Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

November 15 2019 - 4:29PM

Edgar (US Regulatory)

Filed by Envista Holdings Corporation

Pursuant to Rule 425 under the Securities Act of 1933, as amended

Subject Company: Danaher Corporation

Commission File No.: 001-08089

November 15, 2019

Dear Envista Employees,

Today, we begin the next step in

Envista’s journey to becoming a standalone, publicly traded company. As you recall, Danaher is currently Envista’s largest shareholder, owning about 80% of Envista’s common stock. In a press release today, Danaher announced that

it is offering its shareholders the choice to exchange shares of their Danaher common stock for shares of Envista common stock currently held by Danaher. This transaction is commonly referred to as a “split off exchange offer.”

Following the completion of this exchange offer, Danaher will no longer have any ownership interest in Envista. Danaher executives that previously had

been appointed to the Envista Board of Directors, with the exception of Dan Daniel and Daniel Raskas, will step down from the board.

Danaher shareholders

may choose to tender all, some, or none of their shares in exchange for Envista shares (subject to the terms of the exchange offer). More information about the exchange offer can be found here. Shareholders have until December 13th to decide whether they wish to participate in the exchange offer (unless the offer period is extended or terminated for any reason).

This exchange offer may affect you if are participant in certain Danaher stock-based compensation plans and/or are a Danaher shareholder. Read on for

further information and see a list of FAQs here.

If you own Danaher common stock in a brokerage account or other investment account (including

shares acquired from RSUs that have vested):

|

|

•

|

|

You have the choice to participate in the exchange offer

|

|

|

•

|

|

You will receive additional information from your bank or broker explaining the exchange offer and the actions

you need to take if you wish to opt-in

|

If you participate in the US 401(k)

plan:

|

|

•

|

|

Immediately following the completion of the split-off, you will begin to

participate in the Envista 401(k) and future contributions will go into this plan instead of the Danaher 401(k).

|

|

|

•

|

|

After the split-off, the Danaher stock fund in the Envista 401(k) plan

will be frozen. You will have the option to continue to invest in Danaher shares in your Fidelity BrokerageLink account.

|

|

|

•

|

|

Your balances in the Danaher 401(k) plan will transition to the Envista 401(k) plan at the end of the year and

will appear in your Fidelity account on January 2, 2020.

|

Transition brochures for the 401(k) are provided here and, for union

employees, here. These provide details of how your contribution and investment elections will be mapped and how your balances will transition. Note also that, if you hold shares in the Danaher stock fund, you have the choice to participate in the

exchange offer. You will receive additional information from Fidelity explaining the exchange offer and the actions you need to take.

If you are a

Danaher equity award holder (unvested RSUs, unvested stock options, and/or vested, unexercised stock options):

|

|

•

|

|

Your Danaher equity awards will convert to Envista equity awards upon completion of the offering.

|

|

|

•

|

|

Please refer to the separate email sent today for details on the conversion process.

|

If you hold Danaher shares in a non-qualified retirement plan, such as EDIP, DCP/ECP:

|

|

•

|

|

Your Danaher stock fund balance will convert to an Envista stock fund balance upon completion of the offering.

|

|

|

•

|

|

Please refer to the separate email sent today for details on the conversion process.

|

This list may not account for all scenarios by which an Envista employee may hold Danaher common stock. All Danaher shareholders, eligible to participate

in the exchange offer, will receive additional information about the offer. Please read all information you receive about the exchange offer to understand your choices and make the decision right for you.

We are excited by what the future holds for Envista as it begins its journey as a standalone company. We will share updates with you regarding the

outcome of the exchange offer and next steps in due course.

*****

FORWARD-LOOKING STATEMENTS

This communication contains certain statements about Danaher Corporation (“Danaher”) and Envista Holdings Corporation (“Envista”) that are

forward-looking statements. Forward-looking statements are based on current expectations and assumptions regarding Danaher’s and Envista’s respective businesses, the economy and other future conditions. In addition, the forward-looking

statements contained in this communication may include statements about the expected effects on Danaher and Envista of the exchange offer, the anticipated timing and benefits of the exchange offer, Danaher’s and Envista’s anticipated

financial results, and all other statements in this communication that are not historical facts.

Because forward-looking statements relate to the future,

by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and are detailed more fully in Danaher’s and Envista’s respective periodic reports filed from time to time with

the Securities and Exchange Commission (the “SEC”), the registration statement on Form S-4 and Form S-1 filed by Envista (the “Registration

Statement”), including a prospectus (the “Prospectus”) forming a part thereof, the tender offer statement on Schedule TO filed by Danaher (the “Schedule TO”) and other exchange offer documents filed by Envista or Danaher, as

applicable, with the SEC. Such uncertainties, risks and changes in circumstances could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements included herein are made

as of the date hereof, and neither Danaher nor Envista undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances, except to the extent required by applicable securities laws. Investors should not put

undue reliance on forward-looking statements.

ADDITIONAL INFORMATION

This communication is for informational purposes only and is neither an offer to sell or the solicitation of an offer to buy any securities nor a

recommendation as to whether investors should participate in the exchange offer. The offer will be made solely by the Prospectus. The Prospectus contains important information about the exchange offer, Danaher, Envista, and related matters, and

Danaher will deliver the Prospectus to holders of Danaher common stock. Investors and security holders are urged to read the Prospectus and any other relevant documents filed with the SEC, when they become available and before making any

investment decision, because they contain important information about Danaher, Envista and the exchange offer. None of Danaher, Envista, or any of their respective directors or officers makes any recommendation as to whether investors should

participate in the exchange offer.

Envista has filed with the SEC the Registration Statement, including the Prospectus forming a part thereof,

and Danaher has filed with the SEC the Schedule TO, which contain important information about the exchange offer. Holders of Danaher common stock may obtain copies of the Prospectus, the Registration Statement, the Schedule TO, other related

documents, and any other information that Danaher and Envista file electronically with the SEC free of charge at the SEC’s website at www.sec.gov.

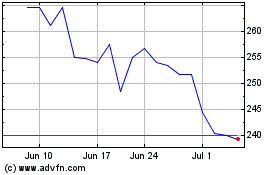

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

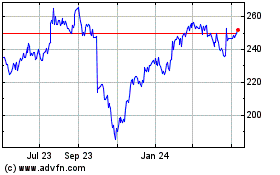

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024