Believes Contura Cannot Fully Reverse its

Years-Long Tailspin Until the Company Accelerates its Exit from

Environmentally-Destructive Thermal Coal, Deleverages its Balance

Sheet and Refreshes its Six-Member Board

Contends that Contura’s Legacy Directors are

Unequipped to Effectively Support the Company’s Strong Management

Team, Misaligned with Stockholders and Unqualified in ESG

Areas

Urges Contura to Seek Stockholder Input and

Promptly Overhaul Half of the Company’s Board by Replacing Three

Legacy Directors with New, Highly-Qualified Individuals

MG Capital Management, Ltd. (together with its affiliates, “MG

Capital” or “we"), a long-term stockholder of Contura Energy, Inc.

(NYSE: CTRA) (“Contura” or the “Company”) and owner of

approximately 5.8% of the Company’s outstanding common stock, today

issued the below letter to the Company’s Board of Directors and

filed a Schedule 13D with the U.S. Securities and Exchange

Commission.

***

VIA EMAIL

October 7, 2020

The Board of Directors Contura Energy, Inc. 340 Martin Luther

King Jr. Blvd. Bristol, TN 37620

Dear Members of the Board of Directors:

MG Capital Management, Ltd. (together with its affiliates, “MG

Capital” or “we") is a long-term stockholder of Contura Energy,

Inc. (“Contura” or the “Company”), with ownership of approximately

5.8% of the Company’s outstanding common stock. Since making our

initial investment in Contura in 2016, MG Capital has continuously

assessed the Company’s assets, corporate governance, strategic

decisions and market positioning against the backdrop of our

country’s rapidly-changing energy economy. We are writing to you

today because it has become abundantly clear to us in recent months

that Contura cannot begin to fully reverse its years-long tailspin

until it accelerates its intended exit from the thermal coal

business and refreshes half of the Company’s six-member Board of

Directors (the “Board”).

We are very concerned that Contura, which only two years ago had

a market capitalization of more than $1 billion and a stock price

of more than $75, continuously trades at a staggering discount to

its intrinsic value. As the country’s largest producer of coking

products (a critical input into the steel production supply chain),

Contura is part of the lifeblood of our economy and has a critical

role to play with respect to infrastructure and national security.

Notably, during the last cyclical high in 2011, Alpha Natural

Resources, Inc. (Contura’s predecessor company) reached more than

$12 billion in enterprise value and generated annual EBITDA in

excess of $1 billion. In stark contrast, Contura’s estimated

enterprise value is currently below $550 million.

After recently assessing all of our concerns pertaining to

Contura’s trajectory, we concluded that the Company’s Board – in

particular, legacy directors John Lushefski, Daniel Geiger and

Albert Ferrara, Jr. – lacks the expertise and skills to support a

turnaround in today’s new energy economy. We explain why our team

came to this conclusion in the next section of this letter.

Importantly, we want to take the opportunity to highlight that

David Stetson and the other management team members that assumed

leadership roles in 2019 have been doing an exceptional job

navigating this year’s difficult market environment. We fully

support new management’s decision to begin exiting the

environmentally-destructive thermal coal business and look forward

to Contura quickly having little-to-no exposure to this segment of

the market. We are also impressed by management’s continued focus

on containing costs and targeting debt reduction, which can

eventually enable the Company to resume its buyback program in a

thoughtful manner.

In our view, Mr. Stetson and the

high-quality executives that he has recruited deserve to be

supported by a refreshed Board that possesses complementary

skillsets, diverse viewpoints and meaningful ownership

perspectives. The new management team and long-suffering

stockholders should not have to be shackled to ineffective legacy

directors with a history of reaping outsized compensation for

overseeing massive value destruction.

The Case for Change in

Contura’s Boardroom is Crystal Clear

We contend that Contura’s new management has inherited a Board

that is ill-equipped and poorly-aligned. It looks as if none of the

long-serving directors – other than Mr. Stetson – have the

expertise needed to support management’s growth, modernization and

efficiency plans. It is also a red flag that the Board is not

sufficiently aligned with stockholders. Excluding Mr. Stetson,

Contura directors have average holdings of approximately 17,000

shares of common stock.

Messrs. Lushefski, Geiger and Ferrara have also seemingly failed

as allocators of capital, authorizing stock buybacks at peak cycle

prices ($31.54 per share vs. $7.92 at Friday’s close) and saddling

the Company with dangerous levels of debt. Indeed, while these

directors were endorsing stock buybacks, they were also selling

stock themselves. In 2019, our research indicates that Mr.

Lushefski sold stock between $61.15 and $52.67, Mr. Geiger sold

stock between $62.99 and $29.07 and Mr. Ferrara sold stock at $53.

These same individuals have also shown what we believe is an

inability to effectively assess strategic transactions in today’s

marketplace, like Contura’s mishandled Powder River Basin sale.

Most disappointing, however, is the Board’s reaction to the

COVID-19 crisis. It appears that Contura’s directors have

maintained their significant Board compensation as the Company has

had few options other than to shutter assets and furlough

employees. For context, in 2019, Mr. Lushefski was paid $293,000,

Mr. Geiger was paid $216,000 and Mr. Ferrara was paid $266,000. We

deem these to be outsized sums given that these legacy directors

have overseen hundreds of millions of dollars in value destruction

and presided over sobering job losses. Perhaps all of the members

of the Board are not aware of industry estimates that show the

average miner in West Virginia makes less than $55,000 per

year.

We were unsurprised upon learning that these legacy directors

also enjoy little support from other stockholders, proxy advisory

firms and the Company’s broader stakeholder set. Ahead of Contura’s

2020 Annual Meeting of Stockholders, Institutional Shareholder

Services, Inc. (“ISS”) recommended that the Company’s stockholders

withhold votes for an astonishing 50% of the Board. ISS also failed

Contura on every climate awareness metric in 2019. We believe

Contura’s legacy directors have repeatedly failed to embrace best

practices when it comes to environmental, social and governance

(“ESG”) criteria.

Now is the Time to

Refresh Contura’s Board

As a major stockholder with significant knowledge of Contura’s

business and market, MG Capital hopes a Company representative will

quickly engage with us and seek our input on a prompt director

refreshment program. We are prepared to share proposed candidates

for appointment to the Board, including ones with strong capital

allocation acumen, new energy expertise, regulatory experience and

ESG knowhow. Contura’s dismal results speak for themself and we

suspect stockholders will not react well to a delay.

Please be advised that MG Capital is

prepared to nominate director candidates ahead of Contura’s 2021

Annual Meeting of Stockholders if the incumbent Board forces us to

do so. However, that is not our first choice.

Sincerely,

Michael Gorzynski Managing Member MG Capital

View source

version on businesswire.com: https://www.businesswire.com/news/home/20201007005145/en/

Profile Greg Marose / Charlotte Kiaie, 347-343-2999

gmarose@profileadvisors.com / ckiaie@profileadvisors.com

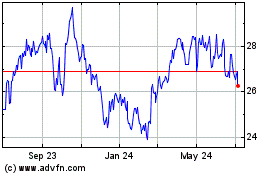

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

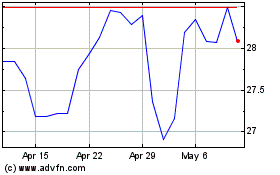

Coterra Energy (NYSE:CTRA)

Historical Stock Chart

From Apr 2023 to Apr 2024