By Kejal Vyas in Caracas and Rebecca Elliott in Houston

Venezuela's leader, Nicolás Maduro, is considered likely to

retain power after Sunday's presidential election. But his

government faces a mounting threat from something he can't control:

creditors targeting the oil shipments that provide nearly all the

country's foreign income.

A series of Caribbean court orders in recent days has authorized

U.S. oil giant ConocoPhillips to seize as much as $2.6 billion in

Venezuelan oil from Dutch Caribbean islands as compensation for

assets that Venezuela's Socialist government expropriated from the

company in 2007.

The rulings are a major blow to the cash-strapped and

increasingly isolated nation at a time when its once-thriving state

energy monopoly, Petróleos de Venezuela SA, or PdVSA, has been left

in tatters after years of mismanagement.

Conoco's aggressive actions, the latest in a decadelong legal

battle, threaten to further undermine Venezuela's diminished

ability to store, refine and export crude oil, which it needs in

part to ship to China as repayment for loans.

They follow efforts by a pair of mining companies to enforce

payment of $2.6 billion won in separate arbitration cases. The

companies are now seeking court approval to seize Venezuela's

external assets, including Citgo Petroleum Corp. in the U.S.

Investors holding at least $2.5 billion in defaulted Venezuelan

bonds could also target Venezuelan assets.

Combined with sanctions levied by the U.S. and other countries

across the Americas, Venezuela is facing the tightest noose on its

economy since 1902, said Venezuelan oil economist Orlando Ochoa.

That is when European gunboats blocked its ports to recover unpaid

infrastructure loans.

"This will have a brutal effect for PDVSA'S operational and

storage capabilities," he said.

Spokesmen at PdVSA and Venezuela's oil ministry didn't respond

to calls seeking comment. The oil ministry posted several messages

on its official Twitter account Friday indicating it was ready to

pay the money it owes Conoco. The posts were deleted an hour

later.

Conoco was able to secure the court orders against PdVSA after

winning a $2 billion arbitration ruling last month by a tribunal

representing the Paris-based International Chamber of Commerce. The

company "will pursue all available legal avenues to obtain full and

fair compensation for our expropriated investments in Venezuela,"

said Conoco spokesman Daren Beaudo.

After the ICC ruling, a Curaçao judge on May 4 authorized a

Dutch-registered Conoco subsidiary to target $636 million in oil

products there. The company then began seizing oil cargoes at the

Isla Refinery in Curaçao, which PdVSA leases from the island

government.

Separately, a judge on the island of Bonaire, where PdVSA uses a

10-million-barrel storage facility, authorized Conoco to seize

assets on Bonaire, St. Martin and Aruba to recover $1.5 billion,

plus $449 million in interest.

The court orders led PdVSA to send a dozen tankers back to

Venezuelan waters out of fear of confiscation, according to people

familiar with the matter, prompting the Isla Refinery to shut

down.

More than 16% of all Venezuelan oil exports passed through the

Isla refinery and storage and port facilities in Aruba, Bonaire and

Curaçao last year, according to BMI Research.

"The timing really couldn't be any worse" for Venezuela, said

Mara Roberts Duque, an analyst with BMI Research. "If they're not

able to get those shipments out, even to the degree that they were

able to do so a week ago, that is going to be detrimental to the

Venezuelan government."

Francisco Monaldi, an energy expert at Rice University in

Houston, said Conoco's actions in Curaçao were "a very big blow" to

Venezuela. He said the country has just one domestic terminal where

it can fill the larger tankers used to export crude to Asia.

Conoco's actions haven't been without controversy on Curaçao,

which is concerned over job losses and fuel shortages on the

island. "Shame on you ConocoPhillips for choosing not to fight this

war on your own turf in the energy corridor in Houston," former

Curaçao Prime Minister Maria Liberia-Peters wrote in a public

letter.

ConocoPhillips said it was working with local officials to

address their concerns. "It is PdVSA that has failed to honor our

award by ignoring the judgment of the ICC tribunal," Mr. Beaudo

said.

The decay of the oil industry in Venezuela, which sits atop the

world's largest crude reserves, is a major political concern for

Mr. Maduro, who first became president in 2013 after the death of

populist Hugo Chávez, and has presided over a 40% economic

contraction in the past five years.

Food and medicine shortages are rampant in Venezuela, as the

country struggles to import basics. As many as three million people

have left the country according to some estimates, fleeing

hyperinflation that has rendered salaries, including those of

oil-field and refinery workers, to about $2 a month.

Sunday's election, in which Mr. Maduro is seeking another six

years in power, has been deemed illegitimate by the Trump

administration and much of Latin America.

Over the past year, Mr. Maduro has responded to the oil crisis

by jailing dozens of PdVSA officials on corruption charges and has

placed the management of the industry into the hands of a national

guard general, Manuel Quevedo, who had no prior experience in the

energy business.

A rusting domestic refining network is operating at less than a

quarter of its 1.3 million barrels-per-day capacity, according to

refinery union leader Ivan Freites.

Venezuelan oil production last month fell to its lowest point in

decades, about 1.4 million barrels a day, according to a Monday

report by the Organization of the Petroleum Exporting

Countries.

The decline has left Venezuela unable to benefit from a global

rise in oil prices -- now at their highest levels in more than

three years.

Venezuelan economists say the country is generating revenue from

only about 500,000 barrels daily. Another 300,000 goes to China to

repay loans. The remainder is consumed domestically, where fuel is

virtually free, or given to allies including Cuba at cut-rate

prices.

--Dick Drayer in Curaçao contributed to this article.

Write to Kejal Vyas at kejal.vyas@wsj.com

(END) Dow Jones Newswires

May 16, 2018 15:05 ET (19:05 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

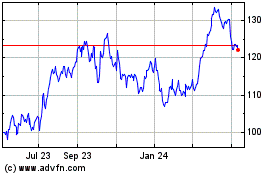

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Mar 2024 to Apr 2024

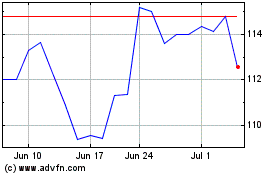

ConocoPhillips (NYSE:COP)

Historical Stock Chart

From Apr 2023 to Apr 2024