Monthly Portfolio Investments Report on Form N-port (public) (nport-p)

November 29 2019 - 10:41AM

Edgar (US Regulatory)

DIAX

Nuveen Dow 30SM Dynamic Overwrite Fund

Portfolio of Investments September 30, 2019

(Unaudited)

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

LONG-TERM INVESTMENTS – 100.3%

|

|

|

|

|

|

|

|

|

|

COMMON STOCKS – 100.3%

|

|

|

|

|

|

|

|

|

|

Aerospace & Defense – 13.1%

|

|

|

|

|

|

|

|

163,500

|

|

Boeing Co, (2)

|

|

|

|

|

|

$62,206,845

|

|

163,500

|

|

United Technologies Corp, (2)

|

|

|

|

|

|

22,321,020

|

|

|

|

Total Aerospace & Defense

|

|

|

|

|

|

84,527,865

|

|

|

|

Banks – 3.0%

|

|

|

|

|

|

|

|

163,500

|

|

JPMorgan Chase & Co

|

|

|

|

|

|

19,242,315

|

|

|

|

Beverages – 1.4%

|

|

|

|

|

|

|

|

163,500

|

|

Coca-Cola Co

|

|

|

|

|

|

8,900,940

|

|

|

|

Capital Markets – 5.2%

|

|

|

|

|

|

|

|

163,500

|

|

Goldman Sachs Group Inc, (2)

|

|

|

|

|

|

33,882,105

|

|

|

|

Chemicals – 1.2%

|

|

|

|

|

|

|

|

163,500

|

|

Dow Inc

|

|

|

|

|

|

7,790,775

|

|

|

|

Communications Equipment – 1.2%

|

|

|

|

|

|

|

|

163,500

|

|

Cisco Systems Inc

|

|

|

|

|

|

8,078,535

|

|

|

|

Consumer Finance – 3.0%

|

|

|

|

|

|

|

|

163,500

|

|

American Express Co, (2)

|

|

|

|

|

|

19,338,780

|

|

|

|

Diversified Telecommunication Services – 1.5%

|

|

|

|

|

|

|

|

163,500

|

|

Verizon Communications Inc, (2)

|

|

|

|

|

|

9,868,860

|

|

|

|

Entertainment – 3.3%

|

|

|

|

|

|

|

|

163,500

|

|

Walt Disney Co

|

|

|

|

|

|

21,307,320

|

|

|

|

Food & Staples Retailing – 4.4%

|

|

|

|

|

|

|

|

163,500

|

|

Walgreens Boots Alliance Inc

|

|

|

|

|

|

9,043,185

|

|

163,500

|

|

Walmart Inc, (2)

|

|

|

|

|

|

19,404,180

|

|

|

|

Total Food & Staples Retailing

|

|

|

|

|

|

28,447,365

|

|

|

|

Health Care Providers & Services – 5.5%

|

|

|

|

|

|

|

|

163,500

|

|

UnitedHealth Group Inc, (2)

|

|

|

|

|

|

35,531,820

|

|

|

|

Hotels, Restaurants & Leisure – 5.4%

|

|

|

|

|

|

|

|

163,500

|

|

McDonald's Corp, (2)

|

|

|

|

|

|

35,105,085

|

|

|

|

Household Products – 3.1%

|

|

|

|

|

|

|

|

163,500

|

|

Procter & Gamble Co, (2)

|

|

|

|

|

|

20,336,130

|

|

DIAX

|

Nuveen Dow 30SM Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

|

Shares

|

|

Description (1)

|

|

|

|

|

|

Value

|

|

|

|

Industrial Conglomerates – 4.1%

|

|

|

|

|

|

|

|

163,500

|

|

3M Co

|

|

|

|

|

|

$26,879,400

|

|

|

|

Insurance – 3.8%

|

|

|

|

|

|

|

|

163,500

|

|

Travelers Cos Inc, (2)

|

|

|

|

|

|

24,310,815

|

|

|

|

IT Services – 8.0%

|

|

|

|

|

|

|

|

163,500

|

|

International Business Machines Corp, (2)

|

|

|

|

|

|

23,776,170

|

|

163,500

|

|

Visa Inc, Class A, (2)

|

|

|

|

|

|

28,123,635

|

|

|

|

Total IT Services

|

|

|

|

|

|

51,899,805

|

|

|

|

Machinery – 3.2%

|

|

|

|

|

|

|

|

163,500

|

|

Caterpillar Inc

|

|

|

|

|

|

20,651,685

|

|

|

|

Oil, Gas & Consumable Fuels – 4.8%

|

|

|

|

|

|

|

|

163,500

|

|

Chevron Corp, (2)

|

|

|

|

|

|

19,391,100

|

|

163,500

|

|

Exxon Mobil Corp

|

|

|

|

|

|

11,544,735

|

|

|

|

Total Oil, Gas & Consumable Fuels

|

|

|

|

|

|

30,935,835

|

|

|

|

Pharmaceuticals – 6.3%

|

|

|

|

|

|

|

|

163,500

|

|

Johnson & Johnson

|

|

|

|

|

|

21,153,630

|

|

163,500

|

|

Merck & Co Inc

|

|

|

|

|

|

13,763,430

|

|

163,500

|

|

Pfizer Inc, (2)

|

|

|

|

|

|

5,874,555

|

|

|

|

Total Pharmaceuticals

|

|

|

|

|

|

40,791,615

|

|

|

|

Semiconductors & Semiconductor Equipment – 1.3%

|

|

|

|

|

|

|

|

163,500

|

|

Intel Corp

|

|

|

|

|

|

8,425,155

|

|

|

|

Software – 3.5%

|

|

|

|

|

|

|

|

163,500

|

|

Microsoft Corp

|

|

|

|

|

|

22,731,405

|

|

|

|

Specialty Retail – 5.9%

|

|

|

|

|

|

|

|

163,500

|

|

Home Depot Inc

|

|

|

|

|

|

37,935,270

|

|

|

|

Technology Hardware, Storage & Peripherals – 5.7%

|

|

|

|

|

|

|

|

163,500

|

|

Apple Inc

|

|

|

|

|

|

36,619,095

|

|

|

|

Textiles, Apparel & Luxury Goods – 2.4%

|

|

|

|

|

|

|

|

163,500

|

|

NIKE Inc, Class B

|

|

|

|

|

|

15,355,920

|

|

|

|

Total Long-Term Investments (cost $278,975,129)

|

|

|

|

|

|

648,893,895

|

|

Principal Amount (000)

|

|

Description (1)

|

|

|

Coupon

|

Maturity

|

|

Value

|

|

|

|

SHORT-TERM INVESTMENTS – 0.4%

|

|

|

|

|

|

|

|

|

|

REPURCHASE AGREEMENTS – 0.4%

|

|

|

|

|

|

|

|

$2,723

|

|

Repurchase Agreement with Fixed Income Clearing Corporation, dated 9/30/19, repurchase price $2,723,502,

collateralized $2,455,000 U.S. Treasury Notes, 2.750%, due 11/15/42, value $2,779,681

|

|

|

0.850%

|

10/01/19

|

|

$2,723,438

|

|

|

|

Total Short-Term Investments (cost $2,723,438)

|

|

|

|

|

|

2,723,438

|

|

|

|

Total Investments (cost $281,698,567) – 100.7%

|

|

|

|

|

|

651,617,333

|

|

|

|

Other Assets Less Liabilities – (0.7)% (3)

|

|

|

|

|

|

(4,240,333)

|

|

|

|

Net Assets Applicable to Common Shares – 100%

|

|

|

|

|

|

$647,377,000

|

Investments in Derivatives

|

Options Written

|

|

|

Description (4)

|

Type

|

Number of

Contracts

|

Notional

Amount (5)

|

Exercise

Price

|

Expiration

Date

|

Value

|

|

S&P 500® Index

|

Put

|

(45)

|

$(12,825,000)

|

$2,850

|

10/18/19

|

$(46,350)

|

|

S&P 500® Index

|

Call

|

(1,000)

|

(301,500,000)

|

3,015

|

10/18/19

|

(1,625,000)

|

|

S&P 500® Index

|

Call

|

(115)

|

(35,075,000)

|

3,050

|

10/18/19

|

(56,925)

|

|

Total Options Written (premiums received $3,454,316)

|

|

(1,160)

|

$(349,400,000)

|

|

|

$(1,728,275)

|

Part F of Form N-PORT was prepared

in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) and in conformity with the applicable rules and regulations of the U.S. Securities and Exchange Commission (“SEC”)

related to interim filings. Part F of Form N-PORT does not include all information and footnotes required by U.S. GAAP for complete financial statements. Certain footnote disclosures normally included in financial

statements prepared in accordance with U.S. GAAP have been condensed or omitted from this report pursuant to the rules of the SEC. For a full set of the Fund’s notes to financial statements, please refer to the

Fund’s most recently filed annual or semi-annual report.

Fair Value Measurements

The Fund's investments in securities

are recorded at their estimated fair value. Fair value is defined as the price that would be received upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the

principal or most advantageous market for the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of

fair value measurements for disclosure purposes. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from

sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable

inputs are based on the best information available in the circumstances. The following is a summary of the three-tiered hierarchy of valuation input levels.

Level 1

– Inputs are unadjusted and prices are determined using quoted prices in active markets for identical securities.

Level 2 – Prices are determined using other significant observable inputs (including quoted prices for similar securities, interest rates, credit spreads, etc.).

Level 3 – Prices are determined using significant unobservable inputs (including management’s assumptions in determining the fair value of investments).

|

DIAX

|

Nuveen Dow 30SM Dynamic Overwrite Fund (continued)

|

|

|

Portfolio of Investments September 30, 2019

|

|

|

(Unaudited)

|

The inputs or methodologies used for

valuing securities are not an indication of the risks associated with investing in those securities. The following is a summary of the Fund’s fair value measurements as of the end of the reporting period:

|

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Long-Tem Investments:

|

|

|

|

|

|

Common Stocks

|

$648,893,895

|

$ —

|

$ —

|

$648,893,895

|

|

Short-Term Investments:

|

|

|

|

|

|

Repurchase Agreements

|

—

|

2,723,438

|

—

|

2,723,438

|

|

Investments in Derivatives:

|

|

|

|

|

|

Options Written

|

(1,728,275)

|

—

|

—

|

(1,728,275)

|

|

Total

|

$647,165,620

|

$2,723,438

|

$ —

|

$649,889,058

|

|

|

For Fund portfolio compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized

market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications into sectors for reporting ease.

|

|

|

(1)

|

All percentages shown in the Portfolio of Investments are based on net assets applicable to common shares unless otherwise noted.

|

|

|

(2)

|

Investment, or portion of investment, has been pledged to collateralized the net payment obligations for investments in derivatives.

|

|

|

(3)

|

Other assets less liabilities includes the unrealized appreciation (depreciation) of certain over-the-counter (“OTC”) derivatives as well as the OTC cleared and

exchange-traded derivatives, when applicable.

|

|

|

(4)

|

Exchange-traded, unless otherwise noted.

|

|

|

(5)

|

For disclosure purposes, Notional Amount is calculated by multiplying the Number of Contracts by the Exercise Price by 100.

|

|

|

S&P

|

Standard & Poor's

|

|

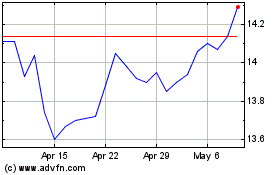

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

From Mar 2024 to Apr 2024

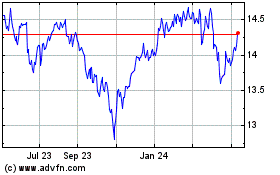

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

From Apr 2023 to Apr 2024