Statement of Changes in Beneficial Ownership (4)

May 12 2020 - 7:15PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Argos Holdings GP LLC |

2. Issuer Name and Ticker or Trading Symbol

Chewy, Inc.

[

CHWY

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

650 MADISON AVENUE |

3. Date of Earliest Transaction

(MM/DD/YYYY)

5/8/2020 |

|

(Street)

NEW YORK, NY 10022

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock, par value $0.01 | 5/8/2020 | | C(1) | | 17584098 | A(1) | (1)(2) | 17584098 | I | See footnotes (1)(4)(7)(8)(9)(10)(11)(12) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B Common Stock, par value $0.01 | (2) | | | | | | | (2) | (2) | Class A Common Stock, par value $0.01 | 191477454 | | 191477454 | I | See footnotes (3)(7)(8)(12) |

| Class B Common Stock, par value $0.01 | (2) | 5/8/2020 | | C (1) | | | 17584098 | (2) | (2) | Class A Common Stock, par value $0.01 | 17584098 | $0.00 (2) | 0 | I | See footnotes (4)(7)(8)(12) |

| Class B Common Stock, par value $0.01 | (2) | | | | | | | (2) | (2) | Class A Common Stock, par value $0.01 | 47260902 | | 47260902 | I | See footnotes (5)(7)(8)(12) |

| Class B Common Stock, par value $0.01 | (2) | | | | | | | (2) | (2) | Class A Common Stock, par value $0.01 | 78600000 | | 78600000 | I | See footnotes (6)(7)(8)(12) |

| Forward purchase contract (obligation to sell) | (9)(10)(11) | 5/11/2020 | | J/K (9)(10)(11) | | 17584098 | | 5/16/2023 | 5/16/2023 | Class A Common Stock, par value $0.01 | 17584098 | (9)(10)(11) | 17584098 | I | See footnotes (4)(7)(8)(9)(10)(11)(12) |

| Explanation of Responses: |

| (1) | Each share of Class A common stock of Chewy, Inc. (the "Issuer") was issued upon conversion of one share of Class B common stock of the Issuer. |

| (2) | Shares of Class B common stock of the Issuer are convertible into shares of Class A common stock of the Issuer on a one-for-one basis at any time at the option of the holder, automatically upon any transfer, with certain exceptions, and upon certain other events as described in the Issuer's registration statement on Form S-1 (File No. 333-231095) relating to the initial public offering of its Class A common stock. |

| (3) | Shares of Class B common stock are held by PetSmart Buddy Holdings Corp. |

| (4) | Shares of Class A common stock and forward purchase contract obligations to sell are held by Buddy Chester Sub LLC. |

| (5) | Shares of Class B common stock are held by Buddy Chester Corp. |

| (6) | Shares of Class B common stock are held by Buddy Holdings Corp. |

| (7) | Argos Holdings GP LLC ("GP LLC") is the general partner of Argos Holdings L.P. ("Argos"). Argos is the sole common equity holder of Citrus Intermediate Holdings L.P. ("Citrus"). GP LLC is the general partner of Citrus. Citrus is the sole stockholder of Argos Intermediate Holdco I Inc. ("Holdco I"). Holdco I is the sole stockholder of Argos Intermediate Holdco II Inc. ("Holdco II"). Holdco II is the sole stockholder of Argos Intermediate Holdco III Inc. ("Holdco III"). Holdco III is the sole stockholder of Buddy Holdings Corp. and Argos Holdings Inc. ("Holdings"). Holdings is the sole stockholder of PetSmart, Inc. ("PetSmart"). PetSmart is the sole stockholder of PetSmart Buddy Holdings Corp. and Buddy Chester Corp. ("Chester"). Chester is the sole stockholder of Buddy Chester Sub LLC ("Buddy Sub"). |

| (8) | (continued from footnote 7) CIE Management IX Limited controls a majority of the equity interests of GP LLC and has the power to appoint members to the board of directors of GP LLC who may exercise majority voting power at meetings of the board of directors of GP LLC. BC Partners Holdings Limited is the controlling shareholder of CIE Management IX Limited. |

| (9) | On May 11, 2020, Buddy Sub entered into a forward purchase contract (the "Contract") with 2020 Mandatory Exchangeable Trust (the "Trust"), a Delaware statutory trust. The Contract obligates Buddy Sub to deliver up to 17,584,098 shares of Class A common stock, par value $0.01 per share of the Issuer (or, at Buddy Sub's election, an equivalent amount of cash based on the market price of the Issuer's Class A common stock at that time) to the Trust on May 16, 2023 (the "Exchange Date"). Buddy Sub received a cash payment of $535,222,699.50 from the Trust on the date it entered into the Contract. Buddy Sub pledged 17,584,098 shares of the Issuer's Class A common stock (the "Pledged Shares") to secure its obligations under the Contract and, unless a default or an event of default occurs, Buddy Sub retains all voting rights with respect to the Pledged Shares. On May 4, 2020, the Trust issued 690,000 mandatory exchangeable trust securities (the "Trust Securities"). |

| (10) | (Continued from footnote 9) The Trust agreed to exchange each Trust Security for a pro rata portion of the Issuer's Class A common stock or other property it receives from Buddy Sub under the Contract. The number of shares of the Issuer's Class A common stock to be delivered to the Trust under the Contract will be equal to the number of Trust Securities outstanding multiplied by a conversion rate, which will be between 21.2368 and 25.4842 and will be determined by reference to the volume-weighted average trading price of the Issuer's Class A common stock during the 20-trading day observation period beginning on, and Including, the 24th scheduled trading day immediately preceding the Exchange Date (the "Daily VWAP"). |

| (11) | (Continued from footnote 10) The conversion rate will be determined as follows: (a) if the Daily VWAP is equal to or greater than the Threshold Appreciation Price (as defined below), the conversion rate will equal 21.2368 divided by 20; (b) if the Daily VWAP is equal to or less than the Threshold Appreciation Price but greater than or equal to the Initial Price (as defined below), the conversion rate will be between 21.2368 and 25.4842 divided by 20; and (c) if the Daily VWAP is equal to or less than the Initial Price, the conversion rate will be 25.4842 divided by 20. The Initial Price, which was the last reported sale price per share of the Issuer's Class A common stock on the New York Stock Exchange as of May 4, 2020, is $39.24 (the "Initial Price"). The Threshold Appreciation Price, which is approximately 120% of the Initial Price, is $47.09 (the "Threshold Appreciation Price"). |

| (12) | Each Reporting Person may be deemed to be the beneficial owner of all or a portion of the securities reported herein. The filing of this statement shall not be deemed to be an admission that, for purposes of Section 16 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise, the Reporting Persons are the beneficial owners of any securities reported herein. The Reporting Persons disclaim beneficial ownership of such securities except to the extent of their pecuniary interest therein. On the basis of the relationship between each of Mr. Raymond Svider, Mr. Fahim Ahmed, Mr. Michael Chang and other directors of the Issuer designated or nominated by the Reporting Persons, the Reporting Persons may be directors of the Issuer by deputization for the purposes of Section 16 of the Exchange Act. |

Remarks:

Because no more than 10 reporting persons can file any one Form 4 through the Securities and Exchange Commission's EDGAR system, Argos Holdings L.P., Citrus Intermediate Holdings L.P., Argos Intermediate Holdco I Inc., Argos Intermediate Holdco II Inc., Argos Intermediate Holdco III Inc., Buddy Holdings Corp., Argos Holdings Inc., PetSmart, Inc. and PetSmart Buddy Holdings Corp. have filed a separate Form 4. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Argos Holdings GP LLC

650 MADISON AVENUE

NEW YORK, NY 10022 |

| X |

|

|

Buddy Chester Corp.

19601 N. 27TH AVE.

PHOENIX, AZ 85027 |

| X |

|

|

Buddy Chester Sub LLC

19601 N. 27TH AVE.

PHOENIX, AZ 85027 |

| X |

|

|

CIE Management IX Ltd

650 MADISON AVENUE

NEW YORK, NY 10022 |

| X |

|

|

BC Partners Holdings Ltd

650 MADISON AVENUE

NEW YORK, NY 10022 |

| X |

|

|

Signatures

|

| /s/ Alan Schnaid, as Attorney-in-Fact for Reporting Person | | 5/12/2020 |

| **Signature of Reporting Person | Date |

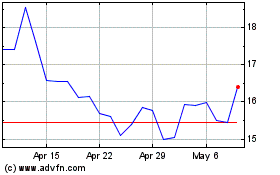

Chewy (NYSE:CHWY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chewy (NYSE:CHWY)

Historical Stock Chart

From Apr 2023 to Apr 2024