Current Report Filing (8-k)

June 01 2020 - 4:02PM

Edgar (US Regulatory)

CHESAPEAKE UTILITIES CORP 734-6799 false 0000019745 0000019745 2020-05-29 2020-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 29, 2020

Chesapeake Utilities Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-11590

|

|

51-0064146

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

909 Silver Lake Boulevard, Dover, Delaware

|

|

19904

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 302. 734.6799

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock - par value per share $0.4867

|

|

CPK

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 29, 2020, Chesapeake Utilities Corporation (“Chesapeake Utilities” or “the Company”) entered into a Credit Agreement (the “Credit Agreement”) with Citizens Bank, National Association (“Citizens Bank”), which provides for a revolving line of credit in the maximum principal amount of $25 million, or such lesser amount as may be advanced to or for the benefit of Chesapeake Utilities, as evidenced by a Revolving Loan Note (the “Note”) issued in favor of Citizens Bank.

The revolving line of credit terminates on October 31, 2020. Borrowings under the Credit Agreement will bear interest at a rate equal to the daily LIBOR rate plus 175 basis points (1.75%) unless an alternate rate is required under the applicable Credit Agreement. Pursuant to the Credit Agreement, Chesapeake Utilities paid an upfront fee of 15 basis points (0.15%) of the maximum principal amount of the revolving line of credit, or $37,500, to Citizens Bank. In addition, beginning on the date of the Credit Agreement and continuing until the Credit Agreement terminates, Chesapeake Utilities must pay an unused fee of 35 basis points (0.35%). The unused fee is calculated on the basis of a 365-day year and the actual number of days elapsed on the daily unused and undisbursed portion of the maximum committed amount under the Note in effect from time to time. The accrued unused fee shall be payable in arrears on the last day of June, September and December.

The Credit Agreement sets forth certain business and financial covenants to which Chesapeake Utilities is subject, including covenants that restrict Chesapeake Utilities and its subsidiaries from incurring indebtedness. These covenants are similar to those included in Chesapeake Utilities’ other lines of credit. The Company has availability capacity under its existing bilateral facilities (aggregating $315 million including this Credit Agreement) and the Company’s syndicated revolving credit facility (representing $150 million). In an abundance of caution, Chesapeake Utilities obtained this additional revolving line of credit, in addition to $70 million of other short-term capacity, to provide incremental liquidity given the current economic environment. At the present time, the Company does not expect to draw under the Credit Agreement. The foregoing descriptions of the Credit Agreement and Note do not purport to be complete and are qualified in their entirety by the full text of such Credit Agreement and Note, which Chesapeake Utilities will file as exhibits to its Quarterly Report on Form 10-Q for the quarter ended June 30, 2020.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information provided in Item 1.01 is incorporated by reference in this Item 2.03.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Chesapeake Utilities Corporation

|

|

|

|

|

|

|

|

|

|

June 1, 2020

|

|

|

|

By:

|

|

Beth W. Cooper

|

|

|

|

|

|

Name:

|

|

Beth W. Cooper

|

|

|

|

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

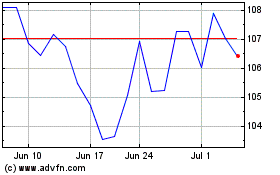

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

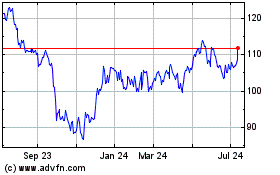

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

From Apr 2023 to Apr 2024