Emergent BioSolutions Inc. (NYSE: EBS) reported financial results

for the three months ended March 31, 2020.

"Emergent is uniquely positioned to respond to the unprecedented

challenges of the COVID-19 pandemic," said Robert G. Kramer Sr.,

president and chief executive officer of Emergent BioSolutions. “We

are deploying our decades of experience in vaccines and

therapeutics development and manufacturing, our well-established

platform technologies, and our significant development and

manufacturing capabilities. Our goal is to create multiple

innovative solutions to deliver on our commitments to our customers

and patients, while continuing to safeguard our employees.”

FINANCIAL HIGHLIGHTS (unaudited)

|

(in millions) |

Q1 2020 |

Q1 2019 |

$ Change |

% Change |

| Total Revenues |

$192.5 |

$190.6 |

$1.9 |

1.0% |

| Net Loss |

$(12.5) |

$(26.0) |

$13.5 |

51.9% |

| Adjusted Net Income (Loss)

(1) |

$0.3 |

$(5.2) |

$5.5 |

105.8% |

| Adjusted EBITDA (1) |

$15.3 |

$8.4 |

$6.9 |

82.1% |

EMERGENT'S RESPONSE TO COVID-19

- Signed a contract development and manufacturing (CDMO)

agreement, valued at $135 million, to be U.S. manufacturing partner

of Johnson & Johnson's lead vaccine candidate for COVID-19.

Negotiations continue on a long-term commercial supply agreement

for large-scale drug substance manufacturing, anticipated to begin

in 2021.

- Initiated development of two investigational plasma-derived

therapies. COVID-Human Immune Globulin (COVID- HIG), a human

plasma-derived product candidate, for which the Company

subsequently received $14.5 million in Health and Human Services

(HHS) funding, is being developed as a potential treatment for

COVID-19 in severe hospitalized and high-risk patients and will be

included in at least one of the studies of the National Institute

of Allergy and Infectious Diseases (NIAID), part of the National

Institutes of Health, evaluating potential treatments for COVID-19.

COVID-Equine Immune Globulin (COVID-EIG) is also being developed as

an equine plasma-derived therapy candidate for potential treatment

of severe disease in humans.

- Signed a CDMO agreement with Novavax, Inc. to provide

development services, drug substance and drug product manufacturing

for its experimental vaccine candidate for COVID-19,

NVX-CoV2373.

- Signed a CDMO agreement with Vaxart, Inc. to provide

development services and drug substance manufacturing to produce

its experimental oral vaccine candidate for COVID-19.

Q1 2020 AND OTHER RECENT BUSINESS

ACCOMPLISHMENTS

- Received agreement from the European Medicines Agency (EMA) and

the U.S. Food and Drug Administration (FDA) on the company’s

proposed development plan to use Serum Neutralizing Antibodies

(SNA) as surrogate endpoint to predict likely clinical benefit of

CHIKV VLP, the company’s chikungunya virus virus-like particle

(VLP) vaccine candidate, in a Phase 3 safety and immunogenicity

study anticipated in late 2020.

- Received positive opinion and subsequent approval from EMA of

Vaxchora® Cholera Vaccine (recombinant, Live, Oral), making it the

only single-dose oral cholera vaccine approved across all European

Union member states, the UK, and the European Economic Area

countries, indicated for active immunization against disease caused

by Vibrio cholerae serogroup 01 in adults and children from 6 years

of age. Commercial launch is being planned for late

2020.

- Signed a CDMO agreement with Novavax, Inc. to provide drug

substance manufacturing of NanoFluTM, its seasonal influenza

vaccine candidate.

- Announced the appointment of Dr. Karen Smith as chief medical

officer with responsibility for leading and further establishing

Emergent’s global integrated capability in clinical development,

medical affairs, and regulatory affairs.

- Submitted a data package to the FDA in support of extending the

shelf life of NARCAN®(naloxone HCl) Nasal Spray from 24 to 36

months, with an expected review by FDA to take approximately six

months.

2020 FINANCIAL PERFORMANCE (unaudited)

(I) Quarter Ended March 31, 2020

(Q1)

Revenues

Total Revenues

For Q1 2020, total revenues were $192.5 million, a slight

increase over 2019. Total revenues reflect a decline in product

sales revenues partially offset by an increase in CDMO and

contracts and grants revenues.

Product Sales

For Q1 2020, product sales were $148.2 million,

a decrease of $4.8 million or 3% as compared to 2019. The change

primarily reflects increases in sales of Anthrax Vaccines and

NARCAN Nasal Spray offset by a decrease in ACAM2000, as previously

anticipated.

| (in

millions) |

Three Months Ended March 31, |

|

2020 |

2019 |

% Change |

|

Product Sales |

|

|

|

|

NARCAN Nasal Spray |

$72.2 |

$65.5 |

10% |

|

ACAM2000 |

$— |

$45.6 |

(100)% |

|

Anthrax vaccines |

$51.9 |

$11.7 |

NM |

|

Other |

$24.1 |

$30.2 |

(20)% |

| Total Product Sales |

$148.2 |

$153.0 |

(3)% |

Contract Development and Manufacturing

For Q1 2020, revenue from the Company’s contract development and

manufacturing operations was $21.7 million, an increase of $5.8

million or 36% as compared to 2019. The increase primarily reflects

increased demand across development services, drug substance and

drug product offerings.

Contracts and Grants

For Q1 2020, revenue from the Company’s development-based

contracts and grants was $22.6 million, an increase of$0.9 million

as compared to 2019. The increase primarily reflects revenues

associated with a grant received related to our PC2A (diazepam)

auto-injector drug-device product candidate.

Operating Expenses

Cost of Product Sales and Contract Development and

Manufacturing

For Q1 2020, cost of product sales and contract manufacturing

was $76.9 million, a decrease of $14.9 million or 16% as compared

to 2019. The decrease primarily reflects a decrease in sales of

ACAM2000 and raxibacumab.

Research and Development (Gross and Net)

For Q1 2020, gross R&D expenses were $42.7 million, a

decrease of $3.4 million or 7% as compared to 2019. The decrease

primarily reflects a decline of costs associated with the Company's

FLU-IGIV product candidate. During 2019, the Company was incurring

costs associated with phase 2 clinical trials for FLU-IGIV.

For Q1 2020, net R&D expense, which reflects investments

made in development programs that are not currently funded in whole

or in part by third-party partners and is calculated as gross

research and development expenses minus contracts and grants

revenue, was 20.1 million, a decrease of $4.3 million or 18% as

compared to 2019. The decrease is also attributable to a decline of

costs associated with the Company's FLU-IGIV product candidate. The

Q1 2020 and Q1 2019 net R&D expense was 12% of adjusted revenue

(total revenue less contracts & grants).

| (in

millions) |

Three Months Ended March 31, |

|

2020 |

2019 |

% Change |

|

Research and Development Expenses |

$42.7 |

$46.1 |

(7)% |

| Adjustments: |

|

Less Contracts and Grants Revenue |

$22.6 |

$21.7 |

4% |

| Net Research and Development

Expenses |

$20.1 |

$24.4 |

(18)% |

| Adjusted Revenue(Total Revenue

less Contracts and Grants Revenue) |

$169.9 |

$168.9 |

1% |

| Net R&D as % of Adjusted

Revenue (Net R&D Margin) |

12% |

14% |

NA |

Selling, General and Administrative

For Q1 2020, selling, general and administrative

expenses were $69.7 million, an increase of $4.3 million or 7% as

compared to 2019. The increase primarily reflects additional

expenses related to staffing to support the Company's growth.

Amortization of Intangible Assets

For Q1 2020, amortization of intangible assets was $14.8 million

was consistent with amortization of intangible assets of $14.5

million in Q1 2019.

Income Taxes

For Q1 2020, the income tax benefit in the amount of $8.8

million was consistent with the benefit during the Q1 2019 as a

percentage of net loss during the periods.

Net Loss & Adjusted Net Income (Loss)

For Q1 2020, the Company recorded net loss of $12.5 million, or

$0.24 per diluted share, versus net loss of $26.0 million, or $0.51

per diluted share, in 2019.

For Q1 2020, the Company recorded adjusted net income of $0.3

million, or $.01 per diluted share, versus adjusted net loss of

$5.2 million, or $.10 per diluted share, in 2019. (1)

Adjusted EBITDA

For Q1 2020, the Company recorded adjusted EBITDA of $15.3

million versus $8.4 million in 2019. (1)

2020 FINANCIAL FORECAST

For full year 2020, the Company reaffirms its expectation of the

following forecasted financial metrics previously provided on

February 20, 2020.

|

(in millions) |

FULL YEAR 2020(As of 4/30/2020) |

| Total Revenues |

$1,175 -- $1,275 |

| Adjusted Net Income (1) |

$160 -- $210 |

| Adjusted EBITDA (1) |

$300 -- $360 |

The Company’s financial forecast for 2020 includes the

anticipated impact of the following items:

- A full year of product sales, including the following ranges

for key components of the product portfolio:- NARCAN Nasal

Spray: $285 million - $315 million;- Anthrax Vaccines: $270

million - $300 million; - ACAM2000: $180 million - $200

million;

- Contract development and manufacturing revenue of $125 million

- $145 million;

- Deliveries of raxibacumab to the Strategic National Stockpile

(SNS) under the anticipated follow-on procurement contract with

HHS;

- Domestic and international sales of the other medical

countermeasures that comprise Other Product sales;

- Continued improvement of gross margin (a combination of product

sales and CDMO services) in a range of 200 - 400 basis points

annually, driven by improved product mix;

- Continued investment in internally funded development projects

most notably the anticipated Phase 3 studies for the CHIKV VLP and

FLU-IGIV product candidates as well as the Phase 1/2 study for

COVID-EIG, among other R&D projects.

Emergent has assessed the risks to its business associated with

the COVID-19 pandemic and has adopted measures to mitigate those

risks as they are understood today, and accordingly is providing

this outlook for 2020. Despite the lack of expected material

disruption to the company’s business, the management team continues

to assess the business and operational implications associated with

the pandemic and market conditions on its employees, patients and

customers.

The outlook for 2020 does not include estimates for potential

new corporate development or other M&A transactions.

Q2 2020 REVENUE FORECAST

For Q2 2020, the Company forecast for total revenues is $270

million - $300 million.

FOOTNOTES

(1) See "Reconciliation of Net Loss to Adjusted Net Loss and

Adjusted EBITDA" for a definition of terms and the reconciliation

tables.

CONFERENCE CALL, PRESENTATION

SUPPLEMENT, AND WEBCAST INFORMATION

Company management will host a conference call

at 5:00 pm (Eastern Time) today, April 30, 2020, to discuss these

financial results. The conference call and presentation supplement

can be accessed from the Company's website or through the

following:

Live Teleconference Information:Dial in: [US] (855) 766-6521;

[International] (262) 912-6157Conference ID: 3784302

Live Webcast Information:Visit

https://edge.media-server.com/mmc/p/juw3z8b3 for the live

webcast feed.

A replay of the call can be accessed at

www.emergentbiosolutions.com under “Investors.”

ABOUT EMERGENT BIOSOLUTIONS INC.

Emergent BioSolutions is a global life sciences company whose

mission is to protect and enhance life. Through our specialty

products and contract development and manufacturing services, we

are dedicated to providing solutions that address public health

threats. Through social responsibility, we aim to build healthier

and safer communities. We aspire to deliver peace of mind to our

patients and customers so they can focus on what’s most important

in their lives. In working together, we envision protecting or

enhancing 1 billion lives by 2030. For more informationvisit

www.emergentbiosolutions.com. Find us on LinkedIn and follow us on

Twitter @emergentbiosolu and Instagram @life_at_emergent.

SAFE HARBOR STATEMENT

This press release includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Any statements, other than statements of

historical fact, including, without limitation, our financial

guidance and related projections and statements regarding our

ability to meet such projections in the anticipated timeframe, if

at all; the ability to advance potential solutions to combat the

novel strain of coronavirus (SARS-CoV-2) causing COVID-19 disease;

statements regarding total contract value; continued product sales

of key components of the product portfolio at specified levels;

deliveries of raxibacumab to the SNS under the anticipated

follow-on procurement contract with the ASPR; domestic and

international sales of the other medical countermeasures at

specified levels; contract development and manufacturing revenues

at specified levels; extending the shelf life of NARCAN® Nasal

Spray; the results of clinical trials; continued improvement of

gross margin (a combination of product sales and CDMO services); as

well as continued investment in internally funded development

projects and any other statements containing the words “will,”

“believes,” “expects,” “anticipates,” “intends,” “plans,”

“targets,” “forecasts,” “estimates” and similar expressions in

conjunction with, among other things, discussions of the Company's

outlook, financial performance or financial condition, financial

and operation goals, strategic goals, growth strategy, product

sales, government development or procurement contracts or awards,

government appropriations, manufacturing capabilities, and the

timing of certain regulatory approvals or expenditures are

forward-looking statements. These forward-looking statements are

based on our current intentions, beliefs and expectations regarding

future events. We cannot guarantee that any forward-looking

statement will be accurate. Investors should realize that if

underlying assumptions prove inaccurate or unknown risks or

uncertainties materialize, actual results could differ materially

from our expectations. Investors are, therefore, cautioned not to

place undue reliance on any forward- looking statement. Any

forward-looking statements speak only as of the date of this press

release, and, except as required by law, we do not undertake to

update any forward-looking statement to reflect new information,

events or circumstances. There are a number of important factors

that could cause our actual results to differ materially from those

indicated by such forward-looking statements, including the impact

of global economic conditions and public health crises and

epidemics, such as the impact from the global pandemic that arose

from the novel strain of coronavirus (SARS-CoV-2) causing COVID-19

disease that recently originated and quickly spread globally, on

the markets, our operations, and employees as well as those of our

customers and suppliers; availability of U.S. government funding

for procurement for our products; our ability to perform under our

contracts with the U.S. government, including the timing of and

specifications relating to deliveries; the continued exercise of

discretion by BARDA to procure additional doses of AV7909 (anthrax

vaccine adsorbed (AVA), adjuvanted) prior to approval by the FDA;

our ability to secure licensure of AV7909 from the FDA within the

anticipated timeframe, if at all; our ability to secure follow-on

procurement contracts for our solutions to public health threats

that are under procurement contracts that have expired or will be

expiring; our ability and the ability of our collaborators to

enforce patents related to NARCAN Nasal Spray against potential

generic entrants; our ability to identify and acquire companies,

businesses, products or product candidates that satisfy our

selection criteria; our ability and the ability of our contractors

and suppliers to maintain compliance with Current Good

Manufacturing Practices and other regulatory obligations; our

ability to comply with the operating and financial covenants

required by our senior secured credit facilities; our ability to

obtain and maintain regulatory approvals for our product candidates

and the timing of any such approvals; the safety and effectiveness

of the current COVID-19 product candidates we are working on; the

procurement of products by U.S. government entities under

regulatory exemptions prior to approval by the FDA and

corresponding procurement by government entities outside of the

United States under regulatory exemptions prior to approval by the

corresponding regulatory authorities in the applicable country; the

success of our commercialization, marketing and manufacturing

capabilities and strategy; and the accuracy of our estimates

regarding future revenues, expenses, and capital requirements and

needs for additional financing. The foregoing sets forth many, but

not all, of the factors that could cause actual results to differ

from our expectations in any forward-looking statement. Investors

should consider this cautionary statement as well as the risk

factors identified in our periodic reports filed with the

Securities and Exchange Commission when evaluating our

forward-looking statements.

Investor Contact Robert BurrowsVice President, Investor

Relations(o) 240/631-3280; (m) 240/413-1917burrowsr@ebsi.com

Media Contact Miko B. NeriSenior Director, Corporate

Communications (o) 240/631-3392NeriM@ebsi.com

Emergent BioSolutions Inc.Consolidated Balance

Sheets (unaudited, in millions, except per share data)

| |

March 31, 2020 |

|

December 31, 2019 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

$ |

181.5 |

|

167.8 |

|

Restricted cash |

|

0.2 |

|

0.2 |

|

Accounts receivable, net |

|

162.5 |

|

270.7 |

|

Inventories |

|

248.1 |

|

222.5 |

|

Income tax receivable, net |

|

10.2 |

|

4.6 |

|

Prepaid expenses and other current assets |

|

24.1 |

|

20.4 |

|

Total current assets |

|

626.6 |

|

686.2 |

|

Property, plant and equipment, net |

|

549.2 |

|

542.3 |

|

Intangible assets, net |

|

708.1 |

|

712.9 |

|

In-process research and development |

|

29.0 |

|

29.0 |

|

Goodwill |

|

266.4 |

|

266.6 |

|

Deferred tax assets, net |

|

17.6 |

|

13.4 |

|

Other assets |

|

81.8 |

|

76.9 |

|

Total assets |

$ |

2,278.7 |

|

$ |

2,327.3 |

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

84.2 |

|

|

94.8 |

|

Accrued expenses |

|

41.5 |

|

|

39.5 |

|

Accrued compensation |

|

47.5 |

|

|

62.4 |

|

Debt, current portion |

|

26.3 |

|

|

12.9 |

|

Other current liabilities |

|

7.6 |

|

|

6.7 |

|

Total current liabilities |

|

207.1 |

|

|

216.3 |

|

Contingent consideration, net of current portion |

|

26.1 |

|

|

26.0 |

|

Debt, net of current portion |

|

762.9 |

|

|

798.4 |

|

Deferred tax liability |

|

63.9 |

|

|

63.9 |

|

Contract liabilities, net of current portion |

|

85.0 |

|

|

85.6 |

|

Other liabilities |

|

58.9 |

|

|

48.6 |

|

Total liabilities |

|

1,203.9 |

|

|

1,238.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 15.0 shares authorized, no

shares issued or outstanding |

|

— |

|

|

— |

| |

|

|

|

|

|

|

Common stock, $0.001 par value; 200.0 shares authorized, 53.5 and

53.0 shares issued; 52.3 and 51.7 shares

outstanding, respectively |

|

0.1 |

|

|

0.1 |

|

Treasury stock, at cost, 1.2 common shares |

|

(39.6) |

|

|

(39.6) |

|

Additional paid-in capital |

|

726.2 |

|

|

716.1 |

|

Accumulated other comprehensive loss, net |

|

(21.2) |

|

|

(9.9) |

|

Retained earnings |

|

409.3 |

|

|

421.8 |

|

Total stockholders' equity |

|

1,074.8 |

|

|

1,088.5 |

|

Total liabilities and stockholders' equity |

$ |

2,278.7 |

|

|

2,327.3 |

Emergent BioSolutions Inc.Consolidated Statements

of Operations (unaudited, in millions, except per share data)

| |

Three Months Ended

March 31, |

| |

2020 |

|

2019 |

| Revenues: |

|

|

|

|

|

Product sales, net |

$ |

148.2 |

|

|

153.0 |

|

|

Contract development and manufacturing services |

|

21.7 |

|

|

15.9 |

|

|

Contracts and grants |

|

22.6 |

|

|

21.7 |

|

| Total revenues |

|

192.5 |

|

|

190.6 |

|

| Operating expenses: |

|

|

|

|

|

Cost of product sales and contract development and manufacturing

services |

|

76.9 |

|

|

91.8 |

|

|

Research and development |

|

42.7 |

|

|

46.1 |

|

|

Selling, general and administrative |

|

69.7 |

|

|

65.4 |

|

|

Amortization of intangible assets |

|

14.8 |

|

|

14.5 |

|

| Total operating expenses |

|

204.1 |

|

|

217.8 |

|

| Loss from operations |

|

(11.6) |

|

|

(27.2) |

|

| Other (expense) income: |

|

|

|

|

|

Interest expense |

|

(8.6) |

|

|

(9.6) |

|

|

Other expense, net |

|

(1.1) |

|

|

(1.0) |

|

| Total other expense, net |

|

(9.7) |

|

|

(10.6) |

|

| Loss before provision for income

taxes |

|

(21.3) |

|

|

(37.8) |

|

| Income tax benefit |

|

8.8 |

|

|

11.8 |

|

| Net loss |

$ |

(12.5) |

|

$ |

(26.0) |

|

| |

|

|

|

|

|

|

| Net loss per common share |

|

|

|

|

|

|

|

Basic |

$ |

(0.24) |

|

$ |

(0.51) |

|

|

Diluted |

$ |

(0.24) |

|

$ |

(0.51) |

|

|

|

|

|

|

|

|

|

| Shares used in computing

loss per share |

|

|

|

|

|

Basic |

52.0 |

|

51.2 |

|

|

Diluted |

52.0 |

|

51.2 |

|

Emergent BioSolutions Inc.Condensed Consolidated

Statements of Cash Flows (unaudited, in millions)

|

|

Three Months Ended March 31, |

|

|

|

2020 |

|

|

2019 |

|

| Cash flows provided by operating

activities: |

|

|

|

|

|

|

|

Net loss |

$ |

(12.5 |

) |

$ |

(26.0 |

) |

|

Adjustments to reconcile net loss to net cash provided by operating

activities: |

|

|

|

|

|

|

|

Share-based compensation expense |

|

6.6 |

|

|

6.8 |

|

|

Depreciation and amortization |

|

28.2 |

|

|

26.6 |

|

|

Amortization of deferred financing costs |

|

0.7 |

|

|

0.7 |

|

|

Deferred income taxes |

|

(4.2 |

) |

|

(11.4 |

) |

|

Change in fair value of contingent consideration, net |

|

0.6 |

|

|

1.7 |

|

|

Other |

|

— |

|

|

(0.1 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

Accounts receivable |

|

108.2 |

|

|

141.6 |

|

|

Inventories |

|

(25.6 |

) |

|

(5.2 |

) |

|

Prepaid expenses and other assets |

|

(15.3 |

) |

|

(16.6 |

) |

|

Accounts payable |

|

(15.6 |

) |

|

4.2 |

|

|

Accrued expenses |

|

1.1 |

|

|

1.7 |

|

|

Accrued compensation |

|

(14.9 |

) |

|

(21.3 |

) |

|

Contract liabilities |

|

0.5 |

|

|

2.1 |

|

|

Net cash provided by operating activities: |

|

57.8 |

|

|

104.8 |

|

| Cash flows used in investing

activities: |

|

|

|

Purchases of property, plant and equipment and other |

|

(24.2 |

) |

|

(21.4 |

) |

|

Net cash used in investing activities: |

|

(24.2 |

) |

|

(21.4 |

) |

| Cash flows used in financing

activities: Proceeds from revolving credit facility |

|

— |

|

|

30.0 |

|

|

Principal payments on revolving credit facility |

|

(20.0 |

) |

|

(80.0 |

) |

|

Principal payments on term loan facility |

|

(2.8 |

) |

|

(2.8 |

) |

|

Proceeds from issuance of common stock upon exercise of stock

options |

|

9.1 |

|

|

0.9 |

|

|

Taxes paid on behalf of employees for equity activity |

|

(5.6 |

) |

|

(6.0 |

) |

|

Contingent consideration payments |

|

(0.7 |

) |

|

(0.5 |

) |

|

Net cash used in financing activities: |

|

(20.0 |

) |

|

(58.4 |

) |

|

Effect of exchange rate changes on cash, cash equivalents and

restricted cash |

|

0.1 |

|

|

— |

|

|

Net increase in cash, cash equivalents and restricted cash |

|

13.7 |

|

|

25.0 |

|

|

Cash, cash equivalents and restricted cash at beginning of

period |

|

168.0 |

|

|

112.4 |

|

|

Cash, cash equivalents and restricted cash at end of period |

$ |

181.7 |

|

$ |

137.4 |

|

RECONCILIATION OF NET LOSS TO ADJUSTED NET LOSS AND ADJUSTED

EBITDA (unaudited)

This press release contains two financial measures

(Adjusted Net Loss and Adjusted EBITDA (Earnings Before

Depreciation and Amortization, Interest and Taxes)) that

are considered “non-GAAP” financial measures under applicable

Securities and Exchange Commission rules and regulations. These

non-GAAP financial measures should be considered supplemental to

and not a substitute for financial information prepared in

accordance with generally accepted accounting principles. The

Company’s definition of these non-GAAP measures may differ from

similarly titled measures used by others. Adjusted Net Loss adjusts

for specified items that can be highly variable or difficult to

predict, or reflect the non-cash impact of charges resulting from

purchase accounting. All adjustments are tax effected utilizing the

federal statutory tax rate for the US, except for changes in the

fair value of contingent consideration as the vast majority is

non-deductible for tax purposes. Adjusted Net Loss margin is

defined as Adjusted Net Loss divided by total revenues. Adjusted

EBITDA reflects net income excluding the impact of depreciation,

amortization, interest expense and provision for income taxes,

excluding specified items that can be highly variable and the non-

cash impact of certain purchase accounting adjustments. Adjusted

EBITDA margin is defined as Adjusted EBITDA divided by total

revenues. The Company views these non-GAAP financial measures as a

means to facilitate management’s financial and operational

decision-making, including evaluation of the Company’s historical

operating results and comparison to competitors’ operating results.

These non-GAAP financial measures reflect an additional way of

viewing aspects of the Company’s operations that, when viewed with

GAAP results and the reconciliations to the corresponding GAAP

financial measure may provide a more complete understanding of

factors and trends affecting the Company’s business.

The determination of the amounts that are excluded from these

non-GAAP financial measures are a matter of management judgment and

depend upon, among other factors, the nature of the underlying

expense or income amounts. Because non-GAAP financial measures

exclude the effect of items that will increase or decrease the

Company’s reported results of operations, management strongly

encourages investors to review the Company’s consolidated financial

statements and publicly filed reports in their entirety.

Reconciliation of Net Loss to Adjusted Net Loss (Unaudited)

|

(in millions, except per share value) |

Three Months Ended March 31, 2020 |

|

|

2020 |

|

2019 |

|

Source |

|

Net loss |

|

($12.5) |

|

($26.0) |

|

|

| Adjustments: |

|

+ Acquisition-related costs (transaction & integration) |

|

— |

|

4.0 |

|

SG&A |

|

+ Non-cash amortization charges |

|

15.5 |

|

15.3 |

|

SG&A,

Other Income |

|

+ Changes in fair value of contingent consideration |

|

0.6 |

|

1.6 |

|

SG&A |

|

+ Impact of purchase accounting on inventory step-up |

|

— |

|

5.0 |

|

COGS |

| Tax effect |

|

(3.3) |

|

(5.1) |

|

|

| Total adjustments: |

|

12.8 |

|

20.8 |

|

|

| Adjusted net income (loss) |

$0.3 |

|

($5.2) |

|

|

| Adjusted net income (loss) per

diluted share |

$0.01 |

|

($0.10) |

|

|

|

(in millions) |

Full Year Forecast |

|

2020F |

Source |

|

Net income |

$105 - $155 |

|

| Adjustments: |

|

+ Acquisition-related costs (transaction & integration) |

4 |

SG&A |

|

+ Non-cash amortization charges |

64 |

Intangible AssetAmortization, Other |

|

+ Change in fair value of contingent consideration |

1 |

COGS |

| Tax effect |

(14) |

|

| Total adjustments: |

55 |

|

| Adjusted net income |

$160 - $210 |

|

Reconciliation of Net Loss to Adjusted EBITDA (Unaudited)

| (in

millions, except per share value) |

Three Months Ended March 31, |

|

2020 |

2019 |

|

Net loss |

($12.5) |

($26.0) |

|

Adjustments: |

|

+ Depreciation & amortization |

28.2 |

26.6 |

|

+ Provision for income taxes |

(8.8) |

(11.8) |

|

+ Total interest expense, net* |

7.8 |

9.0 |

|

+ Changes in fair value of contingent consideration |

0.6 |

1.6 |

|

+ Acquisition-related costs (transaction & integration) |

— |

4.0 |

|

+ Impact of purchase accounting on inventory step-up |

— |

5.0 |

| Total additional adjustments |

27.8 |

34.4 |

| Adjusted EBITDA |

$15.3 |

$8.4 |

| |

| * Includes interest

income of $0.8 million in 2020 and $0.6 million in 2019 |

|

(in millions) |

Full YearForecast |

|

2020F |

| Net income |

$105 - $155 |

|

Adjustments: |

|

+ Depreciation & amortization |

111 to 121 |

|

+ Provision for income taxes |

31 |

|

+ Total interest expense |

48 |

|

+ Acquisition-related costs (transaction & integration) |

4 |

|

+ Change in fair value of contingent consideration |

1 |

| Total additional adjustments |

195 to 205 |

| Adjusted EBITDA |

$300 - $360 |

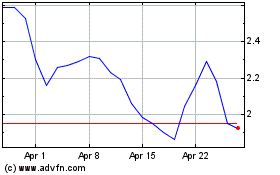

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Emergent Biosolutions (NYSE:EBS)

Historical Stock Chart

From Apr 2023 to Apr 2024