepr.com /

sbraunstein@sloanepr.com

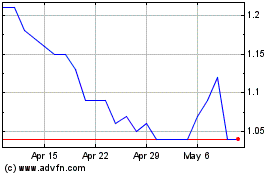

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Apr 2023 to Apr 2024