California Utilities Seek Higher ROE Due to Fire Risks

April 22 2019 - 7:58PM

Dow Jones News

By Josh Beckerman

PG&E Corp.'s (PCG) Pacific Gas & Electric Co. and Edison

International's (EIX) Southern California Edison are seeking a

higher return on equity as they deal with issues include wildfire

risks, according to cost-of-capital proposals filed Monday.

Pacific Gas & Electric said it expects to fund up to $28

billion in energy infrastructure investments over the next four

years. The utility's proposal filed with the California Public

Utilities Commission calls for increasing return on equity to 16%

from 10.25%.

Southern California Edison is seeking a 10.6% base return on

common equity, compared with 10.3% currently, plus an additional

ROE of 6% to "compensate investors for the higher risks associated

with uncertain state policies for utility cost recovery and

liability" from California's wildfires.

Write to Josh Beckerman at josh.beckerman@wsj.com

(END) Dow Jones Newswires

April 22, 2019 19:43 ET (23:43 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

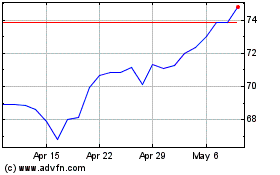

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024