Southern California Edison Files with FERC to Increase Return on Equity

April 11 2019 - 10:01AM

Dow Jones News

By Michael Dabaie

Edison International's (EIX) Southern California Edison Thursday

filed a request with the Federal Energy Regulatory Commission to

include an adjustment for the company's wildfire risk in the

authorized return on equity for the portion of its business

regulated by FERC.

SCE cited "dramatic, material changes" to its regulatory and

financial conditions. The extraordinary risk stems from uncertainty

about state policies for cost recovery and liability resulting from

California wildfires in recent years, the company said.

The company's overall request is for a ROE of 17.12%.

The company estimated the average residential customer would see

an increase of about $2.20 per month on the FERC-regulated portion

of their SCE bill if the request is approved.

FERC has jurisdiction over SCE transmission equipment that is

under the operational control of the California Independent System

Operator and must authorize all rates related to the use of these

assets, which comprise about 20% of the company's rate base.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

April 11, 2019 09:46 ET (13:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

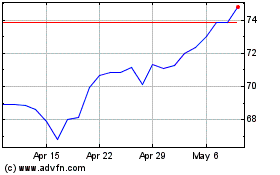

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024