Current Report Filing (8-k)

May 21 2020 - 4:32PM

Edgar (US Regulatory)

false 0001690820 0001690820 2020-05-18 2020-05-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 21, 2020 (May 18, 2020)

CARVANA CO.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38073

|

|

81-4549921

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

1930 W. Rio Salado

Parkway

Tempe, Arizona 85281

(Address of principal executive

offices, including zip code)

(480) 719-8809

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Class A Common Stock, Par value $0.001 Per Share

|

|

CVNA

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On May 21, 2020, Carvana Co. (the “Company”) completed its previously announced public offering of 5,000,000 shares of the Company’s Class A common stock, par value $0.001 per share (the “Offering”) sold pursuant to an Underwriting Agreement (the “Underwriting Agreement”), dated May 18, 2020, among the Company, Carvana Group, LLC, and Citigroup Global Markets Inc. and Wells Fargo Securities, LLC, as underwriters. The Underwriting Agreement contains customary representations, warranties, covenants and conditions, and an agreement that the Company indemnify the underwriters against certain liabilities that could be incurred in connection with the Offering.

The Company intends to use the net proceeds from the Offering for general corporate purposes and to pay any costs, fees and expenses incurred by it in connection with this Offering. The Company may use the net proceeds from the Offering to pay down a portion of the borrowings outstanding under its floor plan facility until it identifies other specific uses.

The Offering was made pursuant to an automatically effective registration statement on Form S-3ASR (File No. 333-231606) (the “Registration Statement”) filed with the Securities and Exchange Commission (the “SEC”) on May 20, 2019. A prospectus supplement relating to the Offering has been filed with the SEC.

The above summary of the Underwriting Agreement does not purport to be complete and is qualified in its entirety by the Underwriting Agreement, a copy of which is filed as Exhibit 1.1 hereto and incorporated herein by reference.

On May 18, 2020, the Company issued a press release announcing the launch of the Offering. A copy of the press release is filed as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

The information contained in this Current Report, including the exhibits hereto, is neither an offer to sell nor a solicitation of an offer to purchase any of the other securities of the Company.

|

Item 9.01

|

Financial Statements and Exhibits.

|

Exhibits 5.1, 23.1 and 99.1 are filed herewith in connection with the Offering by the registration, offering and sale by the Company of the Shares, pursuant to the Company’s Registration Statement.

(d) Exhibits

Exhibits 5.1, 23.1 and 99.1 are incorporated by reference into the Registration Statement as exhibits thereto and are filed as part of this Current Report.

|

|

|

|

|

|

|

Exhibit

No.

|

|

|

Description

|

|

|

|

|

|

|

|

|

1.1

|

|

|

Underwriting Agreement, dated May 18, 2020, among Carvana Co., Carvana Group, LLC, and Citigroup Global Markets Inc. and Wells Fargo Securities, as underwriters.

|

|

|

|

|

|

|

|

|

5.1

|

|

|

Opinion of Kirkland & Ellis LLP.

|

|

|

|

|

|

|

|

|

23.1

|

|

|

Consent of Kirkland & Ellis LLP (included in Exhibit 5.1).

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release, dated May 18, 2020, announcing the Offering.

|

|

|

|

|

|

|

|

|

99.2

|

|

|

Information relating to Part II, Item 14. “Other Expenses of Issuance and Distribution” of the Company’s registration statement on Form S-3 (No. 333-231606).

|

Cautionary Information Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the federal securities laws. These forward-looking statements reflect the Company’s current intentions, expectations or beliefs regarding the Offering. These statements may be preceded by, followed by or include the words “aim,” “anticipate,” “believe,” “estimate,” “expect,” “forecast,” “intend,” “likely,” “outlook,” “plan,” “potential,” “project,” “projection,” “seek,” “can,” “could,” “may,” “should,” “would,” “will,” the negatives thereof and other words and terms of similar meaning. Forward-looking statements include all statements that are not historical facts. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. There is no assurance that any forward-looking statements will materialize. The Company does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned here unto duly authorized.

|

|

|

|

|

|

|

|

|

Date: May 21, 2020

|

|

|

|

CARVANA CO.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Mark Jenkins

|

|

|

|

|

|

Name:

|

|

Mark Jenkins

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

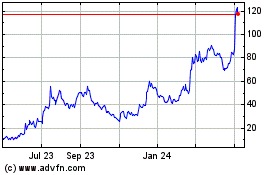

Carvana (NYSE:CVNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carvana (NYSE:CVNA)

Historical Stock Chart

From Apr 2023 to Apr 2024