falsefalse00008270520000092103

0000827052

2019-08-30

2019-08-30

0000827052

exch:XASE

eix:SouthernCaliforniaEdisonCompanyMember

eix:CumulativePreferredStockSeriesFourPointZeroEightPercentMember

2019-08-30

2019-08-30

0000827052

exch:XASE

eix:SouthernCaliforniaEdisonCompanyMember

eix:CumulativePreferredStockSeriesFourPointTwoFourPercentMember

2019-08-30

2019-08-30

0000827052

exch:XASE

eix:SouthernCaliforniaEdisonCompanyMember

eix:CumulativePreferredStockSeriesFourPointThreeTwoPercentMember

2019-08-30

2019-08-30

0000827052

exch:XASE

eix:SouthernCaliforniaEdisonCompanyMember

eix:CumulativePreferredStockSeriesFourPointSevenEightPercentMember

2019-08-30

2019-08-30

0000827052

eix:SouthernCaliforniaEdisonCompanyMember

2019-08-30

2019-08-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 30, 2019

|

|

|

|

|

|

|

|

|

|

|

Commission

File Number

|

|

Exact Name of Registrant

as specified in its charter

|

|

State or Other Jurisdiction of

Incorporation or Organization

|

|

IRS Employer

Identification Number

|

|

1-9936

|

|

EDISON INTERNATIONAL

|

|

California

|

|

95-4137452

|

|

1-2313

|

|

SOUTHERN CALIFORNIA EDISON COMPANY

|

|

California

|

|

95-1240335

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2244 Walnut Grove Avenue

|

|

2244 Walnut Grove Avenue

|

|

(P.O. Box 976)

|

|

(P.O. Box 800)

|

|

Rosemead,

|

California

|

91770

|

|

Rosemead,

|

California

|

91770

|

|

(Address of principal executive offices)

|

|

(Address of principal executive offices)

|

|

(626)

|

302-2222

|

|

|

(626)

|

302-1212

|

|

|

(Registrant's telephone number, including area code)

|

|

(Registrant's telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ☐ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ☐ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ☐ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ☐ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Edison International:

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

EIX

|

NYSE

|

LLC

|

Southern California Edison Company:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Cumulative Preferred Stock, 4.08% Series

|

SCEpB

|

NYSE American LLC

|

|

Cumulative Preferred Stock, 4.24% Series

|

SCEpC

|

NYSE American LLC

|

|

Cumulative Preferred Stock, 4.32% Series

|

SCEpD

|

NYSE American LLC

|

|

Cumulative Preferred Stock, 4.78% Series

|

SCEpE

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This current report and its exhibit include forward-looking statements. Edison International and Southern California Edison Company ("SCE") based these forward-looking statements on their current expectations and projections about future events in light of their knowledge of facts as of the date of this current report and their assumptions about future circumstances. These forward-looking statements are subject to various risks and uncertainties that may be outside the control of Edison International and SCE. Edison International and SCE have no obligation to publicly update or revise any forward-looking statements, whether due to new information, future events, or otherwise. This current report should be read with Edison International's and SCE's combined Annual Report on Form 10-K for the year ended December 31, 2018 and subsequent Quarterly Reports on Form 10-Q. Additionally, Edison International and SCE provide direct links to Edison International and SCE presentations, documents and other information at www.edisoninvestor.com (Events and Presentations) in order to publicly disseminate such information.

|

|

|

|

Item 7.01

|

Regulation FD Disclosure

|

Members of Edison International management will use the information in the presentation attached hereto as Exhibit 99.1 in meetings with institutional investors and analysts and at investor conference presentations. The attached presentation will also be posted on www.edisoninvestor.com.

2021 General Rate Case Filing

On August 30, 2019, Edison International's subsidiary, Southern California Edison ("SCE"), filed its 2021 General Rate Case ("GRC") application for the three-year period 2021 - 2023. SCE is requesting that the California Public Utilities Commission ("CPUC") authorize SCE's Test Year 2021 revenue requirement of $7.601 billion, an increase of $1.155 billion over the 2020 GRC authorized revenue requirement. Including the impact of anticipated lower kWh sales in 2021 and $87.1 million of one-time memorandum account recoveries, this represents a 12.7% increase over presently authorized total rates. SCE's 2021 GRC request also includes proposed revenue requirement increases of $400 million in 2022 and $531 million in 2023.

The critical drivers of SCE's 2021 GRC request include the infrastructure and programs necessary to implement California's ambitious public policy goals, including wildfire mitigation, de-carbonization of the economy through electrification and integration of distributed energy resources across a rapidly modernizing grid, while continuing to provide safe, reliable, and affordable service to customers.

SCE's requested increase to its revenue requirement in the 2021 GRC application is due in large part to the pressing need for SCE to undertake extraordinary measures to reduce wildfire risk, as set forth in SCE's Grid Safety & Resiliency Program and Wildfire Mitigation Plan filings. The proposed increase is also driven by spending previously authorized in SCE's 2018 GRC and placed into service during this cycle and SCE's 2021 GRC depreciation study proposal.

Based on the 2021 GRC application, SCE forecasts a $25.6 billion total capital program requirement for 2019 through 2023, which includes the CPUC-jurisdictional GRC capital expenditures, approved non-GRC CPUC capital spending, all non-GRC wildfire-related spending and Federal Energy Regulatory Commission ("FERC") capital spending. If all capital expenditures requested in SCE’s 2021 GRC were approved by the CPUC, SCE forecasts total weighted-average rate base for CPUC- and FERC-jurisdictional capital expenditures increasing to $40.8 billion by 2023, a six-year compound annual growth rate of 7.7% starting from year-end 2017.

Based on management judgment using historical precedent of previously authorized amounts and potential permitting delays and other operational considerations, a range case has been provided reflecting a 10% reduction on the total capital forecast from 2021 through 2023 and a 10% reduction on FERC capital spending and non-GRC programs only for 2020. Based on the range case, SCE forecasts a $23.8 billion total capital program requirement for 2019 through 2023, which includes the CPUC-jurisdictional GRC capital expenditures, approved non-GRC

CPUC capital spending, all non-GRC wildfire-related spending and FERC capital spending. This implies total weighted-average rate base for CPUC- and FERC-jurisdictional capital expenditures increasing to $39.0 billion by 2023, a six-year compound annual growth rate of 6.9% starting from year-end 2017.

SCE's 2021 GRC request excludes the revenue requirement associated with the approximately $1.6 billion in wildfire risk mitigation capital expenditures that SCE will exclude from the equity portion of SCE's rate base under Assembly Bill 1054. SCE's total capital program forecast includes these expenditures, but these are excluded from the weighted-average rate base forecast.

Due in large part to the fact that SCE’s wildfire mitigation-related enhanced vegetation management, inspection activities, and grid hardening programs are relatively new, it is likely that the related recorded costs will vary from SCE's forecasts. Accordingly, SCE has proposed establishing a two-way Wildfire Mitigation Balancing Account and a two-way Vegetation Management Balancing Account for these costs. Additionally, the test year 2021 request includes $624 million for expenses necessary to maintain wildfire-related insurance coverage. Due to changing insurance market conditions, it is likely that the recorded wildfire insurance premiums will vary from SCE's forecasts. Accordingly, SCE has proposed establishing a two-way Risk Management Balancing Account for these premiums.

Pursuant to revised CPUC Rules, SCE is required to file its full GRC application by September 1, 2019. SCE is requesting that the CPUC issue a final decision by the end of 2020. If the decision is delayed, SCE will, consistent with CPUC practice in prior GRCs, request the CPUC to issue an order directing that the authorized revenue requirement changes be effective January 1, 2021, even if the decision is issued subsequent to that date.

Edison International and SCE cannot predict the revenue requirement the CPUC will ultimately authorize for 2021 through 2023 or forecast the timing of a final decision.

2020 Cost of Capital Application

As previously disclosed, in April 2019, SCE filed an application with the CPUC for authority to establish its authorized cost of capital for utility operations for a three-year term, beginning January 1, 2020. In its application, SCE requested a return on common equity of 16.60% for 2020 and committed to reduce its return on common equity ("ROE") if there was a material reduction in its wildfire cost recovery risk due to regulatory or legislative reform.

On August 1, 2019, as a result of the anticipated impact of Assembly Bill 1054 on SCE's wildfire cost recovery risk, SCE updated its requested ROE to 11.45% for 2020. Based on the capital structure and cost factors discussed in SCE's initial application and SCE's updated ROE request, SCE's proposed weighted average rate of return on rate base is 8.28% for 2020.

Based on the revenue requirement approved in SCE's 2018 GRC, SCE's proposed cost of capital and capital structure will result in a projected revenue requirement increase in 2020 of approximately $204 million from revenue currently included in bundled electric rates of $9.4 billion.

|

|

|

|

Item 9.01

|

Financial Statements and Exhibits

|

See the Exhibit Index below.

EXHIBIT INDEX

|

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

99.1

|

|

|

104

|

The cover page of this report formatted in Inline XBRL (included as Exhibit 101)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EDISON INTERNATIONAL

|

|

|

(Registrant)

|

|

|

|

|

|

/s/ Aaron D. Moss

|

|

|

Aaron D. Moss

|

|

|

Vice President and Controller

|

Date: August 30, 2019

|

|

|

|

|

|

|

SOUTHERN CALIFORNIA EDISON COMPANY

|

|

|

(Registrant)

|

|

|

|

|

|

/s/ Aaron D. Moss

|

|

|

Aaron D. Moss

|

|

|

Vice President and Controller

|

Date: August 30, 2019

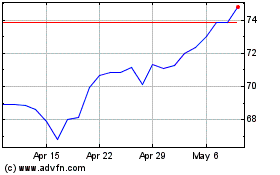

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024