By Joseph Walker and Anna Wilde Mathews

Insurers are scrambling to blunt the expense of new drugs that

can carry prices of more than $2 million per treatment, offering

new setups aimed at making the cost of gene therapies more

manageable for employers.

Cigna Corp. announced Thursday a new program that allows

employers and insurers to pay per-month fees for a service that

will cover the cost of gene therapies and manage their use. CVS

Health Corp. says it plans to offer a new layer of coverage

specifically for gene therapies, which would handle employers'

costs above a certain threshold. Anthem Inc. said it is looking at

special insurance setups to help employers protect themselves from

the financial impact of the drugs.

"You have all these new products coming to the market at these

very high prices," said Steve Miller, Cigna's chief clinical

officer. "Clearly this is a pain point in health care that needs to

be solved."

Cigna hasn't set a fee yet, but Dr. Miller said the company is

aiming for it to be less than $1 per member a month. Under the

program, patients would pay nothing out of pocket for the drugs,

Cigna said.

The protection plans are limited so far, and it isn't clear that

the insurers will be able to bring down the overall costs of the

therapies, as opposed to simply spreading them out. Insurers say

they are pushing for deals that tie payments for gene therapies and

other high-cost medicines to their results in patients.

Drugmakers, for their part, say they are open to working with

insurers on new payment arrangements that improve patient access to

their products.

Gene therapies, which replace a faulty gene with a functioning

copy, promise to cure hard-to-treat inherited diseases. But their

price tags threaten the balance sheets of employers and insurers,

especially as more hit the market.

Novartis AG priced Zolgensma, a gene therapy for a

muscle-wasting condition known as spinal muscular atrophy, at $2.1

million.

Meantime, Spark Therapeutics Inc. listed Luxturna, which treats

a form of inherited vision loss, at $850,000.

In June, Bluebird Bio Inc. said it would price a new gene

therapy for a rare blood disorder at EUR1.6 million ($1.8 million)

in Europe, where it has been approved.

"Employers are saying, 'I just can't afford it,'" said CVS

Health Chief Medical Officer Troy Brennan.

So far, health insurers have tried to balance providing patients

access to the new therapies with managing their cost partly by

setting conditions that limit who can get the drugs.

The protection plans represent an additional approach. The Cigna

program, called Embarc Benefit Protection, will launch with

Zolgensma and Luxturna for 2020, and the company aims to add more

drugs in the future, Dr. Miller said.

Embarc will administer the review process that decides which

patients can get the drugs, and Cigna's specialty pharmacy can

dispense the drugs.

Cigna said it wants to accumulate enough clients in the new

offering to gain more leverage with the drug companies and wring

out better deals for gene therapies. "We're looking for money-back

guarantees," said Dr. Miller.

A spokeswoman for AveXis, the Novartis subsidiary that developed

Zolgensma, said the company hasn't been briefed on the new

insurance payment plans, but recognizes "innovative therapies like

Zolgensma require innovative solutions for access."

A Spark spokesman said the company continues to evaluate "ways

to enhance patient access" to Luxturna with various

stakeholders.

CVS's new offering on gene therapies, for self-insured employers

that are clients of the company's Aetna health insurer, will

include Zolgensma and Luxturna and potentially other treatments,

Dr. Brennan said. The stop-loss program, which would cover an

employer's costs that exceed a set threshold, will be available for

2020. CVS is also working on a broader reinsurance product for

high-cost drugs, he said.

Anthem said it is evaluating reinsurance or stop-loss options

that employers could use to shield themselves from the high cost of

certain drugs.

The new options may prove attractive to employers that aren't

big enough to absorb the cost of the new drugs and don't have

existing stop-loss insurance that would cover them, said Nadina

Rosier, who is head of the pharmacy practice at advisory firm

Willis Towers Watson.

For companies that already have stop-loss policies that cover

such drugs, "You have to ask yourself, 'why am I double paying?'"

she said.

Insurers in Massachusetts have been working on a pilot program

in which they would forge installment-payment plans for expensive

one-time treatments like gene therapy and agree to continue making

payments even if patients taking the drug switch insurers.

The effort has stalled, however, because of drugmaker concerns

about Medicaid best-price rules, which require the government

program to receive the lowest price of any payer, said Mark

Trusheim, strategic director of the New Drug Development Paradigms,

a think tank run out of the Massachusetts Institute of

Technology.

AveXis is currently offering a payment option that allows

insurers to receive a rebate if the drug doesn't meet prespecified

clinical outcomes for the patient, the company spokeswoman said.

The rebate cannot exceed the statutory rebate of 17.1% that

drugmakers pay to Medicaid for pediatric drugs, the spokeswoman

said.

Write to Joseph Walker at joseph.walker@wsj.com and Anna Wilde

Mathews at anna.mathews@wsj.com

(END) Dow Jones Newswires

September 05, 2019 15:59 ET (19:59 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

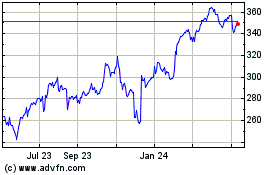

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

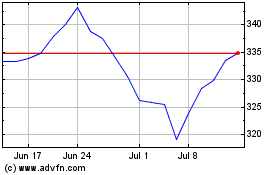

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024