Current Report Filing (8-k)

June 07 2022 - 6:44AM

Edgar (US Regulatory)

0001367644false00013676442022-06-062022-06-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 06, 2022

EMERGENT BIOSOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33137 | | 14-1902018 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

400 Professional Drive, Suite 400,

Gaithersburg, Maryland 20879

(Address of principal executive offices, including zip code)

(240) 631-3200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.001 per share | EBS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.02 Termination of Material Definitive Agreement.

On July 2, 2020, Emergent BioSolutions Inc., through its wholly-owned subsidiary, Emergent Manufacturing Operations Baltimore, LLC (collectively, the “Company”), entered into a manufacturing services agreement (the “Agreement”) with Janssen Pharmaceuticals, Inc., one of the Janssen Pharmaceutical Companies of Johnson & Johnson (“Janssen”), for large-scale drug substance manufacturing of Johnson & Johnson’s investigational SARS-CoV-2 vaccine, Ad26.COV2-S, recombinant based on the AdVac® technology (the “Product”).

As previously disclosed, on June 6, 2022, the Company provided to Janssen a notice of material breach of the Agreement for, among other things, failure by Janssen (i) to provide the Company the requisite forecasts of the required quantity of Product to be purchased by Janssen under the Agreement and (ii) to confirm Janssen’s intent to not purchase the requisite minimum quantity of the Product pursuant to the Agreement, and instead, wind-down the Agreement ahead of fulfilling these minimum requirements.

On the afternoon of June 6, 2022, the Company received from Janssen a purported written notice of termination (the “Janssen Notice”) of the Agreement for asserted material breaches of the Agreement, including failure by the Company to perform its obligations in compliance with current good manufacturing practices (cGMP) or other applicable laws and regulations and failure to supply Janssen with the Product. Janssen alleges that the breaches are not curable and, therefore, the termination is to be effective as of July 6, 2022. The Company disputes Janssen’s allegations of material breach and disagrees that the breaches are not curable.

The Agreement provides, in pertinent part, the following terms, among others, for notice, cure, and termination: Janssen has the right to terminate the Agreement by written notice to the Company (a) if thirty (30) days following receipt by the Company of written notice from Janssen of a material breach of the Agreement, the Company has failed to start and diligently pursue the cure of such breach, and (b) upon twelve (12) months’ advance written notice if Janssen decides to stop selling the Product. The Company has the right to terminate the Agreement by written notice to Janssen if thirty (30) days following receipt by Janssen of written notice from the Company of a material breach of the Agreement Janssen has failed to cure such breach. Upon notification of termination, the Company agrees to promptly cease performing services under the Agreement and to take reasonable steps to mitigate expenses incurred therewith. Termination of the Agreement will not affect the obligation of either party to make any payments for which it is liable prior to or upon such termination, including payment by Janssen for certain raw materials purchased pursuant to the Agreement prior to its termination, and payment by Janssen for all services related to the required minimum quantity.

Under the terms of the Agreement, the Company had agreed to provide contract development and manufacturing (CDMO) services to produce drug substance at large scale for up to five years, originally valued at approximately $480 million in the first two contract years. The Janssen Notice asserts that Janssen has no obligation to make any post-termination payments and further that Janssen is entitled to recoup certain fees paid to the Company. The Company’s position remains that the payments owed to the Company by Janssen, if the Agreement were to be terminated by either party pursuant to any of its terms, would be in the estimated range of approximately $125 million to $420 million.

Safe Harbor Statement

This Current Report on Form 8-K (“Current Report”) includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact, including statements related to the estimated range of payments the Company will receive if the agreement were to be terminated, are forward-looking statements. The reader should not unduly rely on any forward-looking statements, which speak only as of the date of this Current Report. There are a number of factors that could cause actual results to differ from the forward-looking statements, including, but not limited to, those identified in the risk factors contained in our periodic reports filed with the Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| EMERGENT BIOSOLUTIONS INC. |

| | | |

| Dated: June 07, 2022 | By: | /s/ RICHARD S. LINDAHL |

| | Name: Richard S. Lindahl

Title: Executive Vice President, Chief Financial

Officer and Treasurer |

| | |

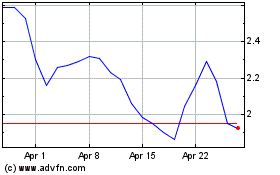

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Apr 2023 to Apr 2024