ADRs End Lower; ArcelorMittal, British American Tobacco and Argentine companies Trade Actively

June 12 2019 - 6:24PM

Dow Jones News

International stocks trading in New York closed lower on

Wednesday.

The S&P/BNY Mellon index of American depositary receipts

fell 0.8% to 138.83. The European index fell 0.6% to 130.30. The

Asian index decreased 1% to 158.19. The Latin American index

decreased 0.8% to 240.42. And the emerging-markets index went down

1.2% to 295.13.

ArcelorMittal SA (MT), British American Tobacco PLC (BTI) and

several Argentine companies were among those with ADRs that traded

actively.

ArcelorMittal's shares may have reached rock bottom after losing

around 50% of their value since early 2018, Goldman Sachs says.

While the European steel market remains tough, share prices for

steelmakers have dropped well below intrinsic valuations,

suggesting they don't have much further to fall, the bank says.

ArcelorMittal's proposed production cuts at its European mills,

lower iron-ore prices and a potential review of EU tariffs all

contribute to an improved outlook for the sector, Goldman says. The

bank upgrades ArcelorMittal to buy from neutral and shaves its

target price to EUR19.50 from EUR20.50. ADRs of ArcelorMittal fell

3% to $16.43.

British American Tobacco's overall group growth was encouraging,

though its loss of cigarette market share in the year so far is set

to cause jitters, says Jefferies. The brokerage says the market is

likely to upgrade its earnings per share forecasts by 1-2% after

the company's comments on the full-year outlook for sales, pretax

earnings, adjusted operating margins and earnings per share. Still,

it notes that one of BAT's core strengths has been continued share

gains for the last several years. "The fact that cigarette volume

share is down 10 basis points in the year to date is, therefore,

likely to cause some concern," Jefferies analysts say. ADRs of

British American Tobacco fell 5% to $39.96.

Shares of Argentine companies with American depository receipts

that trade in New York rose amid recent press reports that

Argentina may be talking with its larger neighbor, Brazil, about a

currency union. The ADRs for Pampa Energia SA (PAM) and Edenor SA

(EDN), two utilities, rose 12.6% and 9.3% respectively, while

construction-materials company Loma Negra Compania Industrial

Argentina SA's (LOMA) shares jumped 6.4% and natural-gas firm

Transportadora de Gas del Sur SA (TGS) shares gained 4.6%. "A

currency union is obviously a good idea in principle, especially

for Argentina, whose institutions have yet to discover the secret

sauce behind price stability," investment manager Ashmore said.

(END) Dow Jones Newswires

June 12, 2019 18:09 ET (22:09 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

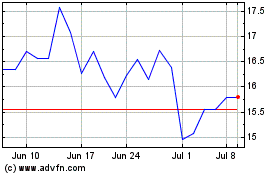

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Mar 2024 to Apr 2024

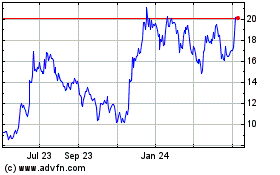

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Apr 2023 to Apr 2024