Domino's Shares Rebound Despite Sales-Growth Warning

October 08 2019 - 5:02PM

Dow Jones News

By Jessica Menton

Domino's Pizza delivered a blow to pizza stocks Tuesday, then

didn't stick around for a slice of the aftermath.

Shares of the world's largest pizza company slid as much as 6.1%

in early trading after a weaker-than-expected earnings report. Papa

John's International slumped 4% while Pizza Hut parent Yum Brands

fell 1%.

Buffeted by increased competition from food-delivery services

such as Grubhub, DoorDash and Uber Eats, the pizza chain said it

expects U.S. same-store sales to grow between 2% and 5% over the

next two to three years. That is down from prior projections for an

increase of 3% to 6% over three to five years.

But Domino's stock turned 4.7% higher after Chief Executive

Ritch Allison tried to ease investors' concerns about the long-term

outlook and the company announced it would repurchase $1 billion in

shares.

"The reality is that we don't have visibility into exactly how

long some of these new entrants into the quick-service delivery

segment are going to benefit from the financial support of

aggregators who are seeking to buy market share," Mr. Allison said

during the earnings call with shareholders Tuesday.

Domino's shares have largely underperformed the broader market

this year. The stock has risen 2.2% in 2019, compared with the

S&P 500's 15% climb.

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

October 08, 2019 16:47 ET (20:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

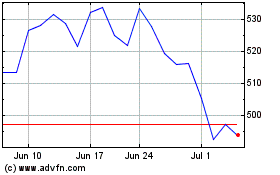

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

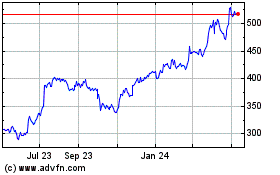

Dominos Pizza (NYSE:DPZ)

Historical Stock Chart

From Apr 2023 to Apr 2024