UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

|

o

|

Preliminary Proxy Statement

|

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

þ

|

Definitive Proxy Statement

|

|

|

o

|

Definitive Additional Materials

|

|

|

o

|

Soliciting Material Pursuant to §240.14a-12

|

|

CASTLIGHT HEALTH, INC.

|

|

|

|

|

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

|

þ

|

No fee required

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

|

|

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.

|

|

|

3)

|

Filing Party:

|

|

|

4)

|

Date Filed:

|

April 24, 2020

To Our Stockholders,

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Castlight Health, Inc. We currently intend to hold the meeting in person at Castlight’s offices at 150 Spear Street, Suite 400, San Francisco, California 94105, on Wednesday, June 3, 2020 at 9:00 a.m. (Pacific Time). We plan to announce any updates as to the location of our annual meeting on our proxy website http://www.astproxyportal.com/ast/18865, and we encourage you to check this website prior to the meeting if you plan to attend.

Under the Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to our stockholders over the Internet. We believe that this delivery process reduces our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. On or about April 24, 2020, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2020 Annual Meeting of Stockholders and our fiscal 2019 Annual Report on Form 10-K. The Notice also provides instructions on how to vote by telephone or through the Internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

The matters to be acted upon are described in the accompanying notice of annual meeting and proxy statement.

Please use this opportunity to take part in our company’s affairs by voting on the business to come before the meeting. Whether or not you plan to attend the meeting, please vote on the Internet or by telephone or request, sign and return a proxy card to ensure your representation at the meeting. Your vote is important.

We hope to see you at the meeting.

Sincerely,

Maeve O'Meara

Chief Executive Officer

|

|

|

|

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 3, 2020: THIS PROXY STATEMENT AND THE ANNUAL REPORT ARE AVAILABLE AT http://www.astproxyportal.com/ast/18865

|

CASTLIGHT HEALTH, INC.

150 Spear Street, Suite 400

San Francisco, California 94105

________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

________________

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2020 Annual Meeting of Stockholders of Castlight Health, Inc. (“Castlight”) will be held on Wednesday, June 3, 2020, at 9:00 a.m. (Pacific Time) at Castlight’s offices at 150 Spear Street, Suite 400, San Francisco, California 94105. We are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials may issue in light of the evolving coronavirus (COVID-19) situation. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described above and herein) or may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). We plan to announce any such updates on our proxy website, http://www.astproxyportal.com/ast/18865, and we encourage you to check this website prior to the meeting if you plan to attend.

We are holding the meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1. To elect three Class III directors of Castlight, each to serve until the 2023 annual meeting of stockholders and until his or her successor has been elected and qualified or until such director's earlier resignation or removal.

2. To ratify the appointment of Ernst & Young LLP as Castlight’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

3. To approve, on a non-binding advisory basis, the compensation paid by us to our named executive officers as disclosed in this proxy statement.

4. To select, on a non-binding advisory basis, whether future advisory votes on the compensation paid by us to our named executive officers should be held every one, two or three years.

5. To approve an amendment to Castlight’s Restated Certificate of Incorporation to effect a reverse stock split of Castlight’s Class A Common Stock and Class B Common Stock at a ratio not less than 1-for-5 and not greater than 1-for-15, and a proportionate reduction in the number of authorized shares of Castlight’s Class A Common Stock and Class B Common Stock, with the exact ratio to be set within that range at the discretion of the Board at any time prior to Castlight’s 2021 annual meeting of stockholders, without the further approval or authorization of Castlight’s stockholders.

6. To transact such other business as may properly come before the Annual Meeting of Stockholders and any postponement or adjournment of the Annual Meeting of Stockholders.

In addition, stockholders may be asked to consider and vote upon such other business as may properly come before the meeting or any adjournment or postponement thereof.

Only stockholders of record at the close of business on April 13, 2020 are entitled to notice of, and to vote at, the meeting and any adjournments thereof. For ten days prior to the meeting, a complete list of the stockholders entitled to vote at the meeting will be available during ordinary business hours at our San Francisco offices for examination by any stockholder for any purpose relating to the meeting.

Your vote as a Castlight Health, Inc. stockholder is very important. With respect to all matters that will come before the meeting, each holder of shares of common stock is entitled to one vote for each share of common stock held as of the close of business on April 13, 2020, the record date. Holders of our Class A common stock and of our Class B common stock will vote together as a single class. For questions regarding your stock ownership, if you are a registered holder, you can contact our transfer agent, American Stock Transfer & Trust Company, LLC, through their website at http://www.astfinancial.com, by mail at 6201 15th Avenue, Brooklyn, NY 11219 or by phone at (800) 937-5449.

By Order of our Board of Directors,

Alex Shvartsman

General Counsel and Corporate Secretary

San Francisco, California

April 24, 2020

Whether or not you expect to attend the meeting, we encourage you to read the proxy statement and vote by telephone or through the Internet or request and submit your proxy card as soon as possible, so that your shares may be represented at the meeting. For specific instructions on how to vote your shares, please refer to the section entitled “General Information About the Meeting” beginning on page 1 of the proxy statement and the instructions on the enclosed Notice of Internet Availability of Proxy Materials.

CASTLIGHT HEALTH, INC.

PROXY STATEMENT FOR 2020 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

GENERAL PROXY INFORMATION

|

|

|

Information About Solicitation and Voting

|

|

|

Internet Availability of Proxy Materials

|

|

|

General Information About the Meeting

|

|

|

Voting Rights; Required Vote

|

|

|

Recommendations of our Board of Directors on Each of the Proposals Scheduled to be Voted on at the Meeting

|

|

|

Voting Instructions; Voting of Proxies

|

|

|

Expenses of Soliciting Proxies

|

|

|

Revocability of Proxies

|

|

|

Electronic Access to the Proxy Materials

|

|

|

Voting Results

|

|

|

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

|

|

|

Corporate Governance Guidelines

|

|

|

Board of Directors Leadership Structure

|

|

|

Role of the Board of Directors in Risk Oversight

|

|

|

Independence of Directors

|

|

|

Committees of Our Board of Directors

|

|

|

Compensation Committee Interlocks and Insider Participation

|

|

|

Board and Committee Meetings and Attendance

|

|

|

Director Attendance at Annual Stockholders’ Meeting

|

|

|

Presiding Director of Non-Employee Director Meetings

|

|

|

Code of Business Conduct

|

|

|

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

|

|

|

Nomination to our Board of Directors

|

|

|

Director Qualifications

|

|

|

PROPOSAL NO. 1 ELECTION OF DIRECTORS

|

|

|

Information Regarding Nominees and Continuing Directors

|

|

|

Director Compensation

|

|

|

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

|

Principal Accountant Fees and Services

|

|

|

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

|

|

|

PROPOSAL NO. 3 ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

|

|

|

PROPOSAL NO. 4 ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

|

|

|

PROPOSAL NO. 5 REVERSE STOCK SPLIT

|

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

|

|

MANAGEMENT

|

|

|

EXECUTIVE COMPENSATION DISCUSSION AND ANALYSIS

|

|

|

|

|

|

|

|

|

|

2019 Summary Compensation Table

|

|

|

2019 Grants of Plan Based Awards

|

|

|

2019 Outstanding Equity Awards at Fiscal Year-End Table

|

|

|

2019 Option Exercises and Stock Vested at Fiscal Year End

|

|

|

Employment Arrangements

|

|

|

Potential Payments upon Termination or Change in Control

|

|

|

Securities Authorized for Issuance Under Equity Compensation Plans

|

|

|

TRANSACTIONS WITH RELATED PARTIES, FOUNDERS AND CONTROL PERSONS

|

|

|

Review, Approval or Ratification of Transactions with Related Parties

|

|

|

REPORT OF THE AUDIT COMMITTEE

|

|

|

ADDITIONAL INFORMATION

|

|

|

Stockholder Proposals to be Presented at Next Annual Meeting

|

|

|

Delinquent Section 16(a) Reports

|

|

|

Available Information

|

|

|

“Householding” – Stockholders Sharing the Same Last Name and Address

|

|

|

STOCKHOLDER COMMUNICATIONS

|

|

|

OTHER MATTERS

|

|

|

APPENDIX A - CASTLIGHT HEALTH, INC. CERTIFICATE OF AMENDMENT TO THE CERTIFICATE OF INCORPORATION

|

|

CASTLIGHT HEALTH, INC.

150 Spear Street, Suite 400

San Francisco, California 94105

________________

PROXY STATEMENT FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS

________________

April 24, 2020

GENERAL PROXY INFORMATION

Information About Solicitation and Voting

The accompanying proxy is solicited on behalf of the Board of Directors of Castlight Health, Inc. (“we”, “us” or “Castlight”) for use at our 2020 Annual Meeting of Stockholders (the “meeting”) to be held at Castlight’s offices at 150 Spear Street, Suite 400, San Francisco, California 94105, on Wednesday, June 3, 2020, at 9:00 a.m. (Pacific Time), and any adjournment or postponement thereof. If you held shares of our common stock on April 13, 2020, (the “record date”), you are invited to attend the meeting and vote on the proposals described in this proxy statement. We currently intend to hold the annual meeting in person. However, we are sensitive to the public health and travel concerns our stockholders may have and recommendations that public health officials may issue in light of the evolving coronavirus (COVID-19) situation. As a result, we may impose additional procedures or limitations on meeting attendees (beyond those described above and herein) or may decide to hold the meeting in a different location or solely by means of remote communication (i.e., a virtual-only meeting). We plan to announce any such updates on our proxy website, http://www.astproxyportal.com/ast/18865, and we encourage you to check this website prior to the meeting if you plan to attend.

Internet Availability of Proxy Materials

Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are furnishing proxy materials to our stockholders via the Internet, instead of mailing printed copies of those materials to each stockholder. On or about April 24, 2020, we expect to send to our stockholders a Notice of Internet Availability of Proxy Materials (“Notice of Internet Availability”) containing instructions on how to access our proxy materials, including our proxy statement and our annual report. The Notice of Internet Availability also provides instructions on how to vote by telephone or through the Internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

This process is designed to reduce our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. However, if you would prefer to receive printed proxy materials, please follow the instructions included in the Notice of Internet Availability.

General Information About the Meeting

Purpose of the Meeting

At the meeting, stockholders will act upon the proposals described in this proxy statement. In addition, following the meeting, management will respond to questions from stockholders.

Record Date; Quorum

Only holders of record of common stock at the close of business on April 13, 2020, the record date, will be entitled to vote at the meeting. At the close of business on April 13, 2020, we had 35,032,053 shares of Class A common stock and 114,490,197 shares of Class B common stock outstanding and entitled to vote. The holders of a majority of the voting power of the shares of stock entitled to vote at the meeting as of the record date must be present at the meeting in order to hold the meeting and conduct business. This majority presence is called a quorum. Your shares are counted as present at the meeting if you are present and vote in person at the meeting or if you have properly submitted a proxy.

Voting Rights; Required Vote

With respect to all matters that will come before the meeting, each holder of shares of common stock is entitled to one vote for each share of common stock held as of the close of business on April 13, 2020, the record date. Holders of our Class A common stock and of our Class B common stock will vote together as a single class. You may vote all shares owned by you as of April 13, 2020, including (1) shares held directly in your name as the stockholder of record and (2) shares held for you as the beneficial owner in street name through a broker, bank, trustee, or other nominee. We do not have cumulative voting rights for the election of directors.

Stockholder of Record: Shares Registered in Your Name. If on April 13, 2020 your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, then you are considered the stockholder of record with respect to those shares. As a stockholder of record, you may vote at the meeting or vote by telephone, through the Internet, or if you request or receive paper proxy materials by mail, by filling out and returning the proxy card.

In light of the evolving COVID-19 situation, we strongly recommend that you vote your shares in advance of the meeting as instructed above, even if you plan to attend the meeting.

Beneficial Owner: Shares Registered in the Name of a Broker or Nominee. If on April 13, 2020 your shares were held in an account with a brokerage firm, bank or other nominee, then you are the beneficial owner of the shares held in street name. As a beneficial owner, you have the right to direct your nominee on how to vote the shares held in your account. However, the organization that holds your shares is considered the stockholder of record for purposes of voting at the meeting. Because you are not the stockholder of record, you may not vote your shares at the meeting unless you request and obtain a valid proxy from the organization that holds your shares giving you the right to vote the shares at the meeting.

In Proposal No. 1, each director will be elected by a plurality of the votes cast, which means that the three individuals nominated for election to our Board of Directors at the meeting receiving the highest number of “FOR” votes will be elected. You may either vote “FOR” all of the nominees or “WITHHOLD” your vote with respect to any of the nominees. Approval of Proposal No. 2 will be obtained if the number of votes cast “FOR” such proposal at the meeting exceeds the number of votes “AGAINST” such proposal. Approval, on a non-binding advisory basis, of Proposal No. 3, the compensation of our named executive officers, will be obtained if the number of votes cast “FOR” the proposal at the meeting exceeds the number of votes “AGAINST” the proposal. The non-binding advisory vote on Proposal No. 4, the frequency of future non-binding advisory votes on the compensation of our named executive officers, will provide stockholders with the opportunity to choose among four options with respect to this proposal. You may vote for holding the non-binding advisory vote to approve the compensation of our named executive officers every “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” or vote for “ABSTAIN.” The frequency receiving the greatest number of votes cast by stockholders will be deemed to be the preferred frequency option of our stockholders. Approval of Proposal No. 5 will be obtained if holders of a majority of the outstanding shares of Class A common stock and Class B common stock of the company entitled to vote on the proposal, voting together as a single class, vote "FOR" the proposal. For Proposal Nos. 1, 2, 3 and 4, abstentions (shares present at the meeting and voted “abstain”) and broker non-votes are counted for purposes of determining whether a quorum is present, and have no effect on the outcome of the matters voted upon. For Proposal No. 5, abstentions and broker non-votes will be counted for purposes of establishing a quorum and, if a quorum is present, will have the same practical effect as a vote against the proposal. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted either because (i) the broker did not receive voting instructions from the beneficial owner, or (ii) the broker lacked discretionary authority to vote the shares. Note that if you are a beneficial holder and do not provide specific voting instructions to your broker, the broker that holds your shares will not be authorized to vote on the election of directors. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the meeting.

Recommendations of our Board of Directors on Each of the Proposals Scheduled to be Voted on at the Meeting

The Board of Directors recommends that you vote FOR all of the Class III directors named in this proxy statement (Proposal No. 1), FOR the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020 (Proposal No. 2), FOR the approval, on a non-binding advisory basis, of the compensation of our named executive officers, as disclosed in this proxy statement (Proposal No. 3), to hold future non-binding advisory votes on the compensation of our named executive officers every ONE YEAR (Proposal No. 4), and FOR the approval of the reverse stock split (Proposal No. 5).

Voting Instructions; Voting of Proxies

If you are a stockholder of record, you may:

•vote in person - we will provide a ballot to stockholders who attend the meeting and wish to vote in person;

•vote via telephone or via the Internet - in order to do so, please follow the instructions shown on your Notice of Internet Availability or proxy card; or

•vote by mail - if you request or receive a paper proxy card and voting instructions by mail, simply complete, sign and date the enclosed proxy card and return it before the meeting in the envelope provided.

Votes submitted by telephone or through the Internet must be received by 11:59 p.m., Eastern Time, on Tuesday, June 2, 2020. Submitting your proxy (whether by telephone, through the Internet or by mail if you request or received a paper proxy card) will not affect your right to vote in person should you decide to attend the meeting. If you are not the stockholder of record, please refer to the voting instructions provided by your nominee to direct it on how to vote your shares. Your vote is important. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure that your vote is counted.

All proxies will be voted in accordance with the instructions specified on the proxy card. If you sign a physical proxy card and return it without instructions as to how your shares should be voted on a particular proposal at the meeting, your shares will be voted in accordance with the recommendations of our Board of Directors stated above.

If you received a Notice of Internet Availability, please follow the instructions included on the notice on how to access your proxy card and vote by telephone or through the Internet. If you do not vote and you hold your shares in street name, and your broker does not have discretionary power to vote your shares, your shares may constitute “broker non-votes” (as described above) and will not be counted in determining the number of shares necessary for approval of the proposals. However, shares that constitute broker non-votes will be counted for the purpose of establishing a quorum for the meeting.

If you receive more than one proxy card or Notice of Internet Availability, your shares are registered in more than one name or are registered in different accounts. To make certain all of your shares are voted, please follow the instructions included on the Notice of Internet Availability on how to access each proxy card and vote each proxy card by telephone or through the Internet. If you requested or received paper proxy materials by mail, please complete, sign and return each proxy card to ensure that all of your shares are voted.

Expenses of Soliciting Proxies

The expenses of soliciting proxies will be paid by us. Following the original mailing of the soliciting materials, we and our agents may solicit proxies by mail, electronic mail, telephone, facsimile, by other similar means, or in person. Our directors, officers, and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, e-mail, or otherwise. Following the original mailing of the soliciting materials, we will request brokers, custodians, nominees and other record holders to forward copies of the soliciting materials to persons for whom they hold shares and to request authority for the exercise of proxies. In such cases, Castlight, upon the request of the record holders, will reimburse such holders for their reasonable expenses. If you choose to access the proxy materials or vote through the Internet, you are responsible for any Internet access charges you may incur.

Revocability of Proxies

A stockholder of record who has given a proxy may revoke it at any time before it is exercised at the meeting by:

•delivering to our Corporate Secretary (by any means) a written notice stating that the proxy is revoked;

•signing and delivering a proxy bearing a later date; or

•attending and voting at the meeting (although attendance at the meeting will not, by itself, revoke a proxy).

Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to revoke a proxy, you must contact that firm to revoke any prior voting instructions.

Electronic Access to the Proxy Materials

The Notice of Internet Availability will provide you with instructions regarding how to:

•view our proxy materials for the meeting through the Internet; and

•instruct us to send our future proxy materials to you electronically by email.

Choosing to receive your future proxy materials by email will reduce the impact of our annual meetings of stockholders on the environment and lower the costs of printing and distributing our proxy materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

Voting Results

Voting results will be tabulated and certified by the inspector of elections appointed for the meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a Current Report on Form 8-K within four business days of the meeting.

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

We are strongly committed to good corporate governance practices. These practices provide an important framework within which our Board of Directors and management can pursue our strategic objectives for the benefit of our stockholders.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines that set forth expectations for directors, director independence standards, board committee structure and functions, and other policies for the governance of Castlight. Our Corporate Governance Guidelines are available on the Investor Relations section of our website, which is located at http://ir.castlighthealth.com/investor-relations/corporate-governance/governance-documents/, by clicking on “Corporate Governance Guidelines,” under “Governance Documents.” The Corporate Governance Guidelines are reviewed at least annually by our Nominating and Corporate Governance Committee, and changes are recommended to our Board of Directors as warranted.

Board of Directors Leadership Structure

Our Corporate Governance Guidelines provide that, and our Board of Directors believes that it is in the best interests of Castlight for, the roles of Chairperson and Chief Executive Officer to be separated. Maintaining separate roles of Chairperson and Chief Executive Officer provides us with optimally effective leadership. Our Chairperson’s duties include, among other things, the nonexclusive authority to preside over meetings of the stockholders and the Board of Directors (including non-executive directors of our Board of Directors) and to hold such other powers and carry out such other duties as are also granted to the Chairperson of our Board of Directors. Our Corporate Governance Guidelines also provide that the independent directors may, if deemed advisable, select a “Lead Independent Director.”

Role of the Board of Directors in Risk Oversight

One of the key functions of our Board of Directors is informed oversight of our risk management process. Our Board of Directors does not have a standing risk management committee, but rather administers this oversight function directly as a whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management are undertaken. The Audit Committee also monitors security management, including our cybersecurity efforts, and compliance with legal and regulatory requirements. Our Compensation and Talent Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking and reviews the steps management has taken to monitor or mitigate compensation-related risk exposures.

Independence of Directors

Our Board of Directors determines the independence of our directors by applying the independence principles and standards established by the New York Stock Exchange, or NYSE. These provide that a director is independent only if our Board of Directors affirmatively determines that the director has no direct or indirect material relationship with our company. They also specify various relationships that preclude a determination of director independence. Material relationships may include commercial, industrial, consulting, legal, accounting, charitable, family and other business, professional and personal relationships.

Applying these standards, our Board of Directors annually reviews the independence of Castlight’s directors, taking into account all relevant facts and circumstances. In its most recent review, our Board of Directors considered, among other things, the relationships that each non-employee director has with our company and all other facts and circumstances our Board of Directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director.

Based upon this review, our Board of Directors has determined that the following director nominees and members of our Board of Directors are currently independent as determined under the rules of the NYSE:

|

|

|

|

|

|

|

|

Michael Eberhard

|

Bryan Roberts

|

|

David Ebersman

|

David B. Singer

|

|

Ed Park

|

Judith K. Verhave

|

|

|

Kenny Van Zant

|

Committees of Our Board of Directors

Our Board of Directors has established an Audit Committee, a Compensation and Talent Committee, and a Nominating and Corporate Governance Committee. The composition and responsibilities of each committee are described below. Also, from time to time the Board may identify special committee to manage certain discreet subject areas as needed. Copies of the charters for each standing committee are available, without charge, upon request in writing to Castlight Health, Inc., 150 Spear Street, Suite 400, San Francisco, California 94105, Attn: General Counsel or by clicking on “Corporate Governance” in the investor relations section of our website, http://ir.castlighthealth.com/investor-relations/investors-overview/. Members serve on these committees until their resignations or until otherwise determined by our Board of Directors.

Audit Committee

Our Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, is comprised of Mr. Eberhard, Mr. Park and Mr. Singer. Mr. Park is the chairman of the Audit Committee. The composition of our Audit Committee meets the requirements for independence under the current NYSE and SEC rules and regulations. Each member of our Audit Committee is financially literate. In addition, our Board of Directors has determined that Mr. Singer is an “audit committee financial expert” as defined in Item 407(d)(5)(ii) of Regulation S-K promulgated under the Securities Act. This designation does not impose on him any duties, obligations or liabilities that are greater than are generally imposed on other members of our Audit Committee and our Board of Directors. Our Audit Committee is directly responsible for, among other things:

•selecting a firm to serve as the independent registered public accounting firm to audit our financial statements;

•ensuring the independence of the independent registered public accounting firm;

•discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and that firm, our interim and year-end operating results;

•establishing procedures for employees to submit, anonymously, concerns about questionable accounting or audit matters;

•considering the adequacy of our internal controls and internal audit function;

•reviewing material related party transactions or those that require disclosure;

•approving or, as permitted, pre-approving all audit and non-audit services to be performed by the independent registered public accounting firm; and

•monitoring security management and compliance with other legal and regulatory requirements.

Compensation and Talent Committee

Our Compensation and Talent Committee is comprised of Mr. Ebersman, Ms. Verhave, and Mr. Van Zant. Mr. Ebersman is the chairman of our Compensation and Talent Committee. The composition of our Compensation and Talent Committee meets the requirements of independence under the NYSE rules and regulations. Each member of this committee is a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended. Our Compensation and Talent Committee retains, and does not delegate, any of its responsibility to determine executive compensation.

Our Compensation and Talent Committee is responsible for, among other things:

•reviewing and approving, or recommending that our Board of Directors approve, the compensation of our executive officers;

•reviewing and approving, or recommending that our Board of Directors approve, the compensation of our directors;

•administering our stock and equity incentive plans;

•reviewing and approving, or making recommendations to our Board of Directors with respect to, incentive compensation and equity plans; and

•reviewing our overall compensation philosophy.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is comprised of Dr. Roberts, Mr. Singer, and Ms. Verhave. Dr. Roberts is the chairman of our Nominating and Corporate Governance Committee. The composition of the Nominating and Corporate Governance Committee meets the requirements of independence under the NYSE rules and regulations. The committee is responsible for, among other things:

•identifying and recommending candidates for membership on our Board of Directors;

•reviewing and recommending our corporate governance guidelines and policies;

•reviewing proposed waivers of the code of conduct for directors and executive officers;

•overseeing the process of evaluating the performance of our Board of Directors; and

•assisting our Board of Directors on corporate governance matters.

The charters of our Audit, Compensation and Talent, and Nominating and Corporate Governance Committees are posted on our website at http://ir.castlighthealth.com/investor-relations/corporate-governance/governance-documents/.

Compensation and Talent Committee Interlocks and Insider Participation

The members of our Compensation and Talent Committee during 2019 were Mr. Ebersman, Mr. Van Zant, and Ms. Verhave. None of the members of our Compensation and Talent Committee in 2019 was at any time during 2019 or at any other time an officer or employee of Castlight or any of our subsidiaries, and except as disclosed below, none had or have any relationships with Castlight that are required to be disclosed under Item 404 of Regulation S-K.

None of our executive officers has served as a member of the board of directors, or as a member of the compensation or similar committee, of any entity that has one or more executive officers who served on our Board of Directors or Compensation and Talent Committee during 2019.

Board and Committee Meetings and Attendance

During 2019, (1) our Board of Directors held 10 meetings and acted by unanimous written consent 2 times, (2) the Audit Committee held 6 meetings and acted by unanimous written consent 1 time, (3) the Compensation and Talent Committee held 14 meetings and acted by unanimous written consent 3 times, and (4) the Nominating and Corporate Governance Committee held 2 meetings and acted by unanimous written consent 1 time. During 2019, each member of our Board of Directors participated in at least 75% of the aggregate of all meetings of our Board of Directors and the aggregate of all meetings of committees on which such member served, that were held during the period in which such director served during 2019.

Director Attendance at Annual Stockholders’ Meeting

It is our policy that directors are invited and encouraged to attend the annual meeting of stockholders in person, however, we do not have a formal policy regarding attendance of annual meetings by the members of our Board of Directors. One of our nine directors at the time attended our 2019 Annual Meeting of Stockholders.

Presiding Director of Non-Employee Director Meetings

The non-employee directors meet in regularly scheduled executive sessions without management to promote open and honest discussion. Our Chairperson, Dr. Roberts, is the presiding director at these meetings.

Code of Business Conduct

We have adopted codes of business conduct that applies to all of our directors, officers and employees. Our Code of Business Conduct is posted on the investor relations section of our website located at http://ir.castlighthealth.com/investor-relations/investors-overview/, by clicking on “Corporate Governance.” Any amendments or waivers of our Code of Business Conduct pertaining to a member of our Board of Directors or one of our executive officers will be disclosed on our website at the above-referenced address.

NOMINATIONS PROCESS AND DIRECTOR QUALIFICATIONS

Nomination to our Board of Directors

Candidates for nomination to our Board of Directors are selected by our Board of Directors based on the recommendation of the Nominating and Corporate Governance Committee in accordance with the committee's charter, our certificate of incorporation and bylaws, our Corporate Governance Guidelines, and the criteria adopted by our Board of Directors regarding director candidate qualifications. In recommending candidates for nomination, the Nominating and Corporate Governance Committee considers candidates recommended by directors, officers, employees, stockholders and others, using the same criteria to evaluate all candidates. Evaluations of candidates generally involve a review of background materials, internal discussions and interviews with selected candidates as appropriate and, in addition, the Nominating and Corporate Governance Committee may engage consultants or third-party search firms to assist in identifying and evaluating potential nominees.

The Nominating and Corporate Governance Committee considers stockholder recommendations for director candidates. The Nominating and Corporate Governance Committee has established the following procedure for stockholders to submit director nominee recommendations:

•Our bylaws establish procedures pursuant to which a stockholder may nominate a person for election to our Board of Directors;

•If a stockholder would like to recommend a director candidate for the next annual meeting, he or she must submit the recommendations by mail to our Corporate Secretary at our principal executive offices, not less than 75 or more than 105 days prior to the first anniversary of the previous year's annual meeting;

•Recommendations for a director candidate must be accompanied by all information relating to such person as would be required to be disclosed in solicitations of proxies for election of such nominee as a director pursuant to Regulation 14A under the Securities Exchange Act of 1934, including such person's written consent to being named in the proxy statement as a nominee and to serve as a director if elected;

•The Nominating and Corporate Governance Committee considers nominees based on our need to fill vacancies or to expand our Board of Directors, and also considers our need to fill particular roles on our Board of Directors or committees thereof (e.g. independent director, Audit Committee financial expert, etc.); and

•The Nominating and Corporate Governance Committee evaluates candidates in accordance with its charter and policies regarding director qualifications, qualities and skills discussed above.

Please see the “Additional Information” section at the end of this proxy statement for details concerning the stockholder proposal process for the 2021 Annual Meeting of Stockholders.

Director Qualifications

The goal of the Nominating and Corporate Governance Committee is to ensure that our Board of Directors possesses a variety of perspectives and skills derived from high-quality business and professional experience. The Nominating and Corporate Governance Committee seeks to achieve a balance of knowledge, experience and capability on our Board of Directors. To this end, the Nominating and Corporate Governance committee seeks nominees on the basis of, among other things, independence, integrity, diversity, skills, financial and other expertise, breadth of experience, knowledge about Castlight's business or industry and willingness and ability to devote adequate time and effort to Board of Directors' responsibilities in the context of the existing composition, other areas that are expected to contribute to the Board of Directors’ overall effectiveness and needs of the Board of Directors and its committees. Although the Nominating and Corporate Governance Committee uses these and other criteria to evaluate potential nominees, we have no stated minimum criteria for nominees. In addition, while the Nominating and Corporate Governance Committee does not have a formal policy with respect to diversity, the Nominating and Corporate Governance Committee values members who represent diverse viewpoints. The Nominating and Corporate Governance Committee does not use different standards to evaluate nominees depending on whether they are proposed by our directors and management or by our stockholders. When appropriate, the Nominating and Corporate Governance Committee may retain executive recruitment firms to assist it in identifying suitable candidates. After its evaluation of potential nominees, the Nominating and Corporate Governance Committee submits its chosen nominees to our Board of Directors for approval. The brief biographical description of each director set forth in Proposal No. 1 below

includes the primary individual experience, qualifications, attributes and skills of each of our directors that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of nine directors and is divided into three classes with each class serving for three years, and with the terms of office of the respective classes expiring in successive years. Directors in Class III will stand for election at this meeting. The terms of office of directors in Class I and Class II do not expire until the annual meetings of stockholders held in 2021 and 2022, respectively. At the recommendation of our Nominating and Corporate Governance Committee, our Board of Directors proposes that each of the Class III nominees named below be elected as a Class III director for a three-year term expiring at the 2023 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified or until such director’s earlier resignation or removal.

Shares represented by proxies will be voted “FOR” the election of each of the three nominees named below, unless the proxy is marked to withhold authority to so vote. If any nominee for any reason is unable to serve or for good cause will not serve, the proxies may be voted for such substitute nominee as the proxy holder might determine. Each nominee has consented to being named in this proxy statement and to serve if elected.

Information Regarding Nominees and Continuing Directors

Nominees to our Board of Directors

The nominees, their ages and their length of service on our Board of Directors as of April 15, 2020 are provided in the table below. Additional occupational and biographical descriptions of each nominee are set forth in the text below the table. These descriptions include the experience, qualifications, qualities and skills of each of our nominees that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director/Nominee

|

|

Age

|

|

Director Since

|

|

Michael Eberhard(1)

|

|

54

|

|

June 2016

|

|

David Ebersman(2)

|

|

50

|

|

July 2011

|

|

Maeve O'Meara

|

|

38

|

|

July 2019

|

(1)Member of the Audit Committee

(2)Member of the Compensation and Talent Committee

(3)Member of the Nominating and Corporate Governance Committee

Michael Eberhard has served as a director of Castlight since June 2016 and is the President of SAP's Intelligent Spend Group, the world's leading provider of integrated spend management solutions and services (SAP Ariba, SAP Concur, and SAP Fieldglass). He joined Concur in 2003 and became President in November 2016. At Concur, he has held roles including Executive Vice President, Worldwide Sales & Business Development; Executive Vice President and General Manager, Global Accounts; and Executive Vice President and General Manager, Asia Pacific. Prior to joining Concur, Mr. Eberhard was Vice President, Worldwide Sales at Xign; Vice President and General Manager for Ariba; and Vice President and General Manager, Education & Government at PeopleSoft. Mr. Eberhard brings to our Board of Directors deep experience in business, sales, operations and strategic planning.

David Ebersman has served as a director of Castlight since July 2011. Mr. Ebersman is currently CEO of Lyra Health, Inc., a company providing technology-enabled behavioral health care services. Previously, Mr. Ebersman served as the Chief Financial Officer of Facebook, Inc., from 2009 through 2014. Prior to joining Facebook, Mr. Ebersman served in various positions at Genentech, Inc., a biotechnology company, including as its Executive Vice President and Chief Financial Officer, Senior Vice President, Product Operations, and Vice President, Product Development. Prior to joining Genentech, Mr. Ebersman was a research analyst at Oppenheimer & Company, Inc., an investment company. Mr. Ebersman has been a member of the board of directors of SurveyMonkey, Inc. since June 2015. Mr. Ebersman holds an A.B. in International Relations and Economics from Brown University

and was selected for a Henry Crown Fellowship in 2000. Mr. Ebersman brings to our Board of Directors over twenty years of business, operations, strategic planning and financial experience with leading companies, such as Genentech and Facebook.

Maeve O’Meara has served as Chief Executive Officer since July 2019. Prior to that she served as Executive Vice President, Product and Customer Experience since June 2018. Ms. O’Meara joined Castlight in 2010, and previously served as Castlight’s Chief Product Officer and Senior Vice President of Products. Prior to joining Castlight, Ms. O’Meara was a venture capital investor at Highland Capital Partners, a venture capital firm, where she focused on investments in healthcare IT and services and the consumer internet markets. Ms. O’Meara holds an M.B.A. from Stanford Graduate School of Business and a B.A. in Economics from the University of Virginia.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ELECTION OF

EACH OF THE THREE NOMINATED DIRECTORS.

Continuing Directors

The directors who are serving for terms that end following the meeting, and their ages and their length of service on our Board of Directors as of April 15, 2020, are provided in the table below. Additional occupational and biographical descriptions of each such director are set forth in the text below the table. These descriptions include the primary individual experience, qualifications, qualities and skills of each of our nominees that led to the conclusion that each director should serve as a member of our Board of Directors at this time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Director

|

|

Age

|

|

Director Since

|

|

Class I Directors - Terms Expiring 2021:

|

|

|

|

|

|

Seth Cohen

|

|

40

|

|

January 2018

|

|

Bryan Roberts, Ph.D.(3)

|

|

53

|

|

April 2008

|

|

Kenny Van Zant(2)

|

|

50

|

|

August 2016

|

|

|

|

|

|

|

|

Class II Directors - Terms Expiring 2022:

|

|

|

|

|

|

Ed Park(1)

|

|

45

|

|

April 2014

|

|

David B. Singer(1)(3)

|

|

57

|

|

June 2010

|

|

Judith K. Verhave(2)(3)

|

|

64

|

|

June 2018

|

(1)Member of the Audit Committee

(2)Member of the Compensation and Talent Committee

(3)Member of the Nominating and Corporate Governance Committee

Seth Cohen has served on our Board of Directors since January 2018. Mr. Cohen is the co-founder and CEO of Ooda Health, a healthcare payments company, which he co-founded in 2018. Previously, Mr. Cohen served as Castlight's vice president, sales and alliances from 2010 to 2017. Prior to joining Castlight, Mr. Cohen served as a consultant for McKinsey & Company, a consulting firm, as a member of their healthcare payer and provider practice from 2008 to 2010. Mr. Cohen holds an MBA from the Harvard Business School, an MPH from the Harvard Kennedy School, and a BA in International Relations from Stanford University. Mr. Cohen's history with the company, experience in the digital healthcare market and insights into customer needs qualify him to make valuable contributions to the Board of Directors.

Ed Park has served as a director of Castlight since April 2014 and is the CEO and co-founder of Devoted Health, a position he has held since March 2017. Prior to his role with Devoted Health, he served as Executive Vice President and COO of athenahealth, Inc., from July 2010 to March 2017, as Chief Technology Officer from March 2007 to June 2010 and as Chief Software Architect

from 1998 to March 2007. Mr. Park obtained a Bachelor of Arts magna cum laude from Harvard College in Computer Science. Mr. Park brings to our Board of Directors his years of experience overseeing technology and operations at a cloud-based services and mobile applications company in the health care industry which make him well suited for service on our Board of Directors.

Bryan Roberts, Ph.D. co-founded Castlight in 2008, served as a director from 2008 to 2010 and has served as the Chairman of Castlight's Board of Directors since 2010. Dr. Roberts joined Venrock, a venture capital firm, in 1997, where he currently serves as a Partner. Dr. Roberts currently serves as the Chairman of the board of directors of 10X Genomics as well as a director on the boards of several private companies. Dr. Roberts previously served on the board of directors of athenahealth, Inc. from 1999 to 2009, XenoPort, Inc. from 2000 to 2007 and Sirna Therapeutics, Inc. from 2003 to 2007, Vitae Pharmaceuticals from 2001 to 2016, Zeltiq Aesthetics, Inc. from 2008 to 2016, Ironwood Pharmaceuticals, Inc. from 2001 to 2016 and Hua Medicine from 2010 to 2018. From 1989 to 1992, Dr. Roberts worked in the corporate finance department of Kidder, Peabody & Co., a brokerage company. Dr. Roberts received a B.A. in Chemistry from Dartmouth College and a Ph.D. in Chemistry and Chemical Biology from Harvard University. Dr. Roberts' experiences with facilitating the growth of health care, health care IT and biotechnology companies, together with his historical perspective of Castlight, make him uniquely qualified to serve on our Board of Directors.

David B. Singer has served on our Board of Directors since June 2010. Mr. Singer has held various positions at Maverick Capital Ltd. or its affiliates, an investment firm, since December 2004, including Managing Partner of Maverick Ventures since February 2015. Previously, Mr. Singer served as the founding President and Chief Executive Officer of three health care companies. He has also served on the board of directors of Pacific Biosciences of California, Inc. from December 2006 to May 2013, Affymetrix, Inc. from 1993 to 2008, Corcept Therapeutics Incorporated from 1998 to 2008 and Oscient Pharmaceuticals Corporation from 2004 to 2006. Mr. Singer has also served as the senior financial officer of two publicly traded companies. Mr. Singer serves on the board of 1Life Healthcare, Inc. and on the boards of several private health care companies. Mr. Singer served as a health commissioner of San Francisco and a member of the San Francisco General Hospital Joint Conference Committee from July 2013 to January 2017. Mr. Singer holds a B.A. in History from Yale University and an M.B.A. from Stanford University. Mr. Singer’s extensive executive experience and his financial and accounting experience with both public and private companies, including those in the health care industry, make him well suited for service on our Board of Directors.

Kenny Van Zant has served on our Board of Directors since August 2016. He previously served as the Head of Business at Asana, the creator of cloud-based SaaS project management tools, where he led all business functions, including sales, marketing, customer support and finance. Prior to his role at Asana, Mr. Van Zant was the Senior Vice President, Chief Product Strategist at SolarWinds, where he led marketing and products. He has also held business and marketing leadership roles at Motive, BroadJump and Cisco Systems. He also serves as a board member for Puppet, Idera and Itential. Mr. Van Zant's deep experience in business, sales, marketing and strategic planning make him well suited for service on our Board of Directors.

Judith K. Verhave has served as a director of Castlight since June 2018. Prior to that, Ms. Verhave served for ten years as Executive Vice President, Global Head of Compensation and Benefits of BNY Mellon, where she was responsible for the design and delivery of compensation, benefits, and well-being for the company's 50,000-person global workforce. From 1989 to 2008, she held a number of human resources leadership positions at Fidelity Investments, including the role of Executive Vice President, Global Head of Compensation and Benefits from 2003 to 2008. From March 2015 to July 2018, Ms. Verhave served as the chairwoman of the National Business Group on Health, a non-profit association of more than 420 large, U.S. employers who provide health coverage for more than 55 million U.S. workers, retirees and their families. She is a member of the board of governors, a member of the Executive Committee and the Chair of the HR Committee of the Handel & Haydn Society. Ms. Verhave holds a B.A. from Carleton College in Northfield, Minnesota. She is an advisory board member for each of Maven, Big Health and Vertus. In addition, Ms. Verhave provides advisory services to Mount Sinai Solutions, LLC and Buck Global, LLC. Ms. Verhave's expertise in benefit design and management at the executive level makes her well suited for service on our board of directors.

There are no familial relationships among our directors and officers.

Director Compensation Policy

The following table provides the total compensation for each person who served as a non-employee member of our Board of Directors during 2019, including all compensation awarded to, earned by or paid to each person who served as a non-employee director for some portion or all of 2019.

2019 Director Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Fees Earned or Paid in Cash

($)

|

|

Stock Awards

($)(1)

|

|

All Other Compensation

($)(2)

|

|

Total

($)

|

|

Bryan Roberts

|

85,000

|

|

|

140,000

|

|

|

—

|

|

|

225,000

|

|

|

Seth Cohen

|

32,500

|

|

|

140,000

|

|

|

—

|

|

|

172,500

|

|

|

Michael Eberhard

|

40,500

|

|

|

140,000

|

|

|

3,615

|

|

|

184,115

|

|

|

David Ebersman

|

42,500

|

|

|

140,000

|

|

|

—

|

|

|

182,500

|

|

|

Ed Park

|

52,000

|

|

|

140,000

|

|

|

668

|

|

|

192,668

|

|

|

David B. Singer

|

43,500

|

|

|

140,000

|

|

|

—

|

|

|

183,500

|

|

|

Kenny Van Zant

|

37,500

|

|

|

140,000

|

|

|

758

|

|

|

178,258

|

|

|

Judith K. Verhave

|

40,500

|

|

|

140,000

|

|

|

15,056

|

|

(3)

|

195,556

|

|

(1) Amounts listed under the "Stock Awards" and "Option Awards" columns represent the aggregate fair value amount computed as of the grant date of each award during 2019 in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718. The fair value of these awards is based on the closing price of Class B common stock on the grant date. As required by SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Our directors will only realize compensation from these stock awards to the extent that they satisfy service-based vesting conditions in the terms of the RSUs. For information regarding the number of awards held by each non-employee director as of December 31, 2019, see the table below.

(2) Represents reimbursement for travel expenses.

(3) Includes $10,000 in additional advisory fees.

Each person who served as a non-employee member of our Board of Directors during 2019 held the following aggregate number of shares of our Class A Common Stock and Class B Common Stock subject to outstanding stock options or restricted stock units as of December 31, 2019:

|

|

|

|

|

|

|

|

|

|

|

Name

|

Number of Securities Underlying Stock Options Held

|

Number of Securities Underlying Restricted Stock Units Held

|

|

Bryan Roberts

|

25,000

|

|

22,082

|

|

|

Seth Cohen

|

13,386

|

|

68,156

|

|

|

Michael Eberhard

|

—

|

|

22,082

|

|

|

David Ebersman

|

285,973

|

|

22,082

|

|

|

Ed Park

|

50,000

|

|

22,082

|

|

|

David B. Singer

|

25,000

|

|

22,082

|

|

|

Kenny Van Zant

|

—

|

|

22,082

|

|

|

Judith K. Verhave

|

—

|

|

50,083

|

|

Annual Retainer Fees. For 2019, our non-employee directors were compensated as follows:

•$35,000 annual cash retainer;

•$60,000 for the independent chair of our Board of Directors;

•$20,000 for the chair of the Audit Committee and $8,000 for each of its other members;

•$10,000 for the chair of the Compensation and Talent Committee and $5,000 for each of its other members; and

•$7,500 for the chair of the Nominating and Corporate Governance Committee and $3,000 for each of its other members.

•$15,000 for the Lead Independent Director, if any.

Equity Awards. Our non-employee director equity compensation policy provides that each newly-elected or appointed non-employee director will be granted an initial restricted stock unit award to acquire shares of Class B common stock calculated by dividing $210,000 by the closing price of Class B common stock on the date of grant of the restricted stock unit award. Following each annual meeting of our stockholders, each non-employee director will automatically be granted an additional annual restricted stock unit award to acquire shares of Class B common stock calculated by dividing $140,000 by the closing price of the Class B common stock on the date of grant of the restricted stock unit award. Awards granted to non-employee directors under the policy described above will accelerate and vest in full in the event of a change of control. In addition to the awards provided for above, non-employee directors are eligible to receive discretionary equity awards.

Non-employee directors receive no other form of remuneration, perquisites or benefits other than as described above, but are reimbursed for their reasonable travel expenses incurred in attending our Board of Directors and Committee meetings.

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected Ernst & Young LLP as our principal independent registered public accounting firm to perform the audit of our consolidated financial statements for fiscal year ending December 31, 2020. As a matter of good corporate governance, our Audit Committee has decided to submit its selection of principal independent registered public accounting firm to stockholders for ratification. In the event that Ernst & Young LLP is not ratified by our stockholders, our Audit Committee will review its future selection of Ernst & Young LLP as our principal independent registered public accounting firm.

Ernst & Young LLP audited our financial statements for our 2019 fiscal year. Representatives of Ernst & Young LLP are expected to be present at the meeting, in which case they will be given an opportunity to make a statement at the meeting if they desire to do so, and will be available to respond to appropriate questions.

Principal Accountant Fees and Services

We regularly review the services and fees from our independent registered public accounting firm. These services and fees are also reviewed with our Audit Committee annually. In accordance with standard policy, Ernst & Young LLP periodically rotates the individuals who are responsible for our audit.

In addition to performing the audit of our consolidated financial statements, Ernst & Young LLP provided various other services during 2019 and 2018. Our Audit Committee has determined that Ernst & Young LLP’s provisioning of these services, which are described below, does not impair Ernst & Young LLP’s independence from us. The aggregate fees billed for 2019 and 2018 for each of the following categories of services are as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Audit fees(1)

|

$

|

2,586

|

|

|

$

|

2,179

|

|

|

Audit related fees(2)

|

3

|

|

|

—

|

|

|

Tax fees(3)

|

—

|

|

|

—

|

|

|

All other fees(4)

|

—

|

|

|

—

|

|

|

Total fees

|

$

|

2,589

|

|

|

$

|

2,179

|

|

(1) “Audit fees” include fees for professional services rendered in connection with the audit of our annual financial statements, review of our quarterly financial statements and advisory services on accounting matters that were addressed during the annual audit and quarterly review. This category also includes fees for services that were incurred in connection with statutory and regulatory filings or engagements, such as consents and review of documents filed with the SEC.

(2) “Audit related fees” include fees for professional services rendered that are reasonably related to the performance of the audit or review of our consolidated financial statements including subscription for the online library of accounting research literature.

(3) “Tax fees” include fees for tax compliance and advice. Tax advice fees encompass a variety of permissible services, including technical tax advice related to federal and state income tax matters; assistance with sales tax; and assistance with tax audits.

(4) “All other fees” consist of the aggregate fees billed for products and services provided by Ernst & Young LLP, other than included in “Audit Fees,” “Audit Related Fees” and “Tax Fees.”

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee's policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date. These services may include audit services, audit related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent registered public accounting firm and management are required to periodically report to the Audit Committee regarding the extent of services provided by the independent registered public accounting firm in accordance with this pre-approval, and the fees for the services performed to date.

All of the services relating to the fees described in the table above were approved by our Audit Committee.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

PROPOSAL NO. 3

ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In accordance with the rules of the SEC, we are providing stockholders with an opportunity to make a non-binding, advisory vote on the compensation of our named executive officers. This non-binding advisory vote is commonly referred to as a “say on pay” vote. The non-binding advisory vote on the compensation of our named executive officers, as disclosed in this proxy statement, will be determined by the vote of a majority of the shares of common stock present or represented at the meeting and voting affirmatively or negatively on the proposal.

Stockholders are urged to read the “Executive Compensation Discussion and Analysis” section of this proxy statement, which discusses how our executive compensation policies and procedures implement our compensation philosophy and contains tabular information and narrative discussion about the compensation of our named executive officers. The compensation committee and the board of directors believe that these policies and procedures are effective in implementing our compensation philosophy and in achieving our goals. Accordingly, we ask our stockholders to vote “FOR” the following resolution at the meeting:

“RESOLVED, that our stockholders approve, on a non-binding advisory basis, the compensation of the named executive officers, as disclosed in the Proxy Statement pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion and the other related disclosures.”

As an advisory vote, this proposal is not binding. However, our Board of Directors and Compensation and Talent Committee, which is responsible for designing and administering our executive compensation program, value the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL, ON A NON-BINDING ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

PROPOSAL NO. 4

ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

In accordance with the rules of the SEC, we are providing our stockholders with an opportunity to make a non-binding, advisory vote on the frequency of future non-binding advisory votes on the compensation of our named executive officers. This non-binding advisory vote must be submitted to stockholders at least once every six years.

You have four choices for voting on this proposal. You can choose whether future non-binding advisory votes on the compensation of our named executive officers should be conducted every “ONE YEAR,” “TWO YEARS,” or “THREE YEARS.” You may also “ABSTAIN” from voting. The frequency that receives the greatest number of votes cast by stockholders on this matter at the meeting will be deemed to be the preferred frequency option of our stockholders.

After careful consideration, our board of directors recommends that future non-binding advisory votes on the compensation of our named executive officers be held every year so that stockholders may express annually their views on our executive compensation program.

Stockholders are not voting to approve or disapprove the board of directors’ recommendation. Instead, stockholders may indicate their preference regarding the frequency of future non-binding advisory votes on the compensation of our named executive officers by selecting one year, two years or three years. Stockholders that do not have a preference regarding the frequency of future advisory votes may abstain from voting on the proposal.

As an advisory vote, this proposal is not binding. However, our board of directors and compensation committee value the opinions expressed by stockholders in their vote on this proposal and will consider the outcome of the vote when making future decisions regarding the frequency of holding future non-binding advisory votes on the compensation of our named executive officers.

OUR BOARD OF DIRECTORS RECOMMENDS TO HOLD FUTURE NON-BINDING ADVISORY VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS EVERY “ONE YEAR”

PROPOSAL NO. 5

TO APPROVE AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT

We are seeking stockholder approval for an amendment to our restated certificate of incorporation to effect a reverse stock split (the “Reverse Stock Split”) of our issued and outstanding Class A common stock and Class B common stock using a ratio of not less than 1-for-5 and not more than 1-for-15, and a proportionate reduction in the number of authorized shares of our Class A common stock and Class B common stock, with the split ratio and the implementation and timing of such Reverse Stock Split to be determined in the discretion of our Board of Directors. The split ratio will be the same for the Class A common stock and the Class B common stock. As further described below, if this proposal is approved, our Board of Directors may determine to effect the Reverse Stock Split at any time prior to the date of the company's 2021 annual meeting of stockholders.

The form of the amendment to our restated certificate of incorporation to effect the Reverse Stock Split is attached as Appendix A to this Proxy Statement. Approval of the proposal would permit (but not require) our Board of Directors to effect the Reverse Stock Split using a split ratio of not less than 1-for-5 and not more than 1-for-15, with the exact split ratio to be set within this range as determined by our Board of Directors in its sole discretion, provided that the Board of Directors must determine to effect the Reverse Stock Split and such amendment must be filed with the Secretary of State of the State of Delaware no later than the date of the company's 2021 annual meeting of stockholders. If our Board of Directors determines to implement the Reverse Stock Split, the exact split ratio of the Reverse Stock Split will be determined by the Board of Directors prior to the effective time of the Reverse Stock Split and will be publicly announced prior to such effective time. We believe that enabling our Board of Directors to set the split ratio of the Reverse Stock Split within the specified range and within the specified time period will provide us with the flexibility to

implement the Reverse Stock Split in a manner and at a time designed to maximize the anticipated benefits for our stockholders. In determining a split ratio for the Reverse Stock Split, if any, following the receipt of stockholder approval, our Board of Directors may consider, among other things, factors such as:

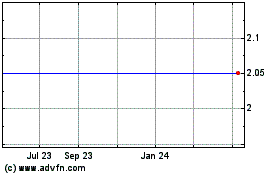

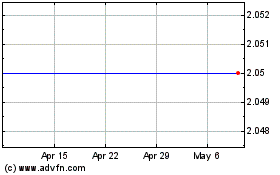

•the historical trading prices and trading volume of our Class B common stock;

•the number of shares of Class B common stock outstanding prior to and after the Reverse Stock Split;

•the then-prevailing trading price and trading volume of our Class B common stock and the anticipated impact of the Reverse Stock Split (including the reduction in the number of outstanding shares) on the trading price and trading volume of our Class B common stock;

•the continuing listing requirements of various stock exchanges, including the NYSE; and

•prevailing general market and economic conditions.

Our Board of Directors reserves the right to elect to abandon the Reverse Stock Split if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of our company and our stockholders.