Cherry Hill Mortgage Investment Corp. to Pay Previously Announced Quarterly Dividend on Common Stock of $0.40 Per Share 50% i...

March 27 2020 - 2:29PM

Business Wire

Cherry Hill Mortgage Investment Corporation (NYSE: CHMI) (the

“Company”) announced today that it has decided to pay its

previously declared cash dividend for the first quarter of 2020 of

$0.40 per share of common stock, in a combination of cash, not to

exceed 50% in the aggregate, and common stock. As previously

announced by the Company on March 12, 2020, the dividend will

continue to be payable on April 28, 2020 to stockholders of record

as of the close of business on March 31, 2020.

The Company also announced that it will pay the previously

declared dividends on its 8.20% Class A Cumulative Redeemable

Preferred Stock and its 8.250% Class B Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock in cash in the ordinary

course.

In accordance with Internal Revenue Service guidelines,

stockholders will be asked to make an election to receive this

dividend all in cash or all in Cherry Hill common stock. To the

extent that more than 50% cash is elected, the cash portion will be

prorated. Stockholders who do not make an election will receive the

dividend all in common stock. The election deadline is April 14,

2020. Shares will be priced at the volume weighted average trading

prices of Cherry Hill’s common stock on the New York Stock Exchange

between April 15, 2020 and April 17, 2020. The Company expects the

dividend to be taxable to its stockholders. Cherry Hill reserves

the right to pay the dividend entirely in cash.

An information letter and election form will be mailed to

stockholders of record promptly after March 31, 2020.

“Due to the significant market volatility related to the

COVID-19 pandemic since we announced our first quarter common share

dividend two weeks ago, the Board made the difficult but prudent

decision to change the form of the common stock dividend in order

to preserve liquidity,” said Jay Lown, President and Chief

Executive Officer of Cherry Hill Mortgage Investment Corporation.

“We have satisfied all margin calls received to date under our

financing arrangements while increasing the Company’s unencumbered

cash position as of March 26, 2020 by more than 300% from the level

of $24.7 million as of December 31, 2019.”

The Company cannot provide any assurances that the rapidly

evolving macroeconomic conditions will not impact the Company.

About Cherry Hill Mortgage Investment Corporation Cherry

Hill Mortgage Investment Corporation is a real estate finance

company that acquires, invests in and manages residential mortgage

assets in the United States. For additional information, visit

www.chmireit.com.

Forward-Looking Statements

This press release contains forward looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995 and other federal securities laws, including, among others,

statements relating to the Company’s long-term growth opportunities

and strategies, expand its market opportunities and create its own

Excess MSRs and its ability to generate sustainable and attractive

risk-adjusted returns for stockholders. These forward-looking

statements are based upon the Company’s present expectations, but

these statements are not guaranteed to occur. For a description of

factors that may cause the Company's actual results or performance

to differ from its forward-looking statements, please review the

information under the heading “Risk Factors” included in the

Company's Annual Report on Form 10-K for the year ended December

31, 2019, and other documents filed by the Company with the

Securities and Exchange Commission.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200327005455/en/

Investor Relations (877) 870 –7005

InvestorRelations@CHMIreit.com

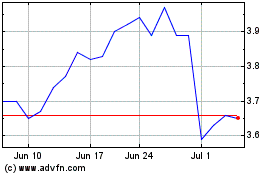

Cherry Hill Mortgage Inv... (NYSE:CHMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

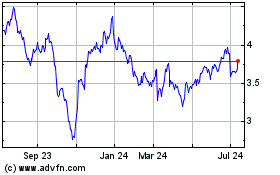

Cherry Hill Mortgage Inv... (NYSE:CHMI)

Historical Stock Chart

From Apr 2023 to Apr 2024