By Alexandra Bruell

Advertisers are pressing for unprecedented flexibility to back

out of monthslong spending commitments with TV networks, concerned

that the coronavirus pandemic is sapping the fall schedule of new

programming and threatening the National Football League's

season.

By this time of year, advertisers usually have struck broad

deals governing the TV season that starts each September. This

year, the pandemic scrambled the equation, delaying those deals and

introducing new risks for marketers -- most notably, whether the

content on which they want to advertise will even get aired.

After several college-football conferences decided not to play

in the fall, Chipotle Mexican Grill Inc. shifted some of its ad

spending from college football to NFL games, said Chris Brandt, the

company's chief marketing officer. He now is asking networks for

the ability to back out of those spending commitments if

professional football games get canceled.

"How's the NFL going to work if you're not in a bubble?" Mr.

Brandt said, referring to the National Basketball Association's

effort to keep its players and games confined to the Orlando, Fla.

area. "The number one thing I'm asking for is flexibility."

Advertisers spent close to $5 billion on the NFL last season,

according to ad-tracking firm Kantar. The NFL plans to launch its

season on Sept. 10, and has expressed confidence it will be

completed.

"We really hope the NFL season goes on as currently planned,"

said Rachel Ferdinando, chief marketing officer for PepsiCo Inc.'s

Frito-Lay North America. She said the snack-food maker expects to

spend as much on the NFL as it did in previous years, but is

working with broadcasters to ensure there are contingencies for any

scheduling changes.

Verizon Communications Inc. is asking networks for the ability

to walk back commitments if football games get canceled and to pull

the plug on some ads closer to their air date than in previous

agreements, according to John Nitti, Verizon's chief media officer.

The telecommunications giant is also looking for the flexibility to

move its ad dollars to digital content if the media companies can

show that they would offer the same if not more value, he said.

The NFL's fate is likely to have a major impact on the ad world,

not only because of the partial postponement of college football

but also because little new entertainment programming is being made

due to pandemic-caused production shutdowns.

With production on scripted programs just starting to resume in

dribs and drabs, all the networks are assembling fall schedules

that are a potpourri of unscripted fare, acquisitions from abroad

and shows from either their bench or sister platforms.

ViacomCBS Inc.'s CBS, for example, has said it doesn't expect

any of the new and returning scripted shows it announced in May to

be ready for airing until November at the earliest. Instead, it

will fill the first few months of the fall with episodes of "Star

Trek: Discovery," which traditionally runs on the streaming

platform CBS All Access. The network will also air episodes of the

reboot of "One Day at a Time," a sitcom that initially ran on

Netflix and is now on the ViacomCBS-owned cable channel Pop, as

well as news and reality programming.

"You have a shortage of original content, you have a lot of news

eyeballs that are not easily monetizable and you have two of the

major five conferences in college football being canceled," said

Michael Nathanson, media analyst and founding partner at

MoffettNathanson. "It comes down to the NFL. Can it come back and

for how long?"

Advertisers that pulled out of previous commitments still have

the option to buy time for commercials outside of the broadly

negotiated contracts, but such last-minute ad buys are more

expensive. Many brands are currently choosing to do so, a sign that

some advertisers are spending again, according to both ad buyers

and media executives.

When the pandemic hit earlier this year, the last round of big

TV deals were already in place. Under those deals, marketers

couldn't immediately cancel any spending -- though networks allowed

that to happen in some instances, in a show of good faith. Buyers

typically had the ability to retrieve a portion, around 30%, of

their commitments two to three months before programming was set to

air. That was a provision standard for ad deals.

During this round of ad negotiations, some brands are asking to

be able to withdraw a larger portion -- at least 50% -- of their

commitments much closer to TV air dates, according to ad buyers.

And if the programming doesn't air at all, they often want 100% of

their commitment canceled.

In March, when it was announced that the Tokyo Olympics would be

postponed to 2021, Comcast Corp.'s NBCUniversal asked advertisers

to let it know by July whether they wanted to keep their ad

commitments for the rescheduled event. NBCU also told advertisers

that if they agreed to commit by May, it would guarantee a 4%

increase in views for the same amount of money, according to people

close to the negotiations.

While some ad buyers agreed, others scoffed. The 4% bump was

small given the relatively short time frame to get approval for

such a large media investment during uncertain times, the people

said.

Mike Law, president at Dentsu ad-buying group Amplifi, said

networks went above and beyond to keep advertisers happy, even

though they contractually didn't always have to. "Now, brands are

going to finance and saying, we need approval to make a commitment

into next year. Their finance person is saying, what's the option

to get out?"

TV networks traditionally give advertisers one window every

three months during which they can renege on some of their ad

commitments. This time around, one TV network is giving them two

such windows in the same time frame.

"Some clients were asking for 10 windows," said an executive at

the TV network. "Hey, I get it. We're in uncharted waters here. But

we also have a business to run."

--Joe Flint contributed to this article.

Write to Alexandra Bruell at alexandra.bruell@wsj.com

(END) Dow Jones Newswires

September 02, 2020 14:56 ET (18:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

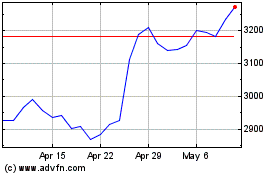

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

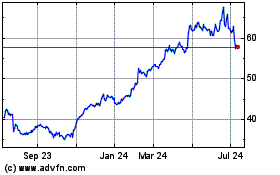

Chipotle Mexican Grill (NYSE:CMG)

Historical Stock Chart

From Apr 2023 to Apr 2024