Cigna Posts Strong Results for First Full Quarter After Express Scripts Deal -- Update

May 02 2019 - 1:17PM

Dow Jones News

By Anna Wilde Mathews and Kimberly Chin

Cigna Corp. raised its earnings projection for the year, saying

first-quarter results showed strong performance for its

health-insurance and pharmacy-benefits businesses.

Cigna's first-quarter profit rose by 50%, reflecting its $54

billion acquisition of Express Scripts Holding Co., which closed in

December. The earnings beat analysts' expectations.

The company became the latest managed-care firm to report strong

results, though share prices in the industry have been dragged down

by investor concern about policy issues, including drug rebates and

some Democrats' discussion of universal government coverage.

Still, "the results didn't blow investors away," said Ana Gupte,

an analyst with SVB Leerink. Though the company did beat analysts'

expectations for the quarter, "people expected a bigger beat and a

bigger raise" in guidance.

Cigna shares were down 5% around midday.

During a call with analysts, Cigna Chief Executive David Cordani

said the integration of the two companies was going smoothly and

pointed to an expected 96%-to-98% retention rate for its

pharmacy-benefits customers for 2020.

"Our intense focus on retention and deepening paid off," said

Mr. Cordani. He said Cigna remained on track to deliver its

targeted earnings of $20 to $21 a share in 2021.

Mr. Cordani also said the company felt it was well-positioned if

there are changes to how drugs are paid for, including the

traditional pharmacy-benefit model. At the federal level, the Trump

administration has proposed changes to the rules surrounding drug

rebates, and some employers are also moving toward delivering

rebates to patients taking the affected drugs.

The Cigna CEO said the company felt its strong PBM retention

numbers showed that clients valued its services, and it expected to

be able to maintain strong margins if payment models evolve. "We've

proven the ability to innovate" and to provide sustainable

shareholder returns, he said.

For the first quarter, Cigna reported earnings of $1.37 billion,

or $3.56 a share, compared with $915 million, or $3.72 a share, a

year earlier. Analysts polled by Refinitiv were expecting earnings

of $3.36 a share.

On an adjusted basis, income from operations was $3.90 a share,

above analysts' estimates of $3.73 a share.

Total revenue more than tripled from a year ago to $37.95

billion, again reflecting the absorption of Express Scripts.

Analysts estimated revenue of $33.11 billion.

The company raised its adjusted-earnings projection for 2019,

which is now between $16.25 and $16.65 a share, up from a previous

projection of $16 to $16.50. Cigna now expects $6.24 billion to

$6.4 billion in earnings for 2019.

The company also expects to add another $1 billion in revenues,

raising its previous forecast to $132.5 billion to $134.5

billion.

Write to Anna Wilde Mathews at anna.mathews@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

May 02, 2019 13:02 ET (17:02 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

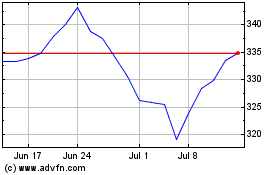

Cigna (NYSE:CI)

Historical Stock Chart

From Mar 2024 to Apr 2024

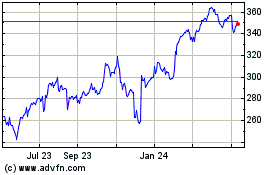

Cigna (NYSE:CI)

Historical Stock Chart

From Apr 2023 to Apr 2024