UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities

Exchange Act of 1934 (Amendment No. –)

Filed by the Registrant

Filed by the Registrant

|

Filed by a Party other than the Registrant

Filed by a Party other than the Registrant

|

|

Check

the appropriate box:

|

|

Preliminary

Proxy Statement

|

|

CONFIDENTIAL,

FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2))

|

|

Definitive

Proxy Statement

|

|

Definitive

Additional Materials

|

|

Soliciting

Material Pursuant to § 240.14a-12

|

CNX RESOURCES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

March 24, 2020

To: Shareholders of CNX Resources

Corporation

During 2019, CNX continued our primary focus on operational

execution and capital allocation. We concentrated on high probability, high internal rate of return (IRR) investments, which resulted

in growing our production, repurchasing approximately 7% of the company’s shares (and approximately 19% since inception of

the repurchase program) at what we believe to be attractive discounts to intrinsic value, and repurchasing $400 million of our

5.875% notes due in 2022. However, the broader macro backdrop for our industry continued to be challenging, and we saw NYMEX gas

prices decline by approximately 15% over 2019. Despite CNX’s best-in-class hedge book, the macro headwinds facing our industry

were significant, and our share price declined 23% in 2019, while our Appalachian peers were down an average of 44% over the same

time period. This relative performance, of course, is cold comfort.

The spread between stock price and long-term intrinsic per

share value at the writing of this letter is as wide as it has ever been. Industry-wide headwinds are also historically strong,

and we continue to focus intently on the key controllable drivers of our business.

As an example, we made the difficult decision to further

reduce expected selling, general, and administrative (SG&A) cash spend by approximately $30 million1 when compared

to 2018 (as reflected in our year-end earnings slides), creating a best-in-basin cost structure that will allow for profitable,

scalable growth in almost any price environment. As capital allocators, we have continued to nimbly refine our activity set in

response to the dynamic macro environment. By way of example, since the time our initial 2020 guidance was first published on July

30, 2019, NYMEX gas prices have dropped by $0.46 per MMBtu (as of January 24, 2020). To address this decrease, we decided to further

reduce production activity in 2020 by approximately 43 Bcfe, which will reduce capital spend by approximately $100 million.

We expect significant free cash flow in both 2020 and 2021

as a result of these actions, despite the weak natural gas forward strip. We are unique among our peers in our intense focus on

hedging. Our hedge book and our broader strategy of minimizing off balance sheet liabilities (importantly including firm transportation)

helps insulate the company from commodity price swings, providing a higher degree of predictability around our entire business.

We expect our leverage ratio to decline in 2020 and 2021, and we believe that our nearest term maturities, senior notes due in

2022, can be paid in the ordinary course with no undue impact. This anticipated 2020 and 2021 de-levering is unique among our peers

in the current severe commodity pricing environment.

The macro situation in our business is approaching crisis

levels and we need to be prepared to act with a seemingly paradoxical combination of patience and aggressiveness as these opportunities

emerge. We expect the coming year will not be dull.

Our core philosophy remains unchanged. All of our key decisions,

resources, tactics, and processes remain concentrated on optimizing the long-term net asset value (NAV) per share1 of

the company. The performance metrics we have developed are ultimately designed to help us achieve our mission:

To empower our team to embrace

and drive innovative change that creates long-term per share value for our investors, enhances our communities and delivers energy

solutions for today and tomorrow.

2019 Highlights

CNX had several important developments in 2019 including

the following:

|

|

●

|

Reporting consolidated net income of $32 million and adjusted consolidated net income of $176 million1 or $0.92

per share1 ;

|

|

|

●

|

Repurchasing CNX stock in the amount of approximately $115 million (or 12.9 million shares) at an average price of $8.91 per

share;

|

|

|

●

|

Increasing total gas production by approximately 6% to 539.1 net Bcfe;

|

|

|

●

|

Increasing proved reserves by approximately 7% to 8.4 Tcfe;

|

|

|

●

|

Total capital expenditures of $1.2 billion and Stand-Alone E&P capital expenditures of $877 million1, below

the low-end of the 2019 guidance range of $890-$915 million;

|

|

|

●

|

Total Adjusted Stand-Alone EBITDAX of $772 million1, above the high-end of the 2019 guidance range of $745-$765

million;

|

|

|

●

|

Total Adjusted Consolidated EBITDAX of $958 million1, above the high-end of the 2019 guidance range of $910-$940

million; and

|

|

|

●

|

Purchasing $400 million of our outstanding 5.875% senior notes due in April 2022.

|

Guiding Principles (Year-After-Year)

The company’s board of directors and management team

continue to focus on managing CNX according to the following three essential principles:

1. Optimizing long-term per share returns for our shareholders

Investing capital exclusively in high-return projects that

correlate with long-term EBITDAX per share growth, which in turn provides increased capital allocation flexibility and allows the

company to maximize long-term per share value for our shareholders.

We also believe that a steadfast, relentless commitment to

best-in-class safety, environmental compliance and employee diversity increases efficiencies, reduces costs and improves margins,

all important drivers of long-term NAV per share.

With a deepening focus on environmental, social, and governance

(ESG) from external stakeholders, CNX will continue to focus on internal, proactive measures and favor measurable, tangible performance

metrics over the abstract and aspirational (we continue to promote math and science over branding and platitudes, from capital

allocation to ESG efforts).

The most notable example of the company’s deep ESG

commitment is the reduction in our carbon intensity (Scope 1 and 2 emissions) by over 90% since 2011. Few companies anywhere can

make such a claim.

While these actions and principles closely align with ESG

objectives, they are also correlated with driving efficiencies and growing NAV per share. We will work to relentlessly improve

in this important area as well.

2. Efficiently and prudently allocating capital

We focus on improving capital efficiency by systematically

earmarking capital dollars to the highest rate of return investment opportunities. We typically insist on minimum internal rates

of return of 20% for all capital investments and our internal projections are based on commodity price assumptions that are at

or below the NYMEX strip.

The key components of our capital allocation strategy include

the following:

|

|

●

|

Methodical execution on high IRR exploration & development projects, including basin disruption through stacked pay development;

|

|

|

●

|

Balance sheet strength to drive capital flexibility (centered on a low targeted leverage ratio);

|

|

|

●

|

Opportunistic share count reduction where we see a significant margin of safety and discount to our internal intrinsic value

per share;

|

|

|

●

|

Strategic control of CNX Midstream Partners LP (CNXM), which provides operational optimization and is expected to generate

significant free cash flow in 2020 and 2021; and

|

|

|

●

|

Risk mitigation with a robust hedge book, reasonable firm transportation commitments, manageable minimum well commitments,

and tiered service contracts.

|

3. Seizing opportunities as the leading Appalachian

E&P company

Over the next few years, we plan to continue utilizing the

following strategies:

|

|

●

|

Capital Efficiency. Continue our rigorous process for allocating capital and methodical focus on projects that generate

the highest risk-adjusted returns and prudent production growth.

|

|

|

●

|

Low Costs. A streamlined corporate office and emphasis on the power of autonomy for business units. We plan to continue

to reduce costs at headquarters and in our business units, where we seek to maintain a low-cost position relative to our peer group.

|

|

|

●

|

Programmatic Hedging. Continue to follow a robust and programmatic hedging strategy that differentiates CNX from its

peers. We plan to lock in our returns by employing a “total” hedge strategy that hedges both NYMEX and basis.

|

|

|

●

|

Strategic Transactions. Continued refinement of our methodical process for evaluating merger and acquisition opportunities,

most importantly, potential strategic tuck-in acquisitions in the Appalachian Basin. We consider acquisitions only when they offer

returns that are compelling relative to all other capital allocation options.

|

|

|

●

|

Compensation Incentives. Remain committed to compensation programs that align management interests with short- and long-term

shareholder returns.

|

Conclusion

As we seek to attract the best possible group of long-term

partners, we will continue to review our approach to investor relations. As it relates to guidance, it is our goal to provide investors

the relevant information they need to make informed long-term decisions but, at the same time, to not over-emphasize short-term

metrics and results. We are concentrating more effort on directly communicating with value investors while deemphasizing the traditional

avenues of sell-side equity research and conferences. We have found this approach to be a better match with our focus on long-term

growth in intrinsic per share value.

CNX enjoys a strong strategic position as the industry faces

a very challenging 2020. Our costs are among the lowest in the basin; and we’re building additional optionality and liquidity

to strengthen the company for a worsening macro environment. That being said, we will not take our foot off the pedal in 2020.

We will continue to push on costs, including SG&A costs. We will continue to focus on efficiencies and simplification across

the business, and we will never stop setting the bar higher. While others struggle to survive, we will be ready to continually

assess strategic opportunities as they arise. CNX is not only built to withstand the current challenging macro environment, but

it is poised to reap the benefits on the other side.

We would be remiss to not mention the topic of ‘pride’.

CNX is a proud company and our team enjoys total conviction that what we do matters greatly for society. We are proud to lead on

responsible business practices and continue to stand ready to advance and defend our unyielding belief that natural gas is not

only a critical element of today’s energy economy, but also a cornerstone fuel that will help meet the world’s ever-changing

energy needs for the next generation and beyond.

Lastly, our thoughts

are with everyone who has been impacted, directly or indirectly, by the grave health crisis our world is facing. In these uncertain

times, it is important to know that over the years, we have taken steps to build a company and balance sheet that can navigate

through unforeseen circumstances. Some of these might be industry-centric like the supply/demand dynamics resulting from OPEC

decisions, while others could be more global in nature like the coronavirus pandemic. In 2020, we are dealing with both types,

but the company’s strategic position allows us the flexibility to meet these dynamic times on our front foot instead of

our heels.

Thank you for your trust,

partnership, and investment in CNX.

|

|

|

Will

Thorndike

Chairman of the Board of Directors

CNX Resources Corporation

|

Nick DeIuliis

President and Chief Executive Officer

CNX Resources Corporation

|

_______________

|

|

(1)

|

For reconciliations to the relevant GAAP measures and an explanation of NAV per share, please refer

to Appendix A in the Company’s proxy statement, filed on March 24, 2020. CNX is unable to provide a reconciliation of projected

SG&A cash spend without unreasonable efforts. This is due to our inability to calculate comparable GAAP projected metrics given

the unknown effect, timing, and potential significance of certain income statement items. Management believes that the presentation

of the above non-GAAP financial measures provides useful information to

investors because they are widely used by professional analysts and sophisticated investors in evaluating oil and gas companies

such as CNX.

|

This letter contains forward-looking statements, estimates

and projections within the meaning of the federal securities laws. Statements that are not historical are forward-looking and may

include our operational and strategic plans; estimates of gas reserves and resources; projected timing and rates of return of future

investments; and projections and estimates of future production, revenues, income and capital spending. These forward-looking statements

involve risks and uncertainties that could cause actual results to differ materially from those statements, estimates and projections.

Investors should not place undue reliance on forward-looking statements as a prediction of future actual results. The forward-looking

statements in this letter speak only as of the date hereof; we disclaim any obligation to update the statements, and we caution

you not to rely on them unduly. Specific factors that could cause future actual results to differ materially from the forward-looking

statements are described in detail under the captions "Forward Looking Statements" and "Risk Factors" in our

annual report on Form 10-K for the year ended December 31, 2019 filed with the SEC, as supplemented by our quarterly reports on

Form 10-Q. Those and other risks include, among other matters, pricing volatility or pricing decline for natural gas and natural

gas liquids; our operational relationship with other parties, including midstream facilities; operational risks relating to pipeline

systems, drilling natural gas wells, and customer interactions, including cyber-security concerns; environmental and health-related

developments, including the COVID-19 pandemic; the impact of laws, regulations and public perception on our business and industry;

competitive and economic concerns; risks associated with our debt and hedging strategy; our ability to accurately estimate economically

recoverable natural gas reserves and acquire economically recoverable natural gas reserves; challenges associated with strategic

determinations, including the allocation of capital to strategic opportunities; our development and exploration projects, as well

as CNXM's midstream system development.

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Mar 2024 to Apr 2024

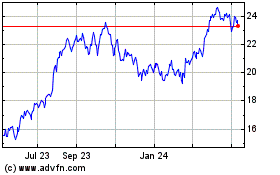

CNX Resources (NYSE:CNX)

Historical Stock Chart

From Apr 2023 to Apr 2024