SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

DANAHER CORPORATION

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, par value $0.01 per share

(Title of Class of Securities)

235851102

(CUSIP Number of Class of Securities)

James F. O’Reilly

Vice President, Associate General Counsel and Secretary

Danaher Corporation

2200 Pennsylvania Avenue, N.W., Suite 800W

Washington, D.C. 20037-1701

(202) 828-0850

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

Copies to:

|

|

|

|

|

|

Mark E. Nance

Senior Vice President, General Counsel and Secretary

Envista Holdings Corporation

200 S. Kraemer Blvd., Building E

Brea, California 92821-6208

(714) 817-7000

|

Thomas W. Greenberg

Skadden, Arps, Slate, Meagher & Flom LLP

Four Times Square

New York, New York 10036

(212) 735-3000

|

CALCULATION OF FILING FEE

|

|

|

|

|

|

Transaction Valuation(1)

|

Amount of Filing Fee(2)

|

|

$3,378,872,138

|

$438,578

|

(1) This valuation assumes the acquisition of up to 24,819,099 shares of common stock, par value $0.01 per share, of Danaher Corporation (“Danaher Common Stock”) in exchange for up to 127,868,000 shares of common stock, par value $0.01 per share, of Envista Holdings Corporation (“Envista Common Stock”) held by Danaher Corporation. This valuation, estimated solely for the purpose of calculating the filing fee pursuant to Rule 0-11(a)(4) under the Securities Exchange Act of 1934, as amended, is based on the product of (i) $136.14, the average of the high and low prices of Danaher Common Stock as reported on the New York Stock Exchange on November 14, 2019 and (ii) 24,819,099, the maximum number of shares of Danaher Common Stock to be acquired in the exchange offer (based on the indicative exchange ratio of 5.1520 shares of Envista Common Stock per share of Danaher Common Stock in effect following the close of trading on the New York Stock Exchange on November 14, 2019, the last trading day prior to commencement of the exchange offer).

|

|

|

|

(2)

|

The amount of the filing fee has been computed in accordance with Rule 0-11(a)(4) under the Securities Exchange Act of 1934, as amended.

|

|

|

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

Amount Previously Paid: $438,578

|

|

Filing Party: Envista Holdings Corporation

|

|

Form or Registration No.: Registration Statement on Form S-4 and Form S-1 (No. 333-234714)

|

|

Date Filed: November 15, 2019

|

|

|

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transaction to which the statement relates:

|

|

|

|

☐

|

third party tender offer subject to Rule 14d-1.

|

|

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

|

|

☐

|

going private transaction subject to Rule 13e-3.

|

|

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

|

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

|

|

☐

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

This Issuer Tender Offer Statement on Schedule TO (this “Schedule TO”) is filed by Danaher Corporation, a Delaware corporation (“Danaher”). This Schedule TO relates to the offer by Danaher to exchange up to an aggregate of 127,868,000 shares of common stock of Envista Holdings Corporation, a Delaware corporation (“Envista”), par value $0.01 per share (“Envista Common Stock”), for outstanding shares of common stock of Danaher, par value $0.01 per share (“Danaher Common Stock”), upon the terms and subject to the conditions set forth in the Prospectus, dated November 15, 2019 (the “Prospectus”), the Letter of Transmittal and the Instruction Booklet to the Letter of Transmittal, copies of which are attached hereto as Exhibits (a)(1)(i), (a)(1)(ii) and (a)(1)(iii), respectively (which, together with any amendments or supplements thereto, collectively constitute the “Exchange Offer”). In connection with the Exchange Offer, Envista has filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended, a registration statement on Form S-4 and Form S-1 (Registration No. 333-234714) (the “Registration Statement”) to register shares of Envista Common Stock offered in exchange for shares of Danaher Common Stock tendered in the Exchange Offer and to be distributed in any pro rata dividend to the extent that the Exchange Offer is not fully subscribed.

As permitted by General Instruction F to Schedule TO, the information set forth in the Prospectus, the Letter of Transmittal and the Instruction Booklet to the Letter of Transmittal, copies of which are attached hereto as Exhibits (a)(1)(i), (a)(1)(ii) and (a)(1)(iii), respectively, is hereby expressly incorporated by reference in response to all the items of this Schedule TO, except as otherwise set forth below.

Item 1. Summary Term Sheet.

Summary Term Sheet. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer” and “Summary” is incorporated herein by reference.

Item 2. Subject Company Information.

(a)Name and Address. The name of the issuer is Danaher Corporation. The principal executive offices of Danaher are located at 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037. Its telephone number at such office is (202) 828-0850.

(b)Securities. Shares of Danaher Common Stock, par value $0.01 per share, are the subject securities in the Exchange Offer. The information relating to Danaher Common Stock set forth in the section of the Prospectus entitled “Summary—Market Price and Dividend Information” is incorporated herein by reference.

(c)Trading Market and Price. The information relating to Danaher Common Stock set forth in the section of the Prospectus entitled “Summary—Market Price and Dividend Information” is incorporated herein by reference.

The following table describes the per share range of high and low sales prices, as reported by the New York Stock Exchange, for shares of Danaher Common Stock for the quarterly periods indicated.

|

|

|

|

|

|

|

|

|

Market Price for

Danaher Common

Stock

|

|

|

High

|

|

Low

|

|

2017

|

|

|

|

|

First Quarter

|

$88.01

|

|

$78.22

|

|

Second Quarter

|

$87.00

|

|

$81.36

|

|

Third Quarter

|

$88.62

|

|

$78.97

|

|

Fourth Quarter

|

$95.16

|

|

$83.81

|

|

2018

|

|

|

|

|

First Quarter

|

$104.82

|

|

$91.84

|

|

Second Quarter

|

$104.13

|

|

$95.02

|

|

Third Quarter

|

$109.32

|

|

$97.40

|

|

Fourth Quarter

|

$110.86

|

|

$94.59

|

|

2019

|

|

|

|

|

First Quarter

|

$132.60

|

|

$96.44

|

|

Second Quarter

|

$144.57

|

|

$124.01

|

|

Third Quarter

|

$147.33

|

|

$133.84

|

|

Fourth Quarter (through November 14, 2019)

|

$145.36

|

|

$132.88

|

Item 3. Identity and Background of Filing Person.

(a)Name and Address. The filing person and subject company is Danaher Corporation. The principal executive offices of Danaher are located at 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037. Its telephone number at such office is (202) 828-0850.

The address of each of the following directors and executive officers is c/o Danaher Corporation, 2200 Pennsylvania Avenue, N.W., Suite 800W, Washington, D.C. 20037, and each such person’s telephone number is (202) 828-0850: Donald J. Ehrlich (Director), Linda Hefner Filler (Director), Teri List-Stoll (Director), Thomas P. Joyce, Jr. (Director, Chief Executive Officer and President), Walter G. Lohr, Jr. (Director), Mitchell P. Rales (Director and Chairman of the Executive Committee), Steven M. Rales (Director and Chairman of the Board), John T. Schwieters (Director), Alan G. Spoon (Director), Raymond C. Stevens, Ph.D. (Director), Elias A. Zerhouni, M.D. (Director), Jessica L. Mega, MD, MPH (Director), Pardis C. Sabeti, MD, D.Phil. (Director), Daniel L. Comas (Executive Vice President), Matthew R. McGrew (Executive Vice President and Chief Financial Officer), Rainer M. Blair (Executive Vice President), William K. Daniel, II (Executive Vice President), Joakim Weidemanis (Executive Vice President), Brian W. Ellis (Senior Vice President and General Counsel), William H. King (Senior Vice President, Strategic Development), Angela S. Lalor (Senior Vice President, Human Resources), Robert S. Lutz (Senior Vice President and Chief Accounting Officer) and Daniel A. Raskas (Senior Vice President, Corporate Development).

Item 4. Terms of the Transaction.

(a)Material Terms. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer,” “Summary,” “The Transaction,” “The Exchange Offer,” “Material U.S. Federal Income Tax Consequences” and “Comparison of Stockholder Rights” and the cover page of the Prospectus is incorporated herein by reference.

(b)Purchases. The Exchange Offer is open to all holders of shares of Danaher Common Stock who tender their shares in a jurisdiction where the Exchange Offer is permitted. Therefore, any officer, director or affiliate of

Danaher who is a holder of shares of Danaher Common Stock may participate in the Exchange Offer on the same terms and conditions as all other Danaher stockholders.

Item 5. Past Contacts, Transactions, Negotiations and Agreements.

(e)Agreements Involving the Subject Company’s Securities. The information set forth in the sections entitled “Director Compensation,” “Director Independence and Related Person Transactions,” “Compensation Discussion and Analysis,” “Compensation Tables and Information” and “Summary of Employment Agreements and Plans” in Danaher’s Definitive Notice and Proxy Statement filed with the SEC on March 27, 2019, under Item 5.02 (Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers) of Danaher’s Current Report on Form 8-K filed with the SEC on November 13, 2019, and in the section of the Prospectus entitled “Security Ownership of Certain Beneficial Owners and Management of Danaher and Envista,” is incorporated herein by reference.

Item 6. Purposes of the Transaction and Plans or Proposals.

(a)Purposes. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer,” “Summary” and “The Transaction—Reasons for the Exchange Offer” is incorporated herein by reference.

(b)Use of Securities Acquired. Shares of Danaher Common Stock acquired in the Exchange Offer will be held as treasury stock unless and until retired or used for other purposes.

(c)Plans. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer,” “Summary,” “The Transaction,” “The Exchange Offer,” “Agreements Between Danaher and Envista and Other Related Person Transactions” and “Comparison of Stockholder Rights” is incorporated herein by reference.

Item 7. Source and Amount of Funds or Other Consideration.

(a)Source of Funds. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer,” “Summary,” “The Transaction” and “The Exchange Offer” is incorporated herein by reference.

(b)Conditions. The information set forth in the sections of the Prospectus entitled “Questions and Answers About the Exchange Offer,” “Summary,” “The Transaction” and “The Exchange Offer” is incorporated herein by reference.

(d)Borrowed Funds. None.

Item 8. Interest in Securities of the Subject Company.

(a)Securities Ownership. The information set forth in the section of the Prospectus entitled “Security Ownership of Certain Beneficial Owners and Management of Danaher and Envista” is incorporated herein by reference.

(b)Securities Transactions. Based on the information available to Danaher as of November 14, 2019, other than with respect to Danaher employee benefit plans, the following table sets forth the transactions in Danaher Common Stock by directors and executive officers of Danaher in the past 60 days:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Date of Transaction

|

|

Number and Type of

Securities

|

|

Price Per Share

|

|

Type of

Transaction

|

|

Elias A. Zerhoun

|

|

10/25/2019

|

|

Acquired 272.091 phantom shares

|

|

$

|

135.87

|

|

|

Pursuant to director deferred compensation plan

|

|

Raymond C. Stevens

|

|

10/25/2019

|

|

Acquired 224.149 phantom shares

|

|

$

|

135.87

|

|

|

Pursuant to director deferred compensation plan

|

|

Alan G. Spoon

|

|

10/25/2019

|

|

Acquired 249.111 phantom shares

|

|

$

|

135.87

|

|

|

Pursuant to director deferred compensation plan

|

|

Teri List-Stoll

|

|

10/25/2019

|

|

Acquired 227.188 phantom shares

|

|

$

|

135.87

|

|

|

Pursuant to director deferred compensation plan

|

|

Linda P. Hefner

|

|

10/25/2019

|

|

Acquired 263.72 phantom shares

|

|

$

|

135.87

|

|

|

Pursuant to director deferred compensation plan

|

|

Steven M. Rales

|

|

11/14/2019

|

|

1,818,024 shares of common stock

|

|

N/A

|

|

Substitution of Danaher common stock for assets held by Mr. Rales' grantor retained annuity trusts

|

Item 9. Persons/Assets, Retained, Employed, Compensated or Used.

(a)Solicitations or Recommendations. The information set forth in the section of the Prospectus entitled “The Exchange Offer—Fees and Expenses” is incorporated herein by reference.

Item 10. Financial Statements.

(a)Financial Information. The audited financial statements of Danaher at December 31, 2018 and 2017 and for the three years ended December 31, 2018 are incorporated herein by reference to Danaher’s Annual Report on Form 10-K, as filed with the SEC on February 21, 2019. The unaudited financial statements of Danaher at September 27, 2019 and for the nine months ended September 27, 2019 are incorporated herein by reference to Danaher’s Quarterly Report on Form 10-Q, as filed with the SEC on October 24, 2019. The information set forth in the sections of the Prospectus entitled “Summary—Comparative Historical and Pro Forma Per Share Data” and “Summary—Selected Historical and Pro Forma Financial Data for Danaher and Envista” is incorporated herein by reference.

This document incorporates by reference important business and financial information about Danaher from documents filed with the SEC that have not been included in this document. This information is available at the website that the SEC maintains at www.sec.gov, as well as from other sources (see the section of the Prospectus entitled “Incorporation by Reference”). You also may ask any questions about this Exchange Offer or request copies of the Exchange Offer documents from Danaher, without charge, upon written or oral request to Danaher’s information agent, Okapi Partners LLC, located at 1212 Avenue of the Americas, 24th Floor, New York, NY 10036 or at telephone number 877-566-1922 (toll-free for stockholders, banks and brokers) or +1-212-297-0720 (all others outside the U.S.) or at the email address info@okapipartners.com. In order to receive timely delivery of the documents, you must make your requests no later than five business days before expiration of the Exchange Offer.

(b)Pro Forma Information. The information set forth in the sections of the Prospectus entitled “Summary—Comparative Historical and Pro Forma Per Share Data,” “Summary—Selected Historical and Pro Forma Financial Data for Danaher and Envista” and “Danaher Corporation Unaudited Pro Forma Consolidated Condensed Financial Statements” is incorporated herein by reference.

Item 11. Additional Information.

(a)Agreements, Regulatory Requirements and Legal Proceedings.

(1)None.

(2)The information set forth in the sections of the Prospectus entitled “Summary—Regulatory Approval” and “The Transaction—Regulatory Approval” is incorporated herein by reference.

(3)The information set forth in the sections of the Prospectus entitled “Summary—Regulatory Approval” and “The Transaction—Regulatory Approval” is incorporated herein by reference.

(4)Not applicable.

(5)None.

(c)Other Material Information. The information set forth in the Prospectus is incorporated herein by reference.

Item 12. Exhibits.

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

(a)(1)(i)

|

|

|

|

|

|

|

|

(a)(1)(ii)

|

|

|

|

|

|

|

|

(a)(1)(iii)

|

|

|

|

|

|

|

|

(a)(1)(iv)

|

|

|

|

|

|

|

|

(a)(1)(v)

|

|

|

|

|

|

|

|

(a)(1)(vi)

|

|

|

|

|

|

|

|

(a)(1)(vii)

|

|

|

|

|

|

|

|

(a)(1)(viii)

|

|

|

|

|

|

|

|

(a)(1)(ix)

|

|

|

|

|

|

|

|

(a)(1)(x)

|

|

|

|

|

|

|

|

(a)(2)

|

|

None

|

|

|

|

|

|

(a)(3)

|

|

None

|

|

|

|

|

|

(a)(4)(i)

|

|

|

|

|

|

|

|

(a)(4)(ii)

|

|

|

|

|

|

|

|

(a)(5)(i)

|

|

|

|

|

|

|

|

(a)(5)(ii)

|

|

|

|

|

|

|

|

(a)(5)(iii)

|

|

|

|

|

|

|

|

(a)(5)(iv)

|

|

|

|

|

|

|

|

(b)

|

|

None

|

|

|

|

|

|

(d)

|

|

None

|

|

|

|

|

|

(g)

|

|

None

|

|

|

|

|

|

(h)(i)

|

|

|

Item 13. Information Required by Schedule 13E-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

DANAHER CORPORATION

|

|

|

|

|

|

By:

|

/s/ Matthew R. McGrew

|

|

|

Name:

|

Matthew R. McGrew

|

|

|

Title:

|

Executive Vice President and Chief

Financial Officer

|

Dated: November 15, 2019

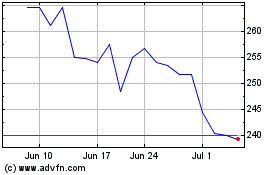

Danaher (NYSE:DHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

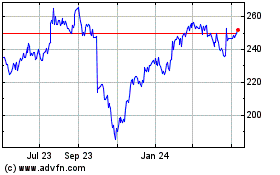

Danaher (NYSE:DHR)

Historical Stock Chart

From Apr 2023 to Apr 2024