Health-Care Stocks Are Big Super Tuesday Winner

March 04 2020 - 3:36PM

Dow Jones News

By Paul Vigna

The big winner of Super Tuesday was former Vice President Joe

Biden, whose presidential campaign found new life.

Investors in health-care stocks had a nice win as well.

As the stock market rallied Wednesday, health-care stocks led

the way, rising 4.5% in the S&P 500. That was the largest gain

among the 11 sectors and outpaced the broader index, which climbed

2.8%. Within the sector, health insurers were doing even

better.

Anthem Inc. added 13%; Humana Inc. climbed 12%; Centene Corp.

rose 12%; and Cigna Corp. was up 9.3%. UnitedHealth Group Inc.,

which is among the biggest companies in the group and a component

of the Dow Jones Industrial Average, rose 8.3%.

Between the political battle over health care and the market's

steep slide over the past two weeks, it has been a rough ride for

investors in the sector.

These stocks fell sharply after Vermont Sen. Bernie Sanders

officially entered the race in February 2019, while the rest of the

market was rising. Mr. Sanders and Massachusetts Sen. Elizabeth

Warren favor a single-payer health-care program, Medicare for All,

that would entail major changes for the industry.

Mr. Biden, who plans to enhance the existing Affordable Care

Act, is generally seen as less disruptive to the industry, and his

ascension has helped the sector. The S&P's health-care group is

down 3.3% this year, but its losses are narrower than the S&P

500's 4.5% year-to-date loss through Wednesday afternoon.

Even though Mr. Biden and Mr. Sanders will likely be engaged in

a long primary fight, Wednesday's gains show how closely investors

in these stocks are following the political tides, said Jared Holz,

a health-care-sector strategist at Jefferies.

"It's basically a reflection of greater confidence around fewer

changes to the overall health-care industry," he said.

For these investors, he said, they have been weighing primary

results on one hand against the sector's performance relative to

the rest of the market. Buying or selling has been a sliding scale

of whether or not the sector has appeared under- or overvalued at

any time, he said.

With Mr. Biden's victories, that decision-making process went

into overdrive, Mr. Holz said. "You're seeing so much of that

happening in one single trading session."

But the Democratic nominee won't be decided until the summer,

and the election isn't until November. Before any of that,

investors have to be mindful of the effects of the coronavirus

epidemic on the stocks in the sector, Mr. Holz said.

If the epidemic sends large numbers of patients to their doctors

or to hospitals, it will likely put pressure on insurers' margins,

he said.

"The 'decision tree' is, do you believe the stocks already

reflect a best-case scenario, or is there still upside?" he

said.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

March 04, 2020 15:21 ET (20:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

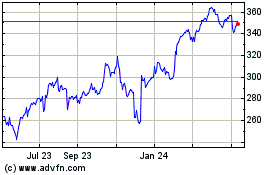

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

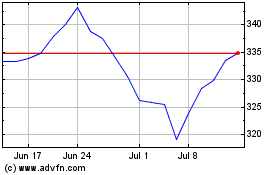

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024