ATTENTION CHESAPEAKE ENERGY INVESTORS – KlaymanToskes Continues Investigation on Behalf of Chesapeake Energy Investors Who ...

June 19 2020 - 9:25AM

Business Wire

KlaymanToskes ("KT"), http://www.klaymantoskes.com, continues

their investigation on behalf of investors who sustained losses in

excess of $250,000 in Chesapeake Energy (NYSE:CHK) (“Chesapeake”)

as a result of recommendations from their financial advisor

including unsuitable asset allocations in the Energy sector. This

investment may have been marketed and sold to customers who were

risk averse, such as retirees or other conservative investors, that

were seeking income and capital preservation and were not explained

the potential risks.

Oil & Gas investments are historically risky during times of

volatility and/or reduced demand. These risks should be explained

by financial advisors prior to recommending these investments.

Chesapeake is currently trading around 13.20 per share after

undergoing a 1:200 reverse split approximately two months ago. It

has been reported that bankruptcy is imminent for Chesapeake, who

is currently holding a $9 billion debt. Investors may seek damages

for violations of sales practice rules and regulations, as set

forth by the Financial Industry Regulatory Authority (FINRA) in

arbitration.

If you made self-directed trades in your investment account with

E-Trade, TD Ameritrade, Charles Schwab, Fidelity, or Interactive

Brokers, or another self-trading platform that was not being

managed by a registered investment advisor, this investigation does

not apply to you.

The sole purpose of this release is to investigate the sales

practices and financial misconduct of brokerage firms and financial

advisors in connection with the sale of Chesapeake to their

customers including unsuitable asset allocations in the Energy

sector. Chesapeake investors who held accounts at full-service

brokerage firms, and have information relating to the manner in

which the firm handled their accounts are encouraged to contact

Lawrence L. Klayman, Esq., at (561) 542-5131, and download our

Special Investor Report.

About Klayman Toskes

KT is a leading national securities law firm which practices

exclusively in the field of securities arbitration and litigation,

on behalf of retail and institutional investors throughout the

world in large and complex securities matters. The firm represents

high net-worth, ultra-high-net-worth, and institutional investors,

such as non-profit organizations, unions, public and multi-employer

pension funds. KT has office locations in California, Florida, New

York, and Puerto Rico.

Destination:

https://klaymantoskes.com/attention-chesapeake-energy-investors

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200619005255/en/

KlaymanToskes Lawrence L. Klayman, Esq. (561) 542-5131

lklayman@klaymantoskes.com www.klaymantoskes.com

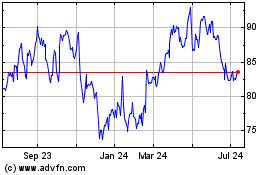

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

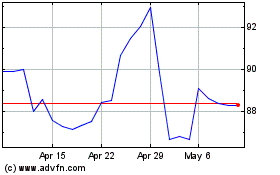

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024