Current Report Filing (8-k)

June 23 2022 - 4:40PM

Edgar (US Regulatory)

0000811156

false

0000201533

false

8-K

2022-06-23

false

false

false

false

0000811156

2022-06-23

2022-06-23

0000811156

cms:ConsumersEnergyCompanyMember

2022-06-23

2022-06-23

0000811156

us-gaap:CommonStockMember

2022-06-23

2022-06-23

0000811156

cms:A5.625JuniorSubordinatedNotesDue2078Member

2022-06-23

2022-06-23

0000811156

cms:A5.875JuniorSubordinatedNotesDue2078Member

2022-06-23

2022-06-23

0000811156

cms:A5.875JuniorSubordinatedNotesDue2079Member

2022-06-23

2022-06-23

0000811156

cms:DepositaryShareseachrepresentinga11000thinterestinashareof4.200PercentMember

2022-06-23

2022-06-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13

OR 15(d) OF

THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

June 23, 2022

| Commission |

|

Registrant; State of Incorporation; |

|

IRS Employer |

| File Number |

|

Address; and Telephone Number |

|

Identification No. |

| |

|

|

|

|

| 1-9513 |

|

CMS ENERGY CORPORATION

(A Michigan Corporation)

One Energy Plaza

Jackson, Michigan 49201

(517) 788-0550 |

|

38-2726431 |

| |

|

|

|

|

| 1-5611 |

|

CONSUMERS ENERGY COMPANY

(A

Michigan Corporation)

One Energy Plaza

Jackson, Michigan 49201

(517) 788-0550 |

|

38-0442310 |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| CMS Energy Corporation Common Stock, $0.01 par value |

|

CMS |

|

New York Stock Exchange |

| CMS Energy Corporation 5.625% Junior Subordinated Notes due 2078 |

|

CMSA |

|

New York Stock Exchange |

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2078 |

|

CMSC |

|

New York Stock Exchange |

| CMS Energy Corporation 5.875% Junior Subordinated Notes due 2079 |

|

CMSD |

|

New York Stock Exchange |

| CMS Energy Corporation, Depositary Shares, each representing a

1/1,000th interest in a share of 4.200% Cumulative Redeemable Perpetual Preferred Stock, Series C

|

|

CMS PRC |

|

New York Stock Exchange |

| Consumers

Energy Company Cumulative Preferred Stock, $100 par value: $4.50 Series |

|

CMS-PB |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company: CMS Energy Corporation ¨ Consumers

Energy Company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

CMS

Energy Corporation ¨ Consumers

Energy Company ¨

| Co-Registrant CIK |

0000201533 |

| Co-Registrant Amendment Flag |

false |

| Co-Registrant Form Type |

8-K |

| Co-Registrant DocumentPeriodEndDate |

2022-06-23 |

| Co-Registrant Written Communications |

false |

| Co-Registrant Solicitating Materials |

false |

| Co-Registrant PreCommencement Tender Offer |

false |

| Co-Registrant PreCommencement Issuer Tender Offer |

false |

| Emerging Growth Company |

false |

Item 8.01. Other Matters.

On June 23, 2022, the Michigan Public Service Commission approved

Consumers Energy Company’s (“Consumers”) integrated resource plan (“IRP”) settlement agreement with a

diverse group of stakeholders. Consumers’ IRP provides a 20-year blueprint to meet Michigan’s energy needs while

protecting the environment for future generations. This approval clears the way for Consumers, a wholly-owned subsidiary of CMS

Energy Corporation (“CMS Energy”), to stop burning coal to generate electricity by 2025 — 15 years faster than

previously planned — and provide reliable electricity for Michigan. The News Release is attached as Exhibit 99 and is

incorporated by reference herein.

Investors

and others should note that CMS Energy routinely posts important information on its website and considers the Investor Relations section,

www.cmsenergy.com/investor-relations, a channel of distribution.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| |

|

CMS ENERGY CORPORATION |

| |

|

|

| |

|

|

| Dated: June 23, 2022 |

By: |

/s/ Rejji P. Hayes |

| |

|

Rejji P. Hayes |

| |

|

Executive Vice President and Chief Financial Officer |

| |

|

|

| |

|

CONSUMERS ENERGY COMPANY |

| |

|

|

| |

|

|

| Dated: June 23, 2022 |

By: |

/s/ Rejji P. Hayes |

| |

|

Rejji P. Hayes |

| |

|

Executive Vice President and Chief Financial Officer |

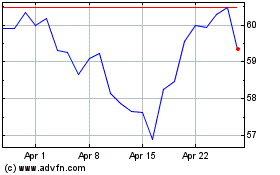

CMS Energy (NYSE:CMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

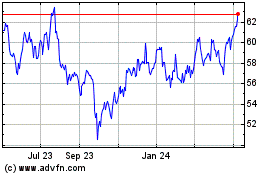

CMS Energy (NYSE:CMS)

Historical Stock Chart

From Apr 2023 to Apr 2024