AM Best Assigns Issue Credit Ratings to Cigna Corporation’s New Senior Unsecured Notes and Indicative Shelf Registration

March 10 2020 - 5:36PM

Business Wire

AM Best has assigned the Long-Term Issue Credit Ratings

(Long-Term IRs) of “bbb” to the $1.5 billion 2.4% senior unsecured

notes due 2030, $750 million 3.2% senior unsecured notes due 2040

and the $1.25 billion 3.4% senior unsecured notes due 2050 recently

issued by Cigna Corporation (Cigna) (headquartered in Bloomfield,

CT) [NYSE:CI]. Furthermore, AM Best has assigned indicative

Long-Term IRs of “bbb” to senior unsecured debt and “bb+” to

preferred shares under the recently filed shelf registration. The

outlook assigned to these Credit Ratings (ratings) is stable. The

existing ratings of Cigna and its subsidiaries are unchanged (see

related press release).

The proceeds of the recent $3.5 billion of aggregate debt,

issued on March 4, 2020, will be used to redeem/tender upcoming

2021, 2022 and 2023 higher coupon issues.

Cigna maintains high financial leverage of approximately 47%,

including the current debt issues, and a high level of goodwill and

intangibles – the increase in both metrics primarily was related to

the Cigna-Express Scripts Inc. acquisition. However, Cigna has

moderated its leverage post transaction, which was over 50%, and

Cigna remains committed to an accelerated deleveraging during 2020,

which is expected to leave financial leverage closer to 40% by the

end of the year. AM Best expects financial deleveraging to be

driven by the strong earnings and dividends from Cigna’s insurance

entities, solid nonregulated earnings from its health services

segment and additional one-time capital sources, such as a portion

of the proceeds from the pending sale of its group employee

benefits business, which is expected to help reduce outstanding

debt.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best’s

Credit Ratings. For information on the proper media use of Best’s

Credit Ratings and AM Best press releases, please view Guide for

Media - Proper Use of Best’s Credit Ratings and AM Best Rating

Action Press Releases.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in New York, London,

Amsterdam, Dubai, Hong Kong, Singapore and Mexico City. For more

information, visit www.ambest.com.

Copyright © 2020 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200310005987/en/

Joseph Zazzera, MBA Director +1 908 439 2200, ext. 5797

joseph.zazzera@ambest.com

Sally Rosen Senior Director +1 908 439 2200, ext. 5280

sally.rosen@ambest.com

Christopher Sharkey Manager, Public Relations +1 908 439 2200,

ext. 5159 christopher.sharkey@ambest.com

Jim Peavy Director, Public Relations +1 908 439 2200, ext. 5644

james.peavy@ambest.com

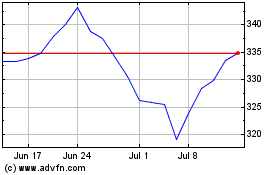

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

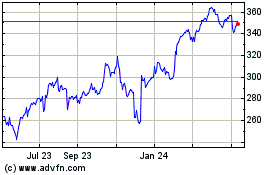

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024