By Tim Mullaney

If investors had to sum up utility stocks in a word, many would

probably say "predictable."

Known for having above-average dividends and stable earnings in

all kinds of markets, these investments tend to attract investors

seeking to play defense rather than pursue growth.

But some money managers say the sector could become less

predictable in coming years, maybe even a little exciting. The

global focus on climate change is shaking up the industry, they

say, and the U.S. presidential election could shake it up even

more.

So far this year, utility stocks have lagged behind the broader

market, hurt by a sharp drop in electricity demand in the first

half of 2020 amid the coronavirus lockdowns. While the S&P 500

has returned around 8.25% year to date, the utility stocks in the

index have fallen almost 1%. The S&P utilities sector had risen

33.7% from year end 2018 to the 2020 high set on Feb. 18.

Some investors say utility shares are still too expensive, but

others say the industry is in the midst of a transition that could

give utiity shares a boost.

Utilities, they say, are pouring billions of dollars into new

plants to generate electricity from renewable sources such as wind

and sunlight -- and preparing for new demand as the nation's auto

and truck fleets shift from running on petroleum products to clean

electricity. The move toward renewable power could accelerate if

Joe Biden wins the U.S. presidential election in November, analysts

say, as the Democratic nominee has proposed extending tax credits

to promote the adoption of green technologies.

The result, some of the sector's fans say, is that savings on

fuel could enable utilities to boost profits and remain solid

dividend payers, even as consumers are spared major increases in

electric bills.

"Investors have to think about utilities differently," says Rob

Thummel, senior portfolio manager at Tortoise Capital, which runs a

series of energy portfolios, including the $9.1 million mutual fund

Tortoise Energy Evolution Fund (TOPTX). "There's more potential for

growth than there has been."

Wind and sun

U.S. utilities are on course to build 100,000 megawatts of new

wind and solar-powered electricity plants over the next 15 years,

enough to replace almost 10% of all of the power produced today,

according to S&P Global Market Intelligence.

The expanding roster of power companies vowing to reduce carbon

emissions includes Minneapolis-based Xcel Energy, a leader in

building wind power plants. Xcel has promised to cut carbon

emissions 80% by 2030 and to be carbon-free by 2050. American

Electric Power, the Columbus, Ohio-based utility that delivers

power to customers in 11 states, has pledged an 80% reduction by

2050, and Edison International, the parent of Southern California

Edison, vows to do the same by 2030.

The shift to renewable power in the U.S. would likely speed up

if Mr. Biden wins, analysts say. He has pledged to rejoin the Paris

Climate Accord as part of a broader $1.7 trillion plan to combat

climate change and promised to make electricity carbon-neutral by

2035. In 2017, President Trump withdrew the U.S. from the Paris

accord, which calls on the U.S. to commit to reducing

greenhouse-gas emission 26% to 28% from 2005 levels by 2025.

"We have an underweight recommendation on the sector based on

fundamental forecasts and price momentum, but that could change

with a Biden-Harris victory," says CFRA Research investment

strategist Sam Stovall.

Pricey or not?

Others, however, believe utility stocks are still too expensive.

Who is right depends on which metric you look at, says Morningstar

utility analyst Travis Miller.

On a price-to-earnings basis, they are expensive. The S&P

utility sector was recently trading at about 19 times this year's

earnings and 18 times 2021 estimates, compared with 25 times and 20

times for the S&P 500.

But utilities traditionally trade at a discount because of their

lower growth rate, which for many investors is offset by their

relatively high dividends. Top dividend-paying utilities like Duke

Energy, for example, may offer yields above 4%.

If you compare dividend yields in the utility sector to interest

rates on investments like bonds, they are historically cheap, Mr.

Miller says.

"The returns are good, slow and steady," says Paige Meyer,

utilities analyst at CFRA Research in Washington. "That's why

Warren Buffett likes utilities."

The industry's biggest challenge will be boosting growth, even

if going green helps profit margins, says Ethan Zindler, head of

Americas research at Bloomberg NEF. Along with switching to

renewable power, the big push on climate has been to make buildings

and manufacturing more energy-efficient -- which has pushed

electricity usage in the U.S. below 2008 levels, with a sharp drop

expected as figures come in for 2020, thanks to the lockdowns, he

says.

"The demand numbers haven't fluctuated that much, but more stuff

gets built because it is getting cheaper," Mr. Zindler says. "If I

had to pick a threat to utilities, it's not overinvestment, it's

that demand for the product is not growing."

It all comes down to whether investors, who were used to holding

utilities as a no-fuss investment, will be willing to stick with

them as they continue to go through wrenching change. And whether

utilities, which have been adding renewables rapidly for a decade,

can continue to offset the capital costs of new plants with fuel

savings, which so far has led to electricity prices for most rate

payers declining in inflation-adjusted dollars, according to Labor

Department data.

"This transition should translate into earnings and dividend

growth," Mr. Miller says. "The key is to get customers on board

with any one-time costs that may spring up."

Mr. Mullaney is a writer in Maplewood, N.J. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

October 18, 2020 11:14 ET (15:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

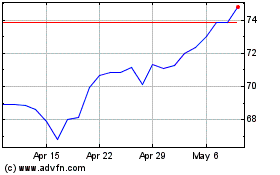

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024