Emergent BioSolutions Inc. (NYSE: EBS) today reported financial

results for the third quarter ended September 30, 2021.

"Emergent's core products and service businesses

remain strong as evidenced by our accomplishments this quarter,"

said Robert G. Kramer, president and CEO of Emergent BioSolutions.

"We have secured renewals of multiple medical countermeasure supply

contracts, made pipeline advancements, implemented organizational

enhancements that better serve our customers, and are pursuing new

business prospects. We are confident in our 2024 growth plan and

remain focused on our mission - to protect and enhance life."

FINANCIAL HIGHLIGHTS (1)

|

($ in millions, except per share amounts) |

Q3 2021 |

Q3 2020 |

% Change |

|

Total revenues |

$329.0 |

$385.2 |

(15)% |

|

Net (loss) income |

($32.7) |

$39.5 |

* |

|

Net (loss) income per diluted share |

($0.61) |

$0.73 |

* |

|

Adjusted net (loss) income (2) |

($19.3) |

$119.0 |

* |

|

Adjusted net (loss) income (2) per diluted share |

($0.36) |

$2.19 |

* |

|

Adjusted EBITDA (2) |

($3.3) |

$168.1 |

* |

|

($ in millions, except per share amounts) |

YTD 2021 |

YTD 2020 |

% Change |

|

Total revenues |

$1,069.5 |

$972.4 |

10% |

|

Net income |

$41.6 |

$119.7 |

(65)% |

|

Net income per diluted share |

$0.77 |

$2.23 |

(65)% |

|

Adjusted net income (2) |

$82.3 |

$225.1 |

(63)% |

|

Adjusted net income (2) per diluted share |

$1.52 |

$4.20 |

(64)% |

|

Adjusted EBITDA (2) |

$169.7 |

$339.5 |

(50)% |

|

* % change is greater than 100% |

Q3 2021 AND OTHER RECENT

BUSINESS

- Announced a mutual

agreement with the U.S. Department of Health and Human Services

(HHS) to terminate the Company's 2012 Center for Innovation in

Advanced Development and Manufacturing (CIADM) contract to

establish a public-private partnership for pandemic preparedness,

along with all associated task orders, including the 2020 task

order to reserve capacity and expand manufacturing for third-party

COVID-19 vaccine and therapeutic candidates

- Initiated a pivotal Phase 3 safety and

immunogenicity study to evaluate CHIKV VLP, the company's

single-dose chikungunya virus virus-like particle vaccine

candidate

- Secured a

multi-year development and manufacturing agreement with Providence

Therapeutics, valued at approximately $90 million, for its mRNA

COVID-19 vaccine candidate

- Received a contract

modification to the 2016 AV7909 (Anthrax Vaccine Adsorbed with

Adjuvant) development and procurement contract with the U.S.

government, valued at approximately $399 million, to deliver doses

of AV7909 to the Strategic National Stockpile (SNS) over 18

months

- Received Orphan

Drug designation from the U.S. Food and Drug Administration (FDA)

for AV7909

- Announced inclusion of the company's

SARS-CoV-2 Immune Globulin Intravenous (Human) (COVID-HIG)

plasma-derived therapy in a Phase 3 safety and efficacy study,

INSIGHT-012, sponsored by the National Institute of Allergy and

Infectious Diseases of the National Institutes of Health,

evaluating hyperimmune intravenous immunoglobulin for outpatient

COVID-19 treatment

Q3 2021 FINANCIAL PERFORMANCE

(1)

(I) Quarter Ended September 30, 2021

(Q3)

Revenues

|

($ in millions) |

Q3 2021 |

Q3 2020 |

% Change |

|

Product sales, net (3): |

|

|

$133.3 |

$88.8 |

50% |

|

|

$80.7 |

$1.0 |

* |

|

|

$15.6 |

$73.9 |

(79)% |

|

|

$40.9 |

$38.5 |

6% |

|

Total product sales, net |

$270.5 |

$202.2 |

34% |

|

Contract development and manufacturing (CDMO): |

|

|

$112.6 |

$53.1 |

* |

|

|

($71.0) |

$104.0 |

* |

|

Total CDMO |

$41.6 |

$157.1 |

(74)% |

|

Contracts and grants |

$16.9 |

$25.9 |

(35)% |

|

Total revenues |

$329.0 |

$385.2 |

(15)% |

|

* % change is greater than 100% |

Product Sales, net NARCAN Nasal

SprayFor Q3 2021, revenues from NARCAN® (naloxone HCI) Nasal Spray

increased $44.5 million as compared to Q3 2020. The increase is

driven by continued growth in unit sales to the U.S. public

interest and commercial retail markets as well as customer channels

in Canada.

ACAM2000For Q3 2021, revenues from ACAM2000®

(Smallpox (Vaccinia) Vaccine, Live) increased $79.7 million as

compared to Q3 2020. The increase is largely driven by the timing

of deliveries to the U.S. government (USG), specifically the

Strategic National Stockpile (SNS). The revenues recognized in Q3

2021 are a result of a recent option exercise in July 2021 by the

USG valued at approximately $182 million. The Company expects to

deliver the remaining units under this option exercise during the

fourth quarter of 2021.

Anthrax vaccinesFor Q3 2021, revenues from Anthrax

vaccines decreased $58.3 million as compared to Q3 2020. The

decrease is largely driven by timing of deliveries to the USG,

specifically the SNS. The Company received an AV7909 contract

modification in September 2021 wherein the Company expects to

deliver additional doses of AV7909 over 18 months from the date of

execution of the contract modification valued at approximately $399

million.

Other (4)For Q3 2021, revenues from other product

sales were consistent as compared to Q3 2020. During the quarter,

an increase in sales of VIGIV [Vaccinia Immune Globulin Intravenous

(Human)] was offset by a decline in sales of BAT® [Botulism

Antitoxin Heptavalent (A, B, C, D, E, F, G) - (Equine)], largely

driven by timing of deliveries to the USG, specifically the

SNS.

CDMO Services For Q3 2021, revenue

from contract development and manufacturing services increased

$59.5 million as compared to Q3 2020. This increase is largely due

to arrangements with innovator manufacturers to address the

COVID-19 pandemic, specifically Johnson & Johnson, as well as

out-of-period adjustments (see discussion below entitled

"Out-of-Period Adjustments").

CDMO LeasesDuring Q3 2021, the

Company determined that it was necessary to classify the

public-private partnership with the Biomedical Advanced Research

and Development Authority (BARDA) as a lease rather than a

stand-ready arrangement. This change has been considered as part of

the immaterial out-of-period adjustment (see discussion below

entitled "Out-of-Period Adjustments"). As such, the Company is now

separately disclosing lease revenues on the statement of

operations. For Q3 2021, revenue from contract development and

manufacturing leases decreased $175.0 million largely due to a

reduction in lease revenues associated with the public-private

partnership with BARDA as the Company recognized revenue of $85.9

million in Q3 2020 and recorded a reversal of revenue of $86.0

million during Q3 2021 based on the lack of cash collections under

the arrangement in recent months. In November 2021, the Company and

BARDA mutually terminated this arrangement ending the

public-private partnership with BARDA. As a result of the

termination, the Company expects to record CDMO lease revenue in

the fourth quarter 2021 to reflect the remaining unrecognized

contract value and associated payments of approximately

$155.7 million.

Contracts and GrantsFor Q3 2021,

revenues from contracts and grants decreased $9.0 million as

compared to Q3 2020. The decrease is primarily due to a decrease in

activities associated with the COVID-HIG therapeutic product

candidate. As a result of the CIADM base contract termination, the

Company expects to record approximately $60.0 million of contracts

and grants revenue during the fourth quarter 2021.

Operating Expenses

|

($ in millions) |

Q3 2021 |

Q3 2020 |

% Change |

|

Cost of product sales |

$103.2 |

$120.2 |

(14)% |

|

Cost of CDMO |

$114.3 |

$28.8 |

* |

|

Research and development |

$49.6 |

$84.4 |

(41)% |

|

Selling, general and administrative |

$82.1 |

$75.5 |

9% |

|

Amortization of intangible assets |

$14.5 |

$15.0 |

(3)% |

Cost of Product SalesFor Q3 2021,

cost of product sales decreased $17.0 million as compared to Q3

2020. The decrease in cost is primarily due to significant items in

the prior year that did not recur in the current period offset by

higher volume of product sales, specifically NARCAN® Nasal Spray

and ACAM2000. During Q3 2020, the Company incurred charges of $30.2

million related to the Company's contingent consideration

liabilities and $13.8 million related to a write-down of inventory

balances related to the Company's travel health vaccines.

Cost of CDMO For Q3 2021, cost of

CDMO increased $85.5 million as compared to Q3 2020. The increase

in cost is primarily due to increases in CDMO services and

additional investments in manufacturing and quality systems and

capabilities, largely from the Company's arrangements to address

the COVID-19 pandemic and out-of-period adjustments (see discussion

below entitled "Out-of-Period Adjustments").

Research and Development For Q3

2021, research and development expenses decreased $34.8 million as

compared to Q3 2020. The decrease is primarily due to a decline in

costs associated with the Company's COVID-HIG therapeutic product

candidate and a non-recurring charge for an impairment of the

Company's in-process research and development (IPR&D)

intangible asset of $29.0 million during Q3 2020.

Selling, General and

AdministrativeFor Q3 2021, selling, general and

administrative expenses increased $6.6 million due to

organizational growth in headcount and professional services in

support of the expansion of the Company's business operations.

Out-of-Period AdjustmentsDuring

the three months ended September 30, 2021, the Company made

immaterial out-of-period adjustments related to its revenue

recognition policy for contract development and manufacturing

(CDMO) services and classification of the BARDA public-private

partnership as a lease. These adjustments resulted in out-of-period

increases of $38.3 million in CDMO service revenue, $36.9

million of costs of product sales and CDMO services for the three

months ended September 30, 2021 with a net impact to income

before income taxes of $1.4 million.

Additional Financial

InformationProduct Margin and Adjusted Product

Margin (2)

|

($ in millions) |

Q3 2021 |

Q3 2020 |

% Change |

|

Product margin |

$167.3 |

$82.0 |

* |

|

Product margin % (product margin divided by product revenues

(2)) |

62% |

41% |

21% |

|

Adjusted product margin |

$168.2 |

$126.0 |

33% |

|

Adjusted product margin % (adjusted product margin divided by

product revenues (2)) |

62% |

62% |

—% |

For Q3 2021, product margin increased

$85.3 million as compared to Q3 2020. Adjusted product margin

increased $42.2 million as compared to Q3 2020. The increase

in gross margin is primarily due to the $44.0 million of charges

related to inventory write-offs of the travel health vaccines and

the Company's contingent consideration liabilities which were not

recurring in Q3 2021. Adjusted product margin percent is consistent

from Q3 2021 as compared to Q3 2020.

CDMO Margin and Adjusted CDMO Margin

(2)

|

($ in millions) |

Q3 2021 |

Q3 2020 |

% Change |

|

CDMO margin |

($1.7) |

$24.3 |

* |

|

CDMO margin % (CDMO margin divided by CDMO service revenues

(2)) |

(2)% |

46% |

(48)% |

|

Adjusted CDMO margin |

$13.3 |

$42.4 |

(69)% |

|

Adjusted CDMO margin % (adjusted CDMO margin divided by adjusted

CDMO revenues (2)) |

10% |

60% |

(50)% |

For Q3 2021, CDMO margin decreased

$26.0 million as compared to Q3 2020. Adjusted CDMO margin

decreased $29.1 million as compared to Q3 2020. The decline in

CDMO margin and adjusted CDMO margin is primarily due to an

increase in CDMO service activities, increase in costs due to

out-of-period adjustments (see discussion below entitled

"Out-of-Period Adjustments") and additional costs to support

remediation efforts for our COVID-19 manufacturing activities.

CDMO Metrics

|

CDMO Backlog Rollforward |

($ in millions) |

|

Beginning backlog (6/30/2021) (5) |

$1,097.0 |

|

Contract development and manufacturing (revenue recognized in Q3

2021): |

|

|

CDMO services |

($112.6) |

|

CDMO leases |

$71.0 |

|

CDMO revenues recognized in Q3 2021 |

($41.6) |

|

New Business - Initial value of contracts secured (6) |

$117.7 |

|

Impact of CIADM termination and other modifications |

($171.1) |

|

Ending backlog (9/30/2021) (5) |

$1,002.0 |

|

($ in millions) |

As of Q3 2021 |

As of Q2 2021 |

% Change |

|

CDMO backlog (5) |

$1,002.0 |

$1,097.0 |

(9)% |

|

CDMO opportunity funnel (7) |

$283.7 |

$672.0 |

(58)% |

Capital Expenditures

|

($ in millions) |

Q3 2021 |

Q3 2020 |

% Change |

|

Gross capital expenditures |

$55.2 |

$45.7 |

21% |

|

- Capital expenditures reimbursed |

$5.7 |

$25.1 |

(77)% |

|

Net capital expenditures |

$49.5 |

$20.6 |

* |

|

Gross capital expenditures as a % of total revenues |

17% |

12% |

5% |

|

Net capital expenditures as a % of total revenues |

15% |

5% |

10% |

For Q3 2021, capital expenditures increased largely

due to the Company's continued investments associated with

increased capacity and capabilities at the Company's Rockville

facility. The increase in gross capital expenditures was offset by

reimbursements of $5.7 million related to arrangements funded by

the USG.

2021 FINANCIAL FORECAST

For full year 2021, the Company's updated forecast

includes the following financial metrics:

|

($ in millions) |

Updated 2021 Forecast |

Previous 2021 Forecast (As of July 29,

2021) |

|

Total revenues |

$1,700 - $1,800 |

$1,700 - $1,900 |

|

|

$400 - $420 |

$305 - $325 |

|

|

$250 - $260 |

$280 - $310 |

|

|

$200 - $220 |

$185 - $205 |

|

|

$600 - $650 |

$765 - $875 |

|

Adjusted EBITDA (2) |

$500 - $550 |

$620 - $720 |

|

Adjusted net income (2) |

$315 - $350 |

$395 - $470 |

|

Gross margin (2) |

54% - 56% |

61% - 63% |

The Company's financial forecast for 2021 includes

the following additional considerations:

Revised Considerations

- Gross margin reflects the impact of

the Q3 2021 performance as well as expectations for the remainder

of the year.

- CDMO services revenue reflects the

impact of the mutual agreement with HHS to end the Company's

involvement in the CIADM program and to close out remaining

obligations under the CIADM base contract and related task orders.

This agreement reduces the total contract value to be realized

under the 2020 task order to $470.9 million from $650.8

million.

Unchanged Considerations

- Narcan® Nasal Spray revenues assume

the naloxone market remains competitive and incorporates the impact

of at least one new branded entrant into the market (one branded

competitor entered the market during the third quarter of 2021), as

well as no generic entrant into the market prior to the anticipated

appellate decision related to the pending patent litigation, which

is expected by the end of 2021.

- Anthrax vaccines revenue is expected

to continue to primarily reflect procurement of AV7909 under the

terms of the Company's existing contract with BARDA at a more

normalized annual level.

- ACAM2000®vaccine revenues incorporate

the expected full delivery of product under the $182 million option

exercise received in July 2021 as well as other international

sales.

- CDMO services revenue reflects the

continued manufacturing of Johnson & Johnson's COVID-19 vaccine

bulk drug substance. On July 29th, the Company announced that it

was informed by the FDA that it can resume production at its

Bayview manufacturing facility.

- Total revenues, specifically other

product sales, are expected to be impacted due to the Company's

assumption that a new raxibacumab contract will be awarded later

than previously planned.

- R&D expenses are expected to

reflect continued pipeline progress across the portfolio, including

the assumption of at least one Phase 3 launch and one Biologics

License Application (BLA)/Emergency Use Authorization (EUA)

filing.

- Capital expenditures, net of

reimbursement, are expected to be in a range of 8% to 9% of total

revenues, reflecting ongoing investments in capacity and capability

expansions in support of the Company's CDMO services business and

product portfolio.

FOOTNOTES

(1) All financial information incorporated within

this release is unaudited. (2) See "Reconciliation of Net Income to

Adjusted Net Income," "Reconciliation of Net Income to Adjusted

EBITDA," "Reconciliation of Product Margin and Adjusted Product

Margin," "Reconciliation of CDMO Margin and Adjusted CDMO Margin"

and "Reconciliation of Net Research and Development Expenses" for a

definition of terms and the reconciliation tables.(3) Product

sales, net are reported net of variable consideration including

returns, rebates, wholesaler fees and prompt pay discounts. (4)

Other can include a combination of sales of any of the following

products: BAT, VIGIV, Anthrasil, raxibacumab, RSDL, Trobigard,

Vivotif, and Vaxchora.(5) CDMO backlog is defined as estimated

remaining contract value as of the indicated period pursuant to

signed contracts, the majority of which is expected to be

recognized over the next 24 months.(6) CDMO new business is defined

as initial value of contracts secured as well as incremental value

of existing contracts modified within the indicated period and is

incorporated into Backlog.(7) CDMO opportunity funnel is defined as

proposal values from new work with new customers, new work with

existing customers and extensions/expansions of existing contracts

with existing customers that, if converted to new business, the

majority of which is expected to be realized over the next 24

months. This excludes any value associated with an extension of the

commercial supply agreement (CSA) with Johnson & Johnson.

CONFERENCE CALL, PRESENTATION SUPPLEMENT

AND WEBCAST INFORMATION

Company management will host a conference call at

5:00 pm (Eastern Time) today, November 4, 2021, to discuss

these financial results. The conference call and presentation

supplement can be accessed from the Company's website or through

the following:

|

Live Teleconference Information:Dial in: [US] (855) 766-6521;

[International] (262) 912-6157Conference ID: 2937668 |

|

|

Live Webcast Information:Visit

https://edge.media-server.com/mmc/p/nitqgk48 for the

webcast. |

|

A replay of the call can be accessed from the

Emergent website.

ABOUT EMERGENT BIOSOLUTIONS

INC.

Emergent BioSolutions is a global life sciences

company whose mission is to protect and enhance life. Through our

specialty products and contract development and manufacturing

services, we are dedicated to providing solutions that address

public health threats. Through social responsibility, we aim to

build healthier and safer communities. We aspire to deliver peace

of mind to our patients and customers so they can focus on what's

most important in their lives. In working together, we envision

protecting or enhancing 1 billion lives by 2030. For more

information, visit our website and follow us on LinkedIn, Twitter,

and Instagram.

RECONCILIATION OF NON-GAAP

MEASURES

This press release contains financial measures

(Adjusted Net Income, Adjusted EBITDA (Earnings Before

Interest, Taxes, Depreciation and Amortization), Adjusted Gross

Margin, Adjusted Product Gross Margin, Adjusted CDMO Gross Margin,

Adjusted Revenues and Net Research and Development

Expenses) that are considered "non-GAAP" financial

measures under applicable Securities and Exchange Commission rules

and regulations. These non-GAAP financial measures should be

considered supplemental to and not a substitute for financial

information prepared in accordance with generally accepted

accounting principles. The Company's definition of these non-GAAP

measures may differ from similarly titled measures used by others.

For its non-GAAP measures, the Company adjusts for specified items

that can be highly variable or difficult to predict, or reflect the

non-cash impact of charges or accounting changes. As needed, such

adjustments are tax effected utilizing the federal statutory tax

rate for the U.S., except for changes in the fair value of

contingent consideration as the vast majority is non-deductible for

tax purposes. The Company views these non-GAAP financial measures

as a means to facilitate management's financial and operational

decision-making, including evaluation of the Company's historical

operating results and comparison to competitors' operating results.

These non-GAAP financial measures reflect an additional way of

viewing aspects of the Company's operations that, when viewed with

GAAP results and the reconciliations to the corresponding GAAP

financial measure, may provide a more complete understanding of

factors and trends affecting the Company's business. For more

information on these non-GAAP financial measures, please see the

tables captioned "Reconciliation of Net Income to Adjusted Net

Income," "Reconciliation of Net Income to Adjusted EBITDA,"

"Reconciliation of Product Margin and Adjusted Product Margin,"

"Reconciliation of CDMO Margin and Adjusted CDMO Margin,"

"Reconciliation of Gross Margin and Adjusted Gross Margin" and

"Reconciliation of Net Research and Development Expenses" included

at the end of this release.

The determination of the amounts that are excluded

from these non-GAAP financial measures are a matter of management

judgment and depend upon, among other factors, the nature of the

underlying expense or income amounts. Because non-GAAP financial

measures exclude the effect of items that will increase or decrease

the Company's reported results of operations, management strongly

encourages investors to review the Company's consolidated financial

statements and publicly filed reports in their entirety.

SAFE HARBOR STATEMENT

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Any statements, other than statements of

historical fact, including, without limitation, our financial

guidance and related projections and statements regarding our

ability to meet such projections in the anticipated timeframe, if

at all; statements regarding the strength of our 2024 growth plan;

annual expectations underlying gross margin; the timing of

deliveries of AV7909; the full delivery in 2021 of vaccines

procured under the July 2021 ACAM2000® option exercise; the

strength of the naloxone market and the number of generic and new

branded naloxone entrants expected to enter into the market this

year; new business prospects; enhanced customer service; capacity

expansion in our pipeline portfolio; our CDMO backlog and

opportunity funnel; total contract value; the timing and level of

future revenues; the continued manufacturing of bulk drug substance

for Johnson & Johnson's COVID-19 vaccine; the expectation of at

least one new Phase 3 launch and one BLA/EUA by year end and the

level of capital expenditures; and any other statements containing

the words "will," "believes," "expects," "anticipates," "intends,"

"plans," "targets," "forecasts," "estimates" and similar

expressions in conjunction with, among other things, discussions of

the Company's outlook, financial performance or financial

condition, financial and operation goals, product sales, government

development or procurement contracts or awards, government

appropriations, manufacturing capabilities, and the timing of

certain clinical trials and regulatory approvals are

forward-looking statements. These forward-looking statements are

based on our current intentions, beliefs and expectations regarding

future events. We cannot guarantee that any forward-looking

statement will be accurate.

The reader should realize that if underlying

assumptions prove inaccurate or unknown risks or uncertainties

materialize, actual results could differ materially from our

expectations. Readers are, therefore, cautioned not to place undue

reliance on any forward-looking statement. Any forward-looking

statements speak only as of the date of this press release, and,

except as required by law, we do not undertake to update any

forward-looking statement to reflect new information, events or

circumstances. There are a number of important factors that could

cause our actual results to differ materially from those indicated

by such forward-looking statements, including the availability of

U.S. government funding for procurement of AV7909 and/or BioThrax

or ACAM2000 and our other U.S. government procurement and

development contracts; the timing of our submission of an

application for and our ability to secure licensure of AV7909 from

the FDA within the anticipated timeframe, if at all; our ability to

perform under our contracts with the U.S. government, including the

timing of and specifications relating to deliveries; whether we

will realize the full benefit of our investments in additional

manufacturing and quality control systems; our ability to meet our

commitments to continued quality and manufacturing compliance at

our manufacturing facilities and the potential impact on our

ability to continue production of bulk drug substance for Johnson

& Johnson's COVID-19 vaccine; our ability to provide CDMO

services for the development and/or manufacture of product

candidates of our customers at required levels and on required

timelines; our ability and the ability of our contractors and

suppliers to maintain compliance with current good manufacturing

practices and other regulatory obligations; our ability to obtain

and maintain regulatory approvals for our product candidates and

the timing of any such approvals; changes to U.S. government

priorities for the SNS; our ability to negotiate additional U.S.

government procurement or follow-on contracts for our public health

threat products that have expired or will be expiring; the

negotiation of further commitments or contracts related to the

collaboration and deployment of capacity toward future commercial

manufacturing under our CDMO contracts; our ability to develop a

safe and effective treatment for COVID-19 and obtain EUA or

approval of such treatment from the FDA; our ability to comply with

the operating and financial covenants required by our senior

secured credit facilities and our 3.875% Senior Unsecured Notes due

2028; the procurement of products by U.S. government entities under

regulatory exemptions prior to approval by the FDA and

corresponding procurement by government entities outside of the

United States under regulatory exemptions prior to approval by the

corresponding regulatory authorities in the applicable country; the

full impact of COVID-19 disease on our markets, operations and

employees as well as those of our customers and suppliers; the

impact on our revenues from and duration of declines in sales of

our vaccine products that target travelers due to the reduction of

international travel caused by the COVID-19 pandemic; our ability

to identify and acquire companies, businesses, products or product

candidates that satisfy our selection criteria; the success of our

commercialization, marketing and manufacturing capabilities and

strategy; and the accuracy of our estimates regarding future

revenues, expenses, capital requirements and needs for additional

financing. The foregoing sets forth many, but not all, of the

factors that could cause actual results to differ from our

expectations in any forward-looking statement. The reader should

consider this cautionary statement as well as the risk factors

identified in our periodic reports filed with the Securities and

Exchange Commission when evaluating our forward-looking

statements.

|

Investor ContactRobert BurrowsVice President,

Investor Relationsburrowsr@ebsi.com(240) 413-1917 |

Media ContactMatt HartwigSenior Director, Media

Relationshartwigm@ebsi.com (240) 760-0551 |

|

Emergent BioSolutions Inc. |

|

Condensed Consolidated Balance Sheets |

|

(unaudited, in millions, except per share

data) |

| |

|

|

|

|

|

September 30, 2021 |

|

December 31, 2020 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

403.8 |

|

|

$ |

621.3 |

|

|

Restricted cash |

0.2 |

|

|

0.2 |

|

|

Accounts receivable, net |

254.6 |

|

|

230.9 |

|

|

Inventories, net |

364.6 |

|

|

307.0 |

|

|

Prepaid expenses and other current assets |

88.3 |

|

|

36.5 |

|

|

Total current assets |

1,111.5 |

|

|

1,195.9 |

|

|

|

|

|

|

|

Property, plant and equipment, net |

768.7 |

|

|

644.1 |

|

|

Intangible assets, net |

618.6 |

|

|

663.1 |

|

|

Goodwill |

266.5 |

|

|

266.7 |

|

|

Other assets |

102.2 |

|

|

113.4 |

|

|

Total assets |

$ |

2,867.5 |

|

|

$ |

2,883.2 |

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

135.2 |

|

|

$ |

136.1 |

|

|

Accrued expenses |

42.9 |

|

|

46.9 |

|

|

Accrued compensation |

73.4 |

|

|

84.6 |

|

|

Debt, current portion |

31.6 |

|

|

33.8 |

|

|

Other current liabilities |

82.3 |

|

|

83.1 |

|

|

Total current liabilities |

365.4 |

|

|

384.5 |

|

| |

|

|

|

|

Contingent consideration, net of current portion |

5.1 |

|

|

34.2 |

|

|

Debt, net of current portion |

817.3 |

|

|

841.0 |

|

|

Deferred tax liability |

53.0 |

|

|

53.2 |

|

|

Contract liabilities, net of current portion |

45.3 |

|

|

55.5 |

|

|

Other liabilities |

58.7 |

|

|

67.8 |

|

|

Total liabilities |

$ |

1,344.8 |

|

|

$ |

1,436.2 |

|

| |

|

|

|

|

Stockholders' equity: |

|

|

|

|

Preferred stock, $0.001 par value; 15.0 shares authorized, no

shares issued or outstanding |

— |

|

|

— |

|

|

Common stock, $0.001 par value; 200.0 shares authorized, 54.9 and

54.2 shares issued; 53.7 and 53.0 shares outstanding,

respectively |

0.1 |

|

|

0.1 |

|

|

Additional paid-in capital |

816.8 |

|

|

784.9 |

|

|

Treasury stock, at cost, 1.2 common shares |

(39.6 |

) |

|

(39.6 |

) |

|

Accumulated other comprehensive loss, net |

(23.1 |

) |

|

(25.3 |

) |

|

Retained earnings |

768.5 |

|

|

726.9 |

|

|

Total stockholders' equity |

1,522.7 |

|

|

1,447.0 |

|

|

Total liabilities and stockholders' equity |

$ |

2,867.5 |

|

|

$ |

2,883.2 |

|

|

Emergent BioSolutions Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited, in millions, except per share

data) |

| |

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2021 |

2020 |

|

2021 |

2020 |

| |

|

|

|

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

Product sales, net |

$ |

270.5 |

|

$ |

202.2 |

|

$ |

589.6 |

|

$ |

648.9 |

|

|

Contract development and manufacturing: |

|

|

|

|

|

|

|

|

|

Services |

|

112.6 |

|

|

53.1 |

|

|

283.7 |

|

|

102.7 |

|

|

Leases |

|

(71.0 |

) |

|

104.0 |

|

|

132.6 |

|

|

148.7 |

|

|

Total contract development and manufacturing |

|

41.6 |

|

|

157.1 |

|

|

416.3 |

|

|

251.4 |

|

|

Contracts and grants |

|

16.9 |

|

|

25.9 |

|

|

63.6 |

|

|

72.1 |

|

|

Total revenues |

|

329.0 |

|

|

385.2 |

|

|

1,069.5 |

|

|

972.4 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of product sales |

|

103.2 |

|

|

120.2 |

|

|

237.0 |

|

|

287.6 |

|

|

Cost of contract development and manufacturing |

|

114.3 |

|

|

28.8 |

|

|

307.6 |

|

|

68.1 |

|

|

Research and development |

|

49.6 |

|

|

84.4 |

|

|

151.0 |

|

|

175.0 |

|

|

Selling, general and administrative |

|

82.1 |

|

|

75.5 |

|

|

254.2 |

|

|

221.2 |

|

|

Amortization of intangible assets |

|

14.5 |

|

|

15.0 |

|

|

44.5 |

|

|

44.8 |

|

|

Total operating expenses |

|

363.7 |

|

|

323.9 |

|

|

994.3 |

|

|

796.7 |

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

(34.7 |

) |

|

61.3 |

|

|

75.2 |

|

|

175.7 |

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

(8.4 |

) |

|

(7.6 |

) |

|

(25.5 |

) |

|

(22.6 |

) |

|

Other, net |

|

(2.4 |

) |

|

1.3 |

|

|

(2.8 |

) |

|

1.3 |

|

|

Total other income (expense), net |

|

(10.8 |

) |

|

(6.3 |

) |

|

(28.3 |

) |

|

(21.3 |

) |

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

(45.5 |

) |

|

55.0 |

|

|

46.9 |

|

|

154.4 |

|

|

Income taxes |

|

12.8 |

|

|

(15.5 |

) |

|

(5.3 |

) |

|

(34.7 |

) |

|

Net income (loss) |

$ |

(32.7 |

) |

$ |

39.5 |

|

$ |

41.6 |

|

$ |

119.7 |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per common share* |

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.61 |

) |

$ |

0.75 |

|

$ |

0.78 |

|

$ |

2.28 |

|

|

Diluted |

$ |

(0.61 |

) |

$ |

0.73 |

|

$ |

0.77 |

|

$ |

2.23 |

|

|

|

|

|

|

|

|

|

|

|

|

Shares used in computing income (loss) per share |

|

|

|

|

|

|

|

|

|

Basic |

|

53.7 |

|

|

53.0 |

|

|

53.6 |

|

|

52.5 |

|

|

Diluted |

|

53.7 |

|

|

54.3 |

|

|

54.3 |

|

|

53.6 |

|

| |

|

|

|

|

|

|

|

|

|

* Any differences in the calculation of net income per common share

is due to rounding. |

|

Emergent BioSolutions Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(unaudited, in millions) |

|

|

|

|

Nine Months Ended September 30, |

|

|

2021 |

|

2020 |

|

Cash flows (used in) provided by operating activities: |

|

|

|

|

Net income |

$ |

41.6 |

|

|

$ |

119.7 |

|

|

Adjustments to reconcile net income to net cash (used in) provided

by operating activities: |

|

|

|

|

Share-based compensation expense |

32.3 |

|

|

41.0 |

|

|

Depreciation and amortization |

94.6 |

|

|

85.6 |

|

|

Adjustment for prior period lease receivables (Note 10) |

86.1 |

|

|

— |

|

|

Change in fair value of contingent consideration, net |

2.6 |

|

|

31.3 |

|

|

Amortization of deferred financing costs |

3.1 |

|

|

2.4 |

|

|

Deferred income taxes |

0.6 |

|

|

(4.4 |

) |

|

Impairment of IPR&D |

— |

|

|

29.0 |

|

|

Other |

5.1 |

|

|

0.6 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

(114.7 |

) |

|

74.6 |

|

|

Inventories |

(58.0 |

) |

|

(47.6 |

) |

|

Prepaid expenses and other assets |

(54.8 |

) |

|

(61.8 |

) |

|

Accounts payable |

3.5 |

|

|

10.6 |

|

|

Accrued expenses and other liabilities |

(19.3 |

) |

|

4.4 |

|

|

Accrued compensation |

(11.1 |

) |

|

14.5 |

|

|

Contract liabilities |

(19.5 |

) |

|

(9.0 |

) |

|

Net cash (used in) provided by operating activities: |

(7.9 |

) |

|

290.9 |

|

|

Cash flows used in investing activities: |

|

|

|

|

Purchases of property, plant and equipment |

(178.3 |

) |

|

(105.0 |

) |

|

Milestone payment from prior asset acquisition |

— |

|

|

(10.0 |

) |

|

Net cash used in investing activities: |

(178.3 |

) |

|

(115.0 |

) |

|

Cash flows (used in) provided by financing activities: |

|

|

|

|

Principal payments on revolving credit facility |

— |

|

|

(373.0 |

) |

|

Principal payments on term loan facility |

(16.9 |

) |

|

(8.4 |

) |

|

Principal payments on convertible senior notes |

(10.6 |

) |

|

— |

|

|

Proceeds from senior unsecured notes |

— |

|

|

450.0 |

|

|

Proceeds from share-based compensation activity |

12.5 |

|

|

26.6 |

|

|

Debt issuance costs |

— |

|

|

(8.4 |

) |

|

Taxes paid for share-based compensation activity |

(13.5 |

) |

|

(12.8 |

) |

|

Contingent consideration payments |

(2.5 |

) |

|

(2.2 |

) |

|

Net cash (used in) provided by financing activities: |

(31.0 |

) |

|

71.8 |

|

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

(0.3 |

) |

|

(0.5 |

) |

|

Net change in cash, cash equivalents and restricted cash |

(217.5 |

) |

|

247.2 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

621.5 |

|

|

168.0 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

404.0 |

|

|

$ |

415.2 |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

Reconciliation of Net Income to Adjusted

Net Income (1)

|

|

Three Months Ended September 30, |

|

($ in millions, except per share value) |

2021 |

2020 |

Source |

|

Net income (loss) |

($32.7) |

$39.5 |

|

|

Adjustments: |

|

+ Non-cash amortization charges |

15.4 |

15.9 |

Intangible Asset(IA) Amortization,Other Income |

|

+ Changes in fair value of contingent consideration |

0.9 |

30.2 |

Product COGS |

|

+ Impairment of IPR&D intangible asset |

— |

29.0 |

R&D |

|

+ Exit and disposal costs |

— |

17.1 |

COGS, SG&A,Other Income |

|

+ Acquisition-related costs (transaction & integration) |

0.4 |

0.5 |

SG&A |

|

Tax effect |

(3.3) |

(13.2) |

|

|

Total adjustments: |

$13.4 |

$79.5 |

|

|

Adjusted net income (loss) |

($19.3) |

$119.0 |

|

|

Adjusted net income (loss) per diluted share |

($0.36) |

$2.19 |

|

|

|

Nine Months Ended September 30, |

|

($ in millions, except per share value) |

2021 |

2020 |

Source |

|

Net income (loss) |

$41.6 |

$119.7 |

|

|

Adjustments: |

|

+ Non-cash amortization charges |

47.5 |

47.2 |

Intangible Asset(IA) Amortization,Other Income |

|

+ Changes in fair value of contingent consideration |

2.6 |

31.3 |

Product COGS |

|

+ Impairment of IPR&D intangible asset |

— |

29.0 |

R&D |

|

+ Exit and disposal costs |

— |

17.1 |

COGS, SG&A,Other Income |

|

+ Acquisition-related costs (transaction & integration) |

0.7 |

0.5 |

SG&A |

|

Tax effect |

(10.1) |

(19.7) |

|

|

Total adjustments: |

$40.7 |

$105.4 |

|

|

Adjusted net income |

$82.3 |

$225.1 |

|

|

Adjusted net income per diluted share |

$1.52 |

$4.20 |

|

|

($ in millions) |

2021 Full Year Forecast |

Source |

|

Net income |

$260 - $295 |

|

|

Adjustments: |

|

+ Non-cash amortization charges |

64 |

IA Amortization,Other Income |

|

+ Changes in fair value of contingent consideration |

3 |

COGS |

|

+ Acquisition-related costs (transaction & integration) |

1 |

SG&A |

|

Tax effect |

(13) |

|

|

Total adjustments: |

$55 |

|

|

Adjusted net income |

$315 - $350 |

|

Reconciliation of Net Income to Adjusted

EBITDA (1)

|

|

Three Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Net income (loss) |

($32.7) |

$39.5 |

|

Adjustments: |

|

+ Depreciation & amortization |

32.6 |

28.8 |

|

+ Income taxes |

(12.8) |

15.5 |

|

+ Total interest expense, net |

8.3 |

7.5 |

|

+ Changes in fair value of contingent consideration |

0.9 |

30.2 |

|

+ Impairment of IPR&D intangible asset |

— |

29.0 |

|

+ Exit and disposal costs |

— |

17.1 |

|

+ Acquisition-related costs (transaction & integration) |

0.4 |

0.5 |

|

Total adjustments |

$29.4 |

$128.6 |

|

Adjusted EBITDA |

($3.3) |

$168.1 |

|

|

Nine Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Net income (loss) |

$41.6 |

$119.7 |

|

Adjustments: |

|

+ Depreciation & amortization |

94.5 |

85.6 |

|

+ Income taxes |

5.3 |

34.7 |

|

+ Total interest expense, net |

25.0 |

21.6 |

|

+ Changes in fair value of contingent consideration |

2.6 |

31.3 |

|

+ Impairment of IPR&D intangible asset |

— |

29.0 |

|

+ Exit and disposal costs |

— |

17.1 |

|

+ Acquisition-related costs (transaction & integration) |

0.7 |

0.5 |

|

Total adjustments |

$128.1 |

$219.8 |

|

Adjusted EBITDA |

$169.7 |

$339.5 |

|

($ in millions) |

2021 Full Year Forecast |

|

Net income |

$260 - $295 |

|

Adjustments: |

|

+ Depreciation & amortization |

127 |

|

+ Provision for income taxes |

76 - 91 |

|

+ Total interest expense, net |

33 |

|

+ Changes in fair value of contingent consideration |

3 |

|

+ Acquisition-related costs (transaction & integration) |

1 |

|

Total adjustments |

240 - 255 |

|

Adjusted EBITDA |

$500 - $550 |

Reconciliation of Gross Margin and Adjusted

Gross Margin (1)

|

|

Three Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Total revenues |

$329.0 |

$385.2 |

|

- Contract and grants revenues |

(16.9) |

(25.9) |

|

Adjusted revenues |

$312.1 |

$359.3 |

|

|

|

|

|

Cost of product sales |

$103.2 |

$120.2 |

|

Cost of contract development and manufacturing |

$114.3 |

$28.8 |

|

Cost of product sales and cost of contract development and

manufacturing services ("COGS") |

$217.5 |

$149.0 |

|

- Changes in fair value of contingent consideration |

(0.9) |

(30.2) |

|

- Inventory reserves related to Travel Health vaccines |

— |

(13.8) |

|

Adjusted COGS |

$216.6 |

$105.0 |

|

|

|

|

|

Gross margin (adjusted revenues minus COGS) |

$94.6 |

$210.3 |

|

Gross margin % (gross margin divided by adjusted revenues) |

30% |

59% |

|

|

|

|

|

Adjusted gross margin (adjusted revenues minus adjusted COGS) |

$95.5 |

$254.3 |

|

Adjusted gross margin % (adjusted gross margin divided by adjusted

revenues) |

31% |

71% |

|

|

Nine Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Total revenues |

$1,069.5 |

$972.4 |

|

- Contract and grants revenues |

(63.6) |

(72.1) |

|

Adjusted revenues |

$1,005.9 |

$900.3 |

|

|

|

|

|

Cost of product sales |

$237.0 |

$287.6 |

|

Cost of contract development and manufacturing |

$307.6 |

$68.1 |

|

Cost of product sales and cost of contract development and

manufacturing services ("COGS") |

$544.6 |

$355.7 |

|

- Changes in fair value of contingent consideration |

($2.6) |

($31.3) |

|

- Inventory reserves related to Travel Health vaccines |

$— |

($13.8) |

|

Adjusted COGS |

$542.0 |

$310.6 |

|

|

|

|

|

Gross margin (adjusted revenues minus COGS) |

$461.3 |

$544.6 |

|

Gross margin % (gross margin divided by adjusted revenues) |

46% |

60% |

|

|

|

|

|

Adjusted gross margin (adjusted revenues minus adjusted COGS) |

$463.9 |

$589.7 |

|

Adjusted gross margin % (adjusted gross margin divided by adjusted

revenues) |

46% |

66% |

Reconciliation of Product Margin and

Adjusted Product Margin (1)

|

|

Three Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Product revenues |

$270.5 |

$202.2 |

|

|

|

|

|

Cost of product sales (COPS) |

$103.2 |

$120.2 |

|

- Changes in fair value of contingent consideration |

(0.9) |

(30.2) |

|

- Inventory reserves related to Travel Health vaccines |

— |

(13.8) |

|

Adjusted cost of product sales |

$102.3 |

$76.2 |

|

|

|

|

|

Product margin (product revenues minus COPS) |

$167.3 |

$82.0 |

|

Product margin % (product margin divided by product revenues) |

62% |

41% |

|

|

|

|

|

Adjusted gross margin (product revenues minus adjusted COPS) |

$168.2 |

$126.0 |

|

Adjusted gross margin % (adjusted product margin divided by product

revenues) |

62% |

62% |

|

|

Nine Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Product revenues |

$589.6 |

$648.9 |

|

|

|

|

|

Cost of product sales |

$237.0 |

$287.6 |

|

- Changes in fair value of contingent consideration |

(2.6) |

(31.3) |

|

- Inventory reserves related to Travel Health vaccines |

— |

(13.8) |

|

Adjusted COPS |

$234.4 |

$242.5 |

|

|

|

|

|

Gross margin (product revenues minus COPS) |

$352.6 |

$361.3 |

|

Gross margin % (product margin divided by product revenues) |

60% |

56% |

|

|

|

|

|

Adjusted product margin (product revenues minus adjusted COPS) |

$355.2 |

$406.4 |

|

Adjusted product margin % (adjusted product margin divided by

product revenues) |

60% |

63% |

Reconciliation of CDMO Margin and Adjusted

CDMO Margin (1)

|

|

Three Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

CDMO services revenues |

$112.6 |

$53.1 |

|

+ Non-USG lease revenue |

15.0 |

18.1 |

|

Adjusted CDMO service revenues |

$127.6 |

$71.2 |

|

|

|

|

|

Cost of CDMO services |

$114.3 |

$28.8 |

|

|

|

|

|

CDMO margin (CDMO service revenues minus Cost of CDMO

services) |

$(1.7) |

$24.3 |

|

CDMO margin % (CDMO margin divided by CDMO services revenues) |

(2)% |

46% |

|

|

|

|

|

Adjusted CDMO margin (adjusted CDMO services revenues minus Cost of

CDMO services) |

$13.3 |

$42.4 |

|

Adjusted CDMO margin % (adjusted CDMO margin divided by adjusted

CDMO services revenues) |

10% |

60% |

|

|

Nine Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

CDMO services revenues |

$283.7 |

$102.7 |

|

+ Non-USG lease revenue |

50.7 |

18.2 |

|

Adjusted CDMO service revenues |

$334.4 |

$120.9 |

|

|

|

|

|

Cost of CDMO services |

$307.6 |

$68.1 |

|

|

|

|

|

CDMO margin (CDMO service revenues minus Cost of CDMO

services) |

$(23.9) |

$34.6 |

|

CDMO margin % (CDMO margin divided by CDMO services revenues) |

(8)% |

34% |

|

|

|

|

|

Adjusted CDMO margin (adjusted CDMO services revenues minus Cost of

CDMO services) |

$26.8 |

$52.8 |

|

Adjusted CDMO margin % (adjusted CDMO margin divided by adjusted

CDMO services revenues) |

8% |

44% |

Reconciliation of Net Research and

Development Expenses (1)

|

|

Three Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Research and Development Expenses |

$49.6 |

$84.4 |

|

Adjustments: |

|

- Contracts and Grants Revenue |

(16.9) |

($25.9) |

|

- Impairment of IPR&D intangible asset |

— |

(29.0) |

|

Net Research and Development Expenses |

32.7 |

29.5 |

|

Adjusted Revenue (Total Revenue less Contracts and Grants

Revenue) |

312.1 |

$359.3 |

|

Net R&D as % of Adjusted Revenue (Net R&D Margin) |

10% |

8% |

|

|

Nine Months Ended September 30, |

|

($ in millions) |

2021 |

2020 |

|

Research and Development Expenses |

$151.0 |

$175.0 |

|

Adjustments: |

|

- Contracts and Grants Revenue |

(63.6) |

($72.1) |

|

- Impairment of IPR&D intangible asset |

— |

(29.0) |

|

Net Research and Development Expenses |

87.4 |

73.9 |

|

Adjusted Revenue (Total Revenue less Contracts and Grants

Revenue) |

1,005.9 |

$900.3 |

|

Net R&D as % of Adjusted Revenue (Net R&D Margin) |

9% |

8% |

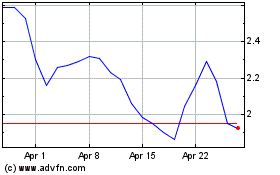

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Apr 2023 to Apr 2024