Eldorado Gold Corporation (“Eldorado” or “the

Company”) is pleased to announce that it has entered into a

definitive agreement (the “Agreement”) with G Mining Ventures Corp.

(“GMIN”) to divest its Tocantinzinho Project (“TZ”) located in

Brazil (the “Transaction”).

Under the terms of the Agreement, Eldorado will

receive:

- Minimum upfront

consideration of US$50 million, comprised of a minimum US$20

million in cash and 19.9% of GMIN shares upon closing of the

Transaction.

- Deferred

consideration of US$60 million in cash to be paid subject to TZ

commencing commercial production, payable on the first anniversary

of commercial production (“Deferred Consideration”).

- GMIN has the

option to defer 50% of the Deferred Consideration at a cost of US$5

million, in which case US$30 million is payable upon the first

anniversary of the commencement of commercial production and US$35

million is payable upon the second anniversary of the commencement

of commercial production.

- Upon closing of

the Transaction, Eldorado and GMIN will enter into an investor

rights agreement (“Investor Rights Agreement”), which will grant

Eldorado certain rights for so long as it maintains 10% ownership

of GMIN common shares on an undiluted basis. The Investor Rights

Agreement will include a customary lockup period until the earlier

of (i) two years, and (ii) GMIN making a positive construction

decision on TZ, the right for Eldorado to participate in future

equity offerings by GMIN in order to maintain the greater of 19.9%

of GMIN’s share capital and Eldorado’s pro rata ownership interest

prior to the offering, and additional customary rights and

restrictions for a transaction of this nature.

“This transaction provides Eldorado with

immediate value for TZ, while also retaining meaningful exposure to

future value creation through our equity stake in GMIN,” said

George Burns, Eldorado’s President and Chief Executive Officer. “TZ

will be a cornerstone asset for GMIN, a team with a strong track

record of building mines on time and on budget. Together with our

local Brazilian team, we believe they are the right group to

responsibly advance the asset and we look forward to following and

supporting their success. On behalf of the management team and

Company, I would like to take this opportunity to thank Lincoln

Silva and his team in Brazil for all their contributions, hard work

and dedication to the Company. We wish them all the best moving

forward.”

The Transaction is subject to customary closing

conditions, including required regulatory approvals. The

Transaction is expected to close in the fourth quarter of 2021.

Trinity Advisors Corporation acted as financial advisors to

Eldorado, and Fasken acted as Eldorado’s legal counsel.

About Eldorado Gold

Eldorado is a gold and base metals producer with mining,

development and exploration operations in Turkey, Canada, Greece,

Romania, and Brazil. The Company has a highly skilled and dedicated

workforce, safe and responsible operations, a portfolio of

high-quality assets, and long-term partnerships with local

communities. Eldorado's common shares trade on the Toronto Stock

Exchange (TSX: ELD) and the New York Stock Exchange (NYSE:

EGO).

Contact

Investor Relations

Lisa Wilkinson, VP, Investor Relations604.757

2237 or 1.888.353.8166 lisa.wilkinson@eldoradogold.com

Cautionary Note about Forward-looking

Statements and Information

Certain of the statements made and information

provided in this press release are forward-looking statements or

information within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Often, these forward-looking statements and

forward-looking information can be identified by the use of words

such as "plans", "expects", "is expected", "budget", “continue”,

“projected”, "scheduled", "estimates", "forecasts", "intends",

"anticipates", or "believes" or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved.

Forward-looking statements or information

contained in this release include, but are not limited to,

statements or information with respect to: completion of the

Transaction, including timing thereof; Receipt of any cash and GMIN

shares payable to Eldorado on closing of the Transaction, including

the amount of such cash and GMIN shares; TZ achieving commercial

production and receipt of any Deferred Consideration, ability to

GMIN to advance TZ and to build a mine, including cost and timing

thereof, and ability to meet the conditions to completing the

Transaction, including receipt of require regulatory approvals. .

Forward-looking statements and forward-looking information by their

nature are based on assumptions and involve known and unknown

risks, market uncertainties and other factors, which may cause the

actual results, performance or achievements of the Company to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements or information.

We have made certain assumptions about the

forward-looking statements and information, including assumptions

about: our ability to completion the Transaction, and the timing

thereof, ability to satisfy all conditions of closing, including

receipt of all required regulatory approvals, the ability of GMIN

to advance TZ, including to achieve commercial production, and the

timing thereof; the amount of the cash and GMIN shares comprising

the consideration paid at the closing of the Transaction; and the

price of the GMIN shares. how the world-wide economic and social

impact of COVID-19 is managed and the duration and extent of the

COVID-19 pandemic; timing and cost of construction and exploration;

the future price of gold and other commodities; the global

concentrate market; exchange rates; anticipated costs, expenses and

working capital requirements; the impact of acquisitions,

dispositions, suspensions or delays on our business; and the

ability to achieve our goals. In particular, except where otherwise

stated, we have assumed a continuation of existing business

operations on substantially the same basis as exists at the time of

this release.

Even though our management believes that the

assumptions made and the expectations represented by such

statements or information are reasonable, there can be no assurance

that the forward-looking statement or information will prove to be

accurate. Many assumptions may be difficult to predict and are

beyond our control.

Furthermore, should one or more of the risks,

uncertainties or other factors materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in forward-looking statements or information.

These risks, uncertainties and other factors include, among others:

inability to complete the transaction, including the inability to

meet the conditions to closing the Transaction, including receipt

of required regulatory approvals, and the timing thereof; inability

of GMIN to advance TZ to commercial production; inability of GMIN

to pay the Deferred Consideration; global outbreaks of infectious

diseases, including COVID-19; timing and cost of construction, and

the associated benefits; recoveries of gold and other metals;

geopolitical and economic climate (global and local), risks related

to mineral tenure and permits; gold and other commodity price

volatility; information technology systems risks; continued

softening of the global concentrate market; risks regarding

potential and pending litigation and arbitration proceedings

relating to our business, properties and operations; expected

impact on reserves and the carrying value; the updating of the

reserve and resource models and life of mine plans; mining

operational and development risk; financing risks; foreign country

operational risks; risks of sovereign investment; regulatory risks

and liabilities including environmental regulatory restrictions and

liability; discrepancies between actual and estimated production;

mineral reserves and resources and metallurgical testing and

recoveries; additional funding requirements; currency fluctuations;

community and non-governmental organization actions; speculative

nature of gold exploration; dilution; share price volatility and

the price of our common shares; competition; loss of key employees;

and defective title to mineral claims or properties, as well as

those risk factors discussed in the sections titled

“Forward-Looking Statements” and "Risk factors in our business" in

the Company's most recent Annual Information Form & Form 40-F.

The reader is directed to carefully review the detailed risk

discussion in our most recent Annual Information Form filed on

SEDAR and EDGAR under our Company name, which discussion is

incorporated by reference in this release, for a fuller

understanding of the risks and uncertainties that affect the

Company’s business and operations.

The inclusion of forward-looking statements and

information is designed to help you understand management’s current

views of our near- and longer-term prospects, and it may not be

appropriate for other purposes.

There can be no assurance that forward-looking

statements or information will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Accordingly, you should not place

undue reliance on the forward-looking statements or information

contained herein. Except as required by law, we do not expect to

update forward-looking statements and information continually as

conditions change.

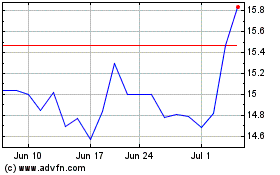

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

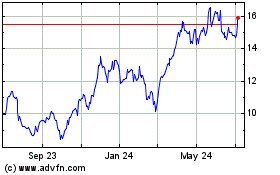

Eldorado Gold (NYSE:EGO)

Historical Stock Chart

From Apr 2023 to Apr 2024